Wrapping up Q1 earnings, we look at the numbers and key takeaways for the consumer internet stocks, including Overstock (NASDAQ:OSTK) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 34 consumer internet stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 2.57%, while on average next quarter revenue guidance was 1.21% under consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows, but consumer internet stocks held their ground better than others, with the share prices up 9.37% since the previous earnings results, on average.

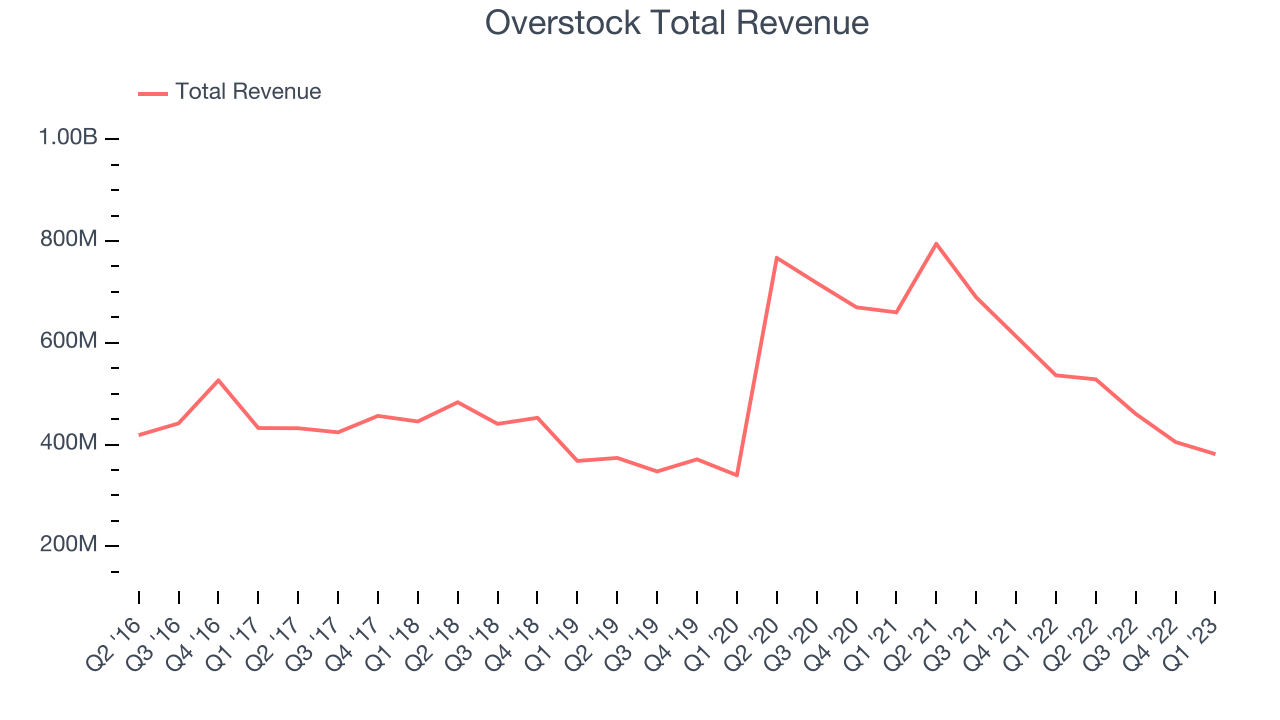

Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $381.1 million, down 28.9% year on year, beating analyst expectations by 6.6%. It was a weak quarter for the company, with declining number of users and revenue.

“The team delivered positive adjusted EBITDA for the twelfth consecutive quarter,” said Overstock CEO Jonathan Johnson.

The stock is up 20.4% since the results and currently trades at $21.75.

Read our full report on Overstock here, it's free.

