Looking back on consumer internet stocks' Q2 earnings, we examine this quarter’s best and worst performers, including Overstock (NASDAQ:OSTK) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 18 consumer internet stocks we track reported a slower Q2; on average, revenues were in line with analyst consensus estimates, while on average next quarter revenue guidance was 8.04% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital and consumer internet stocks have not been spared, with share prices down 16.7% since the previous earnings results, on average.

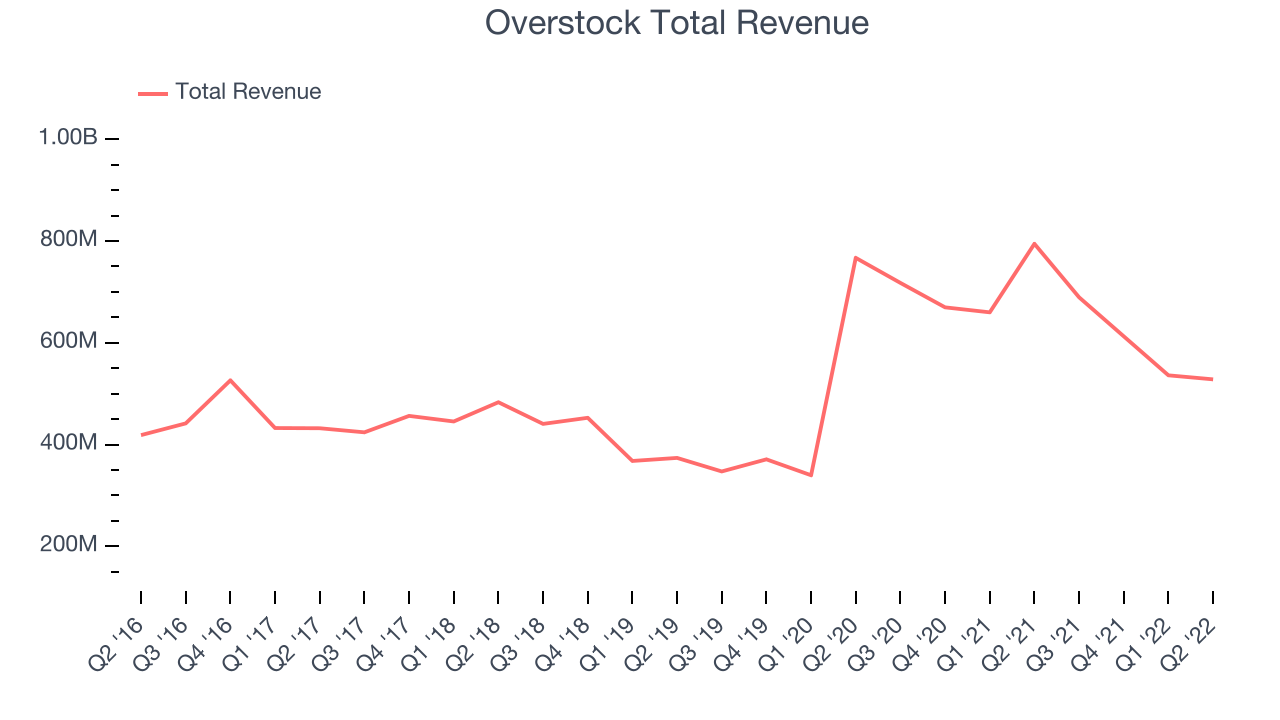

Slowest Q2: Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $528.1 million, down 33.6% year on year, missing analyst expectations by 12%. It was a weak quarter for the company, with declining number of users and a slow revenue growth.

"Our disciplined execution and differentiated asset-light operating model allowed us to remain profitable for the ninth consecutive quarter, even with weak consumer sentiment, ongoing macroeconomic and geopolitical volatility, higher inflation, and significant competitive pressures including competitors liquidating their excess owned inventory," said Overstock CEO Jonathan Johnson.

Overstock delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The company reported 6.5 million active buyers, down 29.4% year on year. The stock is down 10% since the results and currently trades at $25.45.

Read our full report on Overstock here, it's free.

