Payroll and human resources software provider, Paylocity (NASDAQ:PCTY) announced better-than-expected results in Q1 CY2024, with revenue up 18.1% year on year to $401.3 million. Guidance for next quarter's revenue was also better than expected at $349.8 million at the midpoint, 1.2% above analysts' estimates. It made a non-GAAP profit of $2.21 per share, improving from its profit of $1.74 per share in the same quarter last year.

Paylocity (PCTY) Q1 CY2024 Highlights:

- Revenue: $401.3 million vs analyst estimates of $397.2 million (1% beat)

- EPS (non-GAAP): $2.21 vs analyst estimates of $1.98 (11.7% beat)

- Revenue Guidance for Q2 CY2024 is $349.8 million at the midpoint, above analyst estimates of $345.5 million

- Gross Margin (GAAP): 71.1%, down from 71.9% in the same quarter last year

- Free Cash Flow of $147 million, up 157% from the previous quarter

- Annual Recurring Revenue: $366.8 million at quarter end, up 16.7% year on year

- Market Capitalization: $8.41 billion

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

Managing payroll may seem like an easy thing to do from the outside, but it is actually one of the most difficult administrative functions of a company. There are tax compliance issues, employees are eligible for different benefits based on contract type, local and national laws, and even a small mistake can ruin the whole process.

Using Paylocity software, organizations can schedule interviews with job candidates, manage employee attendance, learning, payroll, and benefits. Paylocity also integrates with other software platforms to help employees with tasks such as compliance, tax and insurance management.

The company developed its software for small businesses in search of intuitive and affordable HR solutions, as enterprise HR software is often too expensive and too complex to use for smaller businesses and their employees.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

The major competitors in the mid-market for HCM software include ADP (NASDAQ:ADP) and Paychex (NASDAQ:PAYX).

