Casual sandwich chain Potbelly (NASDAQ:PBPB) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue down 6% year on year to $111.2 million. It made a non-GAAP profit of $0.01 per share, down from its profit of $0.02 per share in the same quarter last year.

Potbelly (PBPB) Q1 CY2024 Highlights:

- Revenue: $111.2 million vs analyst estimates of $109.5 million (1.5% beat)

- EPS (non-GAAP): $0.01 vs analyst estimates of -$0.02 ($0.03 beat)

- Q2 2024 adjusted EBITDA guidance of $7.8 million at the midpoint, below expectations of $9.2 million

- Full year 2024 guidance was lowered for both same store sales and adjusted EBITDA growth

- Gross Margin (GAAP): 34.1%, up from 30.3% in the same quarter last year

- Same-Store Sales were down 0.2% year on year

- Store Locations: 425 at quarter end, decreasing by 1 over the last 12 months

- Market Capitalization: $289.7 million

With a unique origin story where the company actually started as an antique shop, Potbelly (NASDAQ:PBPB) today is a chain known for its toasty sandwiches.

The ‘Turkey Breast’, for example, is a classic sandwich with hand-sliced turkey breast, Swiss cheese as well as lettuce, tomato, and onions if you’re into those. The ‘Pizza Melt’ is a less traditional hot sandwich featuring pepperoni, meatballs, marinara sauce, and provolone cheese. Potbelly isn’t just a one-trick pony, though, and also offers salads, soups, and desserts such as cookies.

There really is no typical Potbelly customer, but in general, it is someone who wants the comfort of a warm sandwich, food that might be slightly more elevated than traditional fast food, or simply convenient and budget-friendly fare that tastes good. The salad options bring in a more health-conscious customer as well.

Potbelly’s locations are designed to elude feelings of warmth of coziness. There are often vintage and antique elements within the stores that are a nod to the company’s antique shop origins. Unlike traditional fast-food joints, these stores favor warm and neutral colors as well as wood. This former antique shop is not stuck in the past though, as the company has an app that allows busy customers to order ahead of time for pickup to maximize convenience and efficiency.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Competitors offering convenient and casual dining options include Chipotle (NYSE:CMG), Sweetgreen (NYSE:SG), and Shake Shack (NYSE:SHAK).Sales Growth

