Multinational media and entertainment corporation Paramount (NASDAQ:PARA) fell short of analysts' expectations in Q4 FY2023, with revenue down 6.1% year on year to $7.64 billion. It made a non-GAAP profit of $0.04 per share, down from its profit of $0.08 per share in the same quarter last year.

Is now the time to buy Paramount? Find out by accessing our full research report, it's free.

Paramount (PARA) Q4 FY2023 Highlights:

- Revenue: $7.64 billion vs analyst estimates of $7.89 billion (3.2% miss)

- EPS (non-GAAP): $0.04 vs analyst estimates of $0 ($0.04 beat)

- Gross Margin (GAAP): 32.6%, in line with the same quarter last year

- Market Capitalization: $7.75 billion

Owner of Spongebob Squarepants and formerly known as ViacomCBS, Paramount Global (NASDAQ:PARA) is a major media conglomerate offering television, film production, and digital content across various global platforms.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

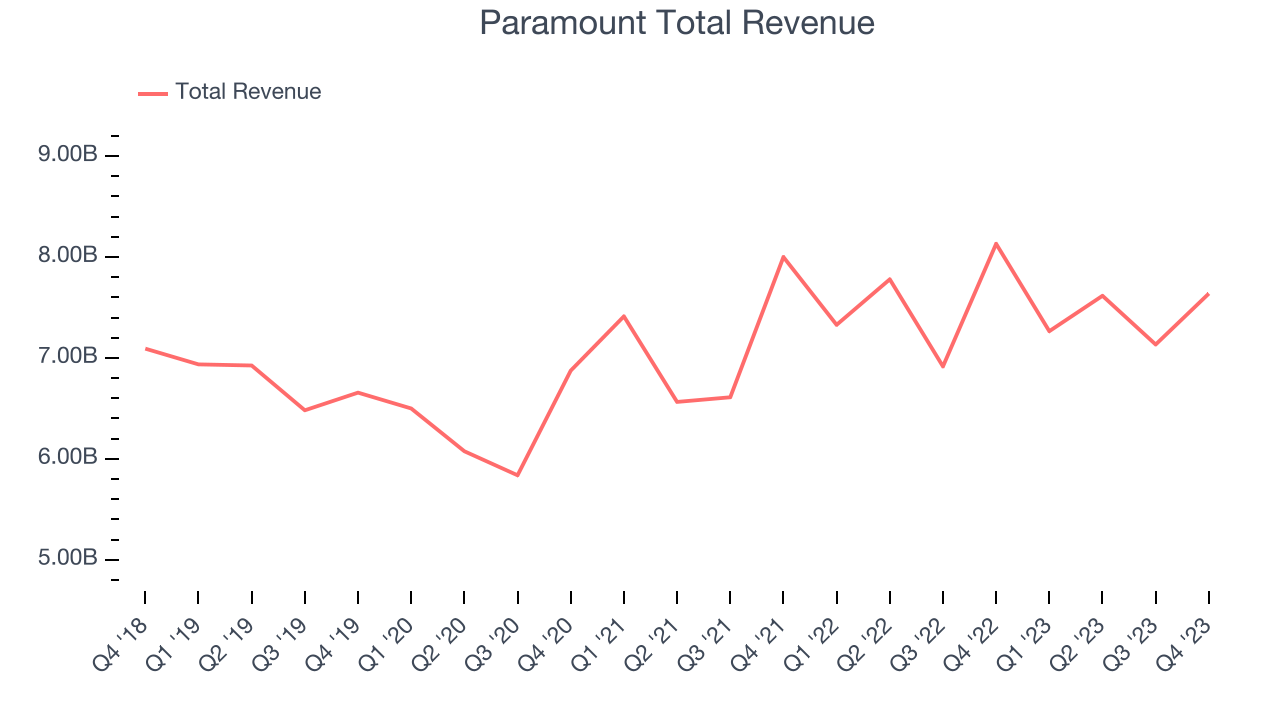

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Paramount's annualized revenue growth rate of 1.7% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Paramount's annualized revenue growth of 1.8% over the last two years aligns with its five-year revenue growth, suggesting the company's demand has been stable.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Paramount's annualized revenue growth of 1.8% over the last two years aligns with its five-year revenue growth, suggesting the company's demand has been stable.

