Identity management software maker Okta (OKTA) announced better-than-expected results in Q3 FY2024, with revenue up 21.4% year on year to $584 million. The company expects next quarter's revenue to be around $586 million, in line with analysts' estimates. It made a non-GAAP profit of $0.44 per share, improving from its loss of $0 per share in the same quarter last year.

Is now the time to buy Okta? Find out by accessing our full research report, it's free.

Okta (OKTA) Q3 FY2024 Highlights:

- Revenue: $584 million vs analyst estimates of $560.4 million (4.2% beat)

- EPS (non-GAAP): $0.44 vs analyst estimates of $0.29 ($0.15 beat)

- Revenue Guidance for Q4 2024 is $586 million at the midpoint, above analyst estimates of $580.3 million

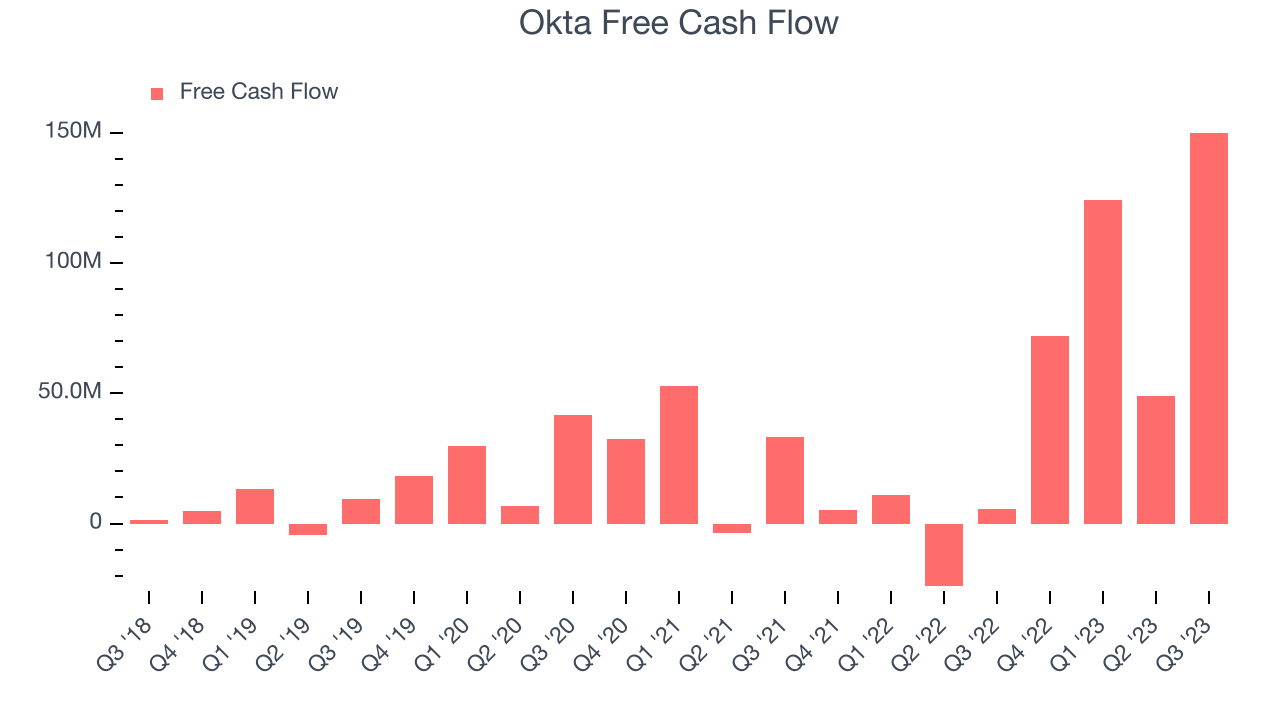

- Free Cash Flow of $150 million, up from $49 million in the previous quarter

- Gross Margin (GAAP): 75.2%, up from 71.4% in the same quarter last year

“Our Q3 performance was highlighted by solid top-line growth, record non-GAAP operating profit, and record free cash flow,” said Todd McKinnon, Chief Executive Officer and co-founder of Okta. "We are particularly enthusiastic about the adoption of Okta Identity Governance and the general availability of Okta Privileged Access, which uniquely positions us as the only unified modern identity platform. Over 18,800 leading organizations around the world put their trust in Okta and we are thankful for their continued partnership."

