Trucking company PACCAR (NASDAQ:PCAR) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 14.3% year on year to $7.36 billion. Its GAAP profit of $1.66 per share was 1.5% below analysts’ consensus estimates.

Is now the time to buy PACCAR? Find out by accessing our full research report, it’s free.

PACCAR (PCAR) Q4 CY2024 Highlights:

- Revenue: $7.36 billion vs analyst estimates of $7.52 billion (14.3% year-on-year decline, 2.1% miss)

- EPS: $1.66 vs analyst expectations of $1.69 (1.5% miss)

- Operating Margin: 12.2%, down from 16.3% in the same quarter last year

- Free Cash Flow Margin: 16.5%, up from 11.5% in the same quarter last year

- Market Capitalization: $57.63 billion

Kenworth and Peterbilt achieved excellent U.S. and Canada Class 8 retail sales market share of 30.7% in 2024. U.S. and Canada Class 8 truck industry retail sales were 268,000 units in 2024 and are estimated to be in a range of 250,000-280,000 trucks in 2025. “Infrastructure spending is driving steady demand for Kenworth and Peterbilt’s industry-leading vocational trucks,” said Laura Bloch, PACCAR Senior Vice President.

Company Overview

Founded more than a century ago, PACCAR (NASDAQ:PCAR) designs and manufactures commercial trucks of various weights and sizes for the commercial trucking industry.

Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Sales Growth

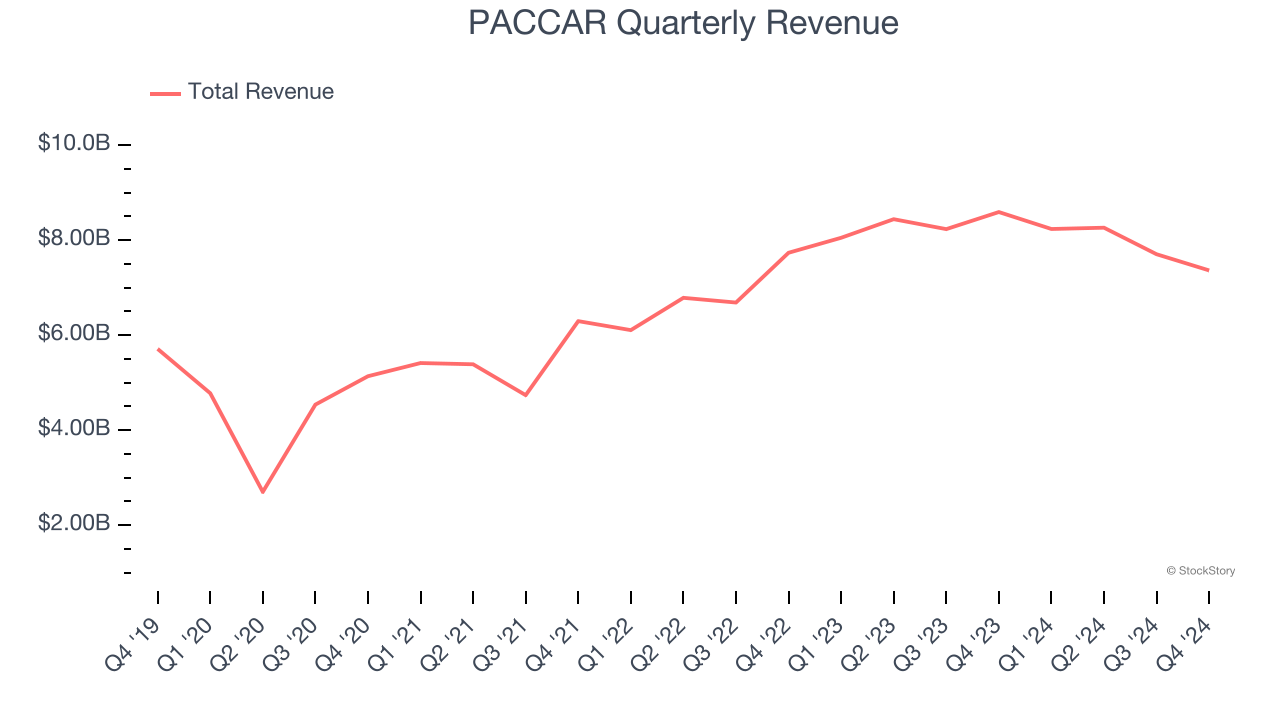

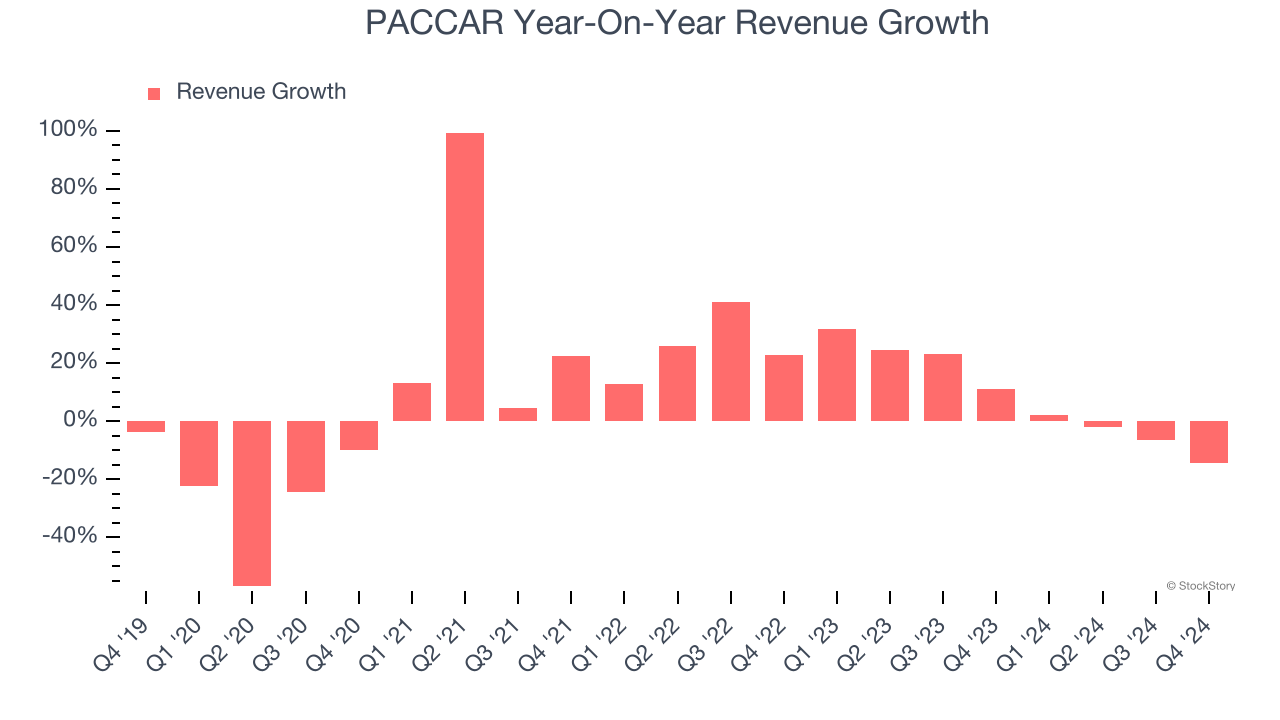

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, PACCAR’s 5.5% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the industrials sector, but there are still things to like about PACCAR.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. PACCAR’s annualized revenue growth of 7.5% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, PACCAR missed Wall Street’s estimates and reported a rather uninspiring 14.3% year-on-year revenue decline, generating $7.36 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

