Boat and marine products retailer OneWater Marine (NASDAQ:ONEW) fell short of analysts' expectations in Q1 CY2024, with revenue down 6.9% year on year to $488.3 million. It made a non-GAAP profit of $0.67 per share, down from its profit of $1.56 per share in the same quarter last year.

OneWater (ONEW) Q1 CY2024 Highlights:

- Revenue: $488.3 million vs analyst estimates of $499.9 million (2.3% miss)

- EPS (non-GAAP): $0.67 vs analyst expectations of $0.68 (2% miss)

- Gross Margin (GAAP): 24.6%, down from 28% in the same quarter last year

- Same-Store Sales were down 5% year on year

- Store Locations: 96 at quarter end, decreasing by 4 over the last 12 months

- Market Capitalization: $293.6 million

A public company since early 2020, OneWater Marine (NASDAQ:ONEW) sells boats, yachts, and other marine products.

The company’s product offering includes boats and yachts from well-known manufacturers such as Sea Ray and Boston Whaler as well as performance and sport vessels from brands like Yamaha and MasterCraft. In addition, OneWater Marine sells watersports equipment, marine electronics for navigation and communication, and safety gear. Lastly, the company’s locations provide financing and servicing to make them a one-stop shop for recreational boating.

The core customer is an affluent individual or and family who has means, interest in marine activities, and proximity or access to water to use the company’s products. These customers are looking for high-quality products that offer some combination of luxury and performance. They also often demand personalized support and assistance through the life of their boats or yachts.

OneWater Marine locations vary; there are small boutique-style locations to larger flagship stores. As expected, these locations usually sit near waterfront locations such as marinas and harbors. Boats are showcased both inside the showroom as well as outside. Also while inside, customers can find equipment and marine products for sale as well as well-versed associates who can talk through products, financing, and servicing.

Boat & Marine Retailer

Retailers that sell boats and marine products sell products, sure, but they also sell an image and lifestyle to an often wealthier customer. Unlike a car–which many use daily to get to/from work and to run personal and family errands–a boat or yacht is certainly a discretionary, luxury, nice-to-have purchase. While there is online competition, especially for research and discovery, the boat and yacht market is still very brick-and-mortar based given the magnitude of the purchase and the logistical costs associated with moving these products over long distances.

Competitors offering recreational marine products include MarineMax (NYSE:HZO), Yamaha Motor Co. (TSE:7272), and Brunswick Corp (NYSE:BC).Sales Growth