Sales Growth

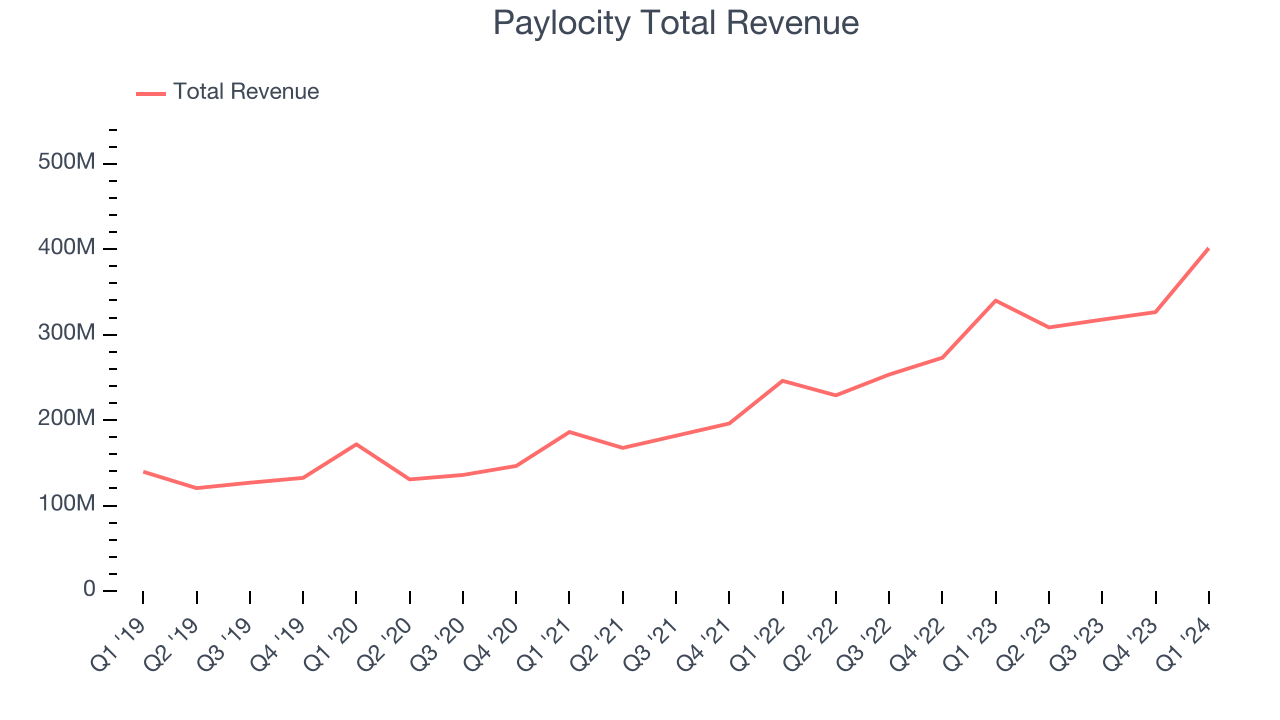

As you can see below, Paylocity's revenue growth has been very strong over the last three years, growing from $186.1 million in Q3 2021 to $401.3 million this quarter.

This quarter, Paylocity's quarterly revenue was once again up 18.1% year on year. We can see that Paylocity's revenue increased by $74.92 million quarter on quarter, which is a solid improvement from the $8.78 million increase in Q4 CY2023. Shareholders should applaud the acceleration of growth.

Next quarter's guidance suggests that Paylocity is expecting revenue to grow 13.4% year on year to $349.8 million, slowing down from the 34.7% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 12.5% over the next 12 months before the earnings results announcement.

Profitability

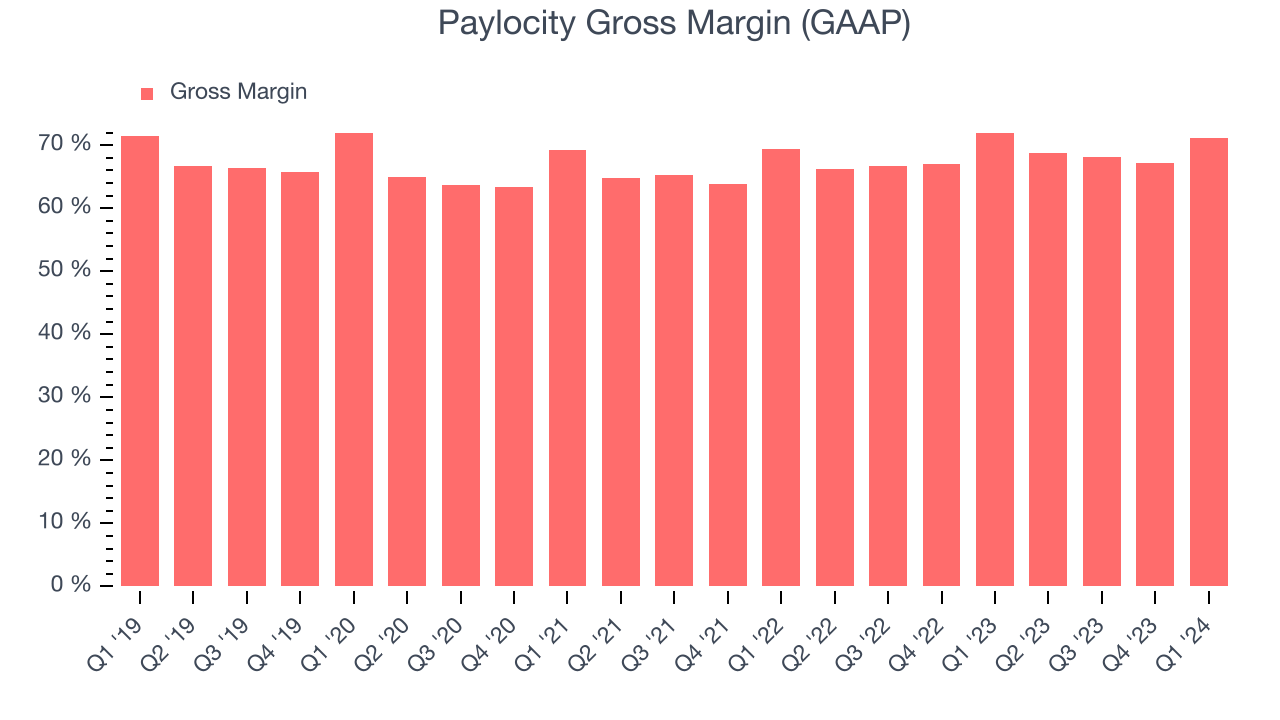

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Paylocity's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 71.1% in Q1.