Potbelly is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

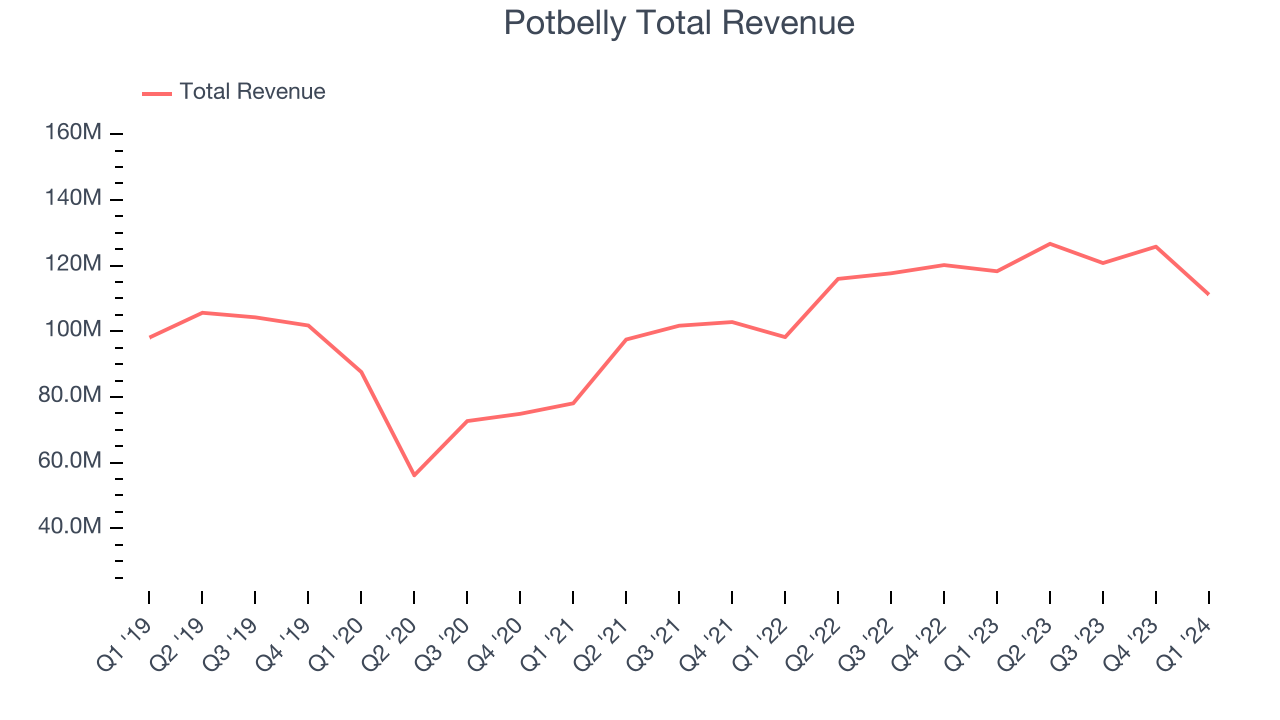

As you can see below, the company's annualized revenue growth rate of 3% over the last five years was weak , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Potbelly's revenue fell 6% year on year to $111.2 million but beat Wall Street's estimates by 1.5%. Looking ahead, Wall Street expects revenue to decline 2.1% over the next 12 months.

Same-Store Sales

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

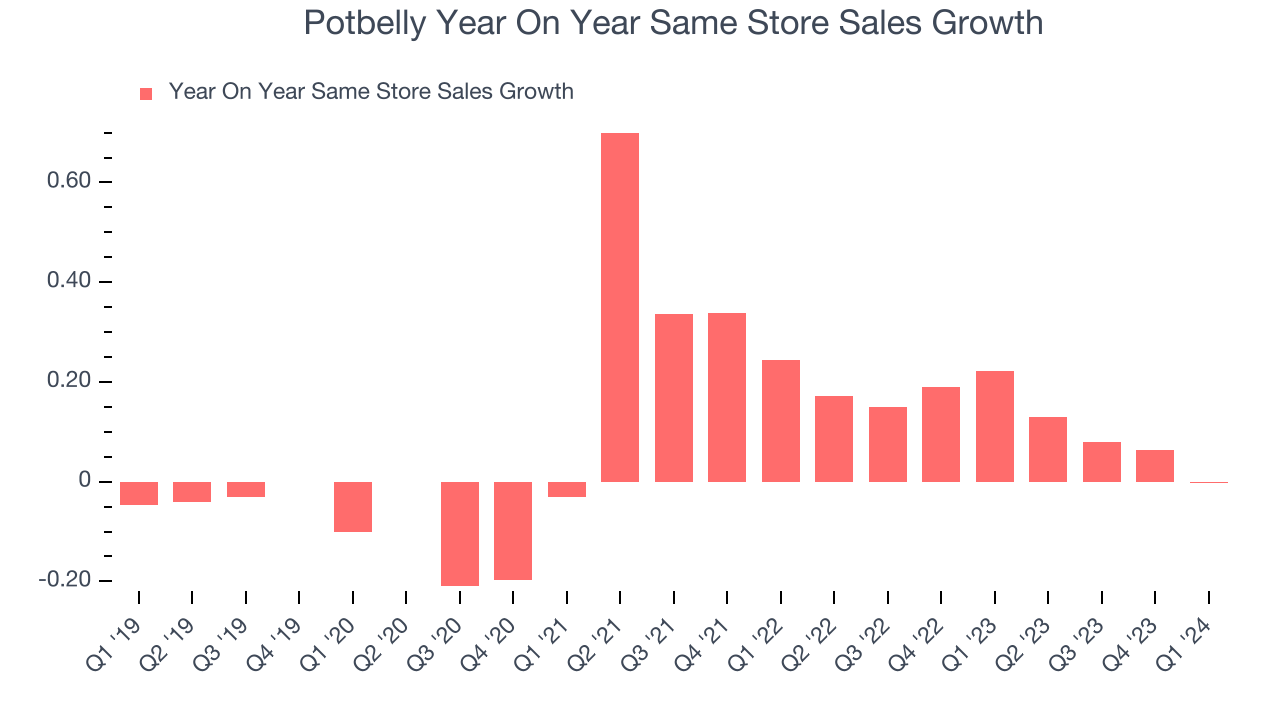

Potbelly's demand has been spectacular for a restaurant business over the last eight quarters. On average, the company has grown its same-store sales by an impressive 12.5% year on year. This performance suggests its steady rollout of new restaurants could be beneficial for shareholders. When a company has strong demand, more locations should help it reach more customers seeking its meals.

