Payroll and human resources software provider, Paychex (NASDAQ:PAYX) missed analysts' expectations in Q1 CY2024, with revenue up 4.2% year on year to $1.44 billion. It made a non-GAAP profit of $1.38 per share, improving from its profit of $1.29 per share in the same quarter last year.

Paychex (PAYX) Q1 CY2024 Highlights:

- Revenue: $1.44 billion vs analyst estimates of $1.46 billion (1.2% miss)

- EPS (non-GAAP): $1.38 vs analyst estimates of $1.37 (small beat)

- Full year revenue guidance: 5-6% growth year on year, midpoint of guide is a miss vs. expectations of 6.2% year on year growth

- Full year EPS (non-GAAP) guidance: 10-11% year on year, midpoint of guide in line with expectations of 10.3% year on year growth

- Gross Margin (GAAP): 73.6%, in line with the same quarter last year

- Free Cash Flow of $631 million, up 105% from the previous quarter

- Market Capitalization: $43.76 billion

One of the oldest service providers in the industry, Paychex (NASDAQ:PAYX) offers its customers payroll and HR software solutions.

Managing basic HR functions like payroll and benefits are requirements for all companies, but are particularly time consuming and expensive for small and medium sized businesses, who have historically used a series of patchwork measures involving spreadsheets, accountants and single purpose software from multiple vendors.

Paychex offers a full range of human capital management (HCM) products including payroll processing and HR services to manage employees, from onboarding, managing schedules and benefits, and offering retirement accounts like 401Ks. Paychex also has a large internal staff of professionals who can provide full offers of outsourced HR and compliance functions, while also providing a range of insurance options (e.g. health, cybersecurity, and property) to businesses and their employees.

While considered more of a legacy payroll provider, Paychex’s value proposition is a breadth of offering that many of the newer cloud-native HCM rivals can’t match, such as retirement accounts and serving as an insurance brokerage. It also offers broad flexibility in how customers can choose to purchase any of Paychex’s services as standalone modules or in bundles, delivered either on-premise or through a cloud-based version. In recent years, it has introduced Paychex Flex, a cloud-based integrated HCM platform that addresses the growing demands of SMBs for lower cost, consumer-like user interfaces.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

ADP (NASDAQ:ADP) is Paychex’s primary competitor, but increasingly has come into competition with cloud-native HCM software providers like Asure (NYSE: ASUR), Ceridian (NYSE:CDAY), (Paycom (NYSE:PAYC), Paycor (NASDAQ:PYCR), Paylocity (NASDAQ:PCTY), and Workday (NASDAQ:WDAY).

