Looking back on HR software stocks' Q4 earnings, we examine the best and worst performers, including Paychex (NASDAQ:PAYX) and its peers.

HR software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy to use platforms.

The 6 HR software stocks we track reported a solid Q4; on average, revenues beat analyst consensus estimates by 3.36%, while on average next quarter revenue guidance was 0.81% above consensus. Tech stocks have been under pressure since the end of last year, but HR software stocks held their ground better than others, with share price down 3.99% since earnings, on average.

Best Q4: Paychex (NASDAQ:PAYX)

One of the oldest payroll service providers, Paychex provides payroll and human resource (HR) solutions.

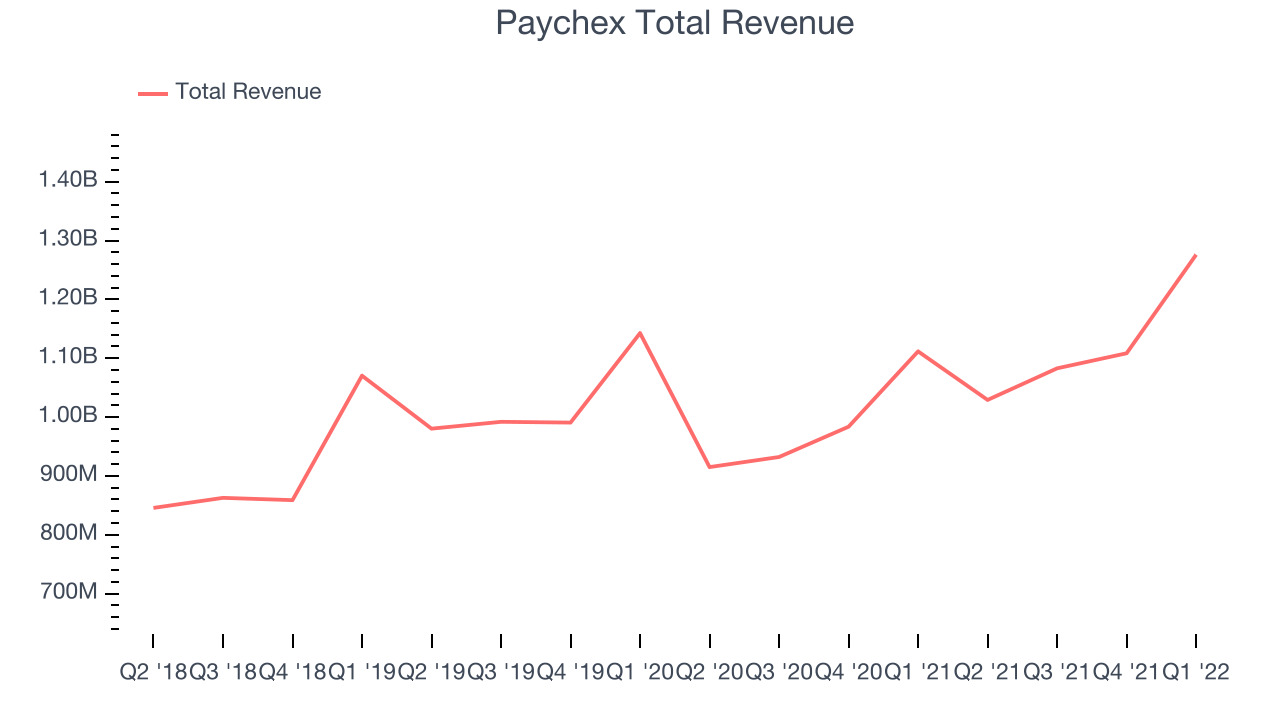

Paychex reported revenues of $1.27 billion, up 14.7% year on year, beating analyst expectations by 4.64%. It was a strong quarter for the company, with a significant improvement in gross margin and a decent beat of analyst estimates.

Martin Mucci, Chairman and Chief Executive Officer, commented, “Our strong results for the third quarter, including double-digit growth in both revenue and earnings are a result of progress against key initiatives. We had a strong calendar year end and selling season, delivering a record quarter for new sales revenue and maintaining high levels of client retention. Our value proposition continues to resonate in the market with our unique blend of innovative Paychex Flex® technology and breadth of solutions to help small and mid-sized businesses.”

Paychex achieved the strongest analyst estimates beat but had the slowest revenue growth of the whole group. The stock is up 4.63% since the results and currently trades at $138.75.

Is now the time to buy Paychex? Access our full analysis of the earnings results here, it's free.

