Enterprise workflow software provider Pegasystems (NASDAQ:PEGA) missed analysts' expectations in Q2 FY2023, with revenue up 8.72% year on year to $298.3 million. Pegasystems made a GAAP loss of $46.8 million, improving from its loss of $286.3 million in the same quarter last year.

Is now the time to buy Pegasystems? Find out by accessing our full research report free of charge.

Pegasystems (PEGA) Q2 FY2023 Highlights:

- Revenue: $298.3 million vs analyst estimates of $310.6 million (3.98% miss)

- EPS (non-GAAP): $0.01 vs analyst estimates of $0.04 (-$0.03 miss)

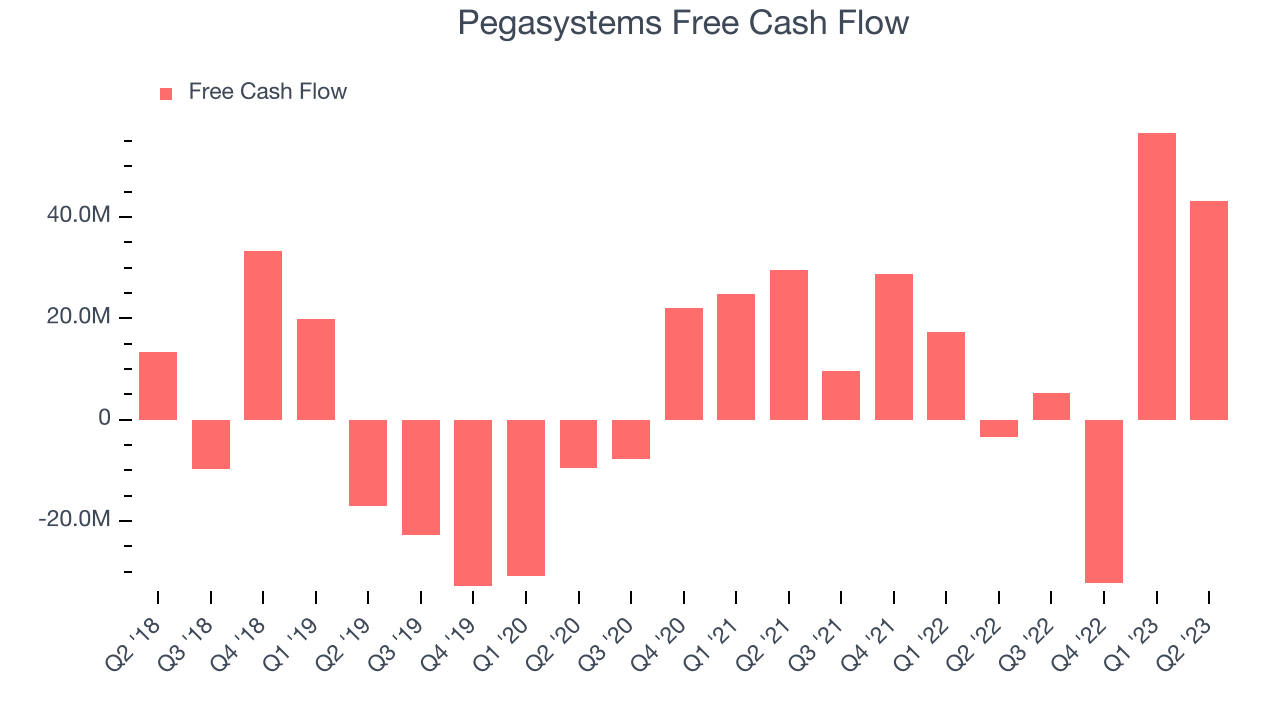

- Free cash flow of $43.2 million, down 23.7% from the previous quarter

- Gross Margin (GAAP): 67.8%, up from 65.3% in the same quarter last year

"In this uncertain and changing environment, focusing on client success is more important than ever," said Alan Trefler, founder and CEO.