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ:OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Identity Management

As software penetrates corporate life, employees are using more apps every day, on more devices, in more locations. This drives the need for identity and access management software that help companies efficiently manage who has access to what, and ensure that access privileges are secure from cyber criminals.

Sales Growth

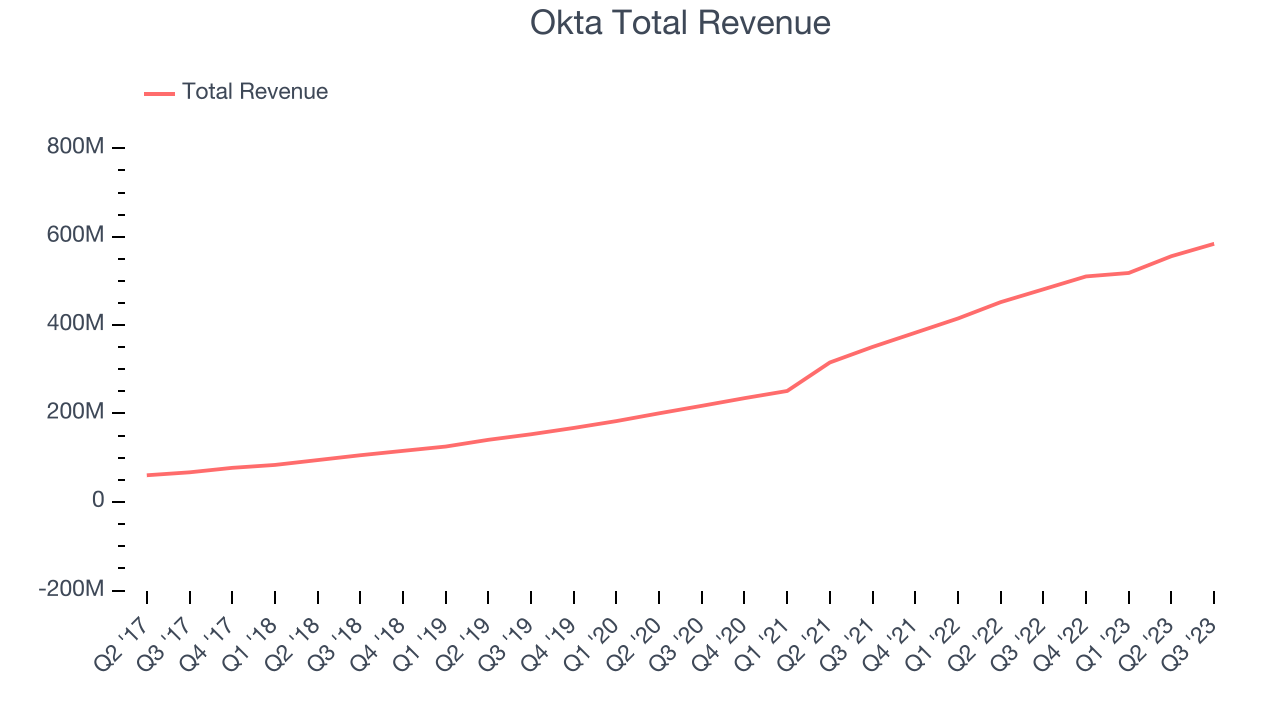

As you can see below, Okta's revenue growth has been very strong over the last two years, growing from $350.7 million in Q3 FY2022 to $584 million this quarter.

This quarter, Okta's quarterly revenue was once again up a very solid 21.4% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $28 million in Q3 compared to $38 million in Q2 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter, Okta is guiding for a 12.9% year-on-year revenue decline to $586 million, a further deceleration from the 33.3% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 13.1% over the next 12 months before the earnings results announcement.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Okta's free cash flow came in at $150 million in Q3, up 2,523% year on year.

Okta has generated $395 million in free cash flow over the last 12 months, an impressive 18.1% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from Okta's Q3 Results

Sporting a market capitalization of $11.91 billion, more than $2.13 billion in cash on hand, and positive free cash flow over the last 12 months, we believe that Okta is attractively positioned to invest in growth.

It was great to see Okta improve its gross margin and beat Wall Street's sales estimates this quarter, both driven by better-than-expected subscription revenue. Its adjusted operating income, free cash flow, EPS, and next quarter's revenue and EPS guidance also topped analysts' forecasts. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. Investors were likely expecting more, however, and the stock is down 2.2% after reporting, trading at $70.99 per share.

So should you invest in Okta right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.