Food and beverage company PepsiCo (NASDAQ:PEP) fell short of analysts' expectations in Q4 FY2023, with revenue flat year on year at $27.85 billion. It made a GAAP profit of $0.94 per share, down from its profit of $1.67 per share in the same quarter last year.

Is now the time to buy PepsiCo? Find out by accessing our full research report, it's free.

PepsiCo (PEP) Q4 FY2023 Highlights:

- Revenue: $27.85 billion vs analyst estimates of $28.37 billion (1.8% miss)

- EPS: $0.94 vs analyst expectations of $1.73 (45.5% miss)

- Guidance for 2024 organic revenue of at least 4% year on year growth vs analyst estimates of up 4.9% year on year

- Guidance for 2024 EPS of at least $8.15 vs analyst estimates of $8.15, meaning guidance is better than expectations since it states a minimum level in line with expectations

- Free Cash Flow of $2.83 billion, down 38.3% from the previous quarter

- Gross Margin (GAAP): 53%, up from 52.3% in the same quarter last year

- Organic Revenue was up 4.5% year on year (miss vs. expectations of up 5.0% year on year)

- Sales Volumes were down 4% year on year

- Market Capitalization: $241.9 billion

With a history that goes back more than a century, PepsiCo (NASDAQ:PEP) is a household name in food and beverages today and best known for its flagship soda.

Beverages and Alcohol

The beverages and alcohol category encompasses companies engaged in the production, distribution, and sale of refreshments like beer, wine, and spirits, along with soft drinks, juices, and bottled water. These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. The industry is highly competitive, with a diverse range of products from large multinational corporations, niche brands, and startups vying for market share. It's also subject to varying degrees of government regulation and taxation, especially for alcoholic beverages.

Sales Growth

PepsiCo is one of the most widely recognized consumer staples companies in the world. Its influence over consumers gives it extremely high negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don't have).

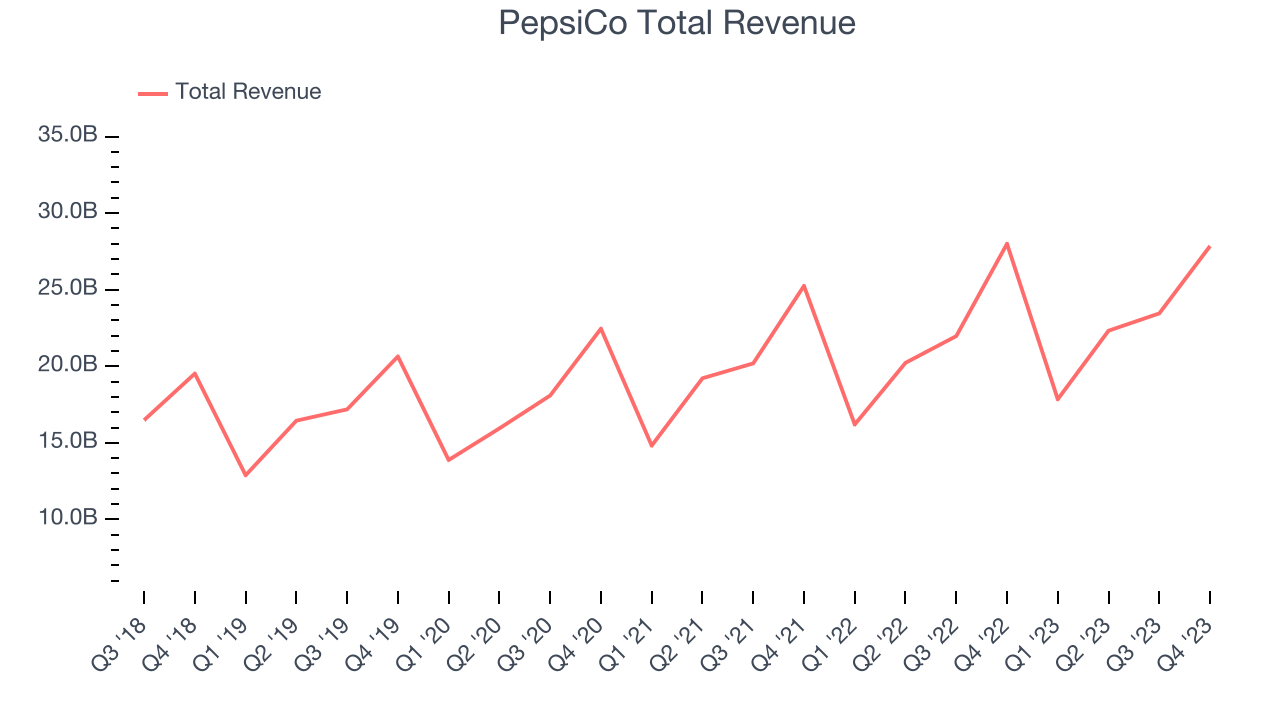

As you can see below, the company's annualized revenue growth rate of 9.1% over the last three years was decent despite consumers buying less of its products. We'll explore what this means in the "Volume Growth" section.

