Hair care company Olaplex (NASDAQ:OLPX) reported results in line with analysts' expectations in Q2 CY2024, with revenue down 4.8% year on year to $103.9 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $449 million at the midpoint. It made a non-GAAP profit of $0.03 per share, improving from its profit of $0.01 per share in the same quarter last year.

Is now the time to buy Olaplex? Find out by accessing our full research report, it's free.

Olaplex (OLPX) Q2 CY2024 Highlights:

- Revenue: $103.9 million vs analyst estimates of $103.6 million (small beat)

- Adjusted EBITDA: $32.1 million vs analyst estimates of $33.4 million (4.0% miss)

EPS (non-GAAP): $0.03 vs analyst expectations of $0.03 (1.5% miss) - The company reconfirmed its revenue guidance for the full year of $449 million at the midpoint (slight miss)

- Full year adjusted EBITDA guidance: $151 million vs analyst estimates of $154 million (miss)

- Gross Margin (GAAP): 69.7%, down from 72.7% in the same quarter last year

- Adjusted EBITDA Margin: 30.8%, down from 33.6% in the same quarter last year

- Market Capitalization: $1.22 billion

Amanda Baldwin, OLAPLEX’s Chief Executive Officer, commented: "Our second quarter performance was in line with our expectations and demonstrated continued stabilization in the business. I am encouraged by the progress we are making on our transformation journey as we delivered on our goals for the first half of the year and are now shifting our focus to the back half of 2024 and beyond. I am confident in the direction we are taking the brand and remain incredibly excited about the long-term growth potential for OLAPLEX."

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ:OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Olaplex is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

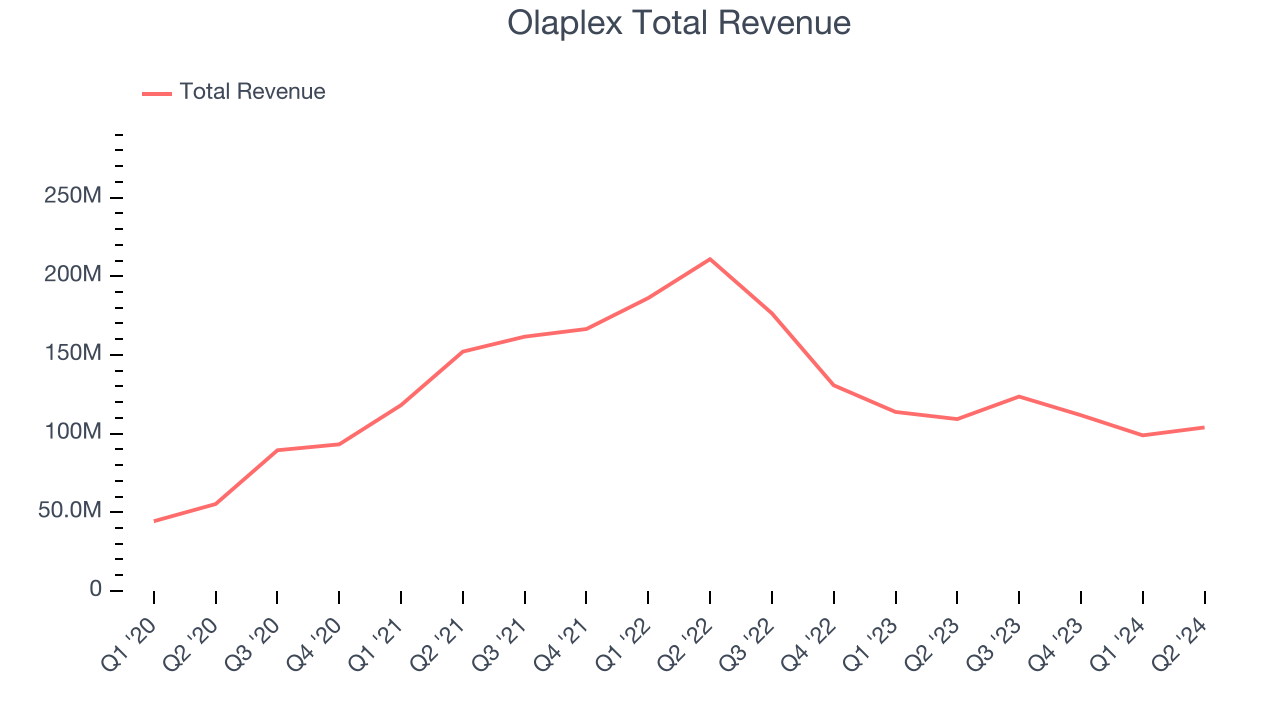

As you can see below, the company's revenue has declined over the last three years, dropping 1.1% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Olaplex reported a rather uninspiring 4.8% year-on-year revenue decline to $103.9 million in revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 5.5% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is a key profitability metric for staples companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

