Hair care company Olaplex (NASDAQ:OLPX) reported Q1 CY2024 results topping analysts' expectations, with revenue down 13.1% year on year to $98.91 million. The company expects the full year's revenue to be around $449 million, in line with analysts' estimates. It made a non-GAAP profit of $0.03 per share, down from its profit of $0.05 per share in the same quarter last year.

Olaplex (OLPX) Q1 CY2024 Highlights:

- Revenue: $98.91 million vs analyst estimates of $95.2 million (3.9% beat)

- Adjusted EBITDA: $35.5 million vs analyst estimates of $31.9 million (11.3% beat)

- EPS (non-GAAP): $0.03 vs analyst expectations of $0.03 (in line)

- The company reconfirmed its revenue guidance for the full year of $449 million at the midpoint (in line)

- The company reconfirmed its adjusted EBITDA guidance for the full year of $151 million at the midpoint (slightly below expectations)

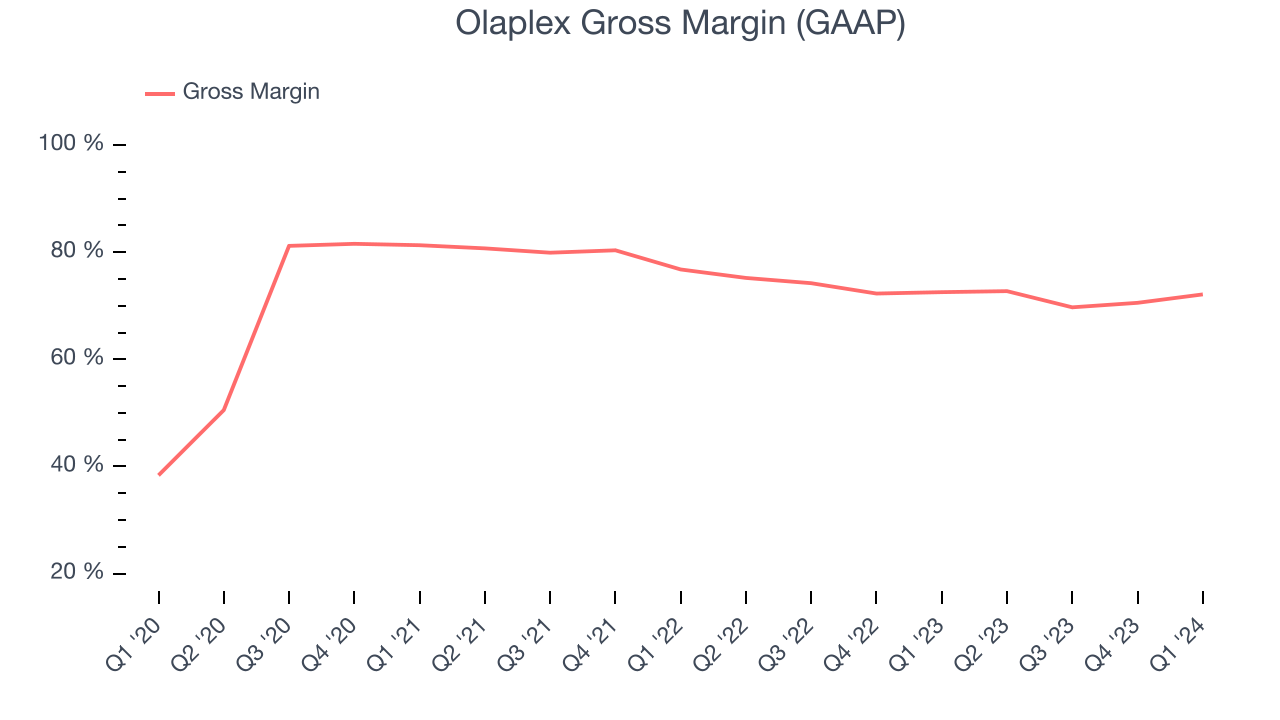

- Gross Margin (GAAP): 72.1%, in line with the same quarter last year

- Market Capitalization: $925.9 million

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ:OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Specifically, the company was founded in 2014 and seeks to address the microscopic broken hair bonds that can occur over time when women repeatedly use hot curling products and chemical dyes. The broken bonds lead to dry, brittle hair that looks unhealthy.

