Enterprise workflow software provider Pegasystems (NASDAQ:PEGA) missed analysts' expectations in Q1 CY2024, with revenue up 1.4% year on year to $330.1 million. It made a non-GAAP profit of $0.48 per share, improving from its profit of $0.23 per share in the same quarter last year.

Pegasystems (PEGA) Q1 CY2024 Highlights:

- Revenue: $330.1 million vs analyst estimates of $337.3 million (2.1% miss)

- ACV (annual contract value): $1.17 billion vs analyst estimates of $1.27 billion (7.2% miss)

- RPO (remaining performance obligations aka backlog): $1.42 billion vs analyst estimates of $1.46 billion (2.1% miss)

- EPS (non-GAAP): $0.48 vs analyst estimates of $0.45 (7.3% beat)

- Gross Margin (GAAP): 71.3%, up from 69.9% in the same quarter last year

- Free Cash Flow of $179.5 million, up 132% from the previous quarter

- Market Capitalization: $4.98 billion

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Founded to offer business process management (BPM), the company originally analyzed workflows and implemented changes to increase quality and reduce inefficiencies. Over time and with technological advances, Pegasystems began offering broader software products to enable automation of the business processes the company once improved. Low-code application building was then added to the platform to empower a customer’s non-technical workers.

A customer problem that Pegasystems solves is how to manage customer interactions across multiple channels. With Pegasystems' software, businesses can create a unified view of customer interactions across email, phone, and social media. This enables businesses to provide more personalized and effective service, which can lead to happier customers. Pegasystems’ flagship product, Pega Platform, is a low-code platform that allows businesses to build custom applications. Whether it is a customer-facing healthcare portal to manage doctors appointments or a back office application for reconciling customer bank balances, this platform allows those who cannot write code to build functional applications.

Pegasystems generates revenue through the sale of software licenses and professional services to ensure customer success. The company’s customers include financial institutions, healthcare providers, and government agencies whose business processes tend to be complex and sometimes regulated.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Competitors in productivity and automation software include ServiceNow (NYSE:NOW), salesforce.com (NYSE:CRM), and private company BMC.Sales Growth