OneWater is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

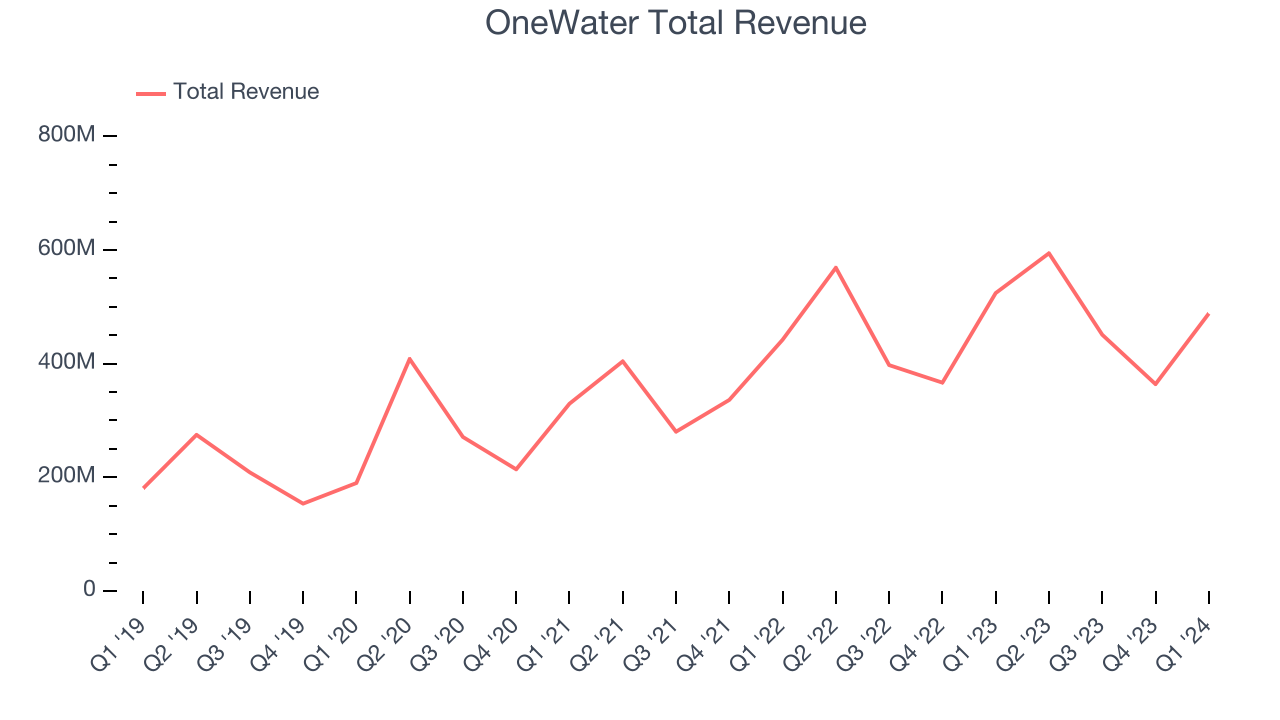

As you can see below, the company's annualized revenue growth rate of 23.3% over the last five years was incredible as it added more brick-and-mortar locations and increased sales at existing, established stores.

This quarter, OneWater missed Wall Street's estimates and reported a rather uninspiring 6.9% year-on-year revenue decline, generating $488.3 million in revenue. Looking ahead, Wall Street expects sales to grow 3.8% over the next 12 months, an acceleration from this quarter.