We can better understand the company's revenue dynamics by analyzing its most important segments, TV Media and Direct-to-Consumer, which are 67.7% and 24.5% of revenue. Over the last two years, Paramount's TV Media revenue (broadcasting) averaged 5.8% year-on-year declines. On the other hand, its Direct-to-Consumer revenue (streaming) averaged 44.5% growth.

This quarter, Paramount missed Wall Street's estimates and reported a rather uninspiring 6.1% year-on-year revenue decline, generating $7.64 billion of revenue. Looking ahead, Wall Street expects sales to grow 5.3% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

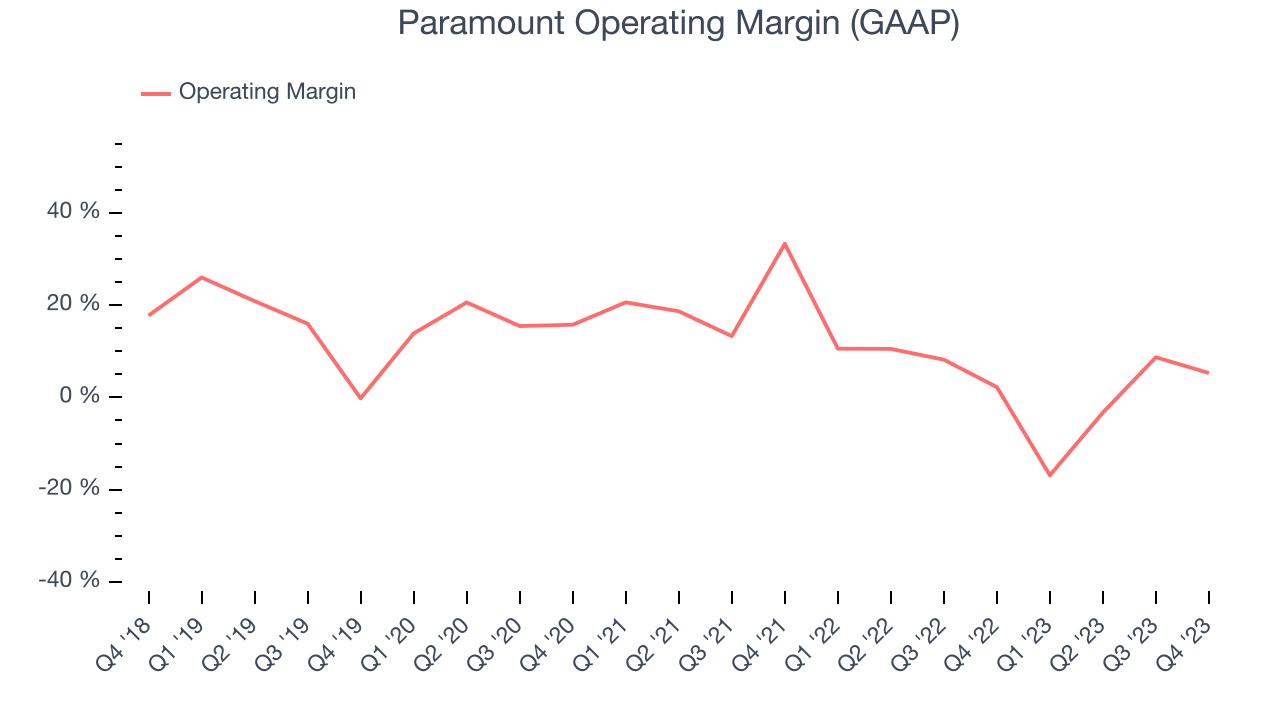

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Paramount was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.2% has been paltry for a consumer discretionary business.

In Q4, Paramount generated an operating profit margin of 5.3%, up 3.1 percentage points year on year.

Over the next 12 months, Wall Street expects Paramount to become profitable. Analysts are expecting the company’s LTM operating margin of negative 1.5% to rise to positive 7.3%.Key Takeaways from Paramount's Q4 Results

We were impressed by how significantly Paramount blew past analysts' EPS expectations this quarter. On the other hand, its sales missed as its TV Media revenue ($5.17 billion vs estimates of $5.3 billion) and Filmed Entertainment revenue ($647 million vs estimates of $805 million) came in below Wall Street's estimates. Both misses were driven by 25% and 32% drops in licensing revenue, respectively. On the bright side, its Direct-to-Consumer streaming segment remained on track and is making progress toward long-term profitability. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $11.18 per share.

So should you invest in Paramount right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.