Olaplex’s product portfolio is broad, but all products fall into three categories: treat, maintain, and protect. For example, the company’s Hair Perfector product is a treatment that reduces breakage and aims to strengthen hair. There are then shampoos to maintain the healthier hair that should result from Hair Perfector use and oils that protect hair throughout the day.

As a player in the prestige hair care space, Olaplex’s end customers are middle to higher-income women who aren’t afraid to spend some extra money on beauty and personal care products. These women also tend to be older individuals whose hair has undergone decades of heat and chemical treatments. Olaplex reaches these customers by selling direct-to-consumer through the company website, via specialty beauty stores, and to salon professionals who will ultimately use the products on customers.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors in the hair care segment include Kerastase and Redken, both owned by L'Oréal (ENXTPA:OR), Bumble and bumble, owned by Estée Lauder (NYSE:EL), and private company Brazilian Bond Builder (b3).Sales Growth

Olaplex is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

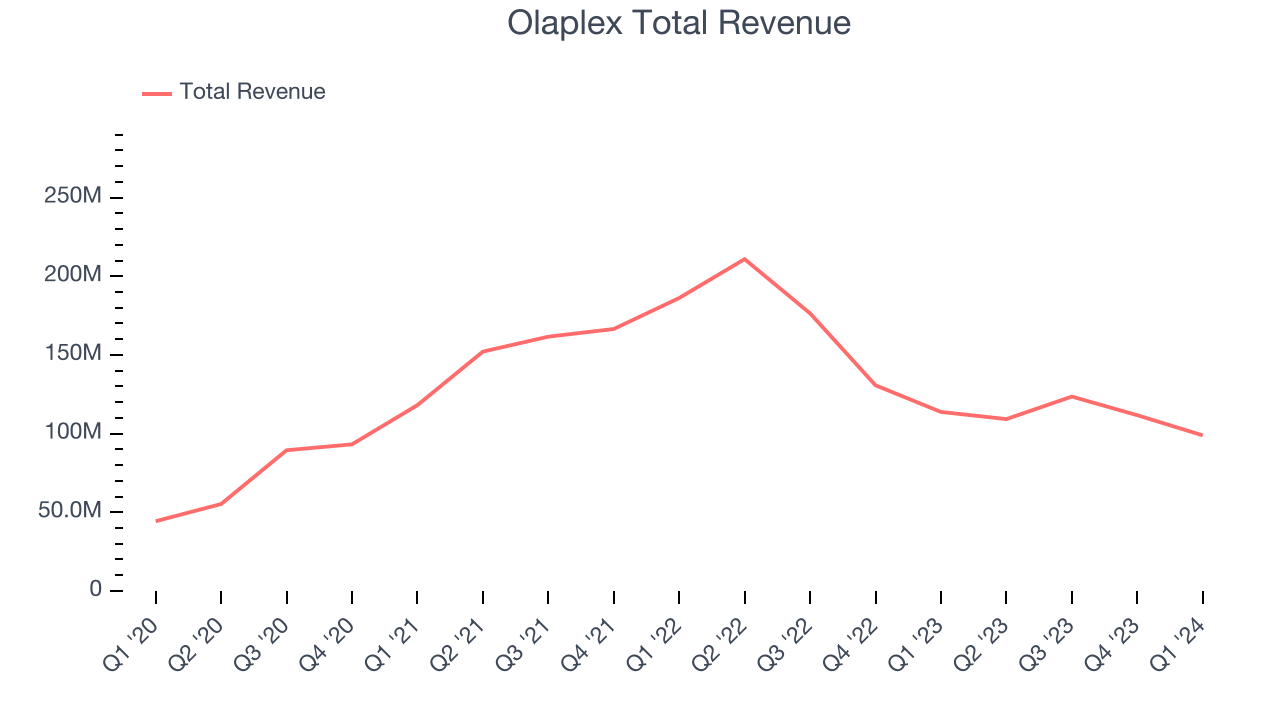

As you can see below, the company's annualized revenue growth rate of 7.6% over the last three years was decent for a consumer staples business.

