Leading designer of graphics chips Nvidia (NASDAQ:NVDA) reported results ahead of analysts' expectations in Q4 FY2024, with revenue up 265% year on year to $22.1 billion. On top of that, next quarter's revenue guidance ($24 billion at the midpoint) was surprisingly good and 9% above what analysts were expecting. It made a non-GAAP profit of $5.16 per share, improving from its profit of $0.88 per share in the same quarter last year.

Is now the time to buy Nvidia? Find out by accessing our full research report, it's free.

Nvidia (NVDA) Q4 FY2024 Highlights:

- Revenue: $22.1 billion vs analyst estimates of $20.55 billion (7.6% beat)

- EPS (non-GAAP): $5.16 vs analyst estimates of $4.64 (11.3% beat)

- Revenue Guidance for Q1 2025 is $24 billion at the midpoint, above analyst estimates of $22.03 billion (gross margin and operating profit guidance also better)

- Free Cash Flow of $11.22 billion, up 59% from the previous quarter

- Inventory Days Outstanding: 90, down from 92 in the previous quarter

- Gross Margin (GAAP): 76%, up from 63.3% in the same quarter last year

- Market Capitalization: $1.72 trillion

“Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations,” said Jensen Huang, founder and CEO of NVIDIA.

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Processors and Graphics Chips

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

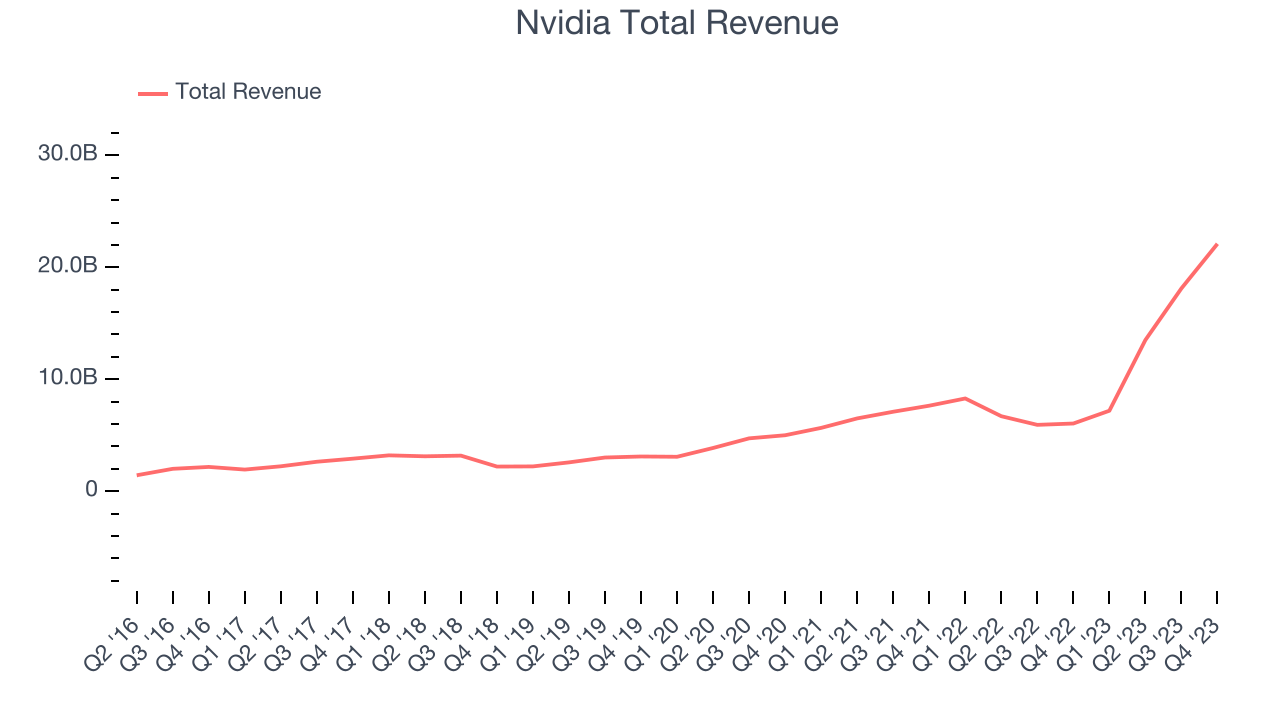

Sales Growth

Nvidia's revenue growth over the last three years has been incredible, averaging 68.9% annually. As you can see below, this quarter was especially strong, with revenue growing from $6.05 billion in the same quarter last year to $22.1 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Nvidia had a fantastic quarter as its 265% year-on-year revenue growth beat analysts' estimates by 7.6%. This marks 3 straight quarters of growth, implying that Nvidia is in the middle of its cycle, as a typical upcycle generally lasts 8-10 quarters.