Number of Stores

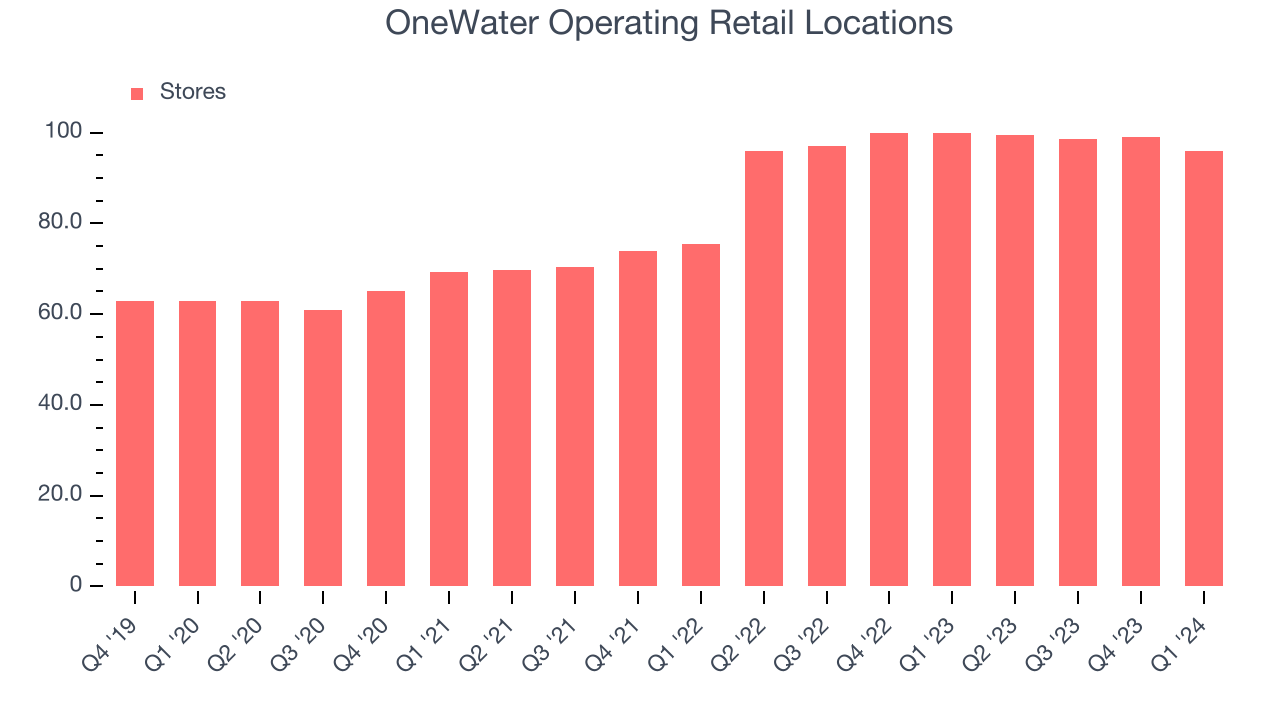

A retailer's store count often determines on how much revenue it can generate.

When a retailer like OneWater is opening new stores, it usually means it's investing for growth because demand is greater than supply. Since last year, OneWater's store count shrank by 4 locations, or 4%, to 96 total retail locations in the most recently reported quarter.

Taking a step back, the company has rapidly opened new stores over the last eight quarters, averaging 17.9% annual growth in its physical footprint. This store growth is much higher than other retailers and gives OneWater a chance to scale towards a mid-sized company over time. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