This quarter, Olaplex's revenue fell 13.1% year on year to $98.91 million but beat Wall Street's estimates by 3.9%. Looking ahead, Wall Street expects sales to grow 2.6% over the next 12 months, an acceleration from this quarter.

Gross Margin & Pricing Power

This quarter, Olaplex's gross profit margin was 72.1%, in line with the same quarter last year. That means for every $1 in revenue, only $0.28 went towards paying for raw materials, production of goods, and distribution expenses.

Olaplex has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 72.8% gross margin over the last two years. Its margin, however, has been trending down over the last year, averaging 3.1% year-on-year decreases each quarter. If this trend continues, it could suggest a more competitive environment.

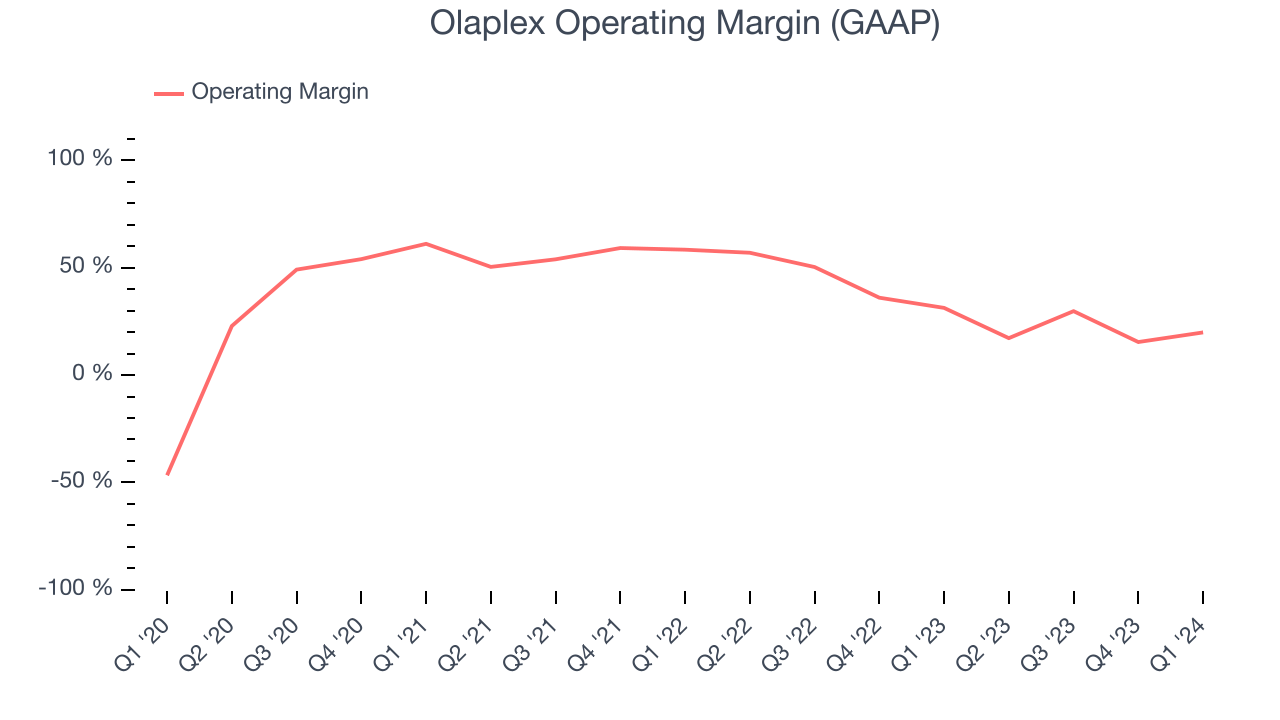

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, Olaplex generated an operating profit margin of 19.8%, down 11.4 percentage points year on year. Because Olaplex's operating margin decreased more than its gross margin, we can infer the company was less efficient and increased spending in discretionary areas like corporate overhead and advertising.