Sales Growth

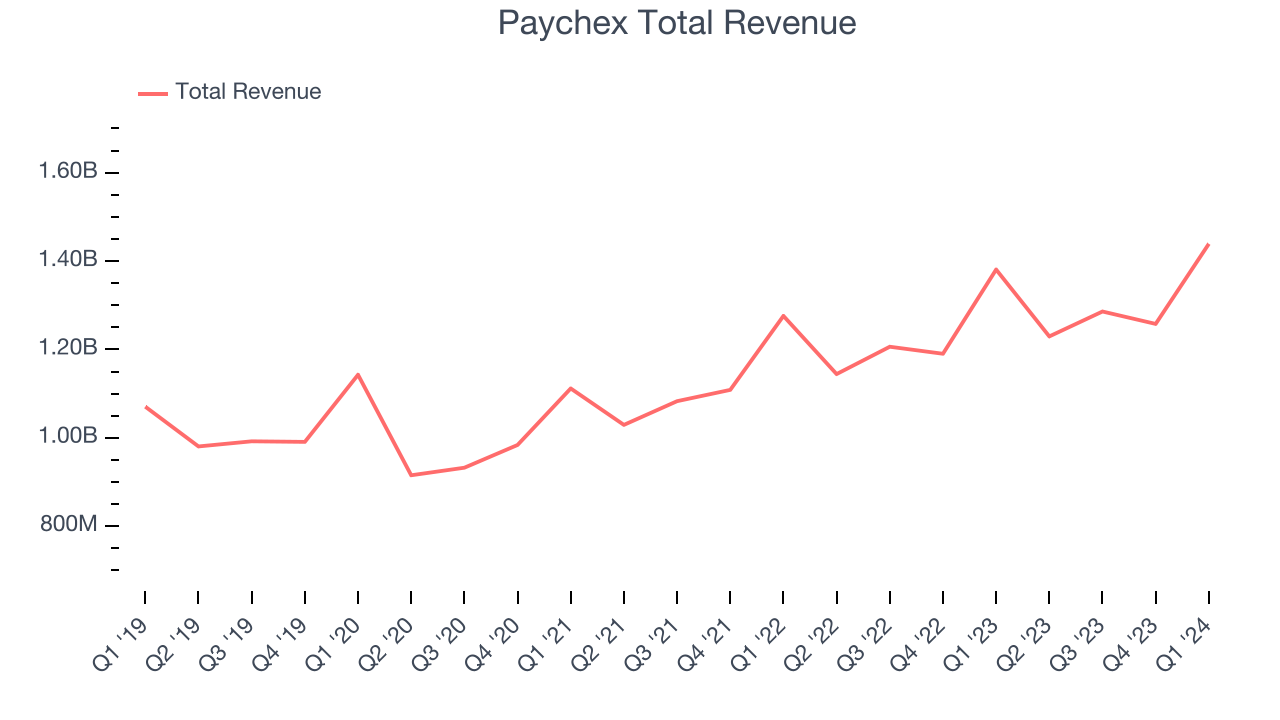

As you can see below, Paychex's revenue growth has been unremarkable over the last three years, growing from $1.11 billion in Q3 2021 to $1.44 billion this quarter.

Paychex's quarterly revenue was only up 4.2% year on year, which might disappoint some shareholders. However, its revenue increased $181.4 million quarter on quarter, a strong improvement from the $28.1 million decrease in Q4 CY2023. This is a sign of acceleration of growth and very nice to see indeed.

Looking ahead, analysts covering the company were expecting sales to grow 6.8% over the next 12 months before the earnings results announcement.

Profitability

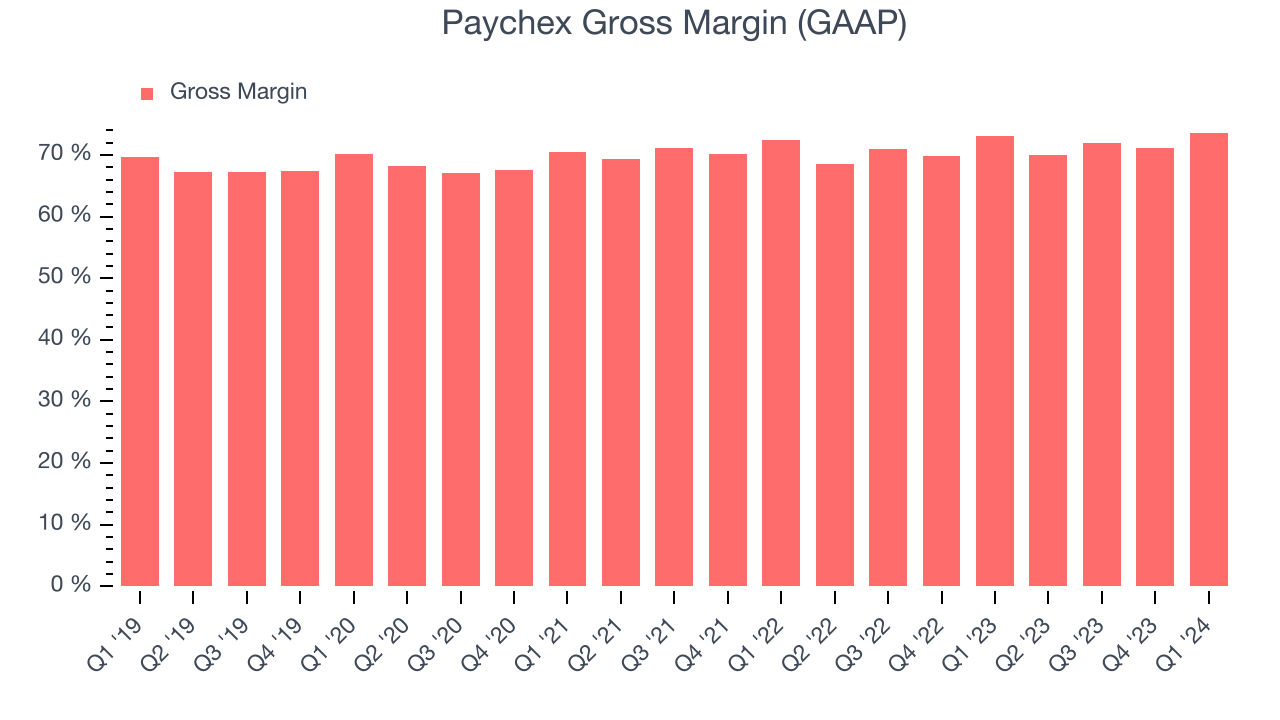

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Paychex's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 73.6% in Q1.