Nvidia's management team believes its revenue growth will continue, guiding to 234% year-on-year growth next quarter. Analysts expect the company to grow its revenue by 85.5% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

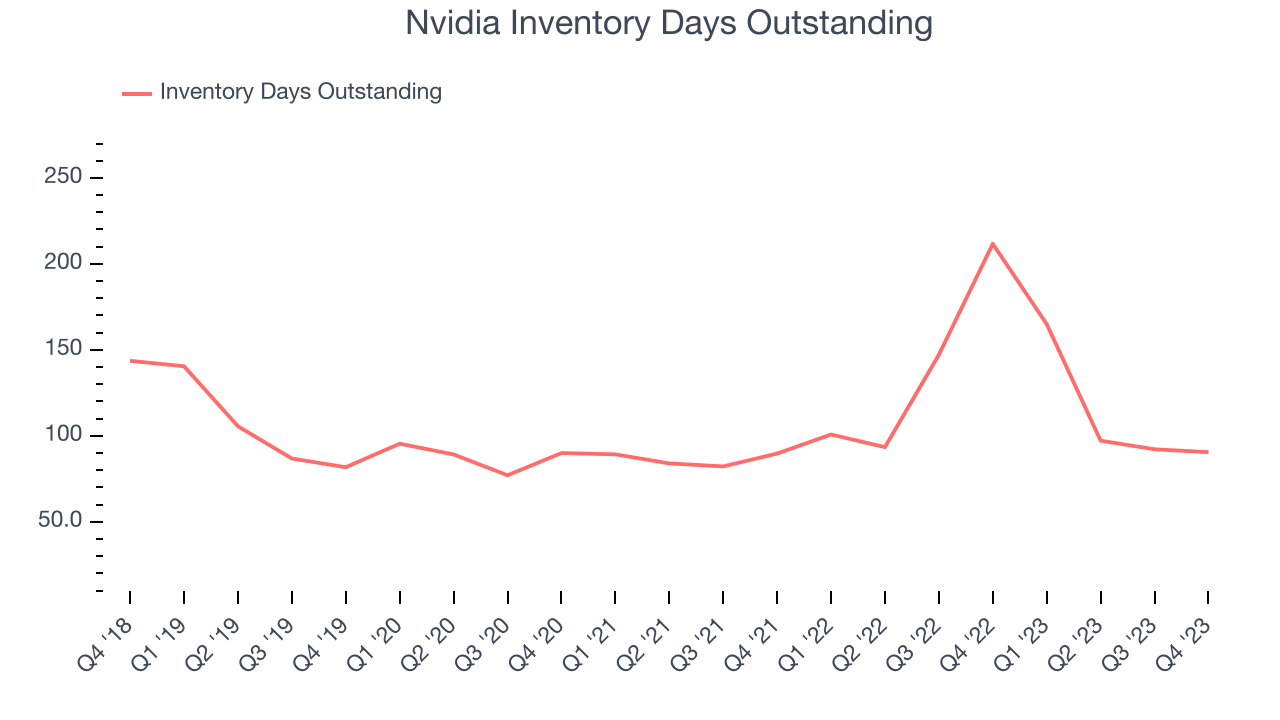

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Nvidia's DIO came in at 90, which is 15 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Nvidia's Q4 Results

We were impressed by Nvidia's meaningful revenue beat, strong gross margin improvement, and EPS outperformance vs. Wall Street's estimates this quarter. Guidance for the next quarter was also good, with revenue, gross margin, and implied operating profit coming in ahead of expectations. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is only up 1.2% after reporting and currently trades at $682.85 per share because NVDA's stock price performance over the last year has been stellar and because expectations for the quarter are likely high.

Nvidia may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.