Kid’s apparel and accessories retailer The Children’s Place (NASDAQ:PLCE) beat analysts' expectations in Q3 FY2023, with revenue down 5.7% year on year to $480.2 million. On top of that, next quarter's revenue guidance ($462.5 million at the midpoint) was surprisingly good and 6.3% above what analysts were expecting. Turning to EPS, Children's Place made a non-GAAP profit of $3.22 per share, down from its profit of $3.33 per share in the same quarter last year.

Children's Place (PLCE) Q3 FY2023 Highlights:

- Revenue: $480.2 million vs analyst estimates of $464.6 million (3.4% beat)

- EPS (non-GAAP): $3.22 vs analyst expectations of $3.51 (8.3% miss)

- Revenue Guidance for Q4 2023 is $462.5 million at the midpoint, above analyst estimates of $435.2 million

- EPS (non-GAAP) Guidance for Q4 2023 is $0.35 at the midpoint, below analyst estimates of $1.30

- Gross Margin (GAAP): 33.7%, down from 34.8% in the same quarter last year

- Same-Store Sales were down 7.3% year on year (miss vs. expectations of down 5.9% year on year)

- Store Locations: 591 at quarter end, decreasing by 67 over the last 12 months

Offering sizes up to young teens, The Children’s Place (NASDAQ:PLCE) is a specialty retailer that sells its own brands of kid’s apparel and accessories.

These private label brands include The Children's Place, Place Baby, and Gymboree and span tops, bottoms, dresses, outerwear, and shoes. While there is product for kids up to 12-13 years old, the company mainly serves toddlers and kids under 10. The Children’s Place sits in the middle of the pricing spectrum, generally pricier (but also higher quality) than fast-fashion or discount retailers but less expensive than designer brands.

The company’s core customer consists of parents who prioritize quality clothing and a certain level of stylishness. The Children’s Place is also a reliable option for grandparents, other family members, or friends who are shopping for a kid’s gift. On average, stores are pretty small and range from 4,000 to 5,000 square feet. They are often located in suburban malls or shopping centers alongside other mass market retailers.

The Children’s Place supplements its physical store footprint with an e-commerce presence. There are online-exclusive promotions and discounts and a plethora of sizing guides and resources, as the company recognizes that the buyer of the clothing is almost never the final wearer.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Competitors that sell children’s clothing include Carter’s (NYSE:CRI), The Gap (NYSE:GPS), and department stores such as Macy’s (NYSE:M) and Kohl’s (NYSE:KSS).Sales Growth

