The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how analog semiconductors stocks fared in Q2, starting with Universal Display (NASDAQ:OLED).

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was 1.2% below.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

While some analog semiconductors stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.3% since the latest earnings results.

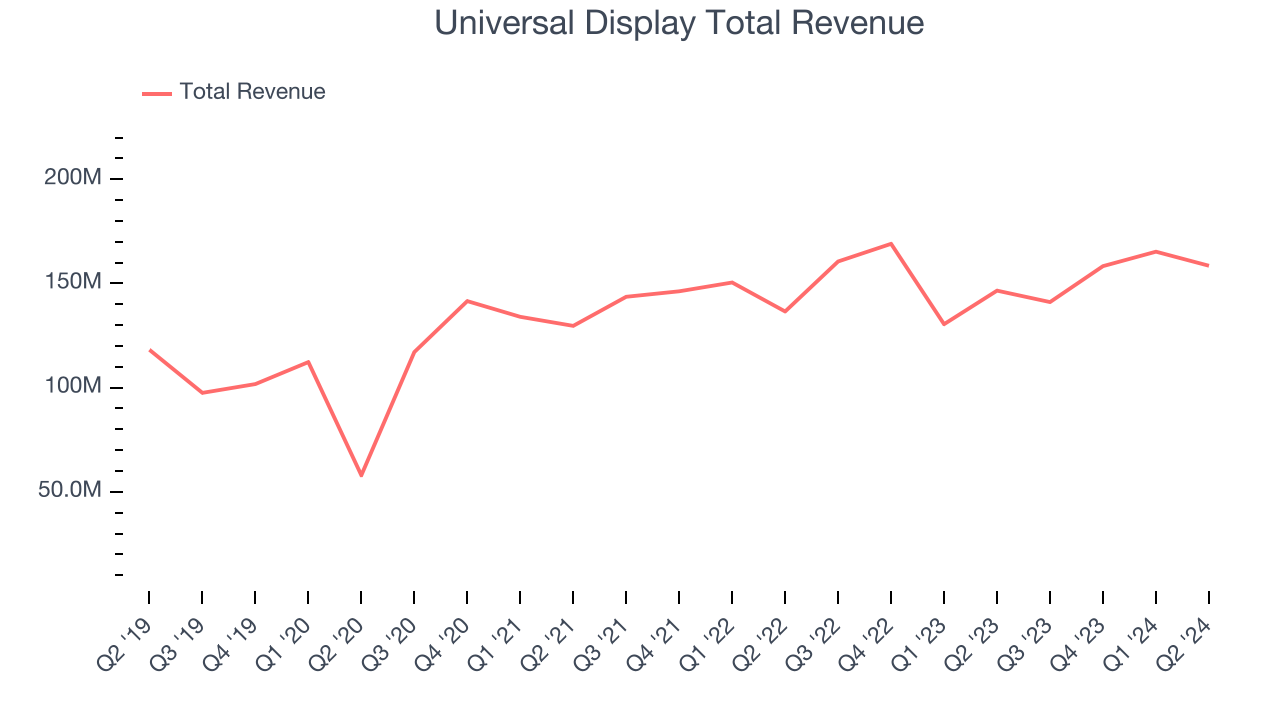

Weakest Q2: Universal Display (NASDAQ:OLED)

Serving major consumer electronics manufacturers, Universal Display (NASDAQ:OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

Universal Display reported revenues of $158.5 million, up 8.1% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with a miss of analysts’ EPS estimates and full-year revenue guidance missing analysts’ expectations.

“We reported solid second quarter results as the OLED IT adoption cycle begins to gain momentum,” said Brian Millard, Vice President and Chief Financial Officer of Universal Display Corporation.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $211.53.

Is now the time to buy Universal Display? Access our full analysis of the earnings results here, it’s free.

