Enterprise workflow software provider Pegasystems (NASDAQ:PEGA) reported results ahead of analysts' expectations in Q4 FY2023, with revenue up 19.6% year on year to $474.2 million. It made a non-GAAP profit of $1.77 per share, improving from its profit of $0.82 per share in the same quarter last year.

Is now the time to buy Pegasystems? Find out by accessing our full research report, it's free.

Pegasystems (PEGA) Q4 FY2023 Highlights:

- Revenue: $474.2 million vs analyst estimates of $415.1 million (14.2% beat)

- EPS (non-GAAP): $1.77 vs analyst estimates of $1.00 (77.6% beat)

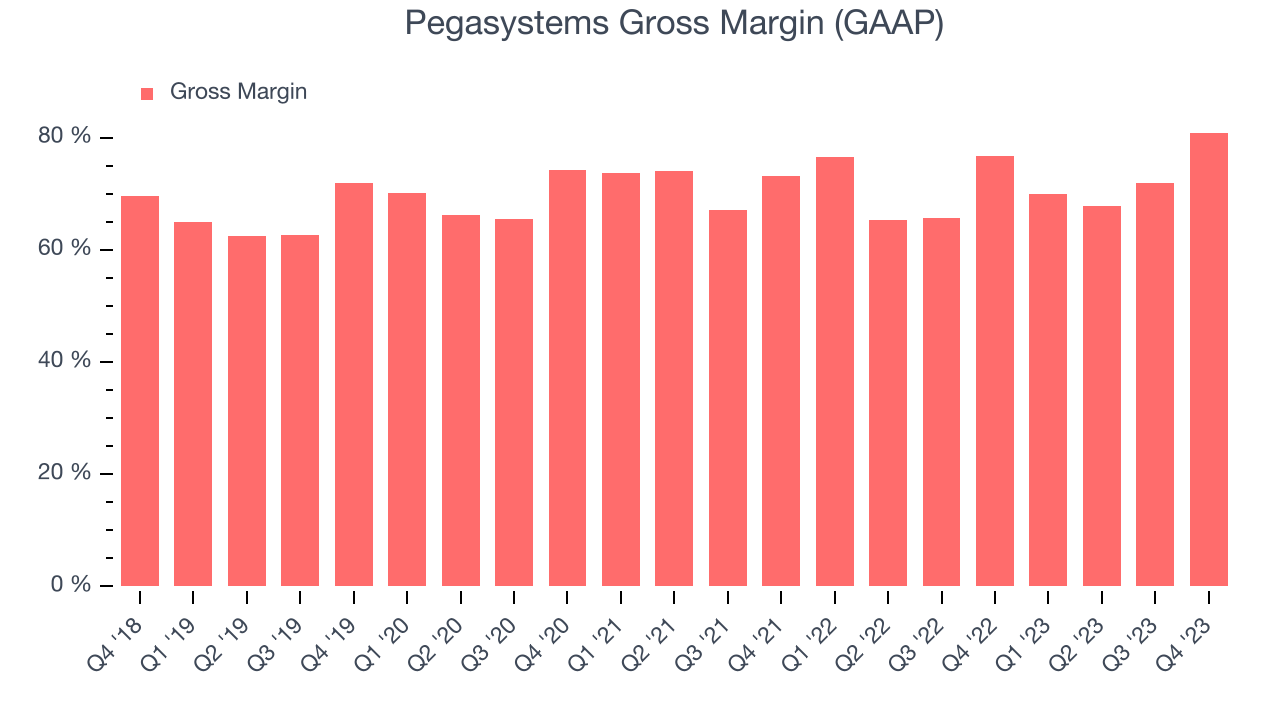

- Gross Margin (GAAP): 80.9%, up from 76.7% in the same quarter last year

- Market Capitalization: $4.04 billion

“It’s awesome to see how well our team performed in 2023,” said Alan Trefler, founder and CEO.

