RFID manufacturer Impinj (NASDAQ:PI) reported results ahead of analysts' expectations in Q1 CY2024, with revenue down 10.6% year on year to $76.83 million. On top of that, next quarter's revenue guidance ($97.5 million at the midpoint) was surprisingly good and 23.4% above what analysts were expecting. It made a non-GAAP profit of $0.21 per share, down from its profit of $0.30 per share in the same quarter last year.

Impinj (PI) Q1 CY2024 Highlights:

- Revenue: $76.83 million vs analyst estimates of $73.58 million (4.4% beat)

- EPS (non-GAAP): $0.21 vs analyst estimates of $0.11 ($0.10 beat)

- Revenue Guidance for Q2 CY2024 is $97.5 million at the midpoint, well above analyst estimates of $79.04 million (adjusted EPS guidance also handily beat expectations)

- Gross Margin (GAAP): 48.9%, down from 50.7% in the same quarter last year

- Inventory Days Outstanding: 203, down from 240 in the previous quarter

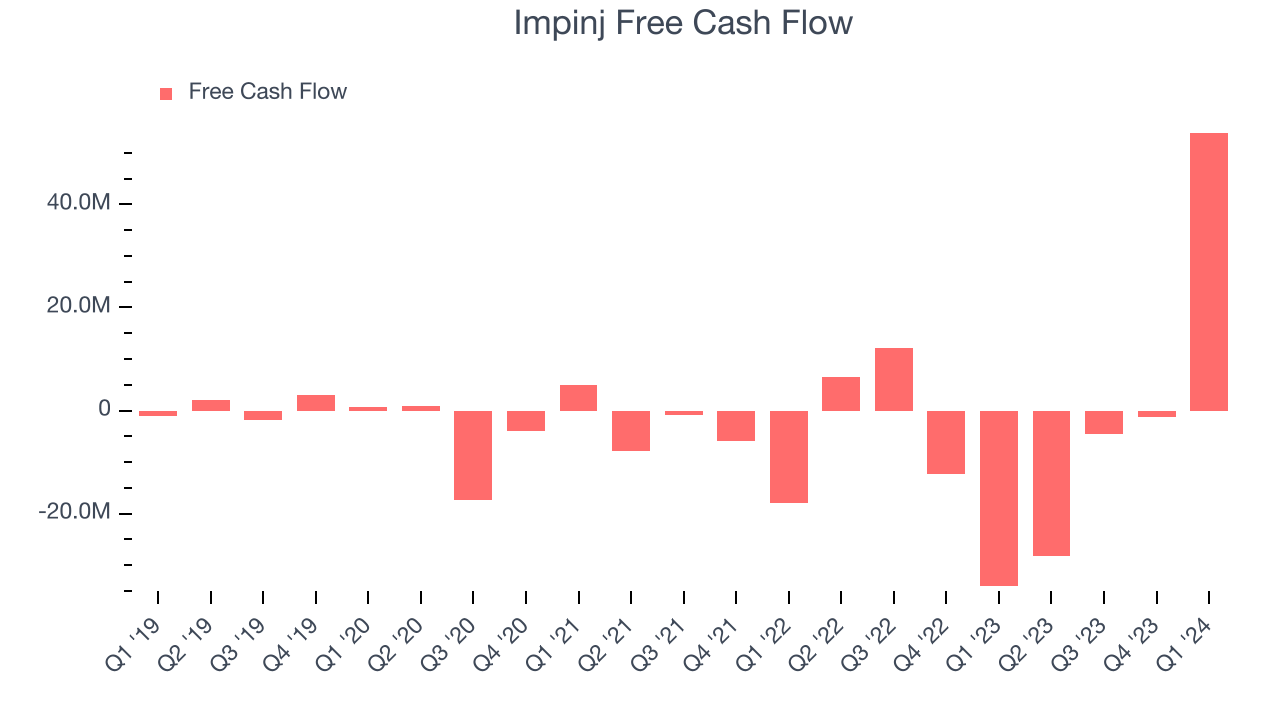

- Free Cash Flow of $53.94 million is up from -$1.20 million in the previous quarter (large beat and first positive FCF quarter in over a year)

- Market Capitalization: $3.42 billion

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ:PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj was founded in 2000, and the company’s name stands for “impact-ionized hot-electron injection”. Impinj went public in 2016, touted as a cornerstone in the ‘Internet of Things’ revolution.