Zooming out, Olaplex has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 35.7%. However, Olaplex's margin has declined by 25.3 percentage points on average over the last year. Although this isn't the end of the world, investors are likely hoping for better results in the future.

Zooming out, Olaplex has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 35.7%. However, Olaplex's margin has declined by 25.3 percentage points on average over the last year. Although this isn't the end of the world, investors are likely hoping for better results in the future. EPS

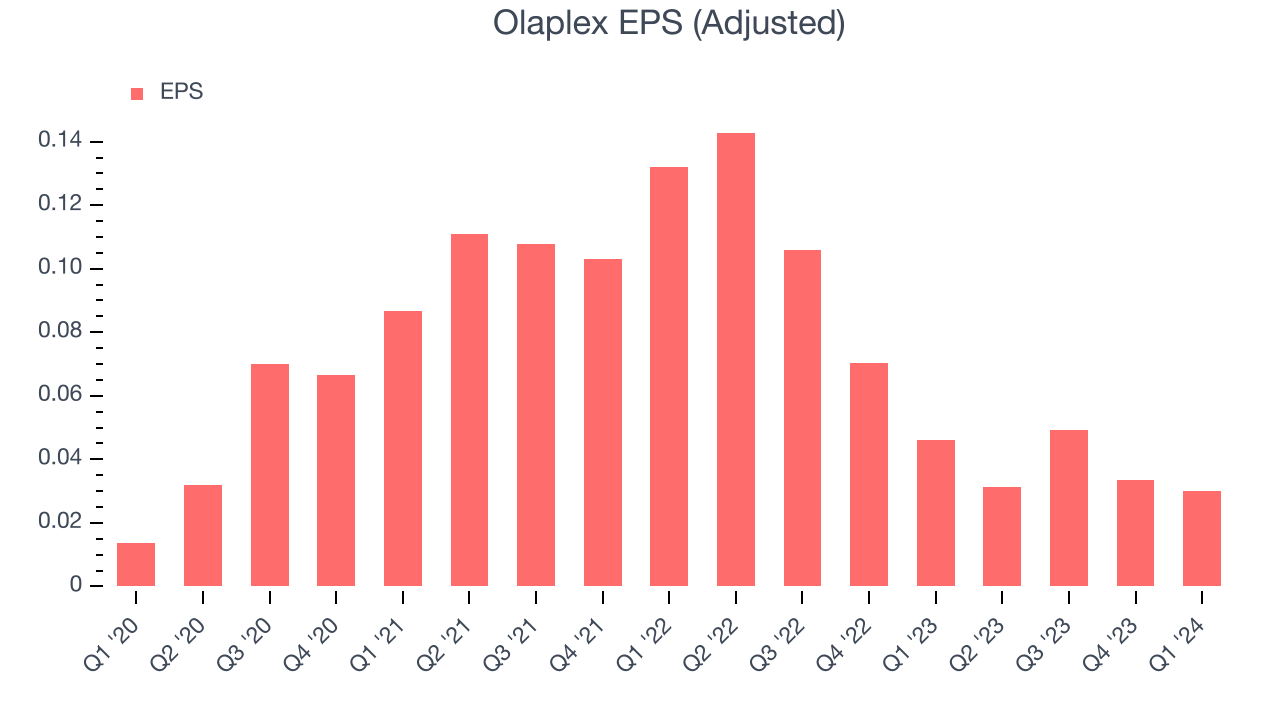

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Olaplex reported EPS at $0.03, down from $0.05 in the same quarter a year ago. This print beat Wall Street's estimates by 7.7%.

Between FY2021 and FY2024, Olaplex's EPS dropped 43.7%, translating into 17.4% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 3.6% year-on-year increase in EPS.