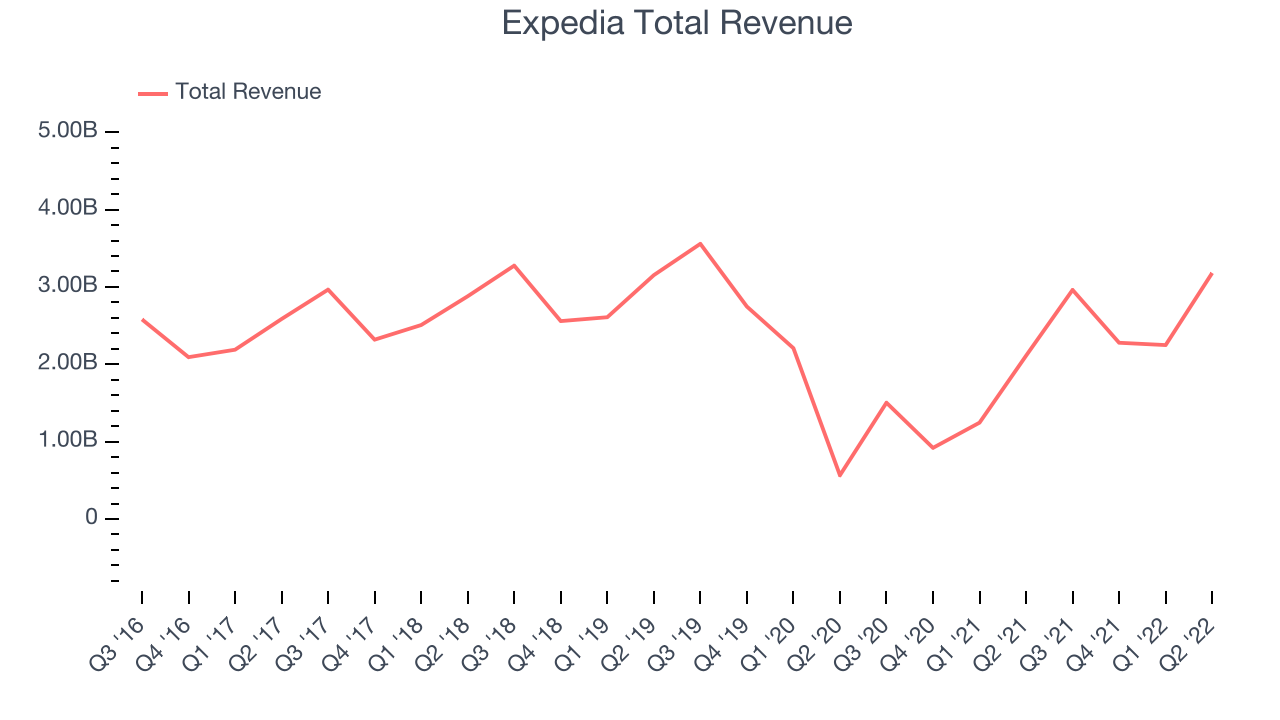

Best Q2: Expedia (NASDAQ:EXPE)

Originally founded as a part of Microsoft, Expedia (NASDAQ: EXPE) is one of the world’s leading online travel agencies.

Expedia reported revenues of $3.18 billion, up 50.6% year on year, beating analyst expectations by 6.42%. It was a good quarter for the company, with solid revenue growth and a growing number of users.

The company reported 79.1 million room nights, up 39.7% year on year. The stock is down 8.59% since the results and currently trades at $93.56.

Is now the time to buy Expedia? Access our full analysis of the earnings results here, it's free.

Fiverr (NYSE:FVRR)

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $85 million, up 12.9% year on year, missing analyst expectations by 1.85%. It was a weak quarter for the company, with an underwhelming revenue guidance for both the next quarter and the full year.

Fiverr had the weakest full year guidance update in the group. The company reported 4.2 million active buyers, up 5% year on year. The stock is down 17.1% since the results and currently trades at $30.70.

Read our full analysis of Fiverr's results here.

Lyft (NASDAQ:LYFT)

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

Lyft reported revenues of $990.7 million, up 29.5% year on year, in line with analyst expectations. It was a solid quarter for the company, with a strong top line growth.

The company reported 19.8 million paying users, up 15.8% year on year. The stock is down 28.2% since the results and currently trades at $12.50.

Read our full, actionable report on Lyft here, it's free.

Snap (NYSE:SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Snap reported revenues of $1.11 billion, up 13.1% year on year, missing analyst expectations by 2.07%. It was a weak quarter for the company, with a miss of the top line analyst estimates and a slow revenue growth.

The company reported 347 million daily active users, up 18.4% year on year. The stock is down 35.5% since the results and currently trades at $10.55.

Read our full, actionable report on Snap here, it's free.

The author has no position in any of the stocks mentioned