Payroll and human resources software provider, Paychex (NASDAQ:PAYX) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 2.5% year on year to $1.32 billion. Its non-GAAP profit of $1.16 per share was 2% above analysts’ consensus estimates.

Is now the time to buy Paychex? Find out by accessing our full research report, it’s free.

Paychex (PAYX) Q3 CY2024 Highlights:

- Revenue: $1.32 billion vs analyst estimates of $1.31 billion (in line)

- EPS (non-GAAP): $1.16 vs analyst estimates of $1.14 (2% beat)

- Gross Margin (GAAP): 71.2%, in line with the same quarter last year

- EBITDA Margin: 44.4%, in line with the same quarter last year

- Free Cash Flow Margin: 38.7%, up from 13.9% in the previous quarter

- Market Capitalization: $48.27 billion

President and Chief Executive Officer , John Gibson commented, "We are off to a solid start in fiscal 2025 with 3% growth in total revenue during the first quarter. Excluding the impact of the expiration of the Employee Retention Tax Credit ("ERTC") program and one less payroll processing day, revenue growth was 7%.

Company Overview

One of the oldest service providers in the industry, Paychex (NASDAQ:PAYX) offers its customers payroll and HR software solutions.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Sales Growth

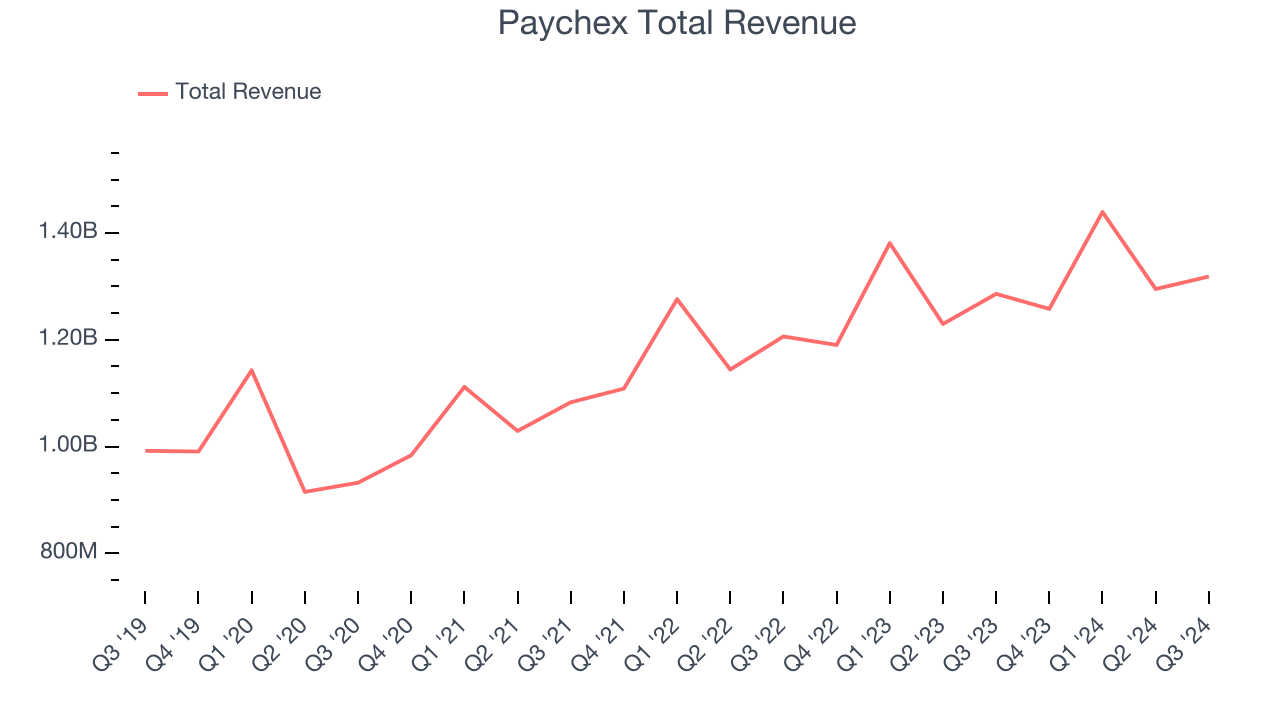

As you can see below, Paychex’s 8.1% annualized revenue growth over the last three years has been sluggish, and its sales came in at $1.32 billion this quarter.