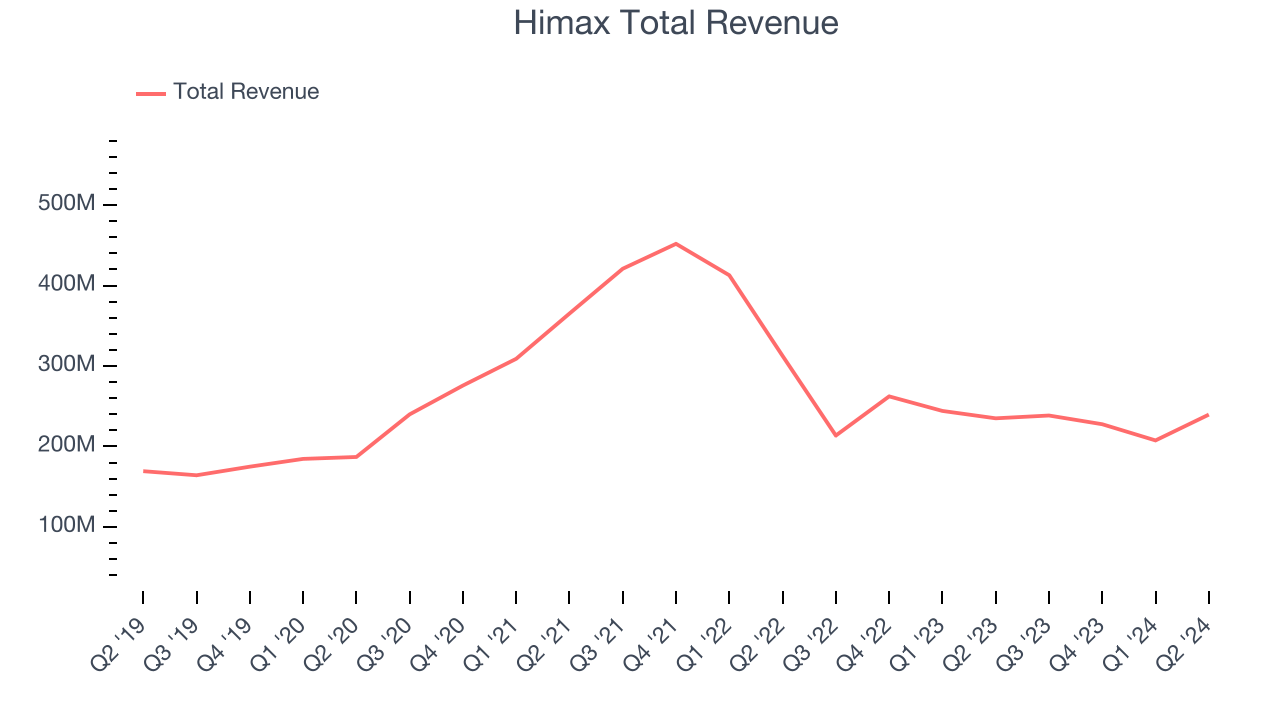

Best Q2: Himax (NASDAQ:HIMX)

Taiwan-based Himax Technologies (NASDAQ:HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $239.6 million, up 2% year on year, outperforming analysts’ expectations by 2.9%. The business had an exceptional quarter with a significant improvement in its gross margin.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 8.2% since reporting. It currently trades at $5.38.

Is now the time to buy Himax? Access our full analysis of the earnings results here, it’s free.

Microchip Technology (NASDAQ:MCHP)

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

Microchip Technology reported revenues of $1.24 billion, down 45.8% year on year, in line with analysts’ expectations. It was a softer quarter as it posted underwhelming revenue guidance for the next quarter and a decline in its operating margin.

Microchip Technology delivered the slowest revenue growth in the group. As expected, the stock is down 8.9% since the results and currently trades at $77.

Read our full analysis of Microchip Technology’s results here.

NXP Semiconductors (NASDAQ:NXPI)

Spun off from Dutch electronics giant Philips in 2006, NXP Semiconductors (NASDAQ: NXPI) is a designer and manufacturer of chips used in autos, industrial manufacturing, mobile devices, and communications infrastructure.

NXP Semiconductors reported revenues of $3.13 billion, down 5.2% year on year. This number met analysts’ expectations. Zooming out, it was a softer quarter as it logged underwhelming revenue guidance for the next quarter and an increase in its inventory levels.

The stock is down 18.3% since reporting and currently trades at $231.90.

Read our full, actionable report on NXP Semiconductors here, it’s free.

Vishay Intertechnology (NYSE:VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $741.2 million, down 16.9% year on year. This number came in 1.7% below analysts' expectations. It was a softer quarter as it also recorded underwhelming revenue guidance for the next quarter and a decline in its operating margin.

Vishay Intertechnology had the weakest performance against analyst estimates among its peers. The stock is down 13% since reporting and currently trades at $18.67.

Read our full, actionable report on Vishay Intertechnology here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.