Casual sandwich chain Potbelly (NASDAQ:PBPB) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue down 6% year on year to $111.2 million. It made a non-GAAP profit of $0.01 per share, down from its profit of $0.02 per share in the same quarter last year.

Is now the time to buy Potbelly? Find out by accessing our full research report, it's free.

Potbelly (PBPB) Q1 CY2024 Highlights:

- Revenue: $111.2 million vs analyst estimates of $109.5 million (1.5% beat)

- EPS (non-GAAP): $0.01 vs analyst estimates of -$0.02 ($0.03 beat)

- Q2 2024 adjusted EBITDA guidance of $7.8 million at the midpoint, below expectations of $9.2 million

- Full year 2024 guidance was lowered for both same store sales and adjusted EBITDA growth

- Gross Margin (GAAP): 34.1%, up from 30.3% in the same quarter last year

- Same-Store Sales were down 0.2% year on year

- Store Locations: 425 at quarter end, decreasing by 1 over the last 12 months

- Market Capitalization: $289.7 million

Bob Wright, President and Chief Executive Officer of Potbelly Corporation, commented, “We’re proud of our solid start to the year across multiple fronts. In terms of profitability, we successfully managed both restaurant-level and corporate costs, driving a 150-basis point expansion in shop-level margins as well as strong corporate profitability with adjusted EBITDA of $5.7 million. On the development front, our franchise sales team added 32 additional commitments to our pipeline during the quarter leading to a 26% increase in open and committed shops year-over-year. We remain excited by the possibilities of this unique brand and believe that we continue to put the building blocks in place to achieve this potential.”

With a unique origin story where the company actually started as an antique shop, Potbelly (NASDAQ:PBPB) today is a chain known for its toasty sandwiches.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

Potbelly is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

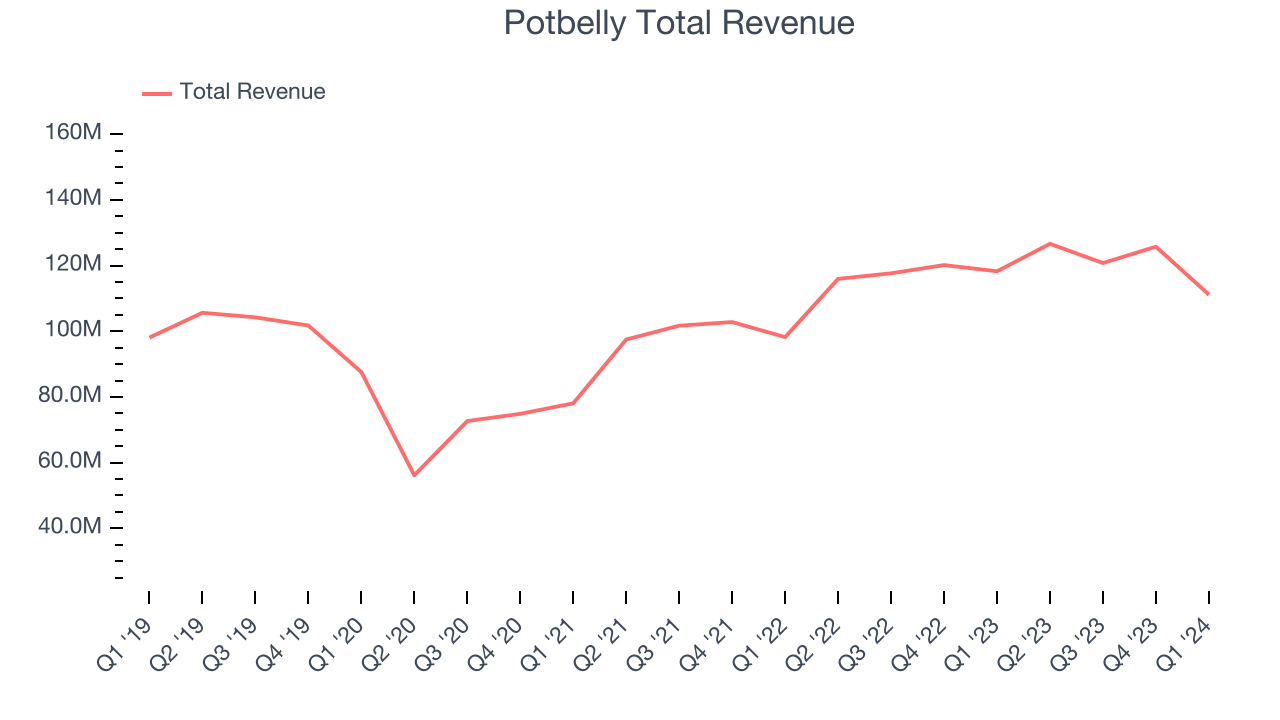

As you can see below, the company's annualized revenue growth rate of 3% over the last five years was weak , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Potbelly's revenue fell 6% year on year to $111.2 million but beat Wall Street's estimates by 1.5%. Looking ahead, Wall Street expects revenue to decline 2.1% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