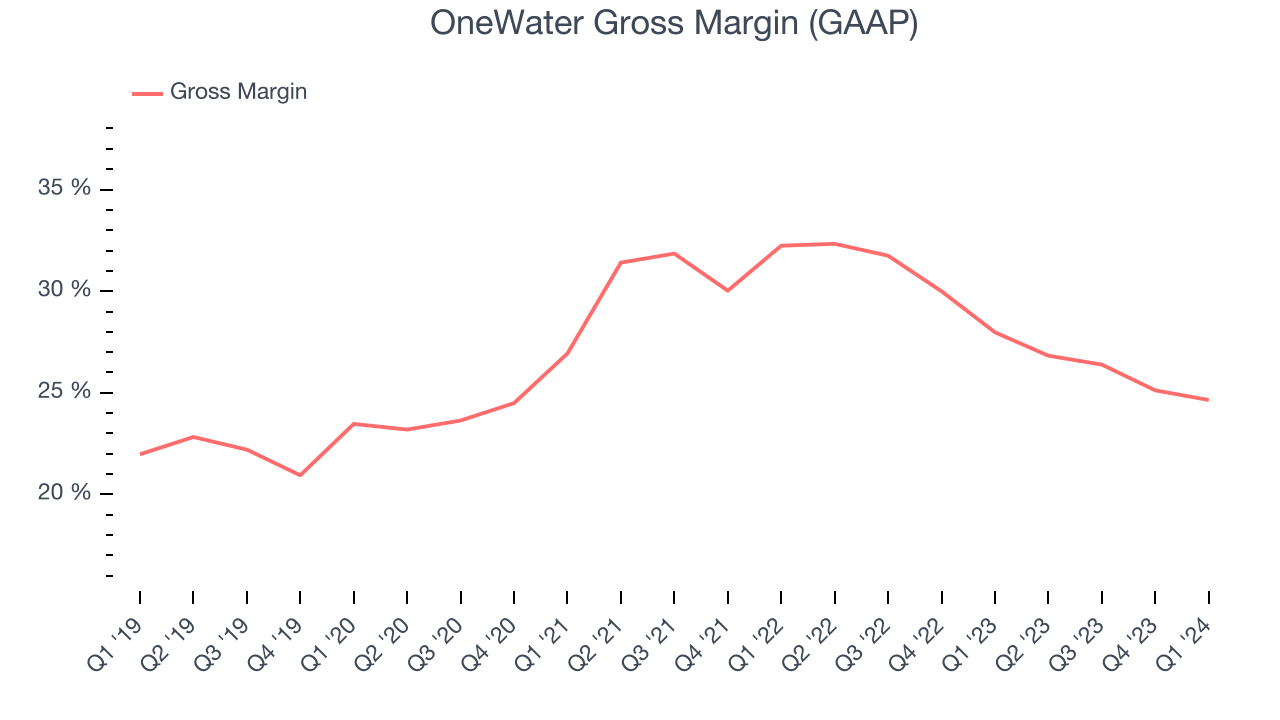

Gross Margin & Pricing Power

OneWater has poor unit economics for a retailer, leaving it with little room for error if things go awry. As you can see below, it's averaged a 28.2% gross margin over the last two years. This means the company makes $0.28 for every $1 in revenue before accounting for its operating expenses.

OneWater's gross profit margin came in at 24.6% this quarter, marking a 3.3 percentage point decrease from 28% in the same quarter last year. Although the company could've performed better, we care more about its long-term trends rather than just one quarter. Additionally, a retailer's gross margin can often change due to factors outside its control, such as product discounting and dynamic input costs (think distribution and freight expenses to move goods). We'll keep a close eye on this.

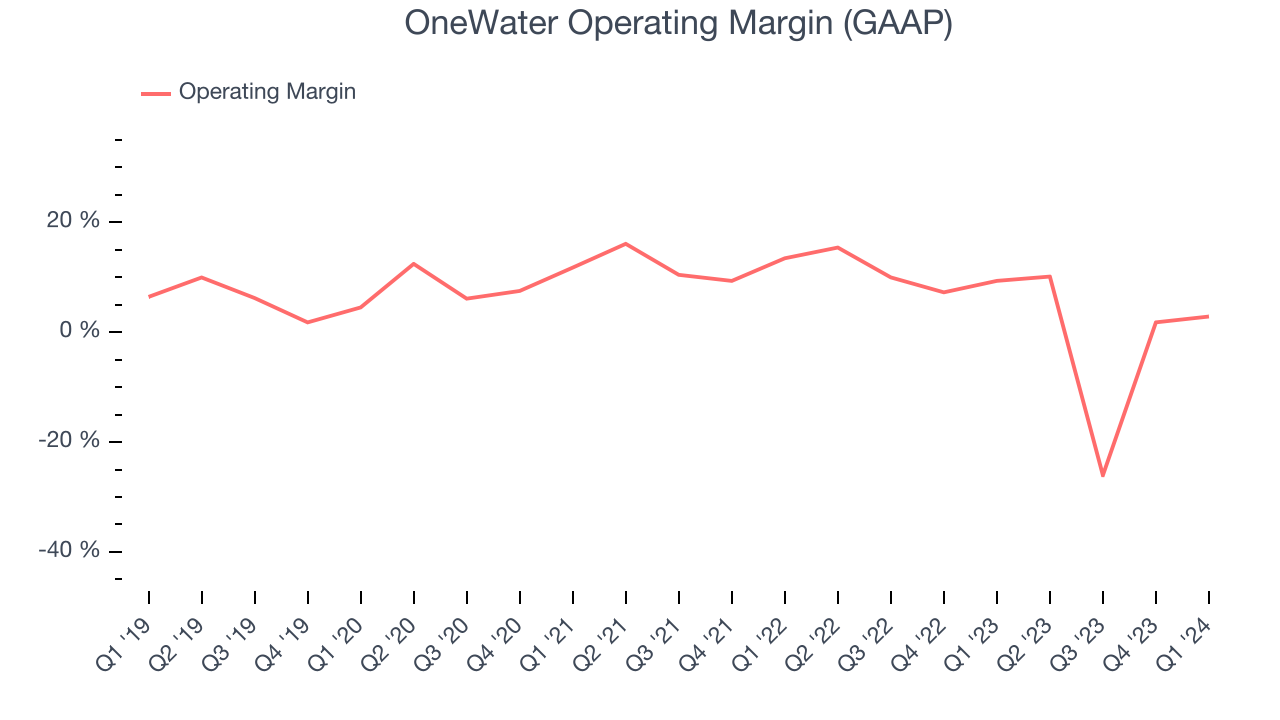

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, OneWater generated an operating profit margin of 2.8%, down 6.5 percentage points year on year. We can infer OneWater was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, OneWater was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 4.4%. On top of that, OneWater's margin has declined, on average, by 12.9 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Zooming out, OneWater was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 4.4%. On top of that, OneWater's margin has declined, on average, by 12.9 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