Visibility into exact inventory positions can help retailers avoid costly out-of-stock positions. Data related to units passing through a supply chain can increase operational efficiencies. However, digitally connecting every consumer product on a grocer’s shelf or every component passing through an automotive supply chain was historically too difficult or costly.

Impinj addresses this problem with the RFID technology it pioneered. The company’s key product consists of endpoint chips that can wirelessly connect to most physical things, leading to item-to-cloud connectivity. Because these radios-on-a-chip cost pennies, they can be deployed at a massive scale. Each of Impinj’s chips attaches to a host item and includes an identifying number. The chip may also include features such as user data storage, security or loss prevention. When a consumer uses self-checkout, for example, RFID can help the retailer manage inventory by highlighting exactly what is being bought while also providing insights on theft by identifying items that leave the store without being scanned.

Competitors offering endpoint chips include NXP B.V., EM Microelectronic, and Alien Technology.Sales Growth

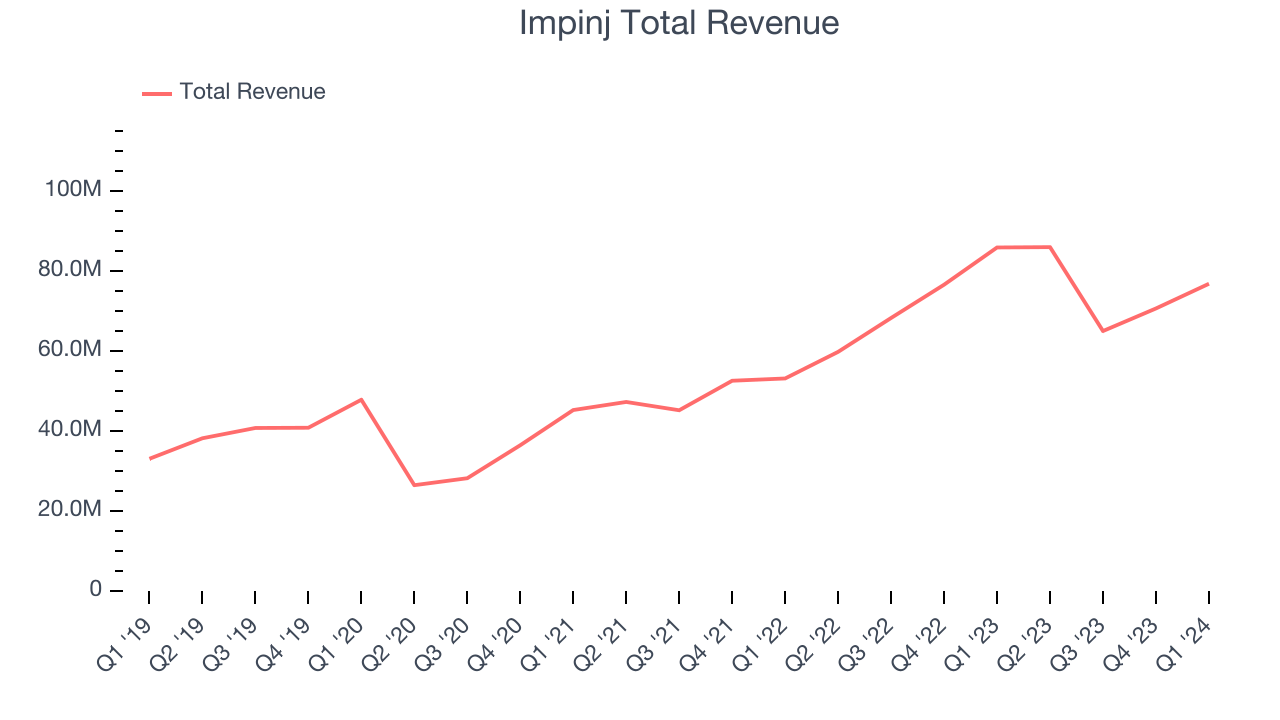

Impinj's revenue growth over the last three years has been very strong, averaging 33.9% annually. But as you can see below, its revenue declined from $85.9 million in the same quarter last year to $76.83 million. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though Impinj surpassed analysts' revenue estimates, this was a slow quarter for the company as its revenue dropped 10.6% year on year. This could mean that the current downcycle is deepening.

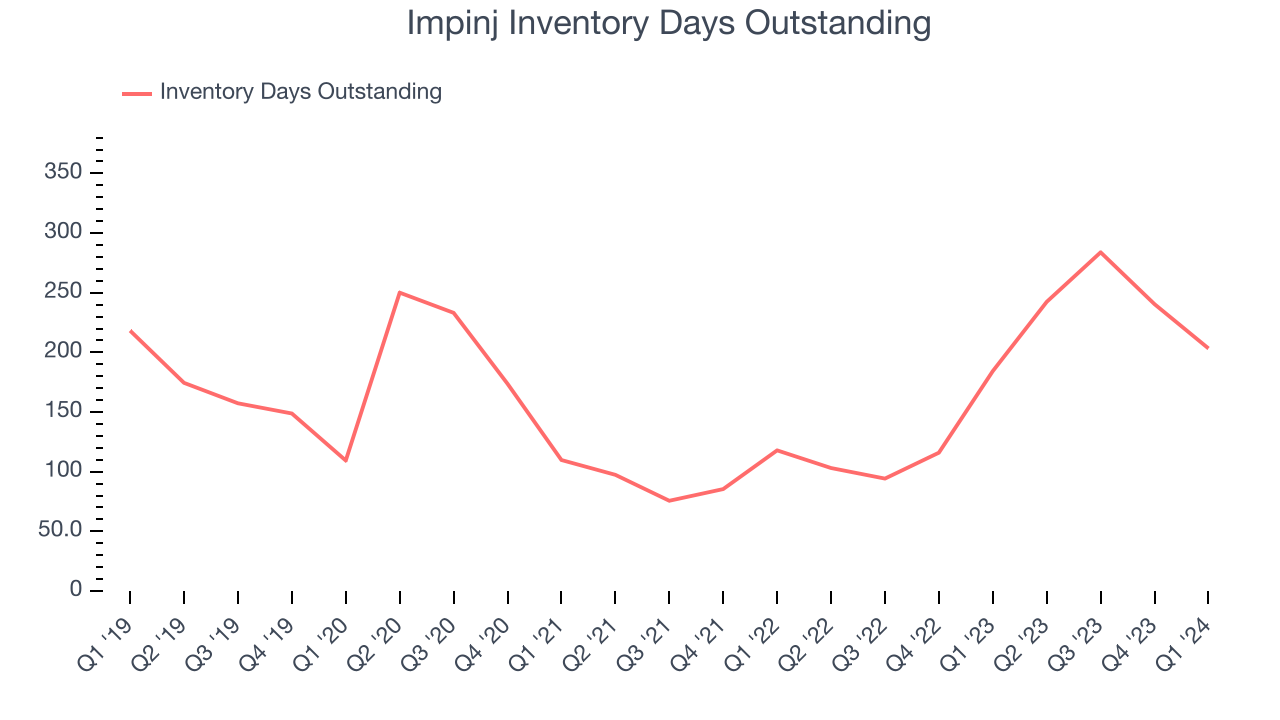

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Impinj's DIO came in at 203, which is 43 days above its five-year average. These numbers suggest that despite the recent decrease, the company's inventory levels are higher than what we've seen in the past.