Children's Place is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

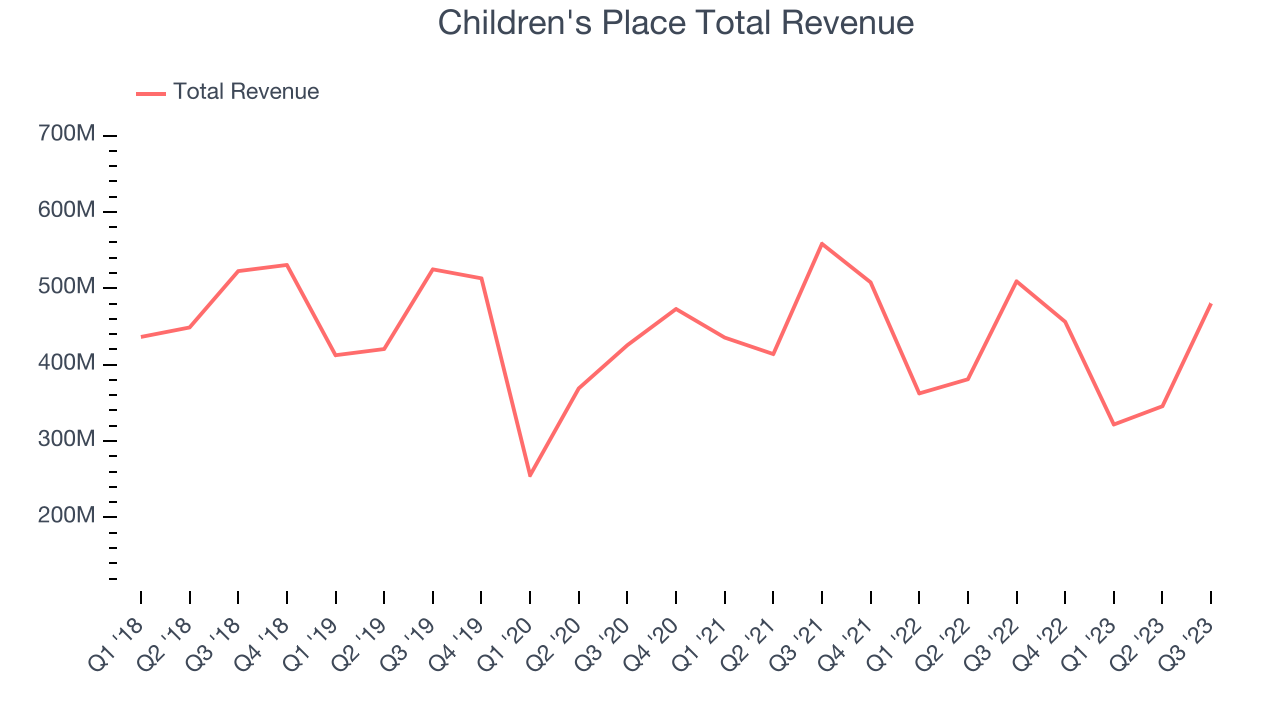

As you can see below, the company's revenue has declined over the last four years, dropping 4% annually as its store count and sales at existing, established stores have both shrunk.

This quarter, Children's Place's revenue fell 5.7% year on year to $480.2 million but beat Wall Street's estimates by 3.4%. The company is guiding for revenue to rise 1.4% year on year to $462.5 million next quarter, improving from the 10.2% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts expect revenue to decline 4.4% over the next 12 months.

