Cybersecurity provider Palo Alto Networks (NASDAQ:PANW) reported Q2 CY2024 results beating Wall Street analysts’ expectations, with revenue up 12.1% year on year to $2.19 billion. The company expects next quarter’s revenue to be around $2.12 billion, in line with analysts’ estimates. It made a non-GAAP profit of $1.51 per share, improving from its profit of $1.44 per share in the same quarter last year.

Is now the time to buy Palo Alto Networks? Find out by accessing our full research report, it’s free.

Palo Alto Networks (PANW) Q2 CY2024 Highlights:

- Revenue: $2.19 billion vs analyst estimates of $2.16 billion (1.2% beat)

- EPS (non-GAAP): $1.51 vs analyst estimates of $1.41 (6.9% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $9.13 billion at the midpoint, in line with analyst expectations and implying 13.7% growth (vs 16.7% in FY2024)

- Gross Margin (GAAP): 73.8%, in line with the same quarter last year

- Market Capitalization: $108.2 billion

"We finished off the year with strong execution on our platformization strategy in Q4," said Nikesh Arora, chairman and CEO of Palo Alto Networks.

Founded in 2005 by cybersecurity engineer Nir Zuk, Palo Alto Networks (NASDAQ:PANW) makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches, and malware threats.

Network Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in insecure environments is increasing demand modern cloud-based network security software, which offers better performance at lower cost than maintaining the traditional on-premise solutions, such as expensive specialized firewall hardware.

Sales Growth

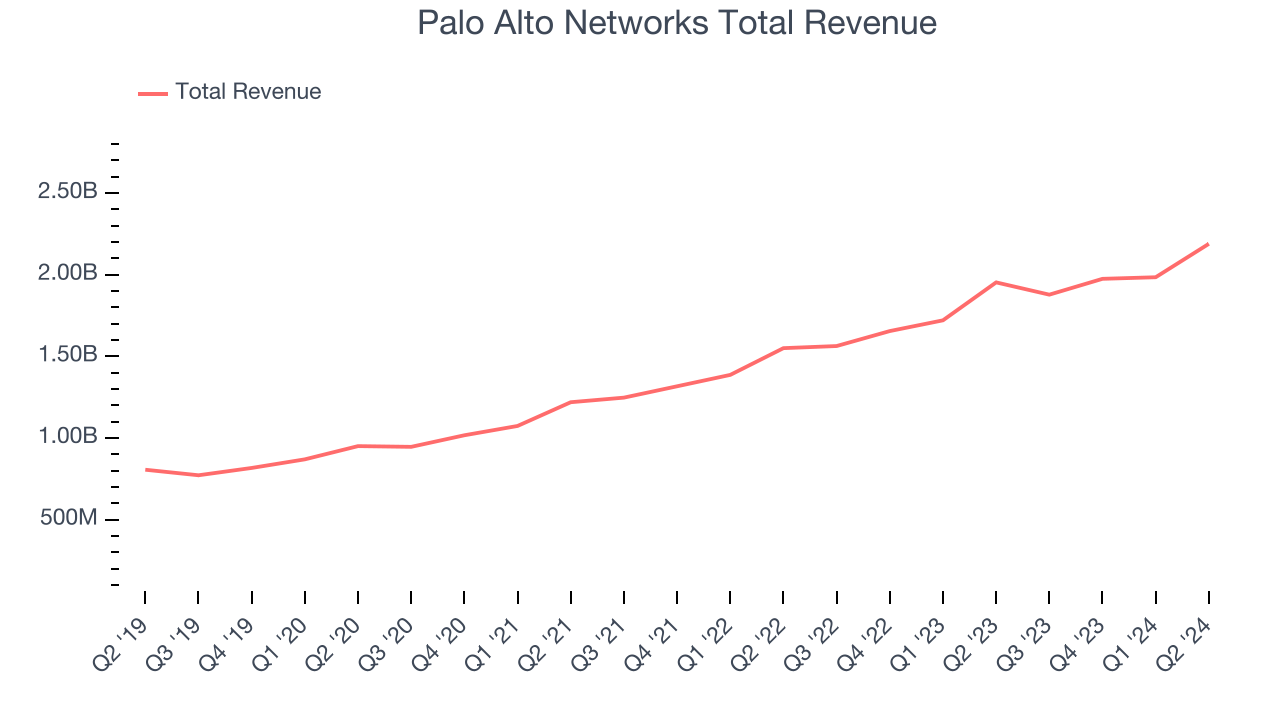

As you can see below, Palo Alto Networks’s 23.6% annualized revenue growth over the last three years has been decent, and its sales came in at $2.19 billion this quarter.

