As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the cybersecurity industry, including Palo Alto Networks (NASDAQ:PANW) and its peers.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 0.5% above.

While some cybersecurity stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.3% since the latest earnings results.

Palo Alto Networks (NASDAQ:PANW)

Founded in 2005 by cybersecurity engineer Nir Zuk, Palo Alto Networks (NASDAQ:PANW) makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches, and malware threats.

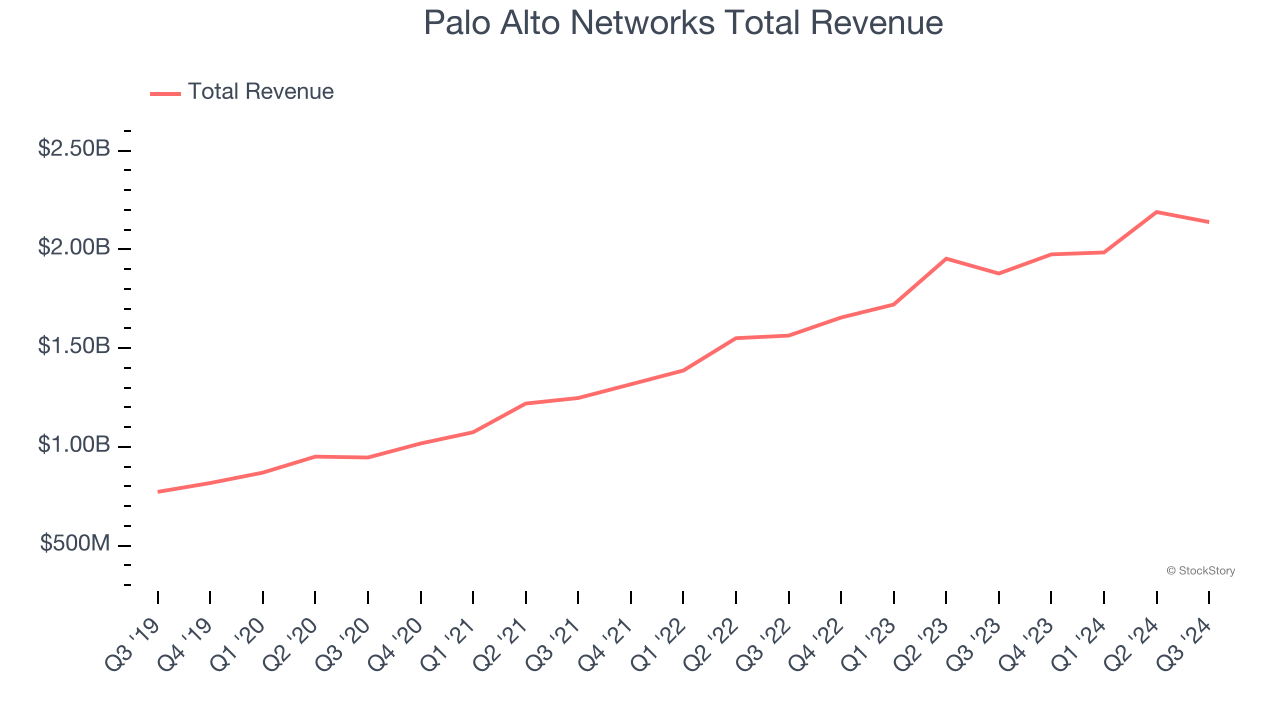

Palo Alto Networks reported revenues of $2.14 billion, up 13.9% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was a strong quarter for the company with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

"Our Q1 results reinforced our conviction in our differentiated platformization strategy," said Nikesh Arora, chairman and CEO of Palo Alto Networks.

Palo Alto Networks delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 2.9% since reporting and currently trades at $201.98.

Is now the time to buy Palo Alto Networks? Access our full analysis of the earnings results here, it’s free.

