Arcade company Dave & Buster’s (NASDAQ:PLAY) missed analysts’ expectations in Q2 CY2024, with revenue up 2.8% year on year to $557.1 million. It made a non-GAAP profit of $1.12 per share, improving from its profit of $0.94 per share in the same quarter last year.

Is now the time to buy Dave & Buster's? Find out by accessing our full research report, it’s free.

Dave & Buster's (PLAY) Q2 CY2024 Highlights:

- Revenue: $557.1 million vs analyst estimates of $560.6 million (small miss)

- EPS (non-GAAP): $1.12 vs analyst estimates of $0.86 (30.9% beat)

- Gross Margin (GAAP): 31.7%, up from 30% in the same quarter last year

- EBITDA Margin: 27.2%, up from 25.9% in the same quarter last year

- Same-Store Sales fell 6.3% year on year (-2.4% in the same quarter last year)

- Market Capitalization: $1.19 billion

“We are pleased with the progress we are making on our strategic initiatives and on the strong financial results achieved during the quarter. During the quarter, we grew Revenue and Adjusted EBITDA, expanded our Adjusted EBITDA margins and generated strong operating cash flow which allowed us to invest in the business and return cash to shareholders. We have also continued to make significant progress toward our strategic goals. Our fully programmed remodels continue to perform well and we are excited about the remodels that have recently opened and will open throughout the remainder of Fiscal 2024 and beyond,” said Chris Morris, Dave & Buster's Chief Executive Officer.

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ:PLAY) operates a chain of arcades providing immersive entertainment experiences.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

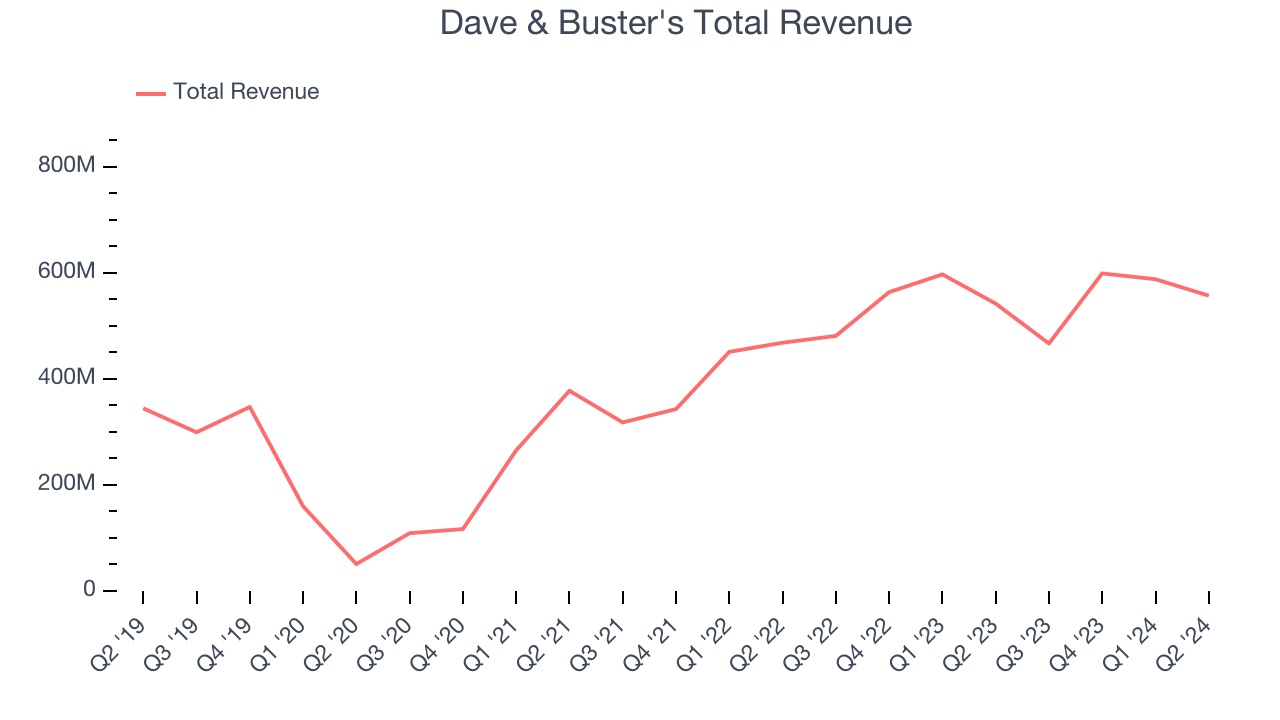

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Regrettably, Dave & Buster’s sales grew at a weak 10.8% compounded annual growth rate over the last five years. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Dave & Buster’s annualized revenue growth of 18.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Dave & Buster’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