That means that for every $1 in revenue the company had $0.71 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite improving significantly since the last quarter, Paylocity's gross margin is still lower than that of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

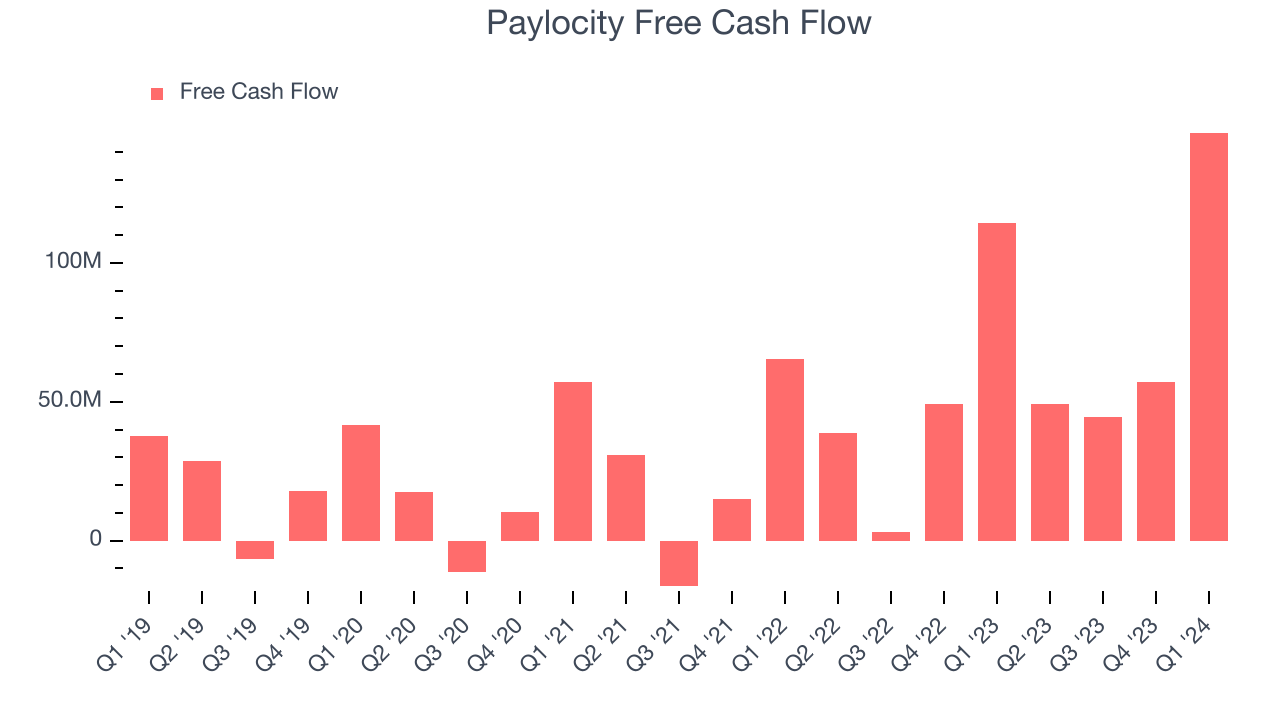

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Paylocity's free cash flow came in at $147 million in Q1, up 28.6% year on year.

Paylocity has generated $297.7 million in free cash flow over the last 12 months, an impressive 22% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from Paylocity's Q1 Results

We were impressed by Paylocity's strong gross margin improvement this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 8.4% after reporting and currently trades at $162 per share.

Is Now The Time?

When considering an investment in Paylocity, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although Paylocity isn't a bad business, it probably wouldn't be one of our picks. Although its revenue growth has been strong over the last three years, Wall Street expects growth to deteriorate from here. And while its efficient customer acquisition hints at the potential for strong profitability, the downside is its existing customers have been reducing their spending, which is a bit concerning. On top of that, its gross margins aren't as good as other tech businesses we look at.

Given its price-to-sales ratio of 5.6x based on the next 12 months, the market is certainly expecting long-term growth from Paylocity. We can find things to like about Paylocity, and there's no doubt it's a bit of a market darling, at least for some. However, we think there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $193.19 right before these results (compared to the current share price of $162).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.