Diversified manufacturing and supply chain services provider Park-Ohio (NASDAQ:PKOH) fell short of analysts' expectations in Q2 CY2024, with revenue up 1.1% year on year to $432.6 million. It made a GAAP profit of $0.92 per share, improving from its profit of $0.43 per share in the same quarter last year.

Is now the time to buy Park-Ohio? Find out by accessing our full research report, it's free.

Park-Ohio (PKOH) Q2 CY2024 Highlights:

- Revenue: $432.6 million vs analyst estimates of $445.5 million (2.9% miss)

- EPS: $0.92 vs analyst estimates of $0.86 (7.6% beat)

- Gross Margin (GAAP): 16.9%, in line with the same quarter last year

- EBITDA Margin: 9.1%, up from 7.4% in the same quarter last year

- Free Cash Flow was -$6.5 million compared to -$7.1 million in the previous quarter

- Market Capitalization: $339.9 million

“We are proud to have delivered record revenue results and improved profitability during the second quarter. We achieved these results against a stable but mixed revenue backdrop, with particular strength coming from our aerospace and defense market as well as benefiting from significant backlogs in some of our long cycle businesses. While we expect mixed demand in global industrial markets to continue, our diversification and improved cost structure will help us achieve year-over-year revenue growth with improved profitability and free cash flow through the business cycle," said Matthew V. Crawford, Chairman and Chief Executive Officer.

Based in Cleveland, Park-Ohio (NASDAQ:PKOH) provides supply chain management services, capital equipment, and manufactured components.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