In the latest quarter, Potbelly's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 22.2% year-on-year increase it posted 12 months ago. We'll be watching Potbelly closely to see if it can reaccelerate growth.

Number of Stores

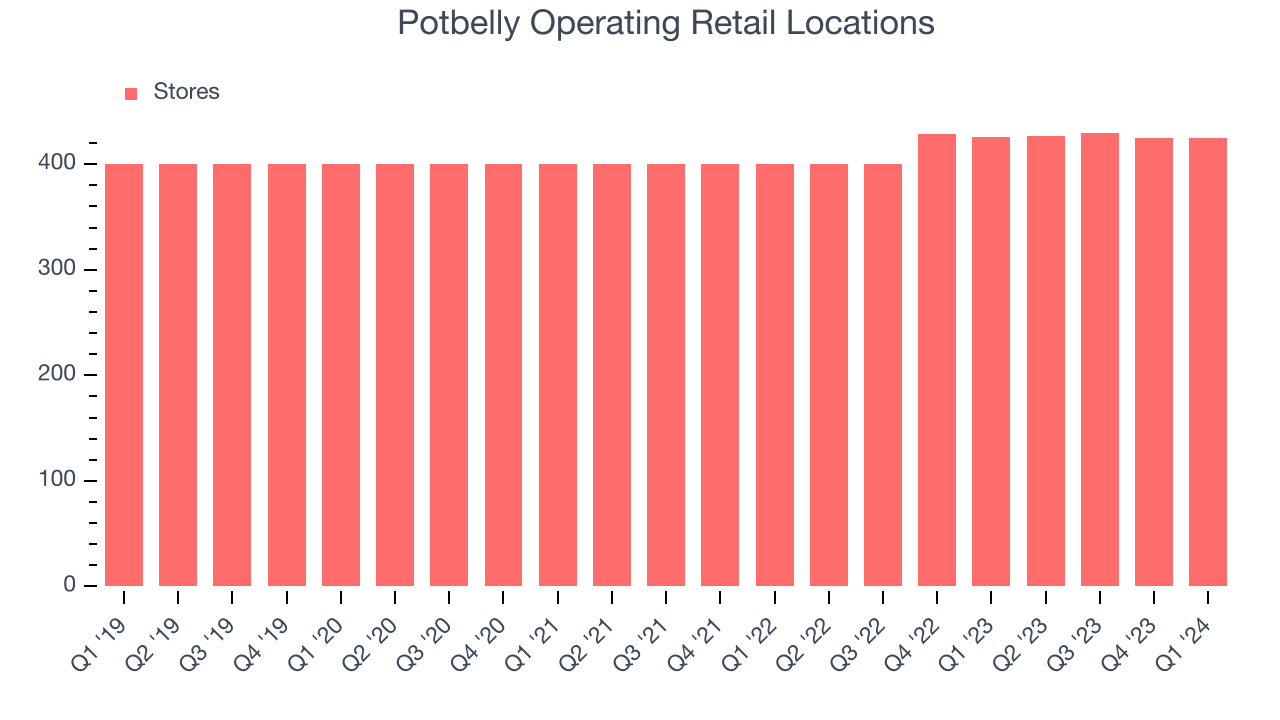

When a chain like Potbelly is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. At the end of this quarter, Potbelly operated 425 total locations, in line with its restaurant count 12 months ago.

Over the last two years, Potbelly has rapidly opened new restaurants, averaging 3.4% annual increases in new locations. This growth is among the fastest in the restaurant sector and gives Potbelly a chance to scale towards a mid-sized company over time. Analyzing a restaurant's location growth is important because expansion means Potbelly has more opportunities to feed customers and generate sales.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