This quarter, Palo Alto Networks’s quarterly revenue was once again up 12.1% year on year. We can see that Palo Alto Networks’s revenue increased by $204.7 million quarter on quarter, which is a solid improvement from the $9.7 million increase in Q1 CY2024. This acceleration of growth was a great sign.

Next quarter’s guidance suggests that Palo Alto Networks is expecting revenue to grow 12.6% year on year to $2.12 billion, slowing down from the 20.1% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $9.13 billion at the midpoint, growing 13.7% year on year compared to the 16.5% increase in FY2024.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service.

These costs include servers, licenses, and certain personnel, and leverage on them can decide the winners in competitive markets because they determine how much can be invested into new products, sales, and talent.

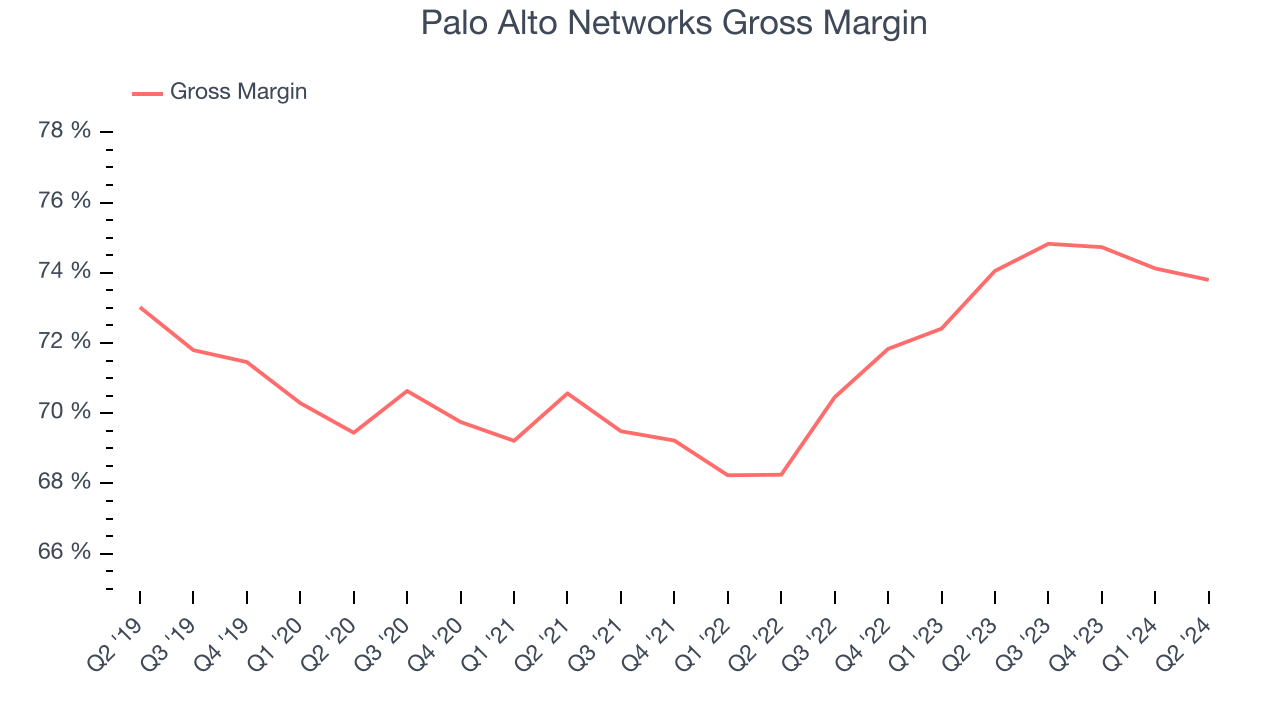

Palo Alto Networks’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged a healthy 74.3% gross margin over the last year. Said differently, Palo Alto Networks paid its providers $25.65 for every $100 in revenue to run its products and services.

Palo Alto Networks produced a 73.8% gross profit margin in Q2, which is in line with the same quarter last year. Zooming out, Palo Alto Networks’s full-year margin has been trending up over the past 12 months, increasing by 2.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

Key Takeaways from Palo Alto Networks’s Q2 Results

It was encouraging to see Palo Alto Networks top analysts’ revenue and EPS expectations. Zooming out, we think this was a decent quarter featuring some areas of strength. The stock traded up 4.5% to $358.50 immediately following the results.

So should you invest in Palo Alto Networks right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.