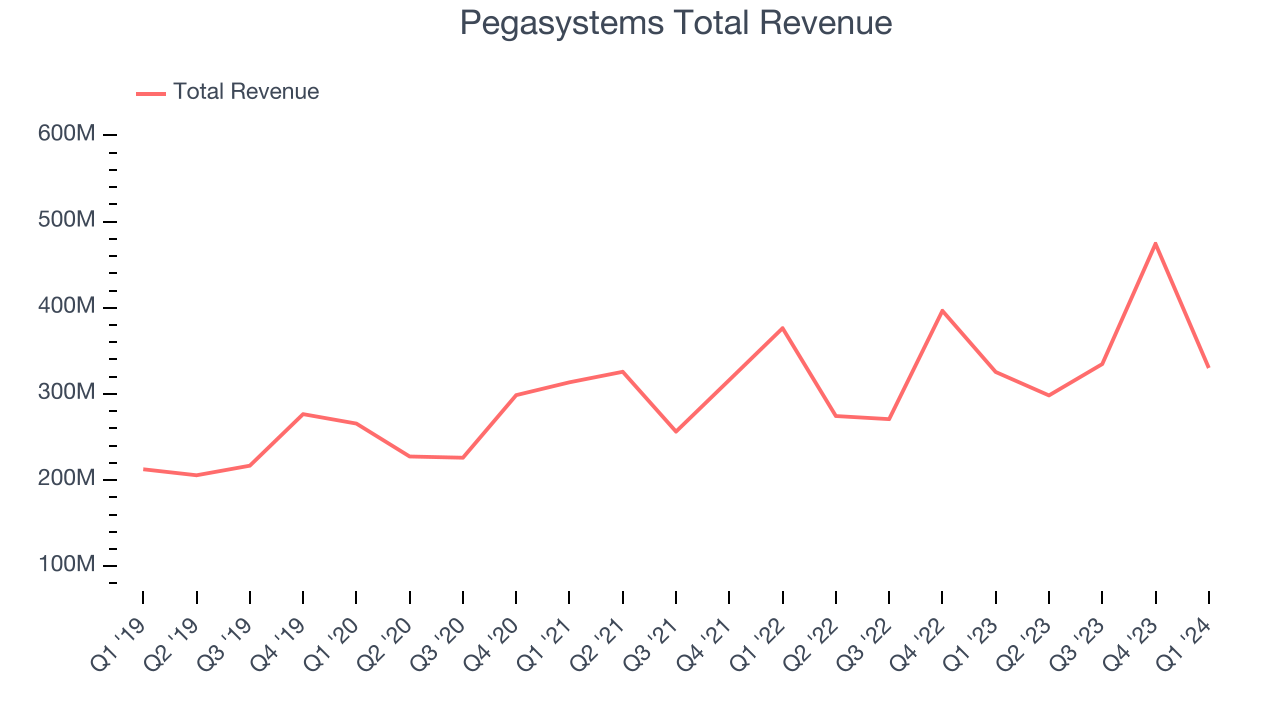

As you can see below, Pegasystems's revenue growth has been unremarkable over the last three years, growing from $313.5 million in Q1 2021 to $330.1 million this quarter.

Pegasystems's quarterly revenue was only up 1.4% year on year, which might disappoint some shareholders. On top of that, the company's revenue actually decreased by $144.1 million in Q1 compared to the $139.6 million increase in Q4 CY2023. Taking a closer look we can a similar revenue decline in the same quarter last year, which could suggest that the business has seasonal elements. Regardless, this situation is worth monitoring as management is guiding for a further revenue drop in the next quarter.

Looking ahead, analysts covering the company were expecting sales to grow 6.6% over the next 12 months before the earnings results announcement.

Profitability

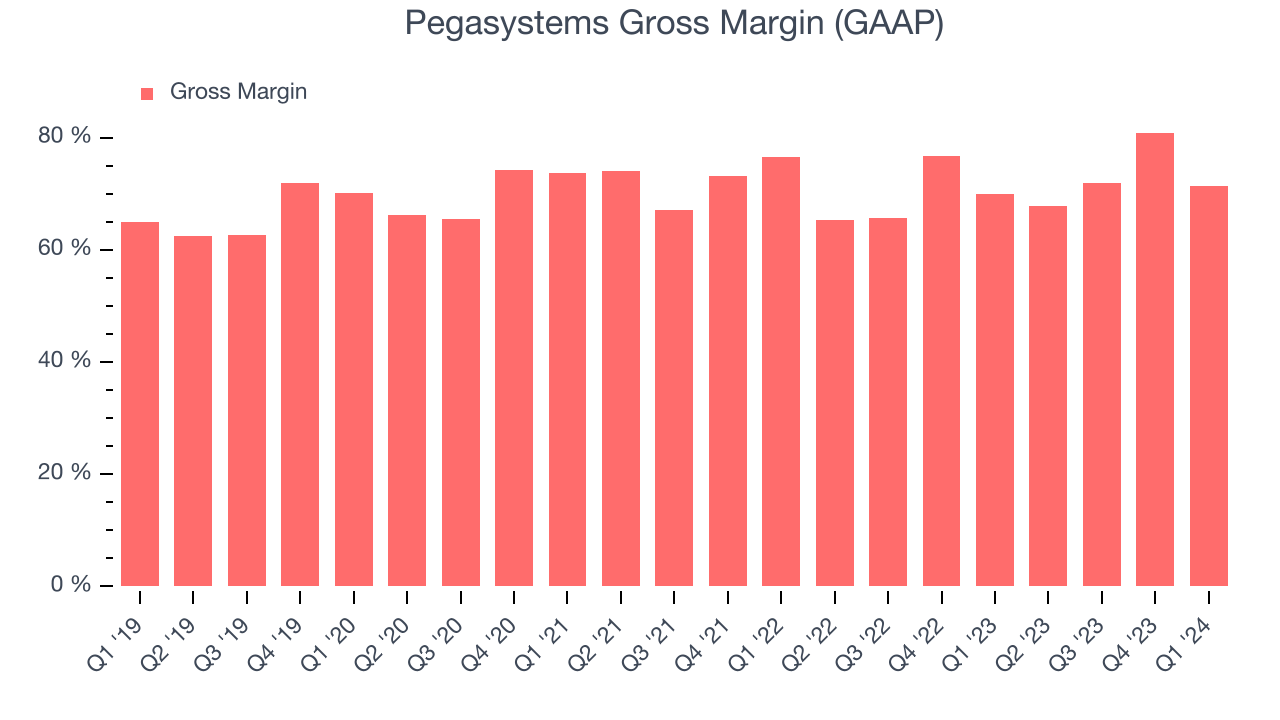

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Pegasystems's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 71.3% in Q1.