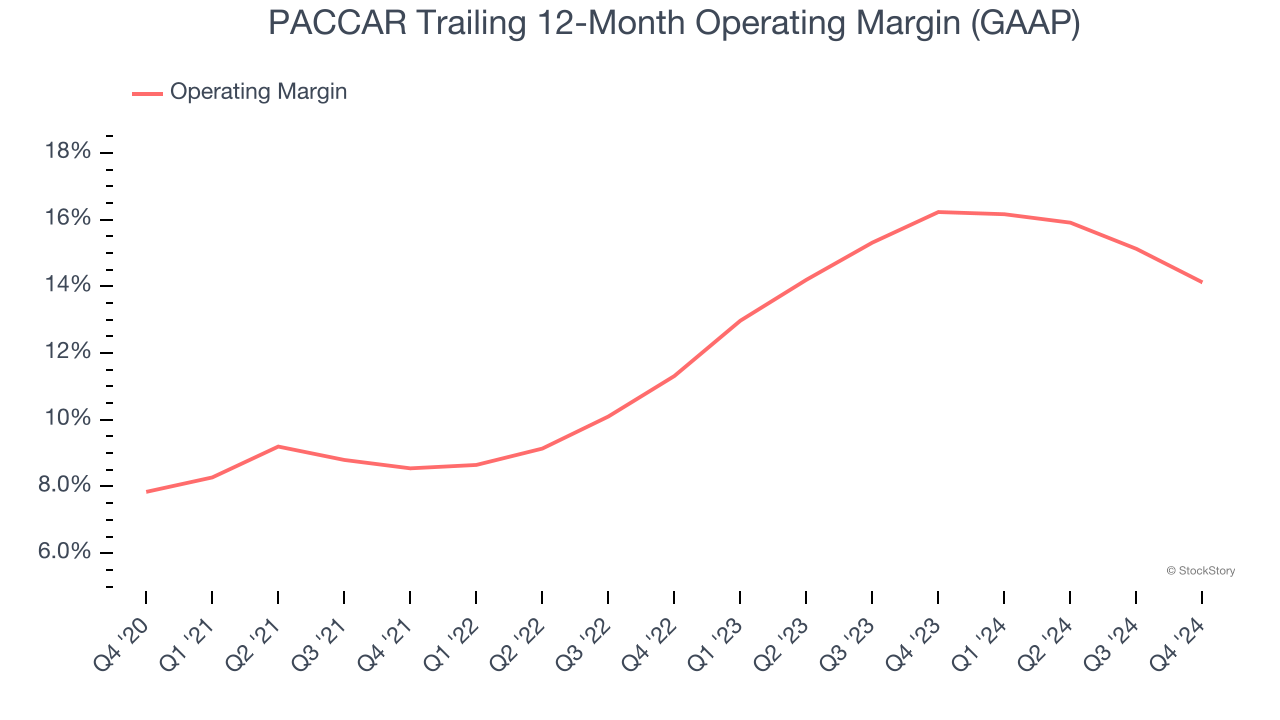

PACCAR has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.3%.

Analyzing the trend in its profitability, PACCAR’s operating margin rose by 6.3 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q4, PACCAR generated an operating profit margin of 12.2%, down 4.1 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

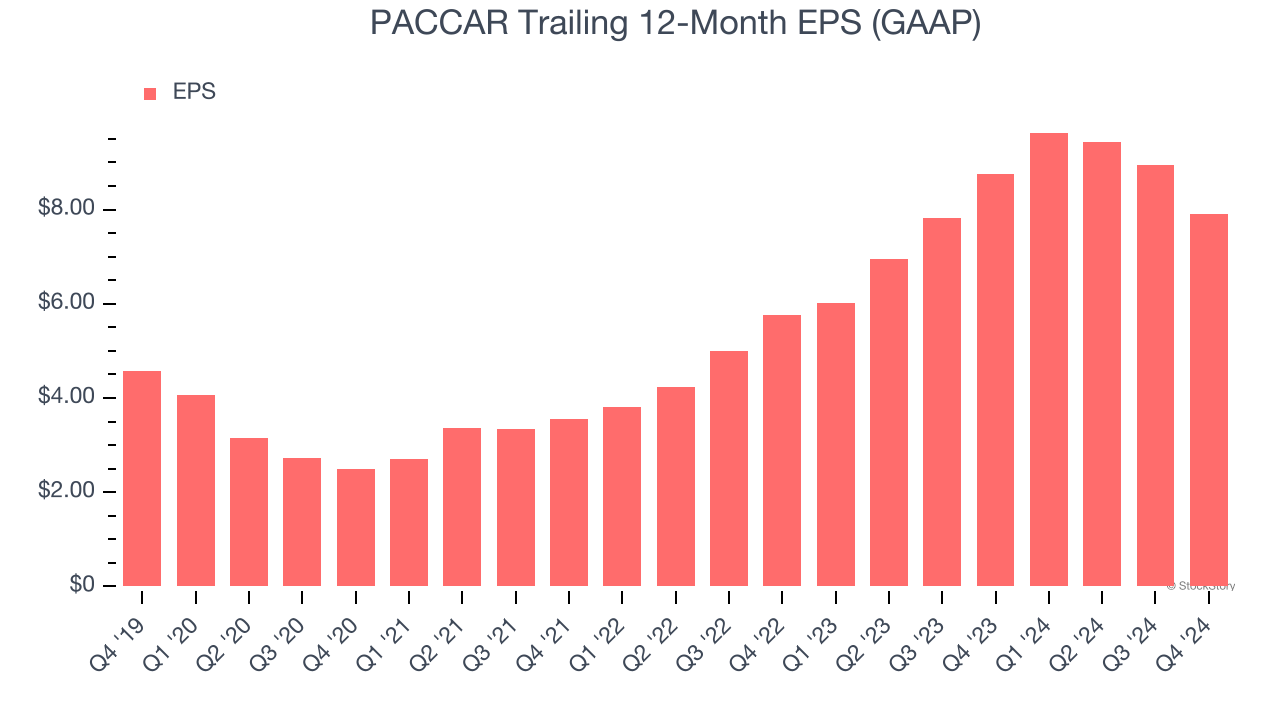

PACCAR’s EPS grew at a solid 11.5% compounded annual growth rate over the last five years, higher than its 5.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into PACCAR’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, PACCAR’s operating margin declined this quarter but expanded by 6.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For PACCAR, its two-year annual EPS growth of 17.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, PACCAR reported EPS at $1.66, down from $2.70 in the same quarter last year. This print slightly missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects PACCAR’s full-year EPS of $7.91 to shrink by 2.6%.

Key Takeaways from PACCAR’s Q4 Results

We struggled to find many resounding positives in these results as its revenue and EPS missed Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4% to $105.50 immediately following the announcement.

PACCAR’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.