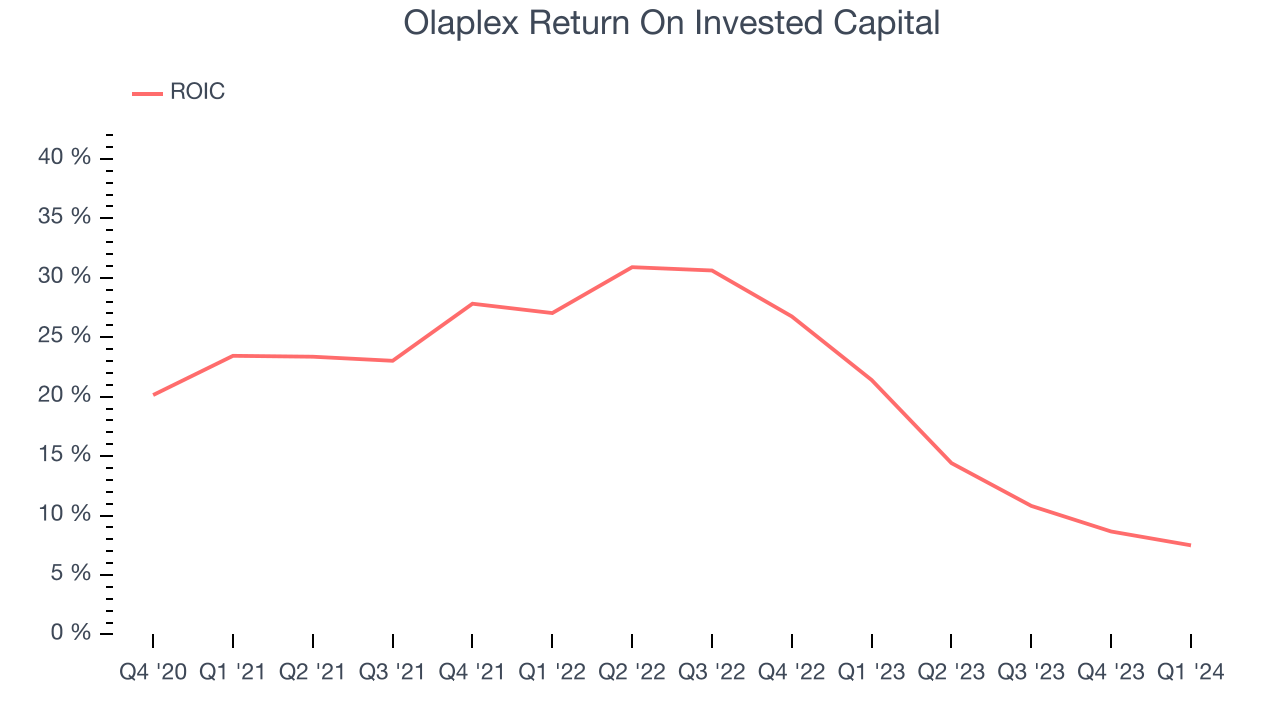

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Olaplex hasn't been the highest-quality company lately, it historically did a solid job investing in profitable business initiatives. Its five-year average ROIC was 19.8%, higher than most consumer staples companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Olaplex's ROIC averaged 10.8 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Olaplex reported $507.5 million of cash and $654.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $159.7 million of EBITDA over the last 12 months, we view Olaplex's 0.9x net-debt-to-EBITDA ratio as safe. We also see its $20.28 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Olaplex's Q1 Results

We enjoyed seeing Olaplex exceed analysts' revenue and adjusted expectations this quarter. The company maintained its previous guidance, showing that things are on track and that the operating environment is roughly unchanged from three months ago. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 2.9% after reporting and currently trades at $1.44 per share.

Is Now The Time?

Olaplex may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Olaplex isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been decent over the last three years, its brand caters to a niche market. And while its impressive gross margins are a wonderful starting point for the overall profitability of the business, the downside is its declining EPS over the last three years makes it hard to trust.

Olaplex's price-to-earnings ratio based on the next 12 months is 9.4x. In the end, beauty is in the eye of the beholder. While Olaplex wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $2.63 per share right before these results (compared to the current share price of $1.44).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.