Number of Stores

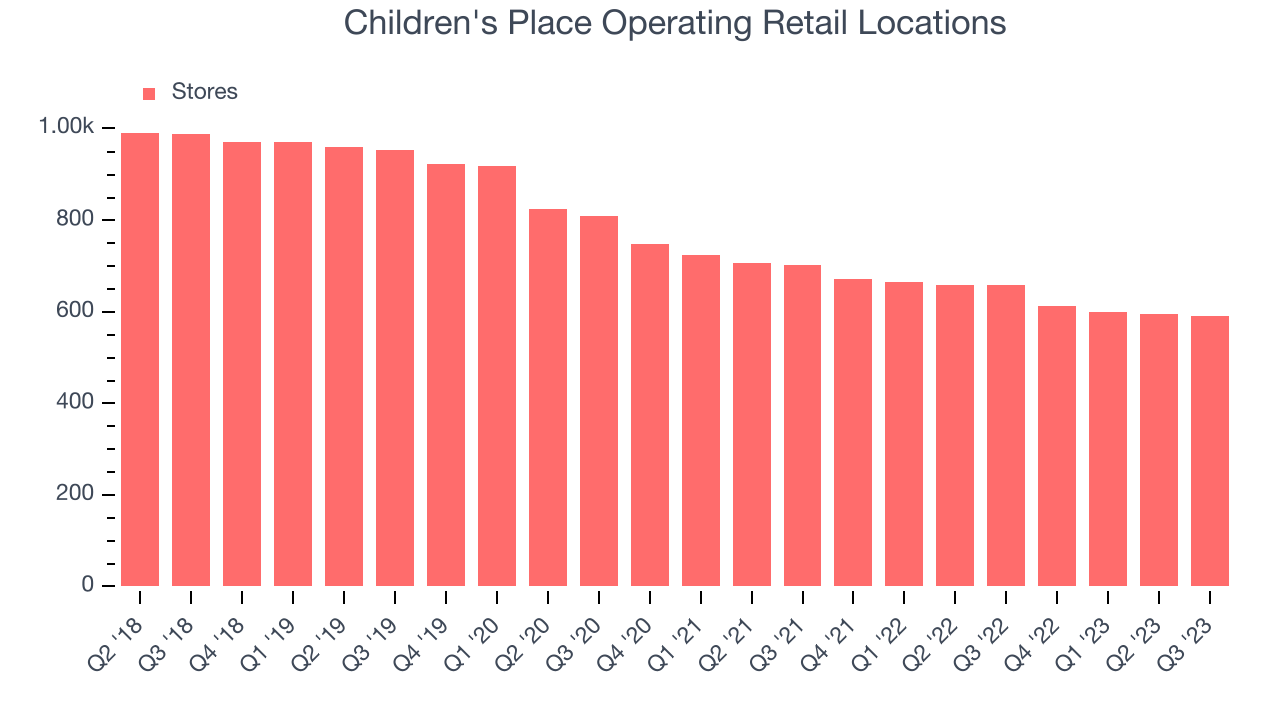

A retailer's store count is a crucial factor influencing how much it can sell, and store growth is a critical driver of how quickly its sales can grow.

When a retailer like Children's Place is shuttering stores, it usually means that brick-and-mortar demand is less than supply, and the company is responding by closing underperforming locations and possibly shifting sales online. Children's Place's store count shrank by 67 locations, or 10.2%, over the last 12 months to 591 total retail locations in the most recently reported quarter.

Taking a step back, the company has generally closed its stores over the last two years, averaging a 8.8% annual decline in its physical footprint. A smaller store base means that the company must rely on higher foot traffic and sales per customer at its remaining stores as well as e-commerce sales to fuel revenue growth.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

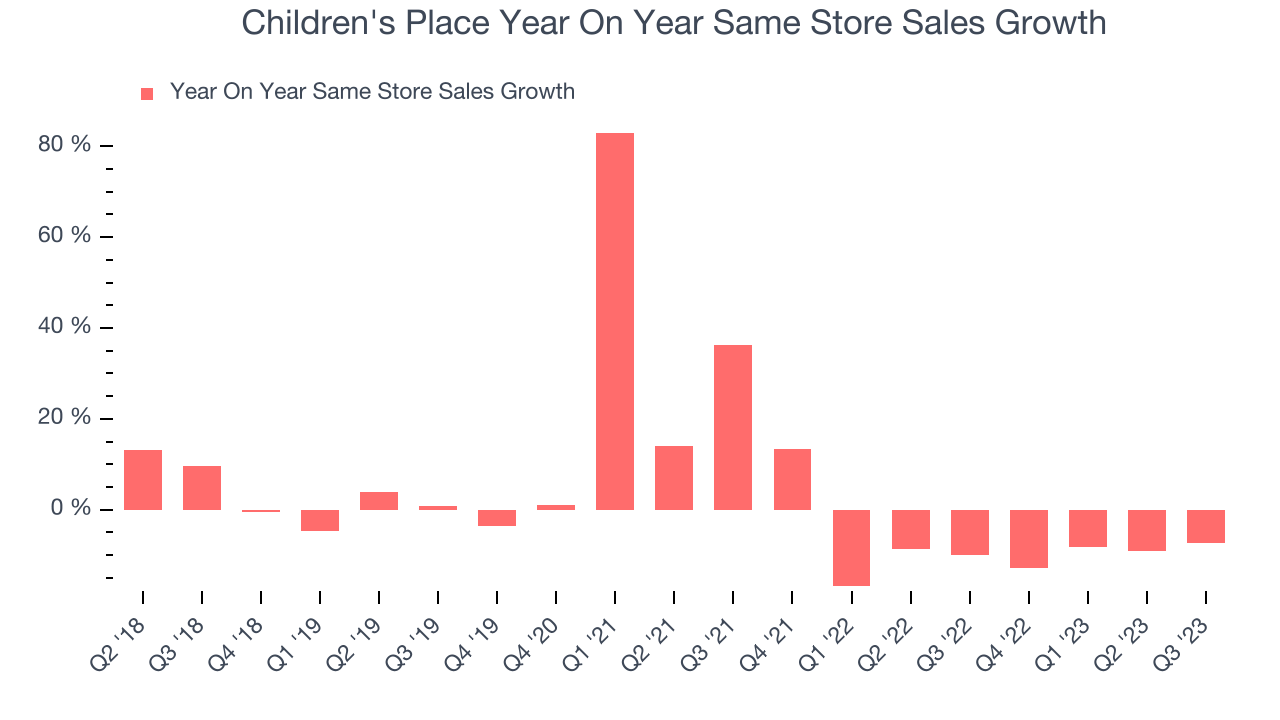

Children's Place's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 7.5% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Children's Place's same-store sales fell 7.3% year on year. This decrease was a further deceleration from the 10% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a retailer gets to keep after paying for the goods it sells.