That means that for every $1 in revenue the company had $0.71 left to spend on developing new products, sales and marketing, and general administrative overhead. Pegasystems's gross margin is lower than that of a typical SaaS businesses and its decline over the last year is putting it in an even deeper hole. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

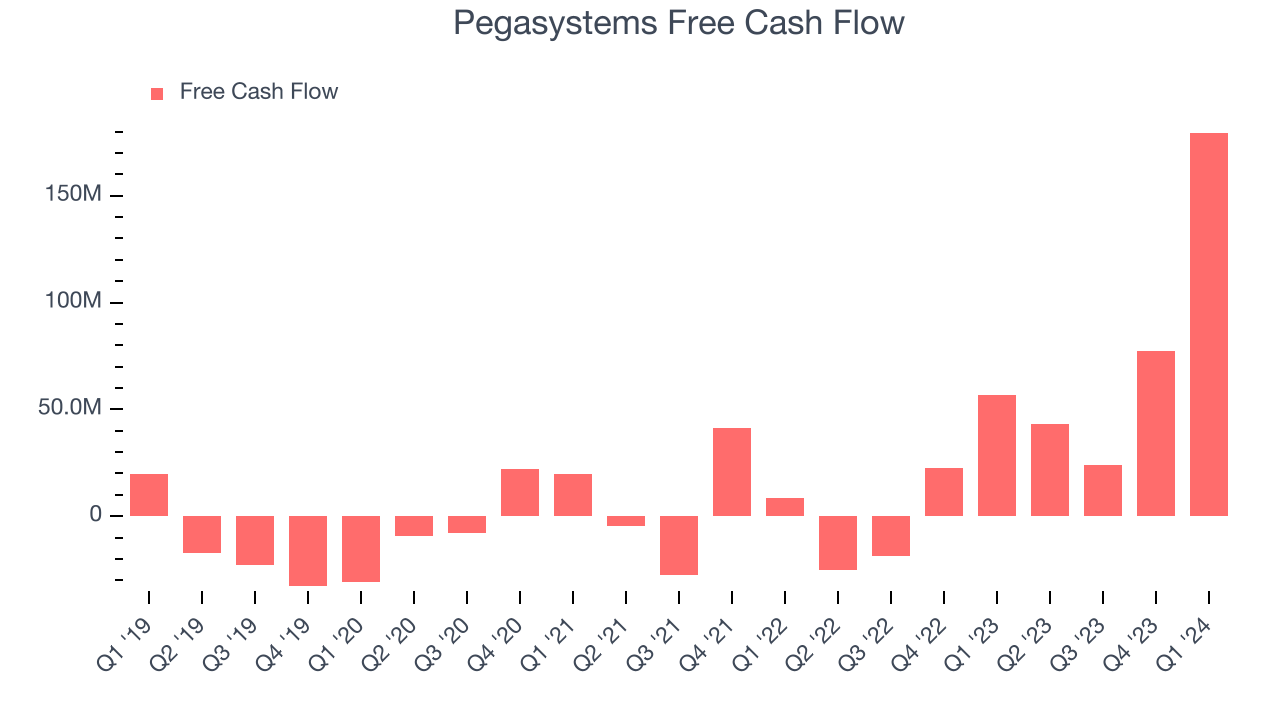

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Pegasystems's free cash flow came in at $179.5 million in Q1, up 217% year on year.

Pegasystems has generated $323.9 million in free cash flow over the last 12 months, an impressive 22.5% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Pegasystems is a well-capitalized company with $618.9 million of cash and $563.6 million of debt, meaning it could pay back all its debt tomorrow and still have $55.32 million of cash on its balance sheet. This net cash position gives Pegasystems the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Pegasystems's Q1 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed analysts' expectations and its gross margin shrunk. Also, alternate topline metrics such as ACV (annual contract value) and RPO (remaining performance obligations), which give further insight into demand, underperformed expectations. Overall, this was a mediocre quarter for Pegasystems. The company is down 3.2% on the results and currently trades at $56.97 per share.

Is Now The Time?

Pegasystems may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although Pegasystems isn't a bad business, it probably wouldn't be one of our picks. Its revenue growth has been weak over the last three years, and analysts expect growth to deteriorate from here. And while its bountiful generation of free cash flow empowers it to invest in growth initiatives, unfortunately, its customer acquisition is less efficient than many comparable companies.

Pegasystems's price-to-sales ratio based on the next 12 months is 3.2x, suggesting the market has lower expectations for the business relative to the hottest tech stocks. In the end, beauty is in the eye of the beholder. While Pegasystems wouldn't be our first pick, if you like the business, it seems to be trading at an interesting price right now.

Wall Street analysts covering the company had a one-year price target of $71.69 right before these results (compared to the current share price of $56.97).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.