Pricing Power

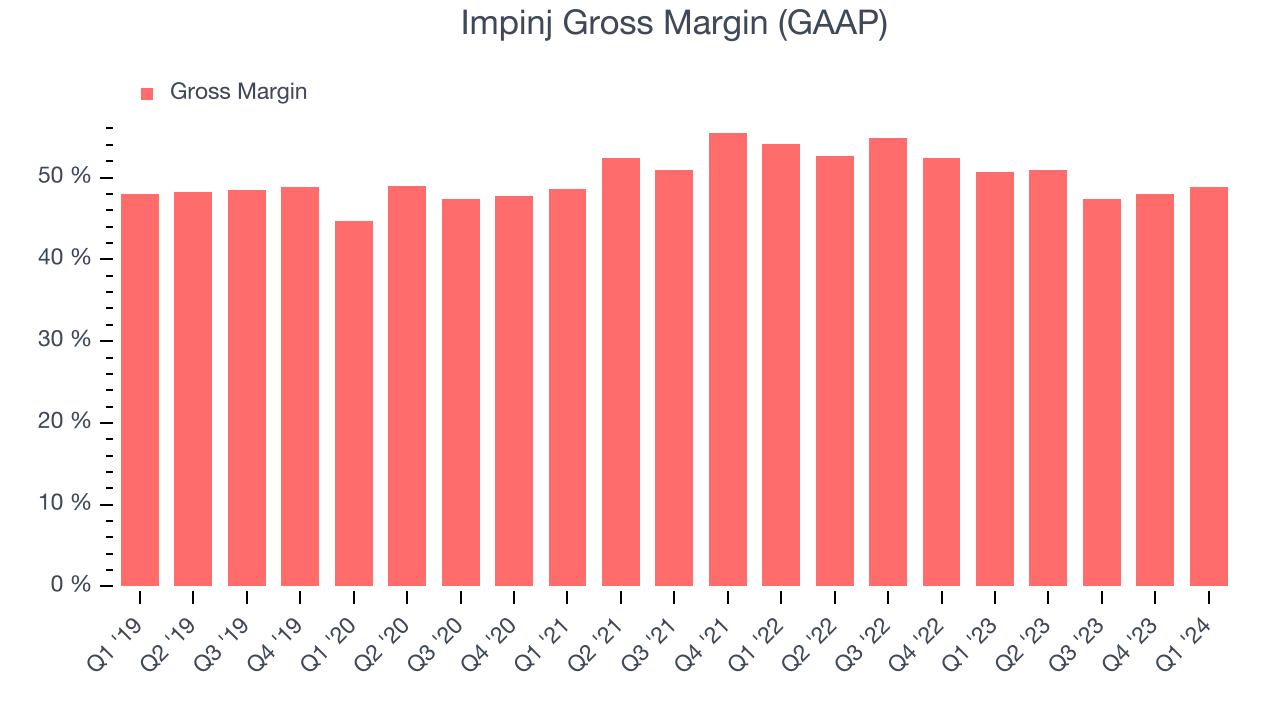

In the semiconductor industry, a company's gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor. Impinj's gross profit margin, which shows how much money the company gets to keep after paying key materials, input, and manufacturing costs, came in at 48.9% in Q1, down 1.8 percentage points year on year.

Impinj's gross margins have been trending down over the last 12 months, averaging 48.9%. This weakness isn't great as Impinj's margins are already slightly below the industry average and falling margins point to potentially deteriorating pricing power.