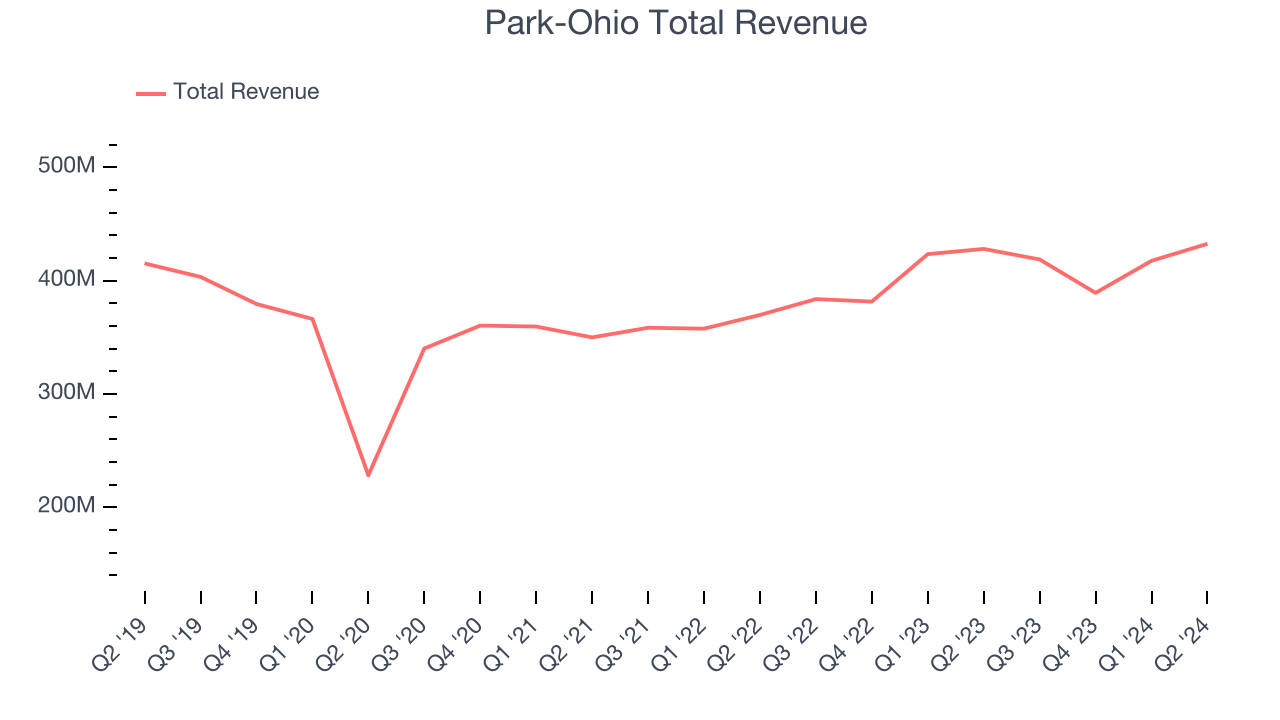

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Park-Ohio's demand was weak over the last five years as its sales were flat, a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Park-Ohio's annualized revenue growth of 8.1% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Park-Ohio's revenue grew 1.1% year on year to $432.6 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 7.6% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

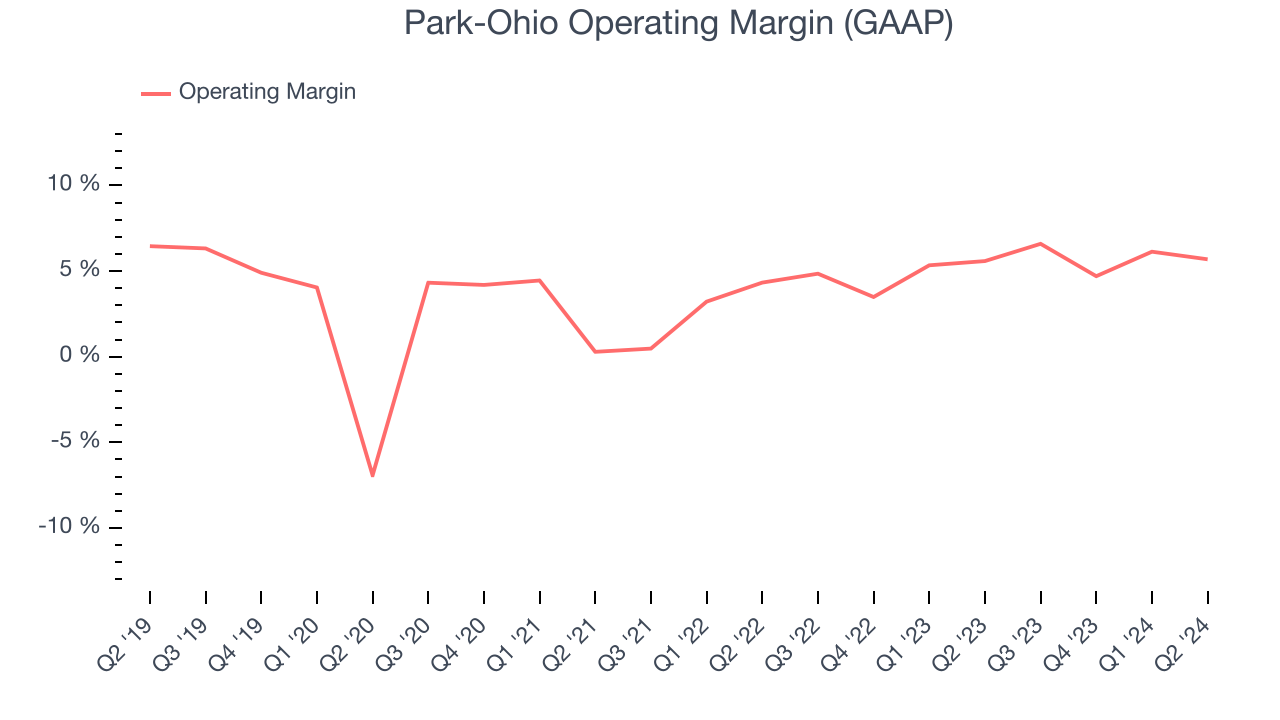

Operating Margin

Park-Ohio was profitable over the last five years but held back by its large expense base. It demonstrated lousy profitability for an industrials business, producing an average operating margin of 4.1%. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, Park-Ohio's annual operating margin rose by 2.7 percentage points over the last five years

In Q2, Park-Ohio generated an operating profit margin of 5.7%, in line with the same quarter last year. This indicates the company's cost structure has recently been stable.