This quarter, PepsiCo missed Wall Street's estimates and reported a rather uninspiring 0.5% year-on-year revenue decline, generating $27.85 billion in revenue. Looking ahead, Wall Street expects sales to grow 5.1% over the next 12 months, an acceleration from this quarter.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

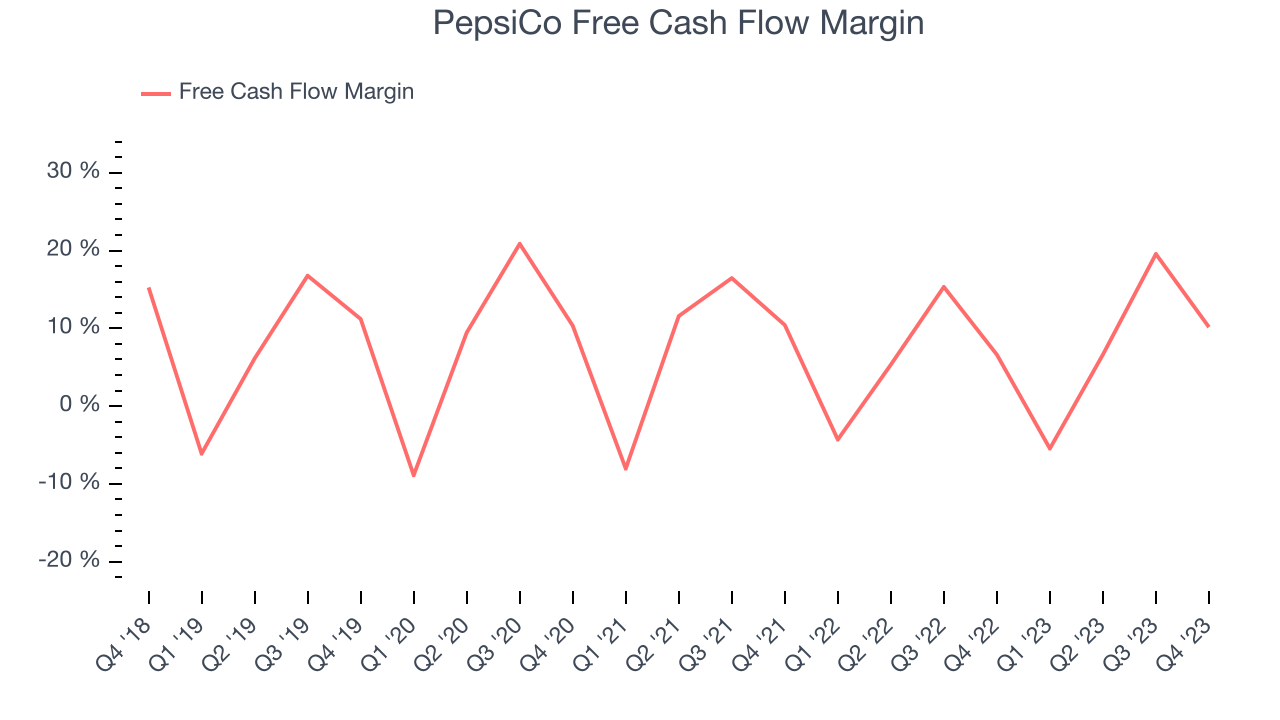

PepsiCo's free cash flow came in at $2.83 billion in Q4, up 52.7% year on year. This result represents a 10.2% margin.

Over the last two years, PepsiCo has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 6.7%, slightly better than the broader consumer staples sector. Furthermore, its margin has averaged year-on-year increases of 2.2 percentage points over the last 12 months. This likely pleases the company's investors.

Key Takeaways from PepsiCo's Q4 Results

It was encouraging to see PepsiCo slightly top analysts' full-year earnings guidance expectations. That stood out as a positive in these results. On the other hand, its organic revenue unfortunately missed analysts' expectations and its operating margin missed Wall Street's estimates. Guidance for full year organic revenue called for growth of at least 4% while analysts' estimates call for 4.9% growth. Full year EPS will be "at least" $8.15, and with Consensus at $8.15, this portion of guidance can be viewed as better. Overall, the results were mixed. The company is down 1.2% on the results and currently trades at $171.9 per share.

PepsiCo may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.