The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how NXP Semiconductors (NASDAQ:NXPI) and the rest of the analog semiconductors stocks fared in Q3.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 10 analog semiconductors stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 1.28%, while on average next quarter revenue guidance was 2.24% under consensus. There has been a stampede out of high valuation technology stocks as raising interest rates encourage investors to value profits over growth again, but analog semiconductors stocks held their ground better than others, with the share prices up 12.3% since the previous earnings results, on average.

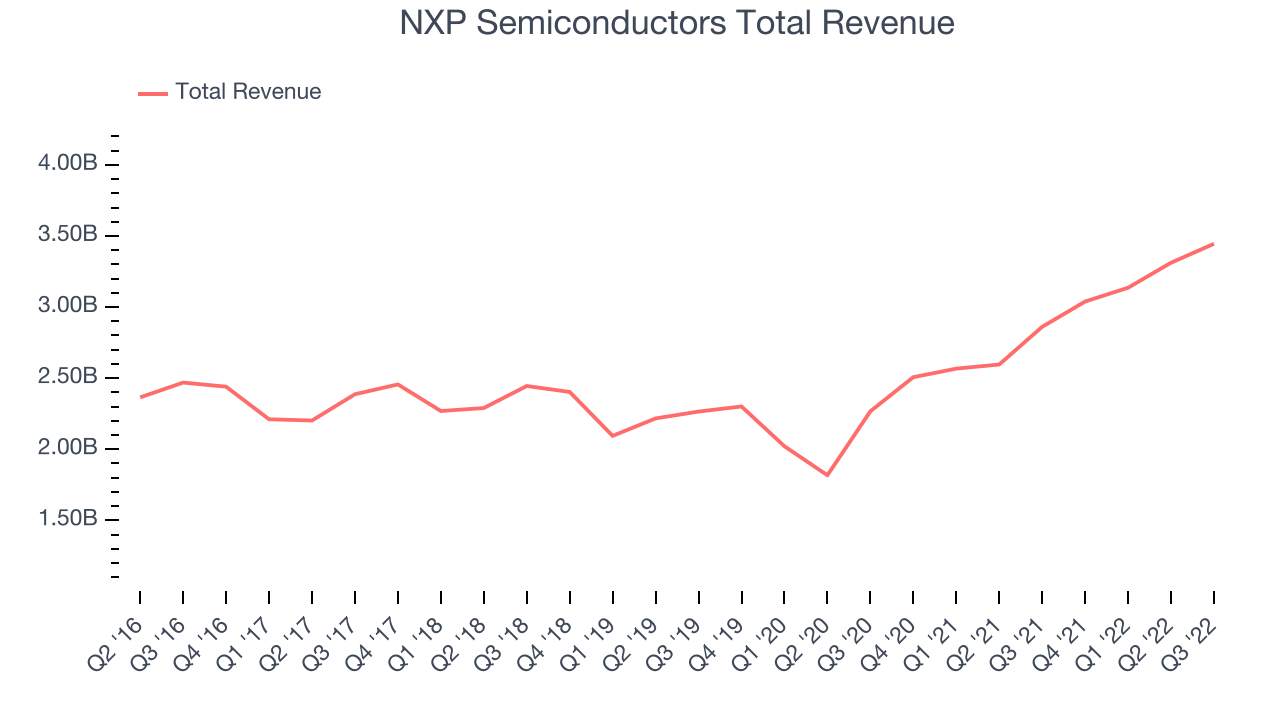

NXP Semiconductors (NASDAQ:NXPI)

Spun off from Dutch electronics giant Philips in 2006, NXP Semiconductors (NASDAQ: NXPI) is a designer and manufacturer of chips used in autos, industrial manufacturing, mobile devices, and communications infrastructure.

NXP Semiconductors reported revenues of $3.44 billion, up 20.4% year on year, in line with analyst expectations. It was a slower quarter for the company, with underwhelming revenue guidance for the next quarter and an increase in inventory levels.

“NXP delivered quarterly revenue of $3.45 billion, an increase of 20 percent year-on-year and above the mid-point of our guidance range. Overall in the third quarter, we performed very well; however, we were impacted by the weakening macro-environment in our consumer-exposed IoT business. At the same time, demand in both the automotive and industrial markets continues to be resilient, driven by secular and company-specific drivers, along with incrementally improved supply. Looking ahead, while we continue to be supply constrained, we are cautious in the intermediate term, due to the uncertainties in the macro environment," said Kurt Sievers, NXP President and Chief Executive Officer.

The stock is up 15.9% since the results and currently trades at $169.4.

Read our full report on NXP Semiconductors here, it's free.