Profitability

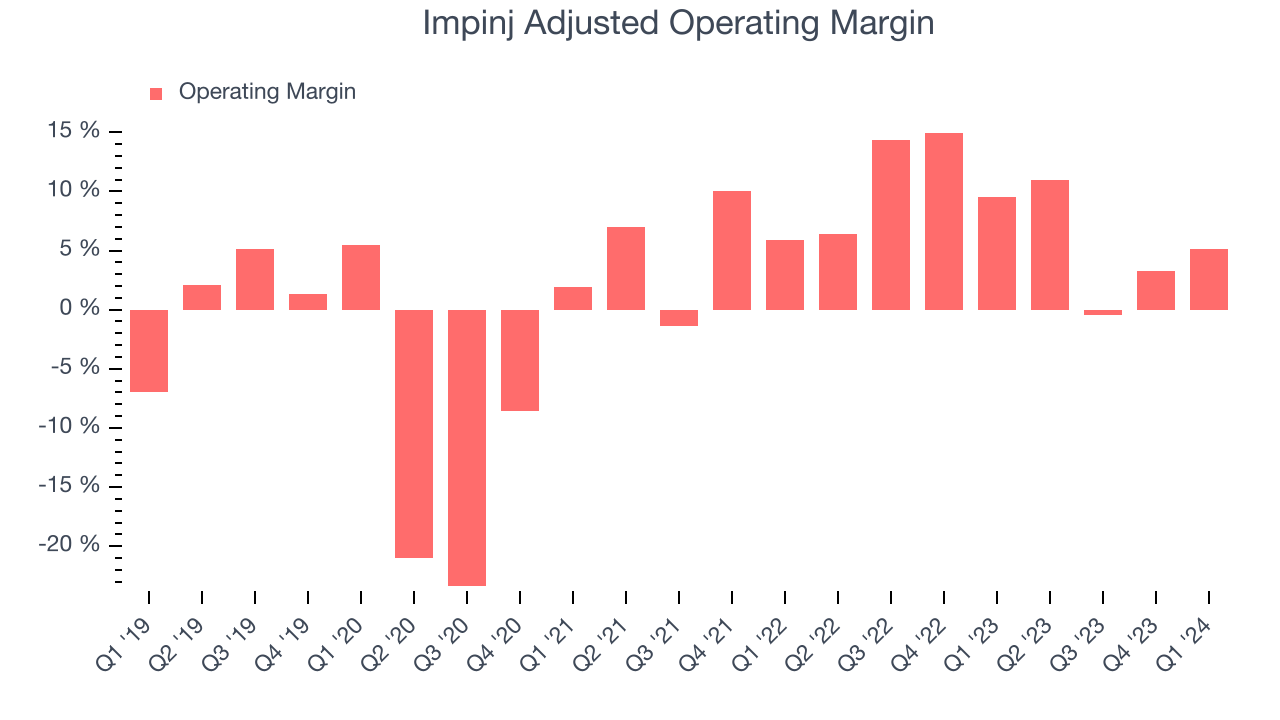

Impinj reported an operating margin of 5.2% in Q1, down 4.4 percentage points year on year. Operating margins are one of the best measures of profitability because they tell us how much money a company takes home after manufacturing its products, marketing and selling them, and, importantly, keeping them relevant through research and development.

Impinj's operating margins have been trending down over the last year, averaging 5.2%. This is a bad sign for Impinj, whose margins are already below average for semiconductor companies. To its credit, however, the company's margins suggest modest pricing power and cost controls.

Earnings, Cash & Competitive Moat

Analysts covering Impinj expect earnings per share to grow 1,767% over the next 12 months, although estimates will likely change after earnings.

Although earnings are important, we believe cash is king because you can't use accounting profits to pay the bills. Impinj's free cash flow came in at $53.94 million in Q1, up 258% year on year.