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Sales Growth

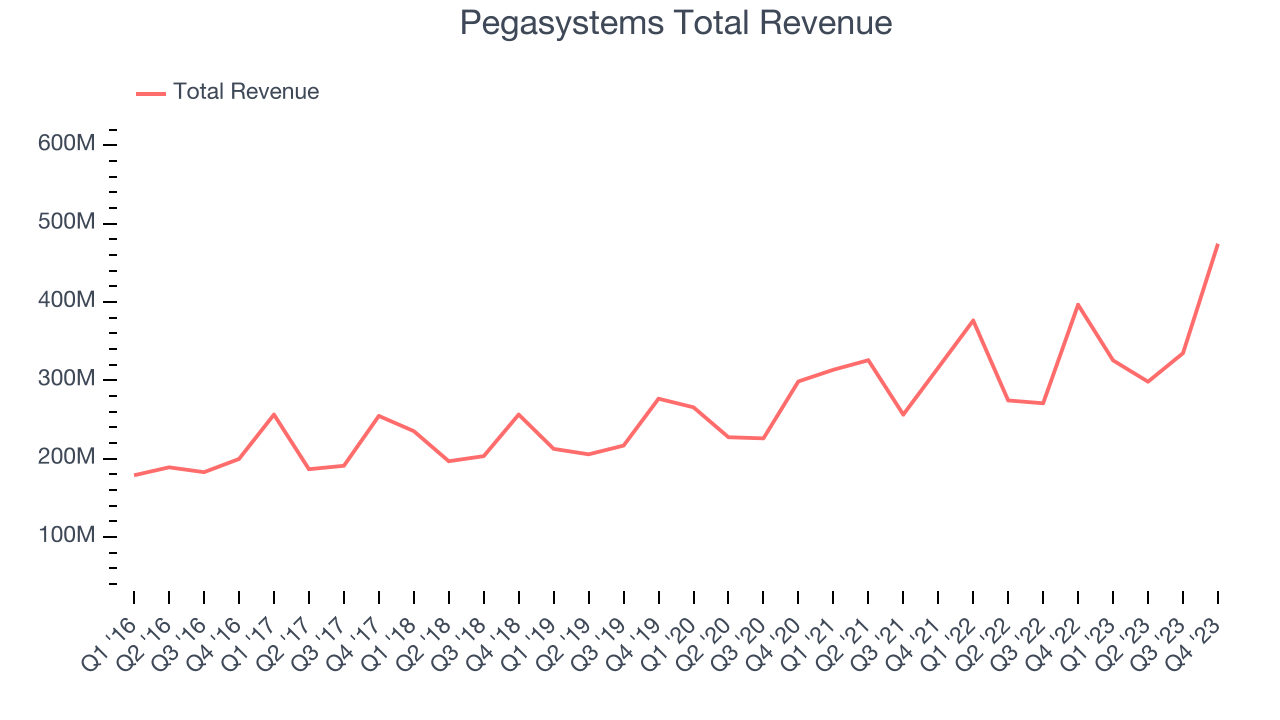

As you can see below, Pegasystems's revenue growth has been unremarkable over the last two years, growing from $316.2 million in Q4 FY2021 to $474.2 million this quarter.

This quarter, Pegasystems's quarterly revenue was up 19.6% year on year, above the company's historical trend. We can see that Pegasystems's revenue increased by $139.6 million quarter on quarter, which is a solid improvement from the $36.38 million increase in Q3 2023. Shareholders should applaud the re-acceleration of growth.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Pegasystems's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 80.9% in Q4.

That means that for every $1 in revenue the company had $0.81 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Pegasystems's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Key Takeaways from Pegasystems's Q4 Results

We were impressed by Pegasystems's strong gross margin improvement this quarter. We were also excited its revenue outperformed Wall Street's estimates, driven by outperformance in its subscription license segment ($207.6 million of revenue vs estimates of $146.7 million). Its revenue, EPS, and free cash flow guidance for full-year 2024 also beat expectations (specifically, free cash flow is projected to be $350 million in 2024 vs estimates of $258 million), with the company forecasting 11% annual contract value growth. Zooming out, we think this was a fantastic beat-and-raise quarter that should have shareholders cheering. The stock is up 5.5% after reporting and currently trades at $53.5 per share.

Pegasystems may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.