That means that for every $1 in revenue the company had $0.74 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Paychex's gross margin is around the average of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

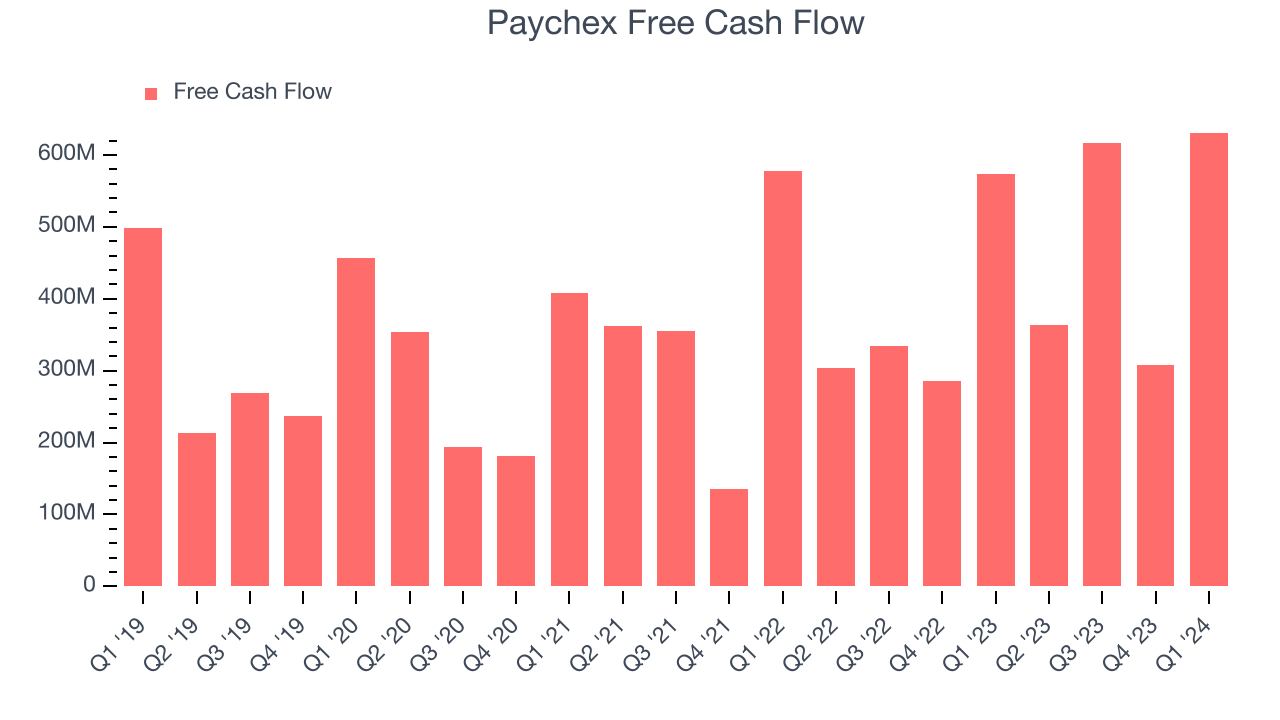

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Paychex's free cash flow came in at $631 million in Q1, up 10.1% year on year.

Paychex has generated $1.92 billion in free cash flow over the last 12 months, an eye-popping 36.8% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Paychex's Q1 Results

Revenue unfortunately missed analysts' expectations, although EPS beat. With regards to the full year, revenue guidance missed expectations. Guidance for full year EPS was maintained from last quarter, which is roughly in line with expectations. Overall, this was a mediocre quarter for Paychex. The company is down 5.8% on the results and currently trades at $114.5 per share.

Is Now The Time?

Paychex may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although we have other favorites, we understand the arguments that Paychex isn't a bad business. Although its revenue growth has been weak over the last three years with analysts expecting growth to slow from here, its bountiful generation of free cash flow empowers it to invest in growth initiatives.

Given its price-to-sales ratio of 7.9x based on the next 12 months, the market is certainly expecting long-term growth from Paychex. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Paychex, it seems to be trading at a reasonable price right now.

Wall Street analysts covering the company had a one-year price target of $121.22 right before these results (compared to the current share price of $114.50).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.