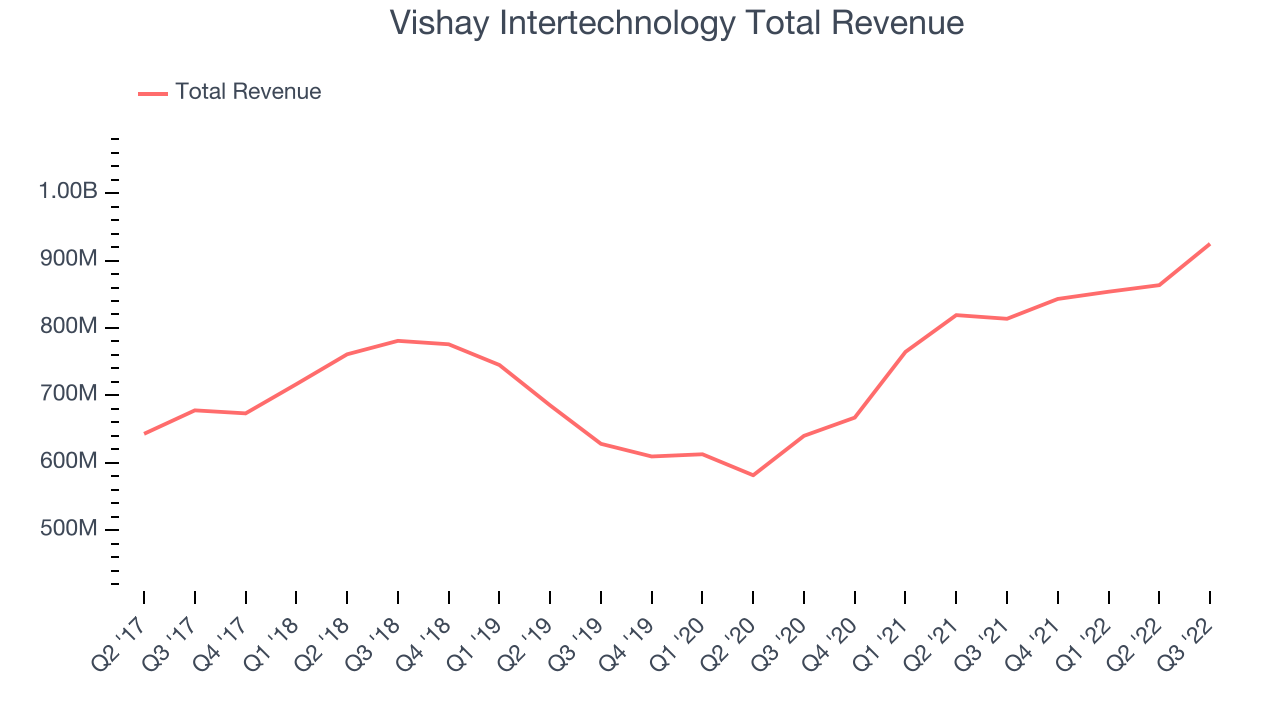

Best Q3: Vishay Intertechnology (NYSE:VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $924.7 million, up 13.6% year on year, inline with analyst expectations. It was an impressive quarter for the company, with a significant improvement in gross margin and a beat on the bottom line.

Vishay Intertechnology had the weakest performance against analyst estimates among its peers. The stock is up 6.92% since the results and currently trades at $22.86.

Is now the time to buy Vishay Intertechnology? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Texas Instruments (NASDAQ:TXN)

Headquartered in Dallas, Texas since the 1950s, Texas Instruments (NASDAQ: TXN) is the world’s largest producer of analog semiconductors.

Texas Instruments reported revenues of $5.24 billion, up 12.8% year on year, beating analyst expectations by 1.9%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and an increase in inventory levels.

The stock is up 7.7% since the results and currently trades at $174.66.

Read our full analysis of Texas Instruments's results here.

Microchip Technology (NASDAQ:MCHP)

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

Microchip Technology reported revenues of $2.07 billion, up 25.6% year on year, in line with analyst expectations. It was a decent quarter for the company, with very optimistic guidance for the next quarter but an increase in inventory levels.

The stock is up 25.2% since the results and currently trades at $74.46.

Read our full, actionable report on Microchip Technology here, it's free.

MACOM Technology (NASDAQ:MTSI)

Founded in the 1950s as Microwave Associates, a communications supplier to the US Army Signal Corp, today MACOM Technology Solutions (NASDAQ: MTSI) is a provider of analog chips used in optical, wireless, and satellite networks.

MACOM Technology reported revenues of $178.1 million, up 14.7% year on year, in line with analyst expectations. It was a solid quarter for the company, with a significant improvement in operating margin.

The stock is up 12.6% since the results and currently trades at $64.73.

Read our full, actionable report on MACOM Technology here, it's free.

The author has no position in any of the stocks mentioned