Best Q3: Okta (NASDAQ:OKTA)

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ:OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

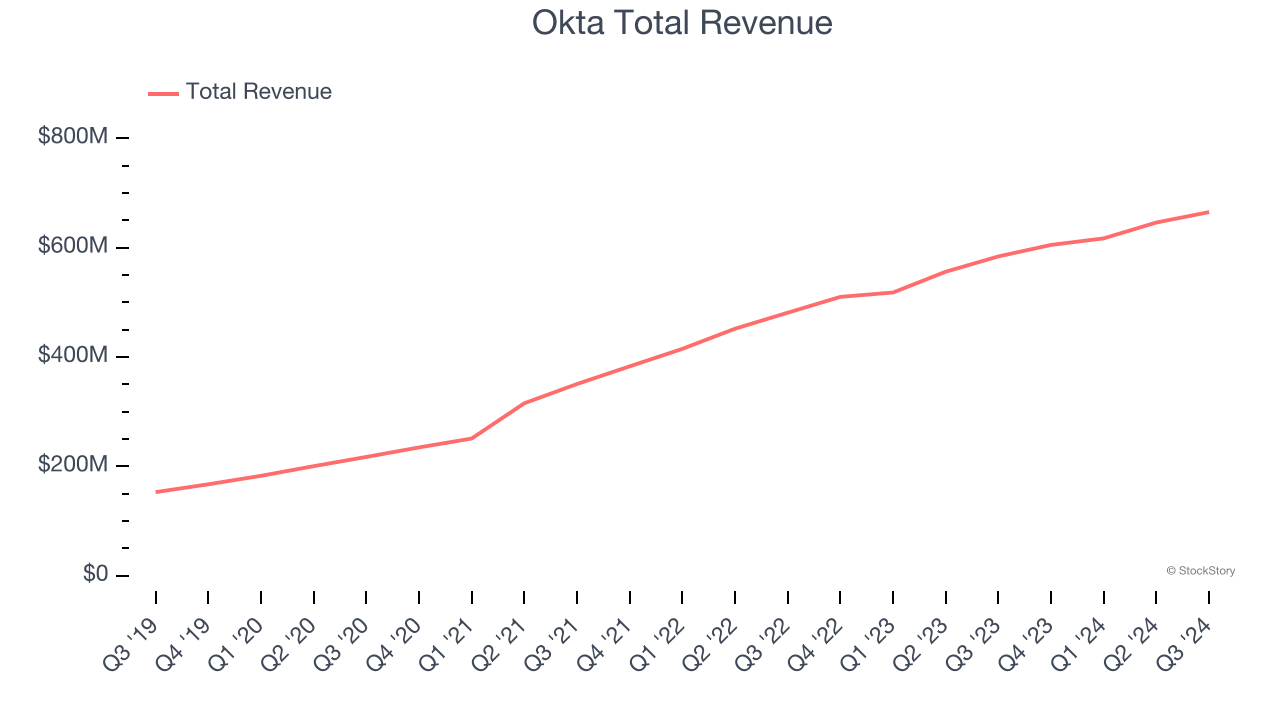

Okta reported revenues of $665 million, up 13.9% year on year, outperforming analysts’ expectations by 2.4%. The business had a very strong quarter with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The market seems content with the results as the stock is up 4% since reporting. It currently trades at $85.

Is now the time to buy Okta? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: SentinelOne (NYSE:S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $210.6 million, up 28.3% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted an impressive beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

SentinelOne delivered the weakest performance against analyst estimates in the group. The company added 77 enterprise customers paying more than $100,000 annually to reach a total of 1,310. As expected, the stock is down 16.6% since the results and currently trades at $23.93.

Read our full analysis of SentinelOne’s results here.

CrowdStrike (NASDAQ:CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $1.01 billion, up 28.5% year on year. This number topped analysts’ expectations by 2.8%. It was a strong quarter as it also put up an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

CrowdStrike achieved the fastest revenue growth among its peers. The stock is up 3.5% since reporting and currently trades at $377.15.

Read our full, actionable report on CrowdStrike here, it’s free.

Varonis (NASDAQ:VRNS)

Founded by a duo of former Israeli Defense Forces cyber warfare engineers, Varonis (NASDAQ:VRNS) offers software-as-service that helps customers protect data from cyber threats and gain visibility into how enterprise data is being used.

Varonis reported revenues of $148.1 million, up 21.1% year on year. This result beat analysts’ expectations by 4.7%. Overall, it was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Varonis pulled off the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is down 19.7% since reporting and currently trades at $47.19.

Read our full, actionable report on Varonis here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.