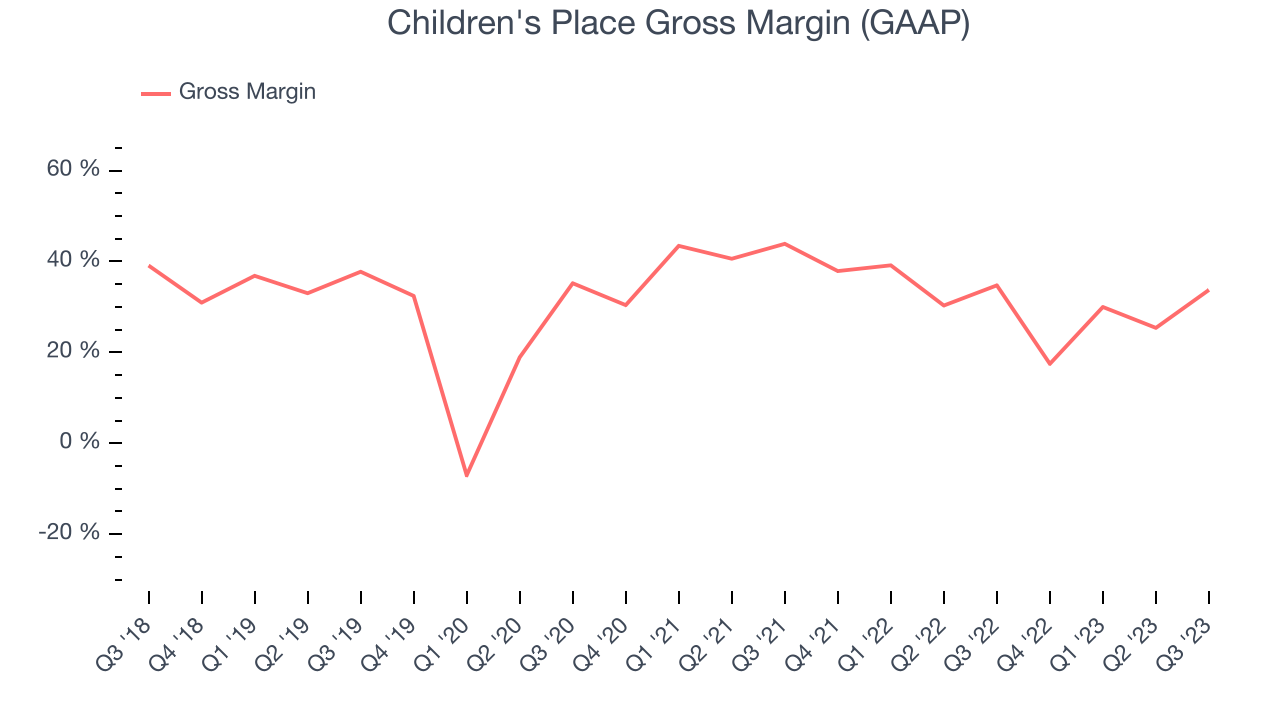

Children's Place has weak unit economics for a retailer, making it difficult to reinvest in the business. As you can see below, it's averaged a 31.1% gross margin over the last eight quarters. This means the company makes $0.31 for every $1 in revenue before accounting for its operating expenses.

Children's Place's gross profit margin came in at 33.7% this quarter, marking a 1 percentage point decrease from 34.8% in the same quarter last year. One quarter of margin contraction shouldn't worry investors as a retailers' gross margins can often change due to factors such as product discounting and dynamic input costs (think distribution and freight expenses to move goods).