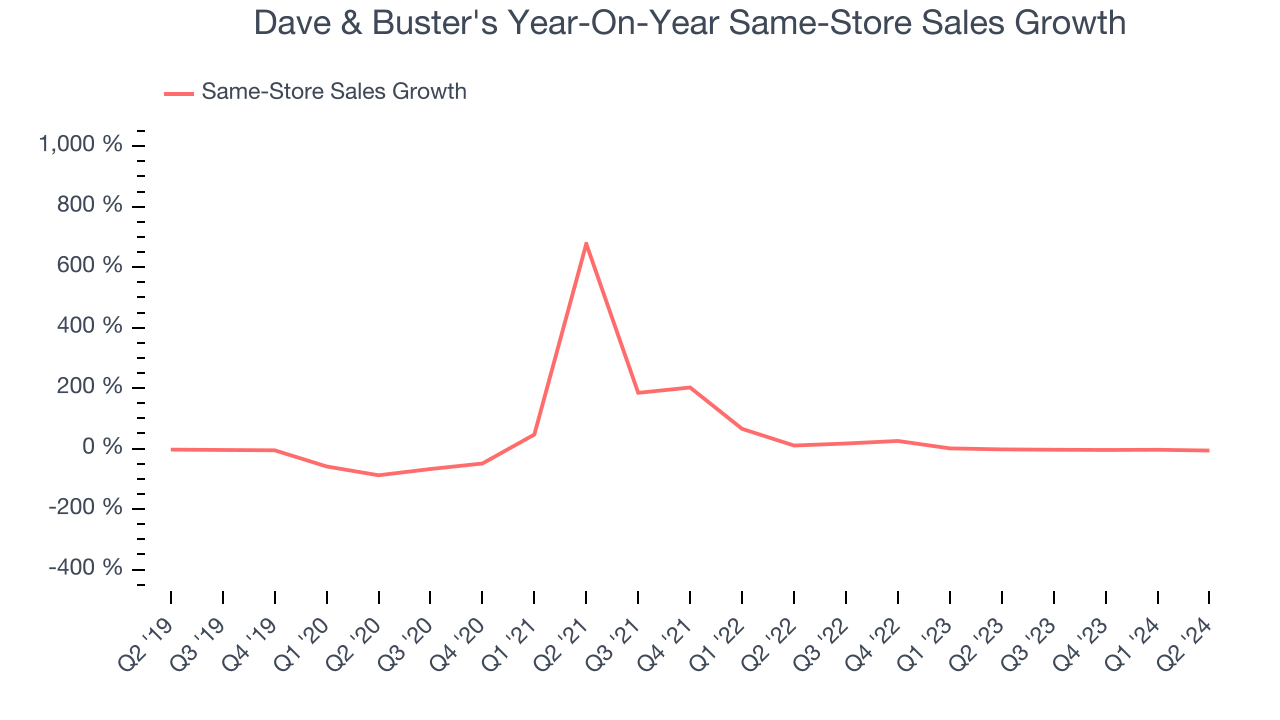

We can better understand the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Dave & Buster’s same-store sales averaged 2.8% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Dave & Buster’s revenue grew 2.8% year on year to $557.1 million, falling short of Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 4.7% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

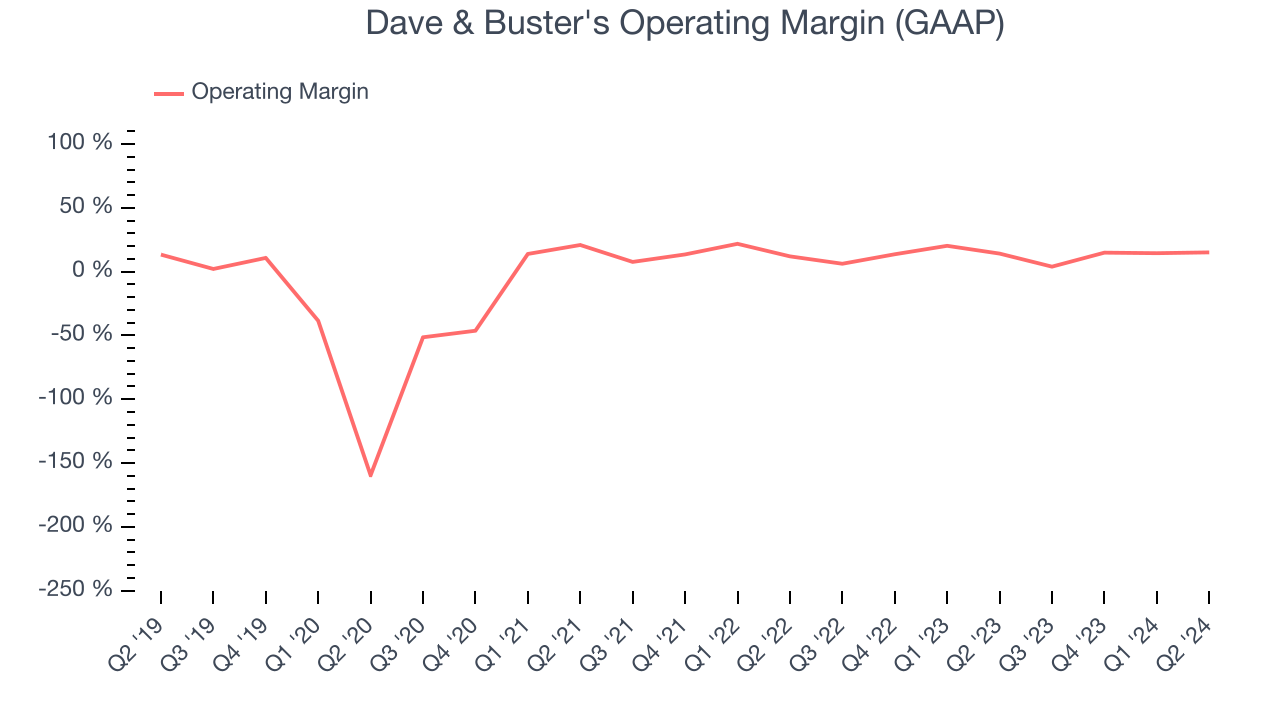

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Dave & Buster’s operating margin has been trending down over the last year, but it still averaged 13.3%, solid for a consumer discretionary business. This shows it generally manages its expenses well.

In Q2, Dave & Buster's generated an operating profit margin of 15.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Key Takeaways from Dave & Buster’s Q2 Results

We were impressed by how significantly Dave & Buster's blew past analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed Wall Street’s estimates, but the earnings beat was enough to send shares higher. The stock traded up 10% to $32.85 immediately after reporting.

So should you invest in Dave & Buster's right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.