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

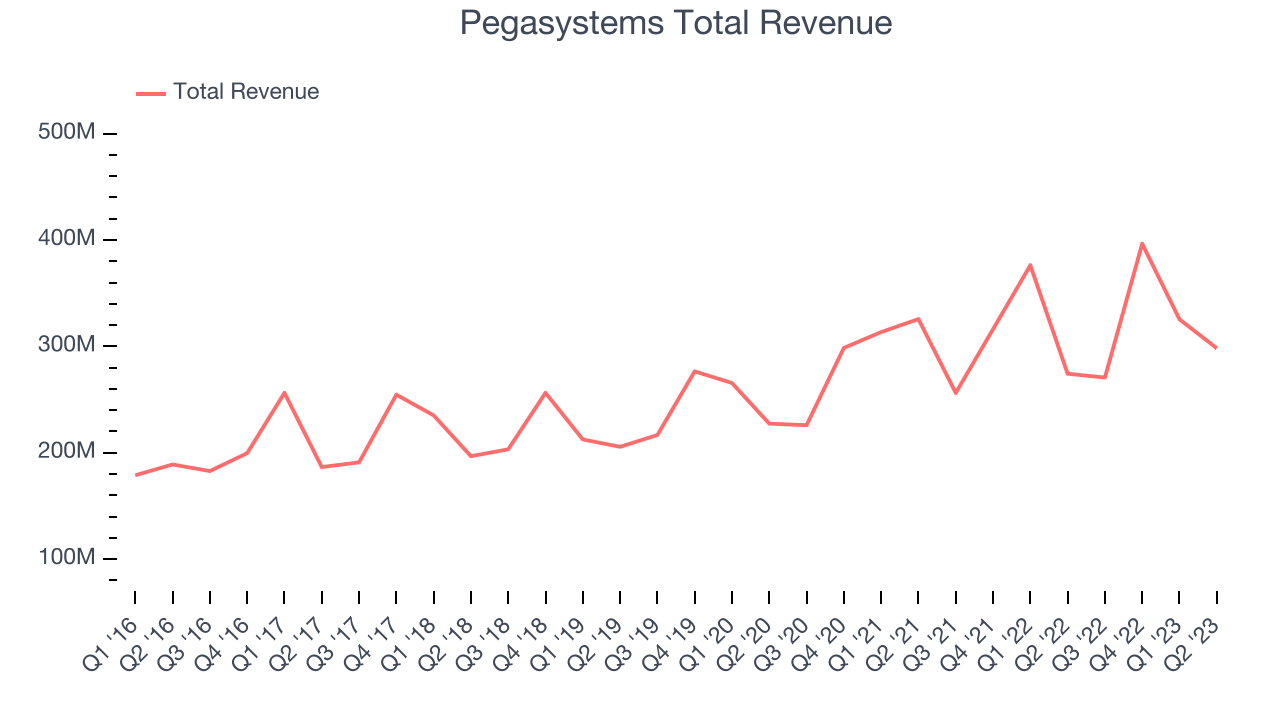

Sales Growth

Pegasystems's quarterly revenue was only up 8.72% year on year, which isn't particularly great. On top of that, its revenue decreased again in Q2 by $27.2 million, following the same trend as its $71 million decrease in Q1 2023. While one-off fluctuations aren't always concerning, we have no doubt that shareholders would like to see its revenue rebound soon.

Ahead of the earnings results announcement, the analysts covering the company were expecting sales to grow 11.1% over the next 12 months.

In volatile times like these, we look for robust businesses with strong pricing power. Overlooked by most investors, this company is one of the highest-quality software companies in the world, and its software products have been the gold standard in critical industries for decades. The result is an impressive business that's up an incredible 18,000%+ since its IPO. You can find it on our platform for free.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Pegasystems's free cash flow came in at $43.2 million in Q2, turning positive over the last year.

Pegasystems has generated $73 million in free cash flow over the last 12 months, a decent 6.44% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Pegasystems's Q2 Results

Sporting a market capitalization of $4.53 billion, Pegasystems is among smaller companies, but its more than $312.8 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

We struggled to find many strong positives in these results. On the other hand, it was unfortunate that the company's revenue missed analysts' expectations and its gross margin declined. Overall, this was a mediocre quarter for Pegasystems. The company is down 1.98% on the results and currently trades at $54 per share.

Pegasystems may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, and what's happened in the latest quarter. We cover this and more in our full company report, and it's free.

Looking for more investment opportunities? One way to find them is to watch for paradigm shifts, just like how every company in the world is slowly becoming a technology company and facing increasing cybersecurity risks. This company is leading the charge in cyber defense with its cloud-native cybersecurity solutions while generating best-in-class revenue growth and SaaS performance metrics. It should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.