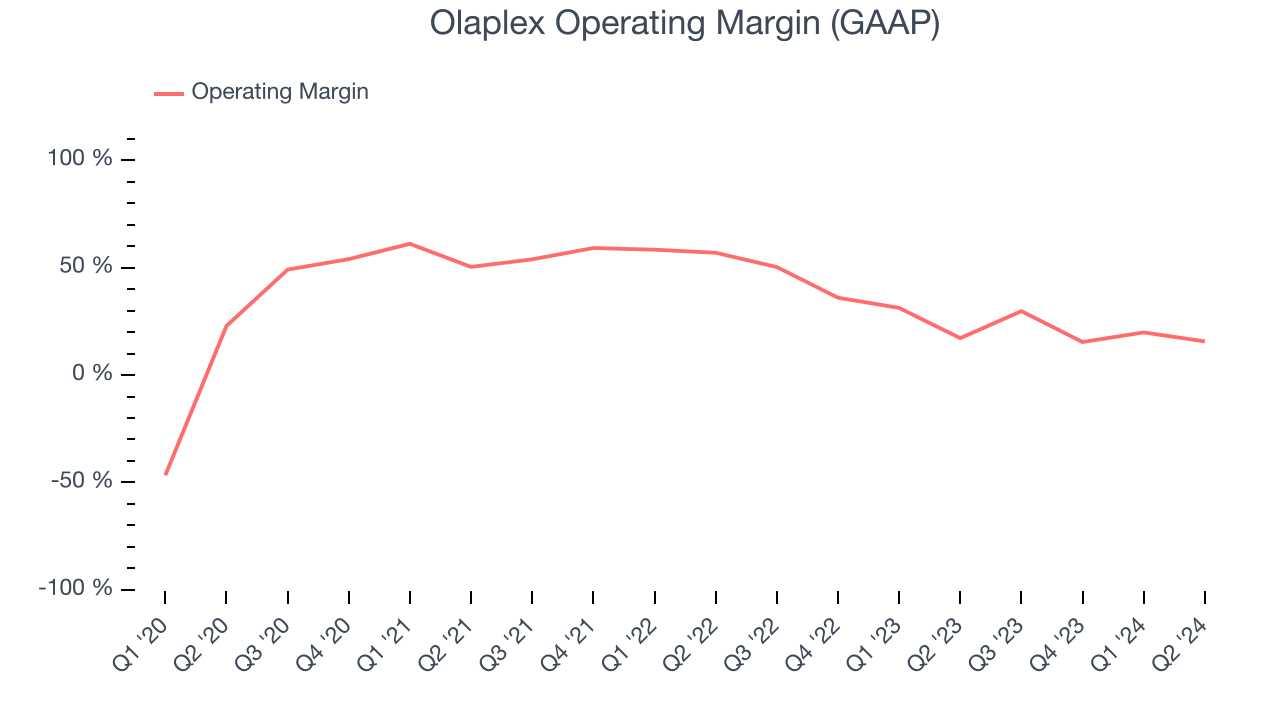

Olaplex has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 28.9%. This result isn't surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Olaplex's annual operating margin decreased by 15.4 percentage points over the last two years. Even though its margin is still high, shareholders will want to see Olaplex become more profitable in the future.

In Q2, Olaplex generated an operating profit margin of 15.7%, down 1.5 percentage points year on year. Since Olaplex's gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased sales, marketing, and administrative overhead expenses.

Key Takeaways from Olaplex's Q2 Results

We struggled to find many strong positives in these results. Its gross margin and adjusted EBITDA both missed analysts' expectations, leading to EPS underperformance compared to Wall Street's estimates. Guidance was also below expectations across the board. Overall, this was a mediocre quarter for Olaplex. The stock traded down 18.3% to $1.50 immediately after reporting.

Olaplex may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.