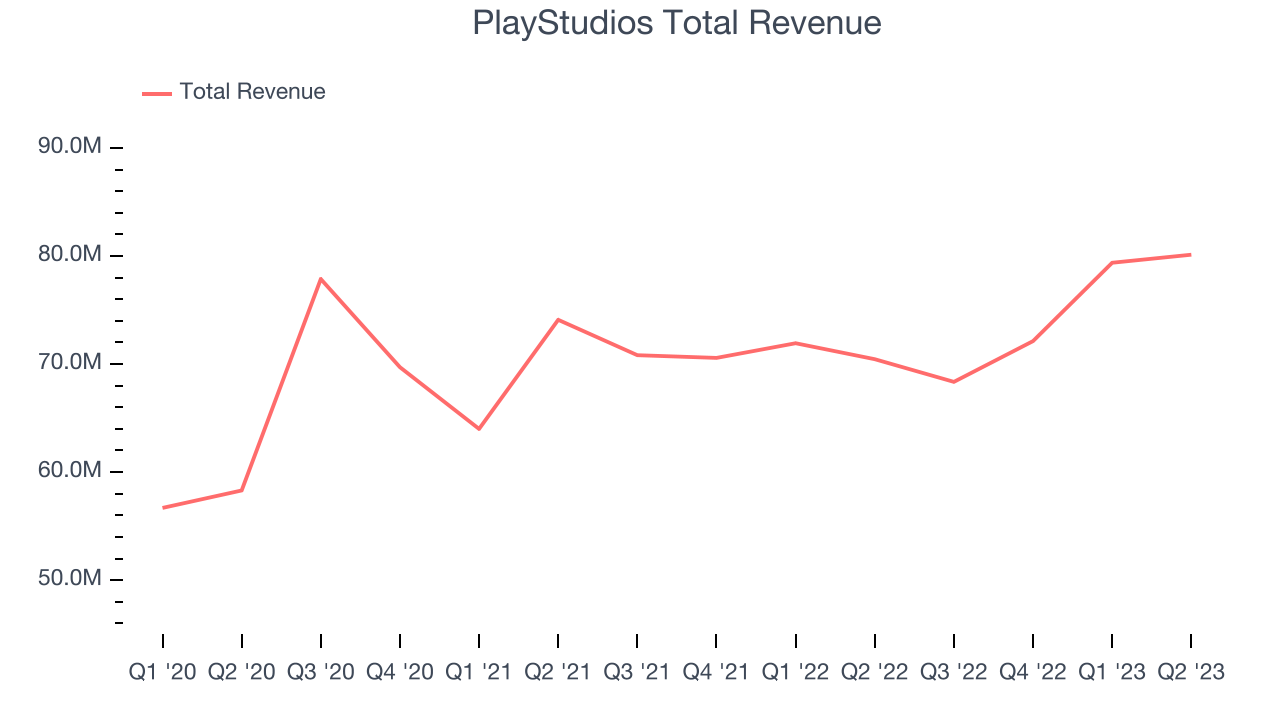

Best Q1: PlayStudios (NASDAQ:MYPS)

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

PlayStudios reported revenues of $80.1 million, up 13.7% year on year, beating analyst expectations by 9.12%. It was a very strong quarter for the company, with growing number of users and an impressive beat of analyst estimates.

PlayStudios pulled off the strongest analyst estimates beat and highest full year guidance raise among its peers. The company reported 13.1 million monthly active users, up 89.2% year on year. The stock is up 5.61% since the results and currently trades at $4.52.

Is now the time to buy PlayStudios? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $44.4 million, down 52.5% year on year, missing analyst expectations by 0.59%. It was a weak quarter for the company, with declining number of users and revenue.

Skillz had the slowest revenue growth in the group. The company reported 214 thousand monthly active users, down 62.5% year on year. The stock is down 2.06% since the results and currently trades at $0.57.

Read our full analysis of Skillz's results here.

CarGurus (NASDAQ:CARG)

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ:CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

CarGurus reported revenues of $232 million, down 46.1% year on year, beating analyst expectations by 8.22%. It was a decent quarter for the company, with a beat of analyst estimates and revenue guidance for the next quarter exceeding Consensus.

The company reported 31.3 thousand paying users, up 1.37% year on year. The stock is up 25.8% since the results and currently trades at $20.6.

Read our full, actionable report on CarGurus here, it's free.

Nextdoor (NYSE:KIND)

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE:KIND) is a social network that connects neighbors with each other and with local businesses.

Nextdoor reported revenues of $49.8 million, down 2.41% year on year, beating analyst expectations by 8.34%. It was a strong quarter for the company, with an impressive beat of analyst estimates and solid guidance for the next quarter.

The company reported 42.4 million daily active users, up 15.5% year on year. The stock is up 43.8% since the results and currently trades at $2.92.

Read our full, actionable report on Nextdoor here, it's free.

The author has no position in any of the stocks mentioned