Over the past six months, Power Integrations’s stock price fell to $64.53. Shareholders have lost 13.1% of their capital, which is disappointing considering the S&P 500 has climbed by 10.6%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Power Integrations, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Even though the stock has become cheaper, we're cautious about Power Integrations. Here are three reasons why you should be careful with POWI and a stock we'd rather own.

Why Do We Think Power Integrations Will Underperform?

A leading supplier of parts for electronics such as home appliances, Power Integrations (NASDAQ:POWI) is a semiconductor designer and developer specializing in products used for high-voltage power conversion.

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Power Integrations struggled to consistently increase demand as its $403.2 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

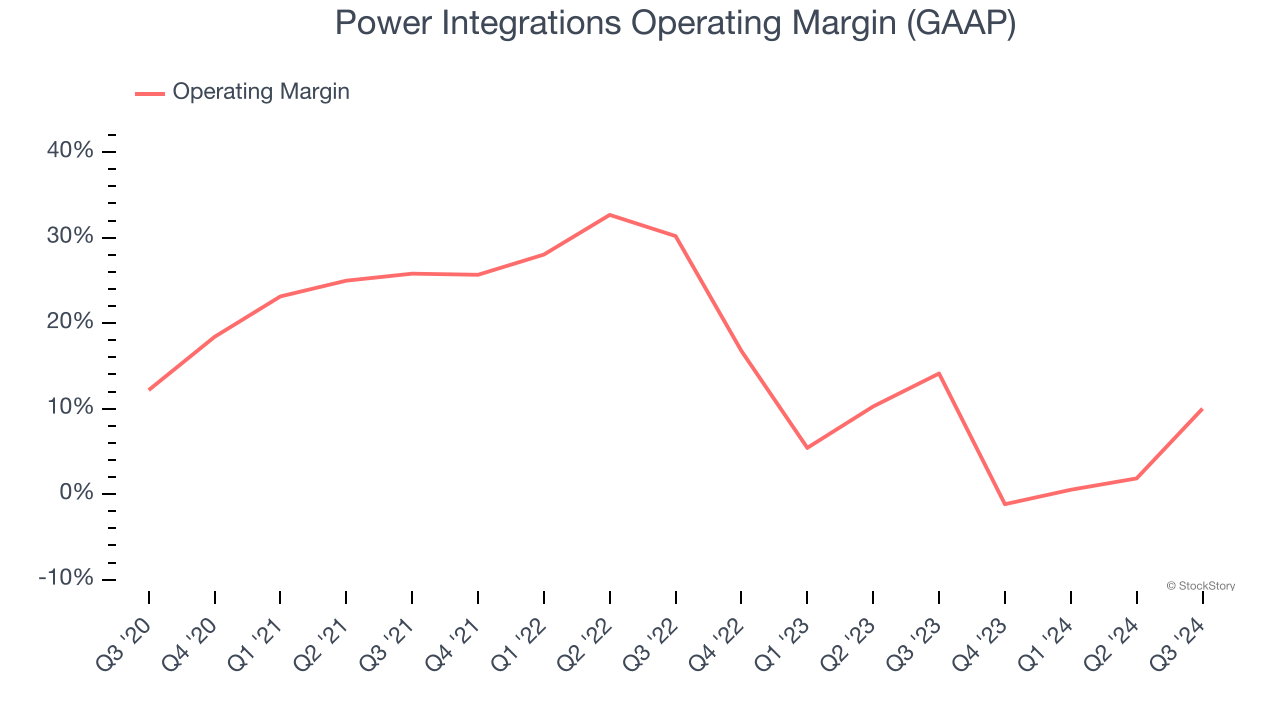

2. Operating Margin Falling

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Power Integrations’s operating margin decreased by 46.9 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers. Its operating margin for the trailing 12 months was 3.2%.

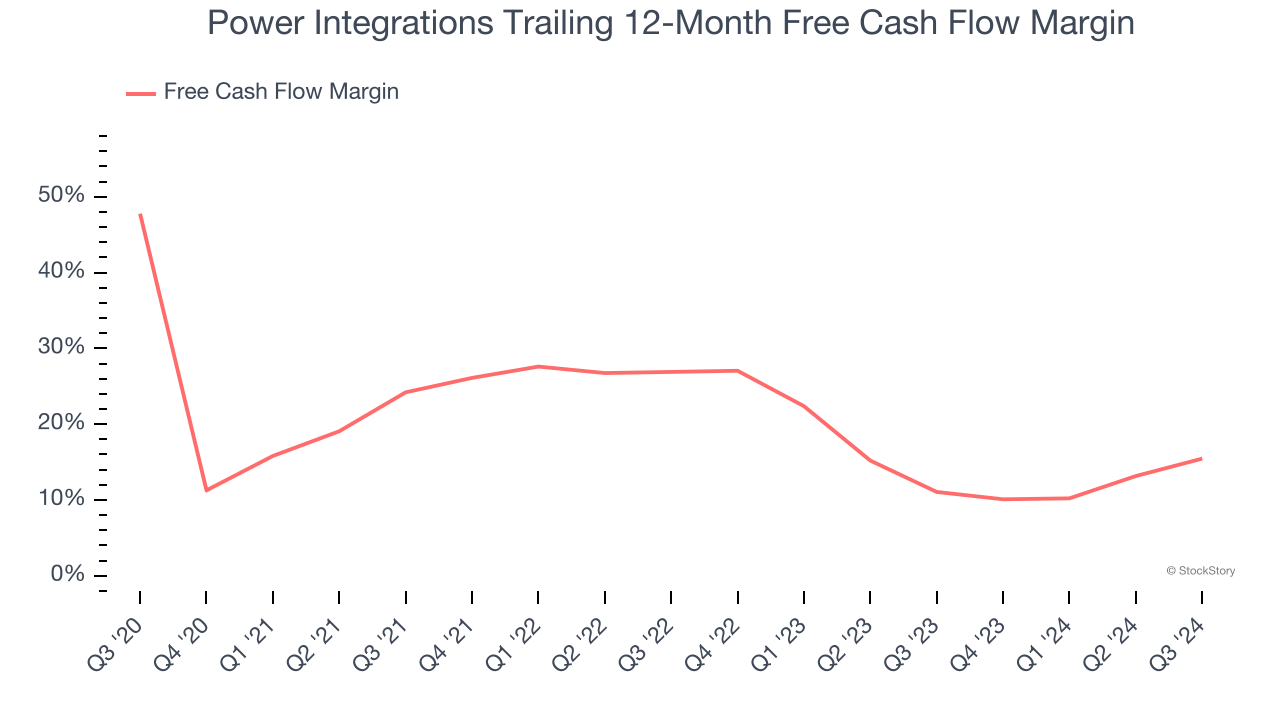

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Power Integrations’s margin dropped by 32.3 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its relatively low cash conversion. Power Integrations’s free cash flow margin for the trailing 12 months was 15.5%.

Final Judgment

Power Integrations falls short of our quality standards. After the recent drawdown, the stock trades at 38.2× forward price-to-earnings (or $64.53 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d recommend looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Power Integrations

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.