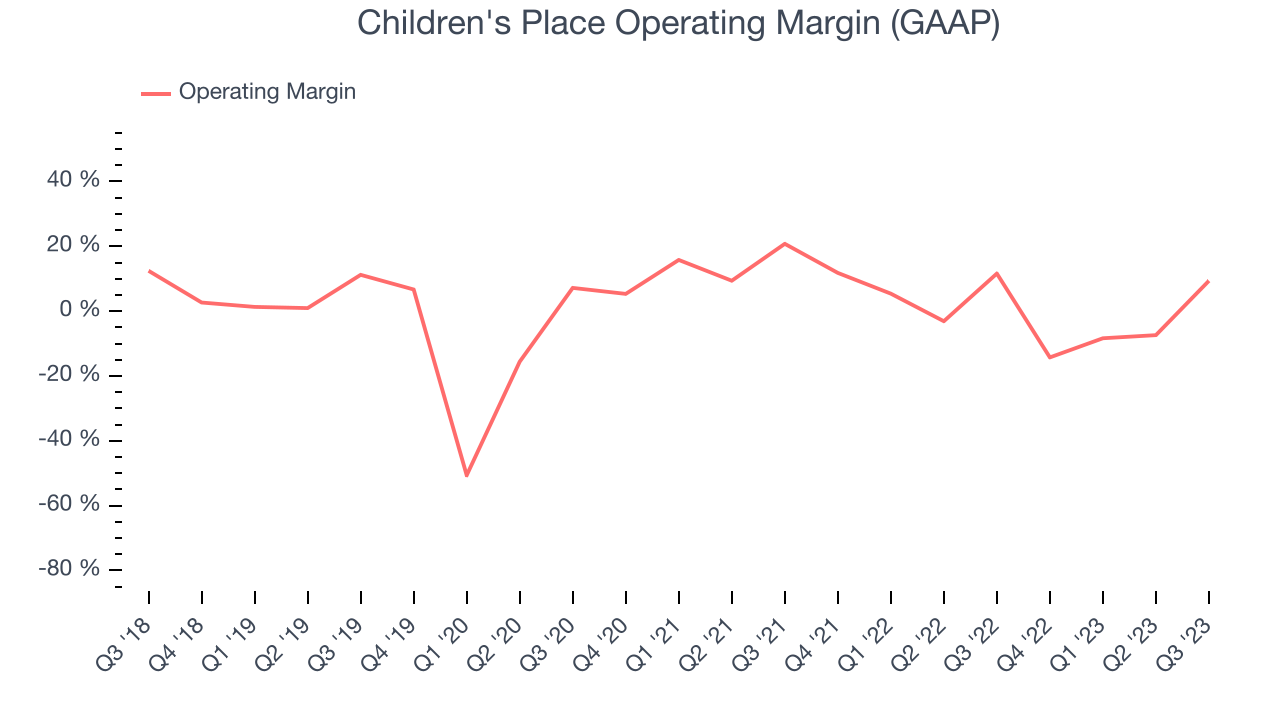

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Children's Place generated an operating profit margin of 9.4%, down 2.2 percentage points year on year. We can infer Children's Place was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, Children's Place over the last eight quarters but held back by its large expense base. Its average operating margin of 0.6% has been among the worst in consumer retail. On top of that, Children's Place's margin has declined, on average, by 11.6 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Zooming out, Children's Place over the last eight quarters but held back by its large expense base. Its average operating margin of 0.6% has been among the worst in consumer retail. On top of that, Children's Place's margin has declined, on average, by 11.6 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