Paychex’s quarterly revenue was only up 2.5% year on year, which might disappoint some shareholders. However, its revenue increased $23.4 million quarter on quarter, a strong improvement from the $144.2 million decrease in Q2 CY2024. This acceleration of growth was very nice to see.

Looking ahead, analysts covering the company were expecting sales to grow 5.3% over the next 12 months before the earnings results announcement.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

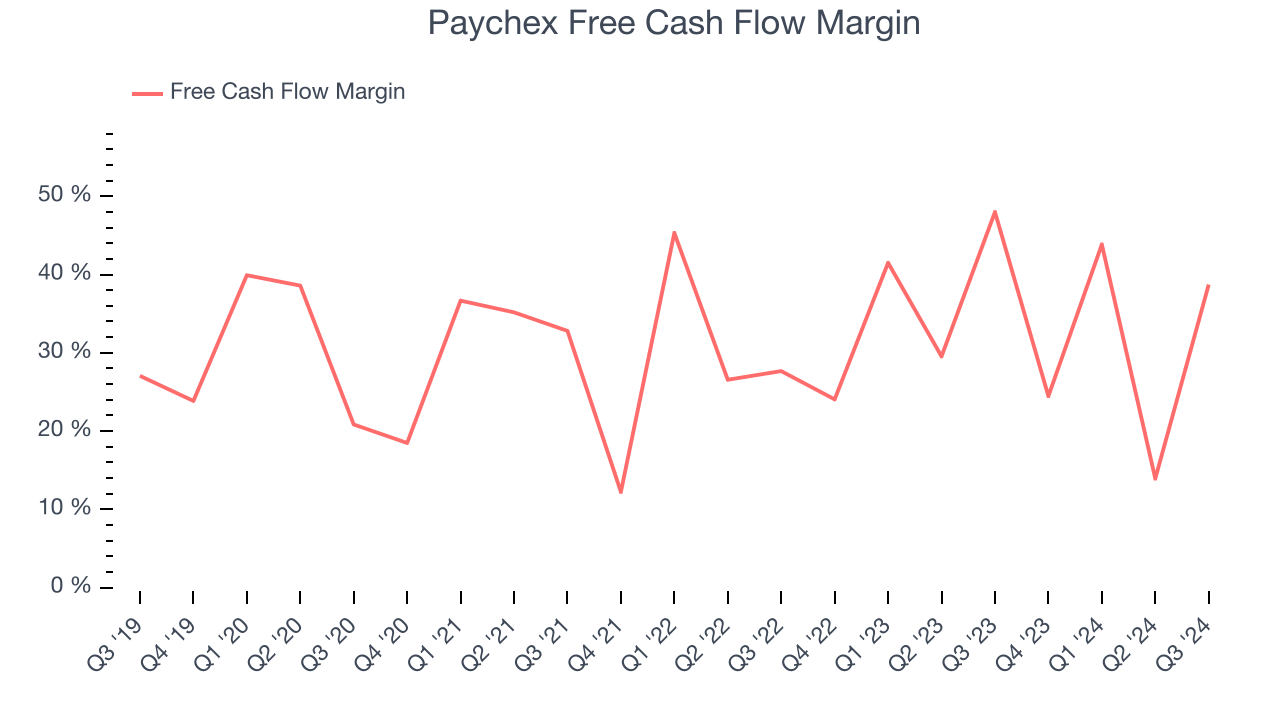

Paychex has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 30.7% over the last year.

Paychex’s free cash flow clocked in at $510.5 million in Q3, equivalent to a 38.7% margin. The company’s cash profitability regressed as it was 9.3 percentage points lower than in the same quarter last year, but it’s still above its one-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

Key Takeaways from Paychex’s Q3 Results

Revenue was in line and EPS beat by a bit. This wasn't the most exciting quarter, but it was solid and lacked big negative surprises. The stock traded up 1.6% to $136.35 immediately after reporting.

So do we think Paychex is an attractive buy at the current price?We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.