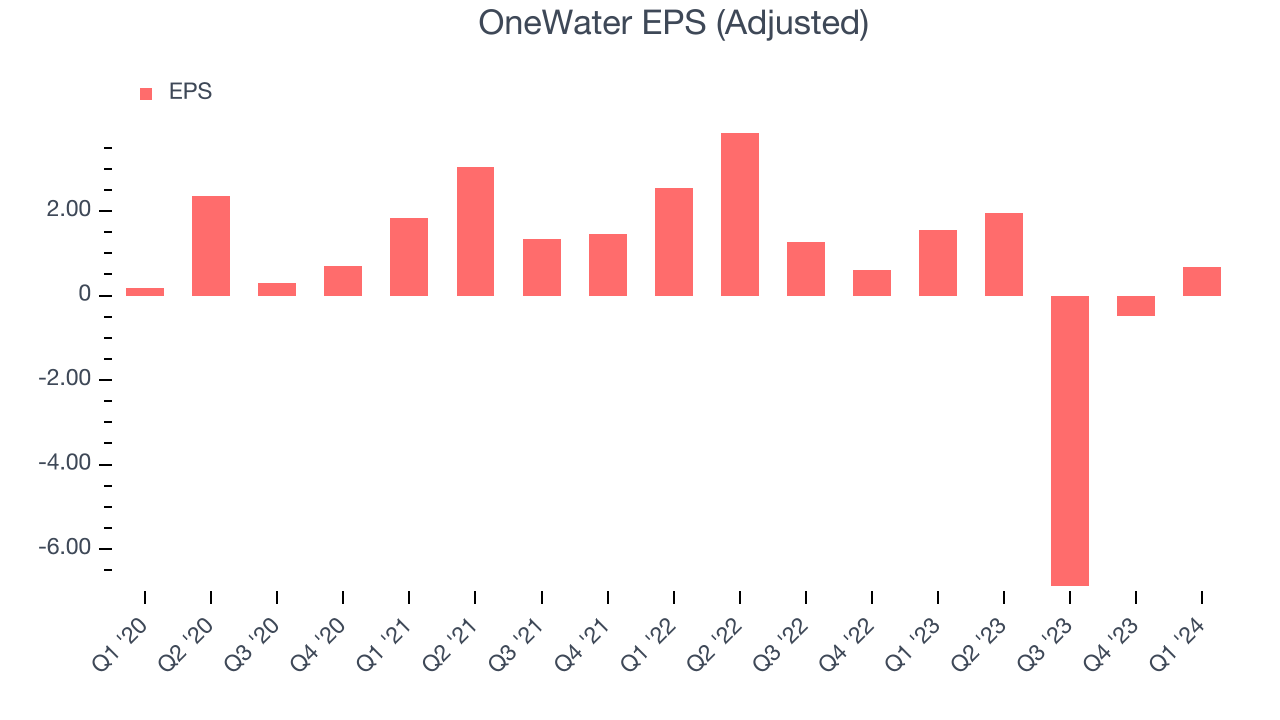

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, OneWater reported EPS at $0.67, down from $1.56 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2021 and FY2024, OneWater's adjusted diluted EPS dropped 81.4%, translating into 42.9% annualized declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 179% year-on-year increase in EPS.