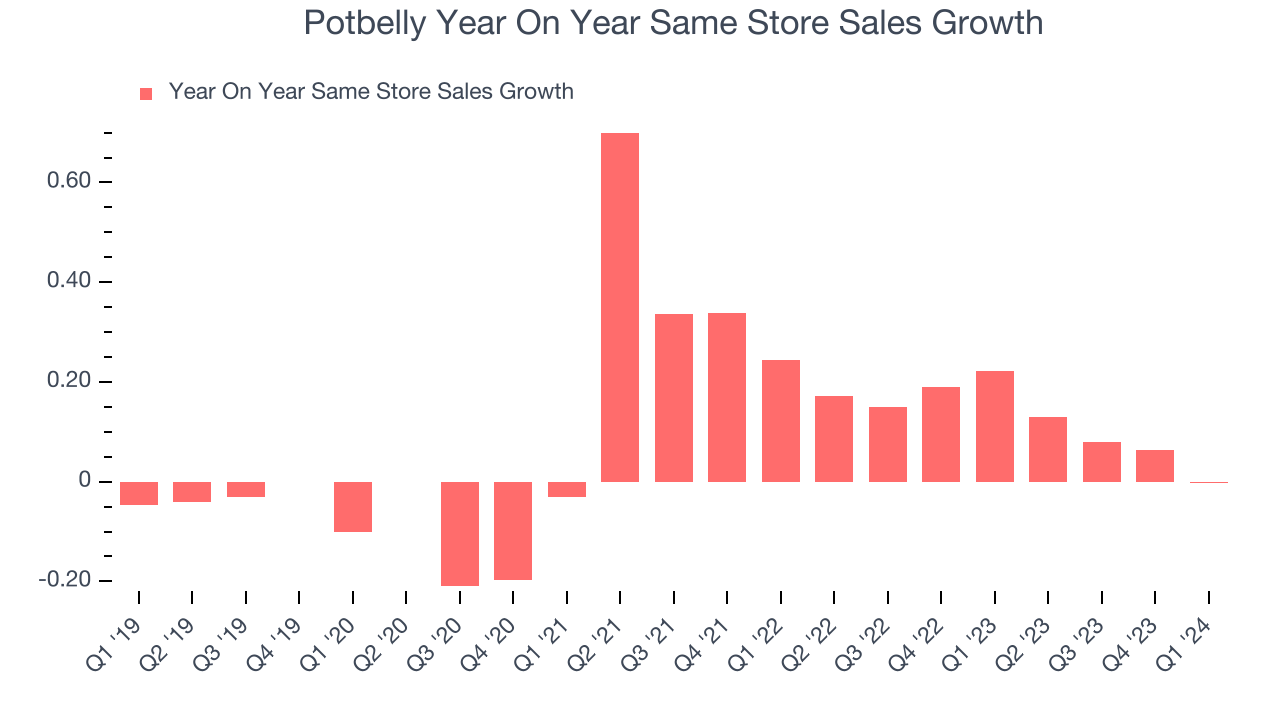

Potbelly's demand has been spectacular for a restaurant business over the last eight quarters. On average, the company has grown its same-store sales by an impressive 12.5% year on year. This performance suggests its steady rollout of new restaurants could be beneficial for shareholders. When a company has strong demand, more locations should help it reach more customers seeking its meals.

In the latest quarter, Potbelly's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 22.2% year-on-year increase it posted 12 months ago. We'll be watching Potbelly closely to see if it can reaccelerate growth.

Key Takeaways from Potbelly's Q1 Results

Although sales and EPS beat in the quarter, guidance was a negative. Q2 same store sales and adjusted EBITDA guidance were both below expectations, and the company lowered its same store sales and adjusted EBITDA growth guidance for 2024. The stock is flat after reporting and currently trades at $9.95 per share.

Potbelly may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.