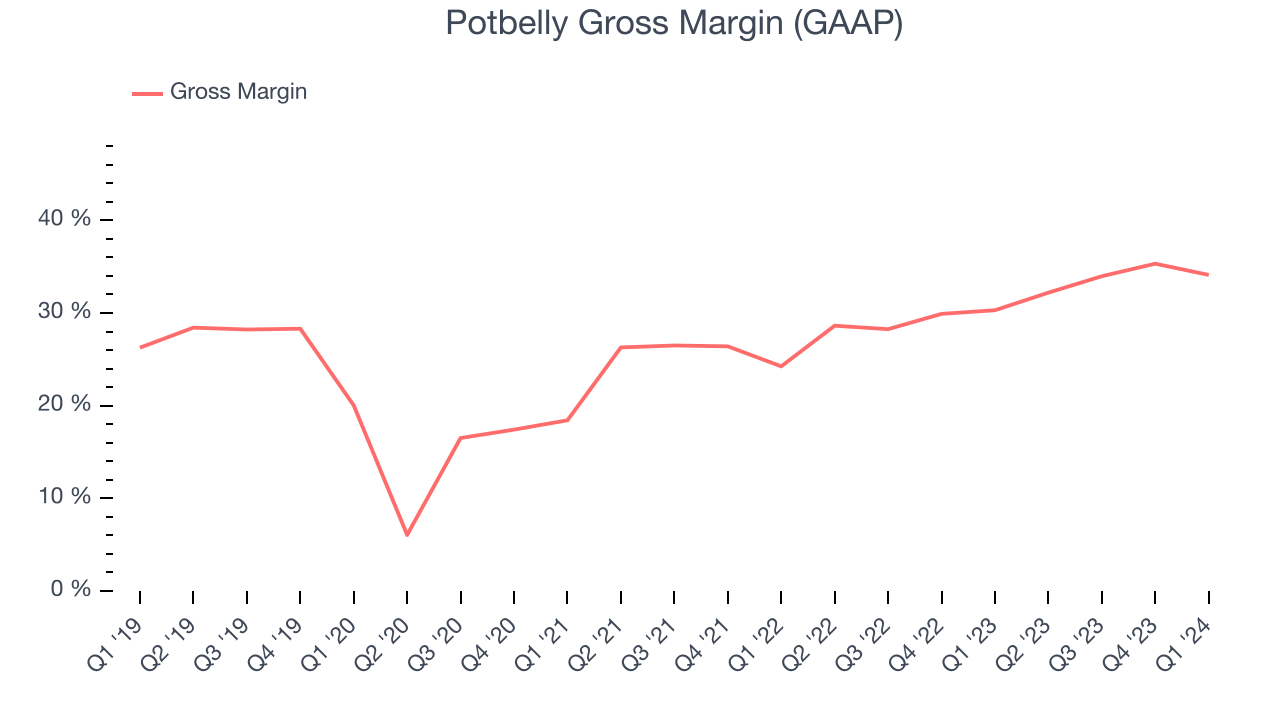

Potbelly's gross profit margin came in at 34.1% this quarter. up 3.8 percentage points year on year. This means the company makes $0.32 for every $1 in revenue before accounting for its operating expenses.

Potbelly has good unit economics for a restaurant company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see above, it's averaged a healthy 31.6% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 15.8% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more stable input costs (such as ingredients and transportation expenses).