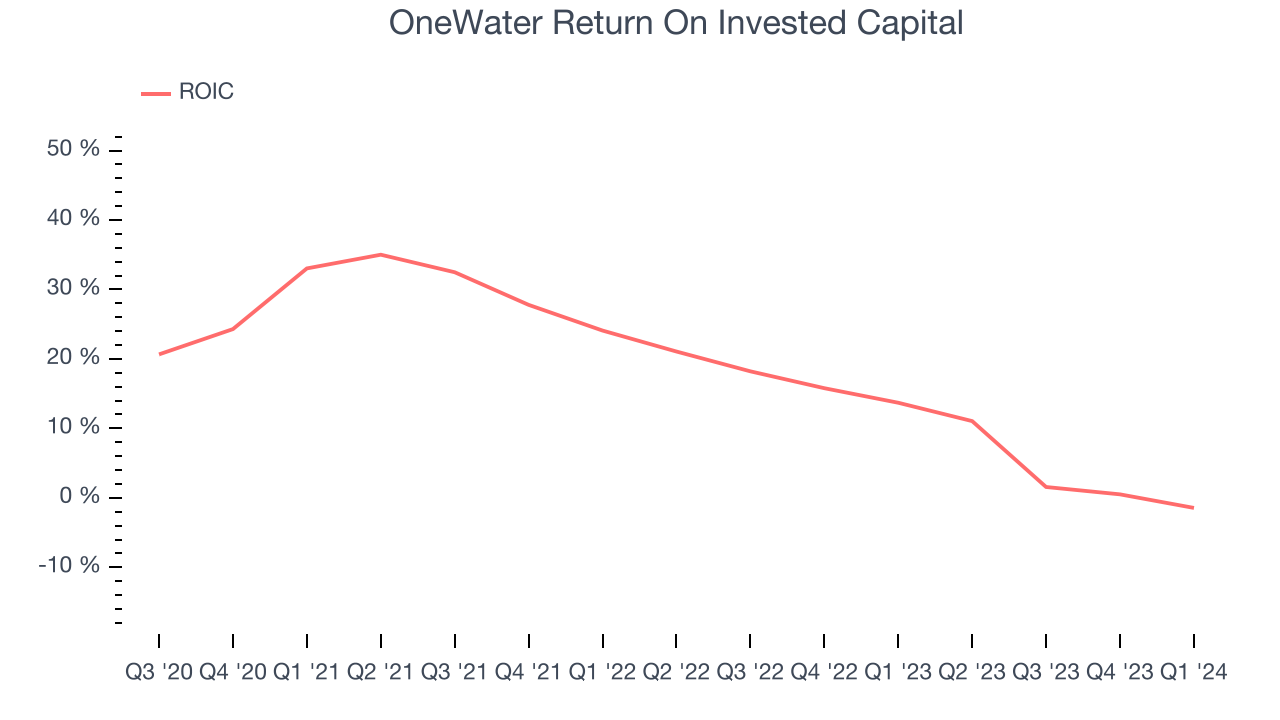

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

OneWater's five-year average ROIC was 17.3%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, OneWater's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, OneWater's ROIC significantly decreased over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

OneWater reported $47 million of cash and $554.9 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $123.2 million of EBITDA over the last 12 months, we view OneWater's 4.1x net-debt-to-EBITDA ratio as safe. We also see its $40.97 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from OneWater's Q1 Results

It was unfortunate to see OneWater miss analysts' revenue and EPS estimates this quarter, driven by a sizeable decrease in its same-store sales (a decline of 5% compared to estimates of a 2% decline). On the bright side, its full-year EPS and EBITDA guidance was robust and easily exceeded Wall Street's expectations.

It also anticipates its full-year same-store sales growth to be in the low to mid-single digits, which is comforting given Malibu Boats (a boat manufacturer) reported this morning and anticipates a 40% drop in sales. It isn't a clean comp because OneWater runs a dealership model, but the two companies are in the same industry. Overall, this was a mediocre quarter for OneWater, but its outlook was quite encouraging. The stock is flat after reporting and currently trades at $20.15 per share.

Is Now The Time?

OneWater may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that OneWater isn't a bad business. First off, its revenue growth has been exceptional over the last five years. And while its declining EPS over the last three years makes it hard to trust, its marvelous same-store sales growth is on another level.

OneWater's price-to-earnings ratio based on the next 12 months is 5.3x. In the end, beauty is in the eye of the beholder. While OneWater wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $32.33 per share right before these results (compared to the current share price of $20.15).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.