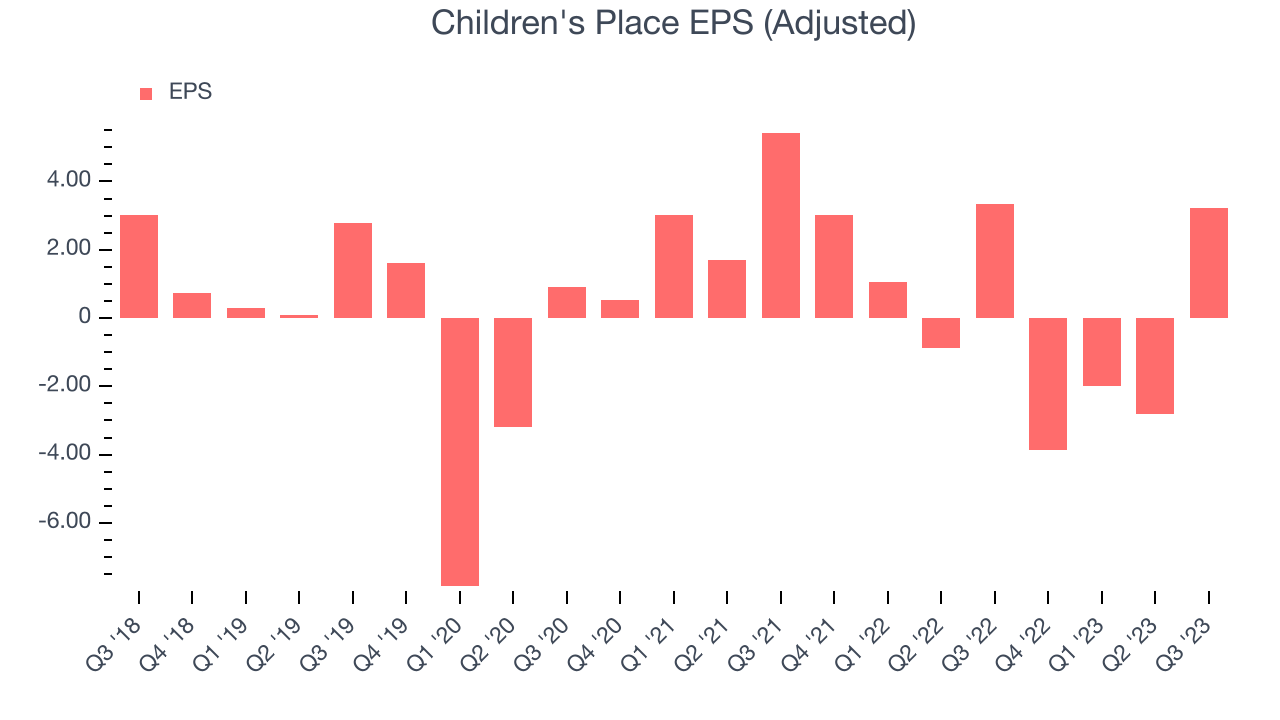

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q3, Children's Place reported EPS at $3.22, down from $3.33 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Over the next 12 months, however, Wall Street is projecting an average 58.5% year-on-year decline in EPS.

Return on Invested Capital (ROIC)

We like to track a company's long-term return on invested capital (ROIC) in addition to its recent results because it gives a big-picture view of a business's past performance. It also sheds light on its management team's decision-making prowess and is a helpful tool for benchmarking against peers.

Children's Place's subpar returns on capital may signal a need for future capital raising or borrowing to fund growth. Its five-year average ROIC is 9%, somewhat low compared to the best retail companies that consistently pump out 25%+ returns.

Key Takeaways from Children's Place's Q3 Results

With a market capitalization of $356.4 million and more than $13.52 million in cash on hand, Children's Place can continue prioritizing growth.

This was a mixed but overall weaker quarter. Management said that "bottom-line results were negatively impacted...by higher than planned distribution costs driven by a combination of largely unplanned but addressable factors. First, higher fulfillment costs...Second, significantly higher labor costs...Third, a delay of certain planned freight and fulfillment savings. Looking ahead, we are planning for these increased distribution costs to continue in the fourth quarter.”

Same-store sales missed. While revenue guidance for next quarter was ahead, full-year earnings forecast underwhelmed. Overall, the results could have been better and shows the company is under pressure from a cost perspective. The company is down 11.7% on the results and currently trades at $25.25 per share.

Is Now The Time?

Children's Place may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Children's Place, we'll be cheering from the sidelines. Its revenue growth has been weak over the last four years, and analysts expect growth to deteriorate from here. On top of that, its declining physical locations suggests its demand is shrinking and its declining same-store sales suggests it'll need to change its strategy to succeed.

Children's Place's price-to-earnings ratio based on the next 12 months is 8.5x. While we've no doubt one can find things to like about Children's Place, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

To get the best start with StockStory, check out our most recent stock picks and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.