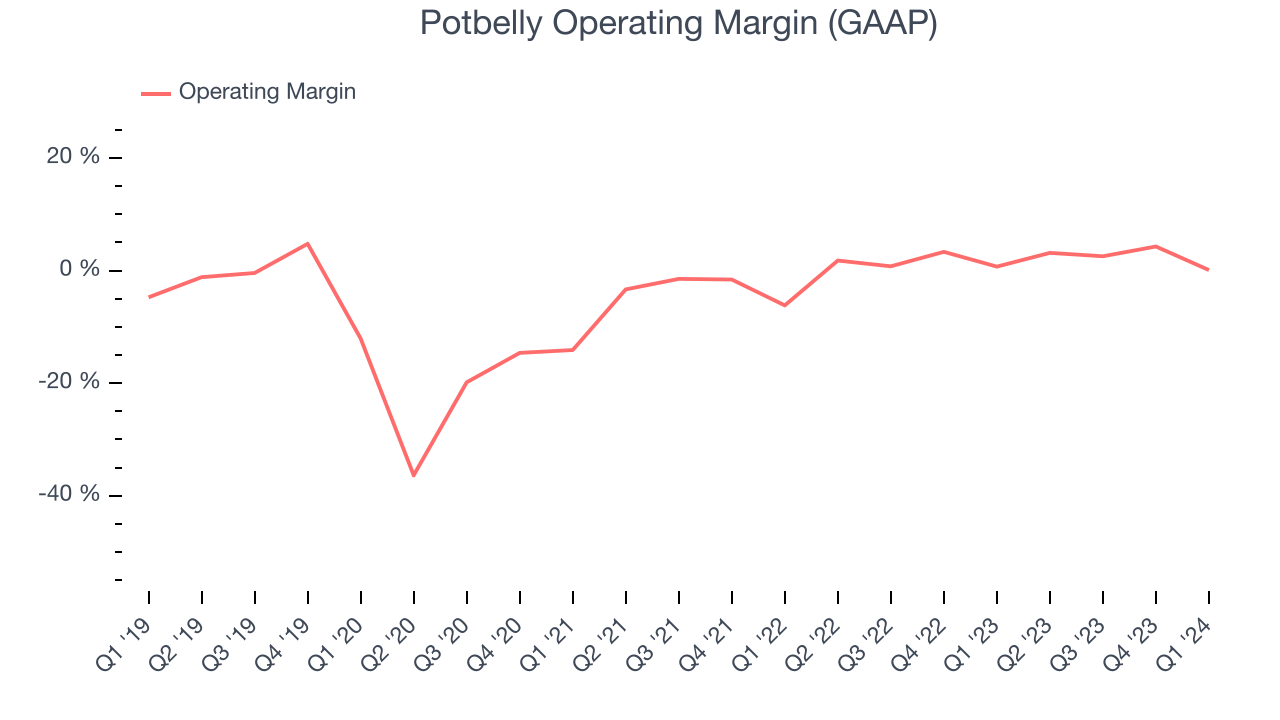

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Potbelly generated an operating profit margin of 0.1%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Potbelly was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.1% has been paltry for a restaurant business. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.

Zooming out, Potbelly was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.1% has been paltry for a restaurant business. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.EPS

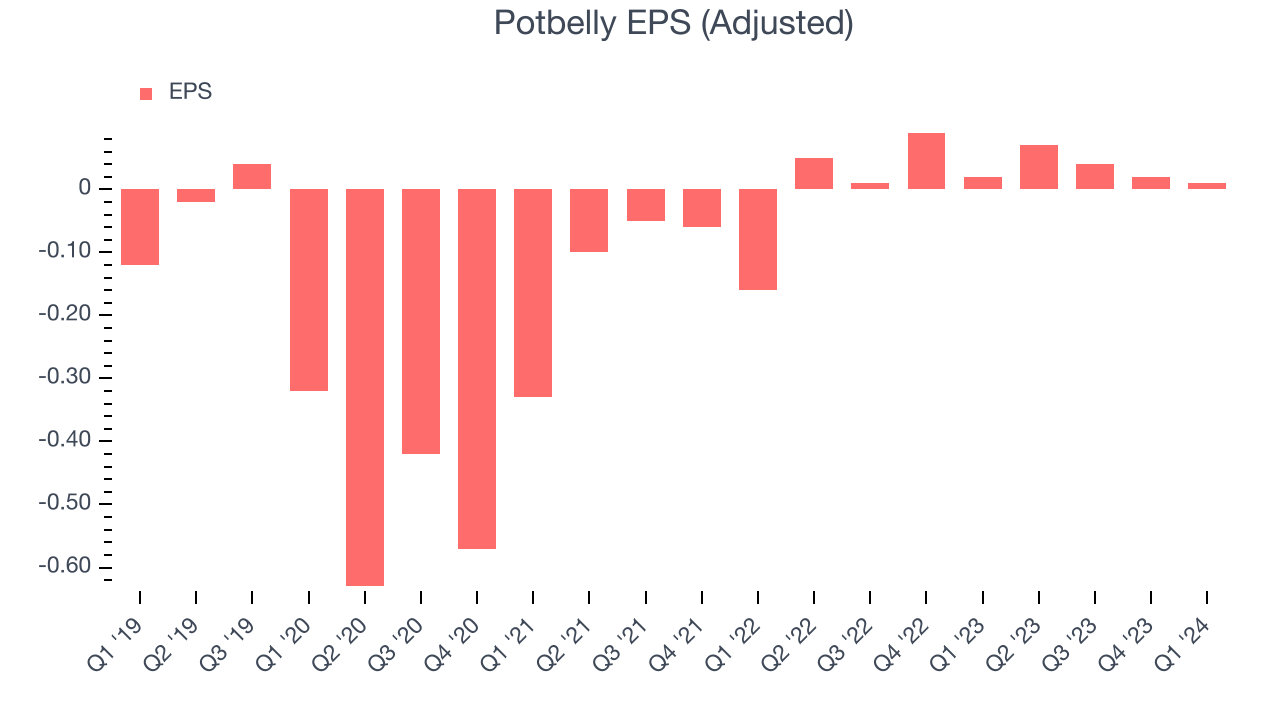

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Potbelly reported EPS at $0.01, down from $0.02 in the same quarter a year ago. This print easily cleared Wall Street's estimates, and shareholders should be content with the results.