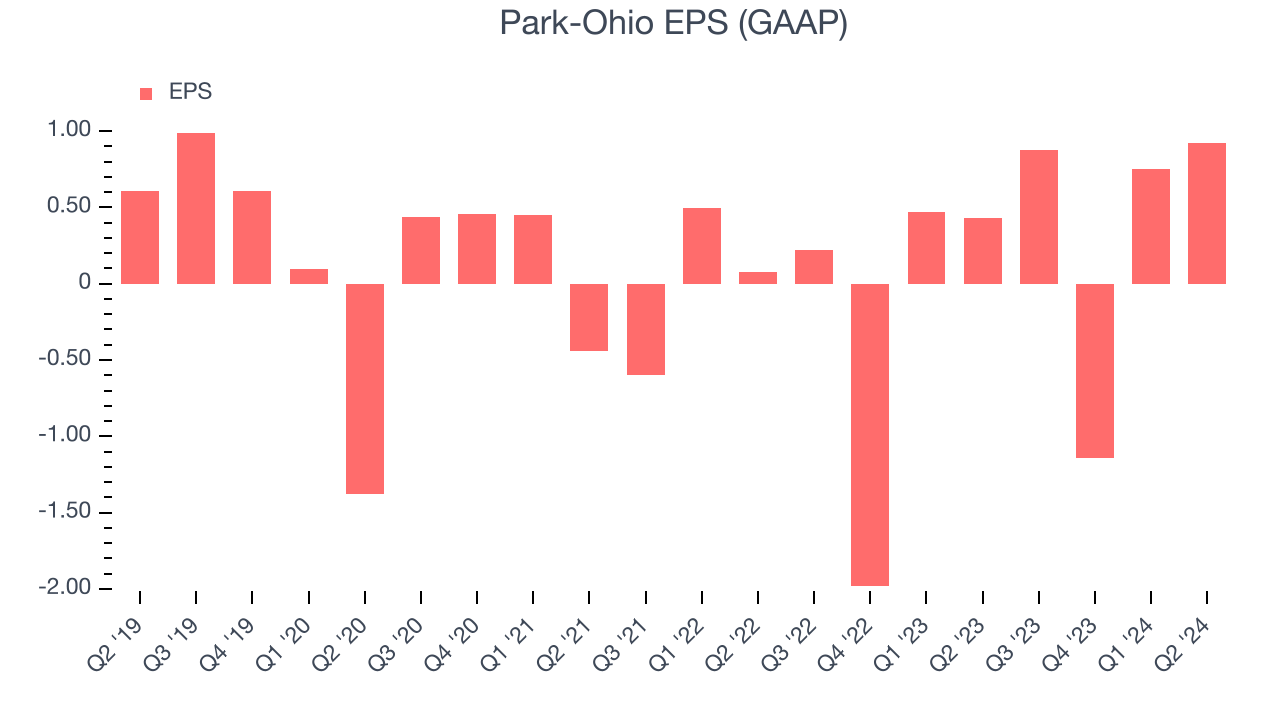

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Park-Ohio's EPS grew at a weak 2.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

Diving into the nuances of Park-Ohio's earnings can give us a better understanding of its performance. As we mentioned earlier, Park-Ohio's operating margin was flat this quarter but expanded by 2.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Park-Ohio, its two-year annual EPS growth of 70.7% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q2, Park-Ohio reported EPS at $0.92, up from $0.43 in the same quarter last year. This print beat analysts' estimates by 7.6%. Over the next 12 months, Wall Street expects Park-Ohio to grow its earnings. Analysts are projecting its EPS of $1.41 in the last year to climb by 157% to $3.62.

Key Takeaways from Park-Ohio's Q2 Results

It was good to see Park-Ohio beat analysts' EPS expectations this quarter. On the other hand, its revenue unfortunately missed. Overall, this was a weaker quarter for Park-Ohio. The stock traded up 2.7% to $26.95 immediately after reporting.

So should you invest in Park-Ohio right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.