Impinj has generated $20.11 million in free cash flow over the last 12 months, or 6.7% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

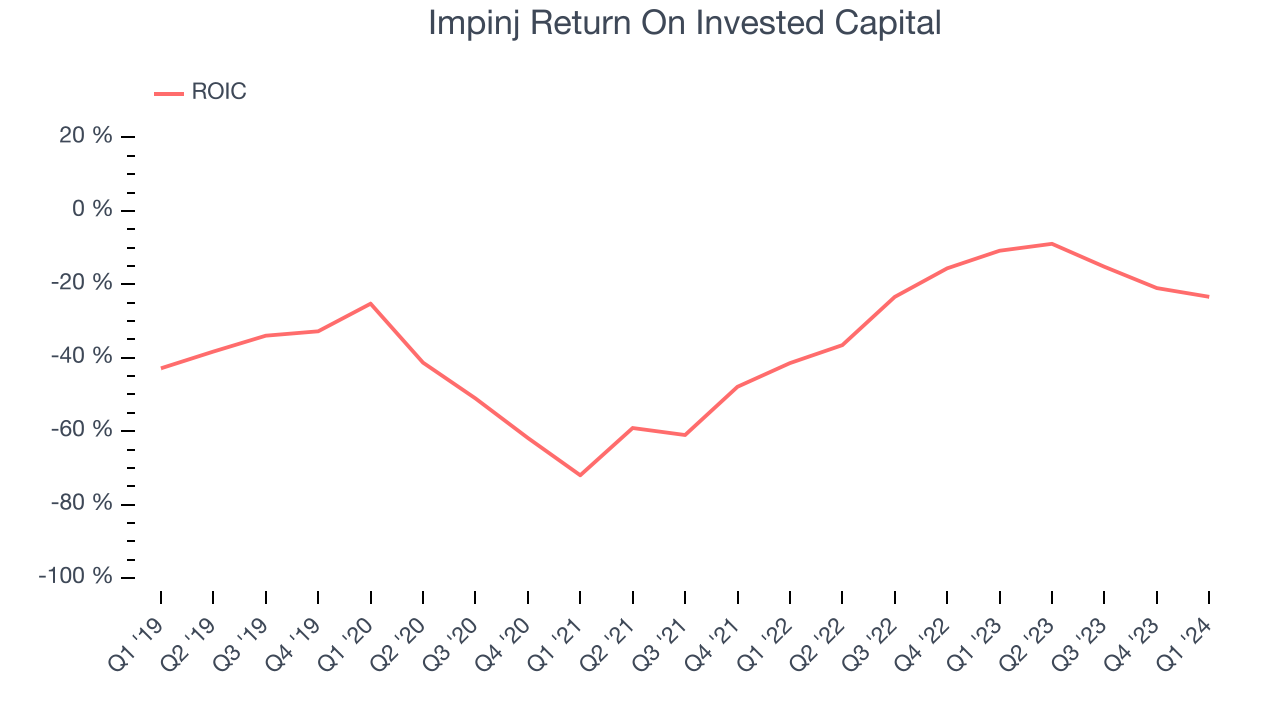

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Impinj's five-year average ROIC was negative 34.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the semiconductor sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Impinj's ROIC has significantly increased. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Impinj's $294.2 million of debt exceeds the $174.1 million of cash on its balance sheet. Furthermore, its 7x net-debt-to-EBITDA ratio (based on its EBITDA of $17.13 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Impinj could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Impinj can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Impinj's Q1 Results

We were impressed by Impinj's strong improvement in inventory levels. We were also excited its revenue and EPS outperformed Wall Street's estimates. Adding to the good news was guidance that came in well above expectations for revenue and EPS. Overall, we think this was a really good quarter that should please shareholders. The stock is up 14.3% after reporting and currently trades at $138 per share.

Is Now The Time?

Impinj may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for everyone who's making the lives of others easier through technology, but in the case of Impinj, we'll be cheering from the sidelines. Although its superb revenue growth over the last three years implys it's winning market share and its growth over the next 12 months is expected to be higher, its relatively low ROIC suggests it has struggled to grow profits historically. On top of that, its operating margins reveal subpar cost controls compared to other semiconductor businesses.

Given its price-to-earnings ratio based on the next 12 months of 103.5x, Impinj is priced with expectations for long-term growth, and there's no doubt it's a bit of a market darling, at least for some. While we've no doubt one can find things to like about Impinj, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $135.38 per share right before these results (compared to the current share price of $138).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.