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 90.4% year-on-year increase in EPS.

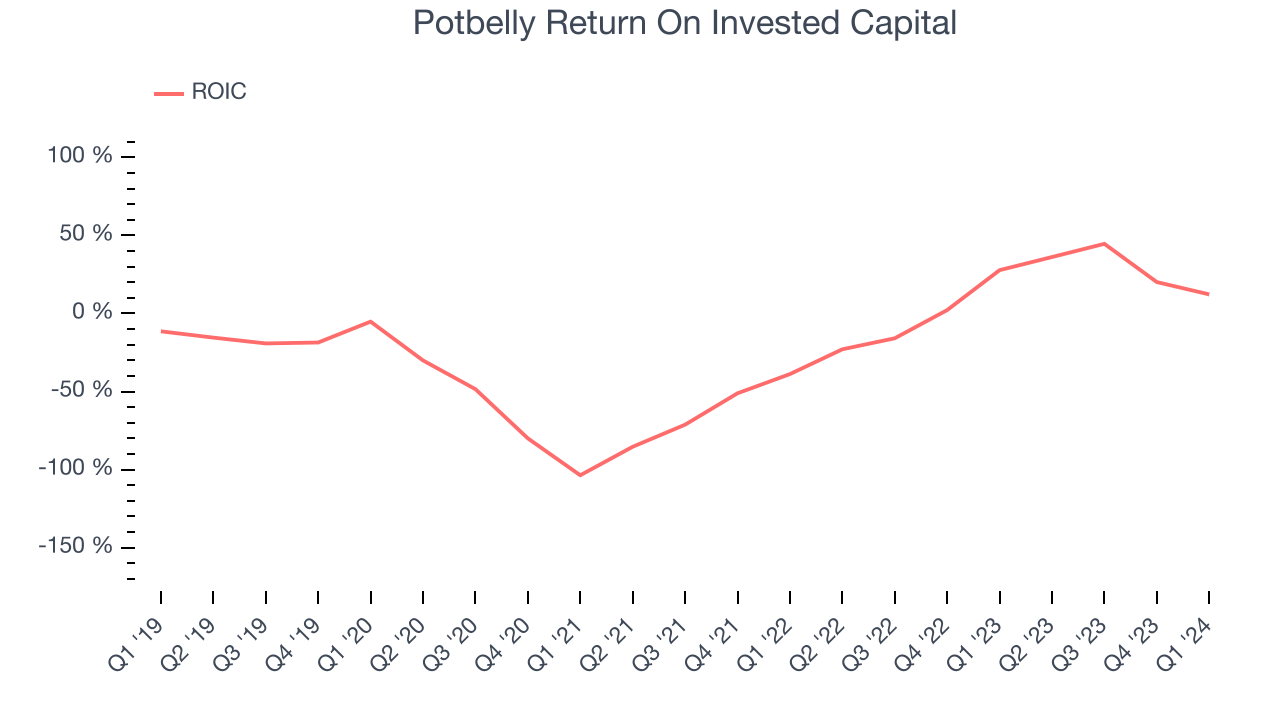

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Potbelly's five-year average ROIC was negative 1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Potbelly's ROIC has significantly increased. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Potbelly's $164.2 million of debt exceeds the $12.72 million of cash on its balance sheet. Furthermore, its 5x net-debt-to-EBITDA ratio (based on its EBITDA of $28.45 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Potbelly could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Potbelly can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Potbelly's Q1 Results

Although sales and EPS beat in the quarter, guidance was a negative. Q2 same store sales and adjusted EBITDA guidance were both below expectations, and the company lowered its same store sales and adjusted EBITDA growth guidance for 2024. The stock is flat after reporting and currently trades at $9.95 per share.

Is Now The Time?

Potbelly may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Potbelly, we'll be cheering from the sidelines. Its revenue growth has been weak over the last five years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its brand caters to a niche market. On top of that, its relatively low ROIC suggests it has struggled to grow profits historically.

While there are some things to like about Potbelly and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $17 per share right before these results (compared to the current share price of $9.95).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.