Ceridian (NYSE:CDAY)

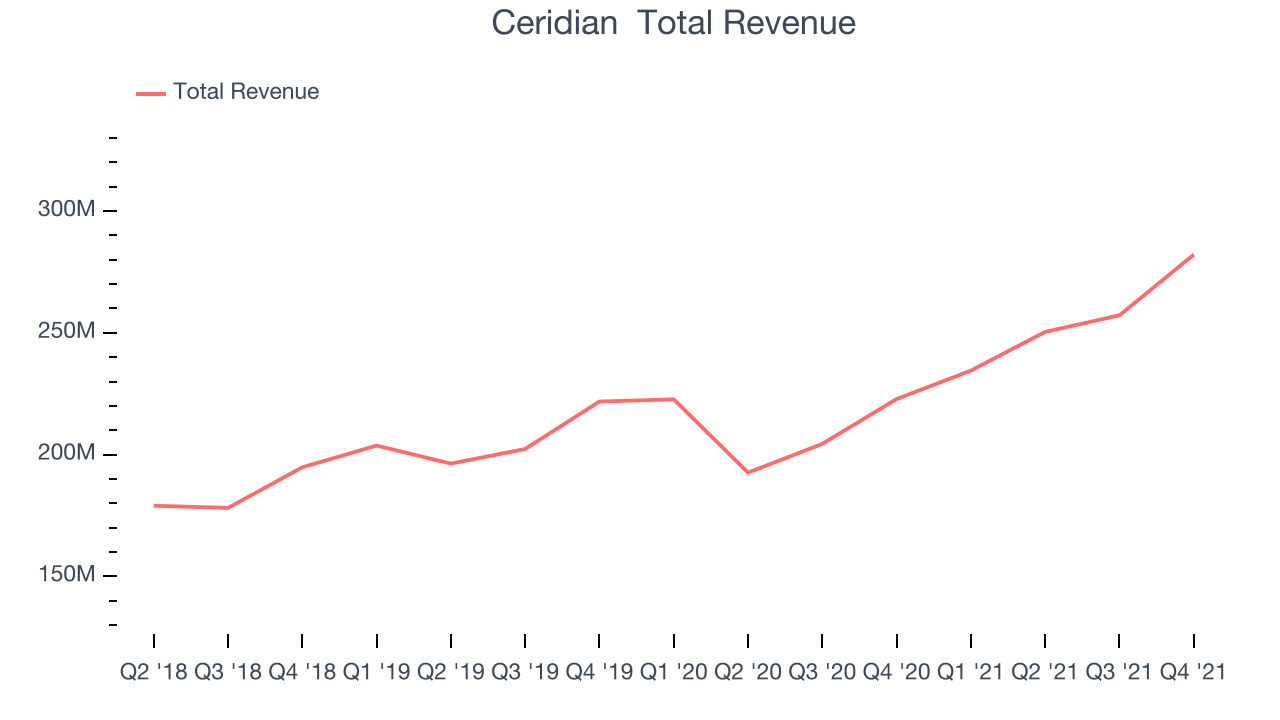

Founded in 1992 as an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Ceridian (NYSE:CDAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Ceridian reported revenues of $282.1 million, up 26.6% year on year, beating analyst expectations by 2.56%. It was a solid quarter for the company, with accelerating customer growth and a decent beat of analyst estimates.

The stock is down 26.5% since the results and currently trades at $59.52.

Is now the time to buy Ceridian? Access our full analysis of the earnings results here, it's free.

Paylocity (NASDAQ:PCTY)

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and human resources software for small and medium-sized enterprises.

Paylocity reported revenues of $196 million, up 33.9% year on year, beating analyst expectations by 4.11%. It was a decent quarter for the company, with a strong top line growth but a decline in gross margin.

Paylocity achieved the fastest revenue growth and highest full year guidance raise in the group. The stock is up 1.6% since the results and currently trades at $199.93.

Read our full analysis of Paylocity's results here.

Paycor (NASDAQ:PYCR)

Found in 1990 in Cincinnati, Ohio Paycor (NASDAQ: PYCR), provides software for small businesses to manage their payroll and HR needs in one place.

Paycor reported revenues of $103 million, up 20% year on year, beating analyst expectations by 3.56%. It was a good quarter for the company, with a very optimistic guidance for the next quarter.

The stock is up 8.25% since the results and currently trades at $27.14.

Read our full, actionable report on Paycor here, it's free.

Asure Software (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure Software reported revenues of $21.1 million, up 28.4% year on year, beating analyst expectations by 2%. It was a solid quarter for the company, with a significant improvement in gross margin and a strong top line growth.

Asure Software had the weakest performance against analyst estimates and weakest full year guidance update among the peers. The stock is down 5.19% since the results and currently trades at $6.39.

Read our full, actionable report on Asure Software here, it's free.

The author has no position in any of the stocks mentioned