Chicken producer Pilgrim’s Pride (NASDAQ:PPC) missed analysts' expectations in Q1 CY2024, with revenue up 4.7% year on year to $4.36 billion. It made a non-GAAP profit of $0.77 per share, improving from its profit of $0.08 per share in the same quarter last year.

Pilgrim's Pride (PPC) Q1 CY2024 Highlights:

- Revenue: $4.36 billion vs analyst estimates of $4.43 billion (1.5% miss)

- Adjusted EBITDA: $371.9 million vs analyst estimates of $342.9 million (8.5% beat)

- EPS (non-GAAP): $0.77 vs analyst estimates of $0.63 (22.1% beat)

- Gross Margin (GAAP): 8.8%, up from 4.2% in the same quarter last year

- Free Cash Flow of $162.6 million, similar to the previous quarter

- Market Capitalization: $8.53 billion

Offering everything from pre-marinated to frozen chicken, Pilgrim’s Pride (NASDAQ:PPC) produces, processes, and distributes chicken products to retailers and food service customers.

The company was founded in 1946 when Aubrey Pilgrim and Pat Johns started a feed store and, later, a chicken farm in Pittsburg, Texas. Throughout its history, Pilgrim’s Pride has grown organically as well as through acquisitions, a key tool in its international expansion. For example, the company acquired Moy Park, a leading European poultry producer, in 2017.

Pilgrim’s Pride goes to market through numerous brands including Pilgrim’s, Just BARE, Gold’n Pump, Gold Kist, County Pride, and Pierce Chicken. The company sells its products to the retail market, which is primarily through grocery stores, and the food service channel, which includes restaurants and food processors. In the retail channel, Pilgrim’s Pride enjoys widespread distribution and advantaged shelf placement.

The end consumer who buys Pilgrim’s Pride products is typically someone who is in charge of groceries for the household. This consumer is seeking reliable protein brands at reasonable prices. At the same time, chicken doesn’t command the same brand loyalty as coffee or breakfast cereal, for example, so the availability of products at a shopper’s local grocery store is key. Said differently, consumers are unlikely to shop elsewhere because a store doesn’t carry a brand of chicken.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Competitors in the chicken market include Tyson Foods (NYSE:TSN) and private companies Perdue Farms, Sanderson Farms, and Koch Foods.Sales Growth

Pilgrim's Pride is one of the largest consumer staples companies and benefits from a strong brand, giving it customer trust and leverage in many purchasing and distribution negotiations.

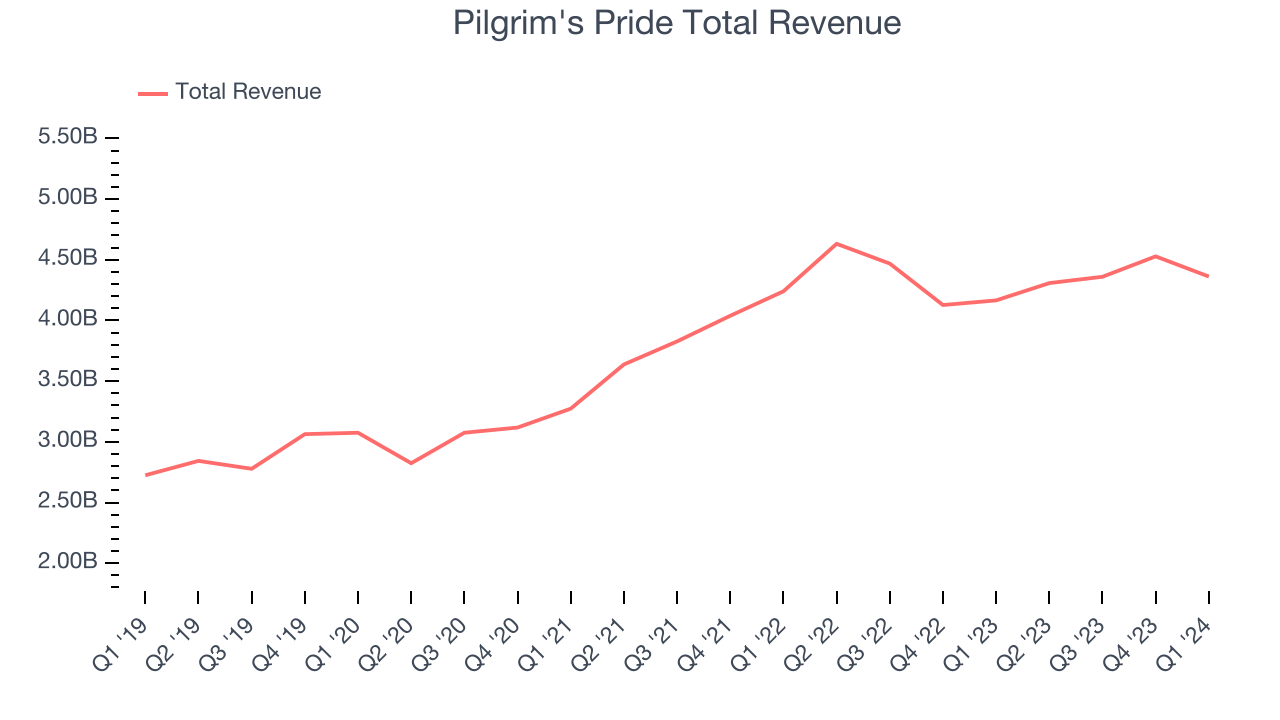

As you can see below, the company's annualized revenue growth rate of 12.6% over the last three years was solid for a consumer staples business.

This quarter, Pilgrim's Pride's revenue grew 4.7% year on year to $4.36 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 4.4% over the next 12 months, a deceleration from this quarter.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

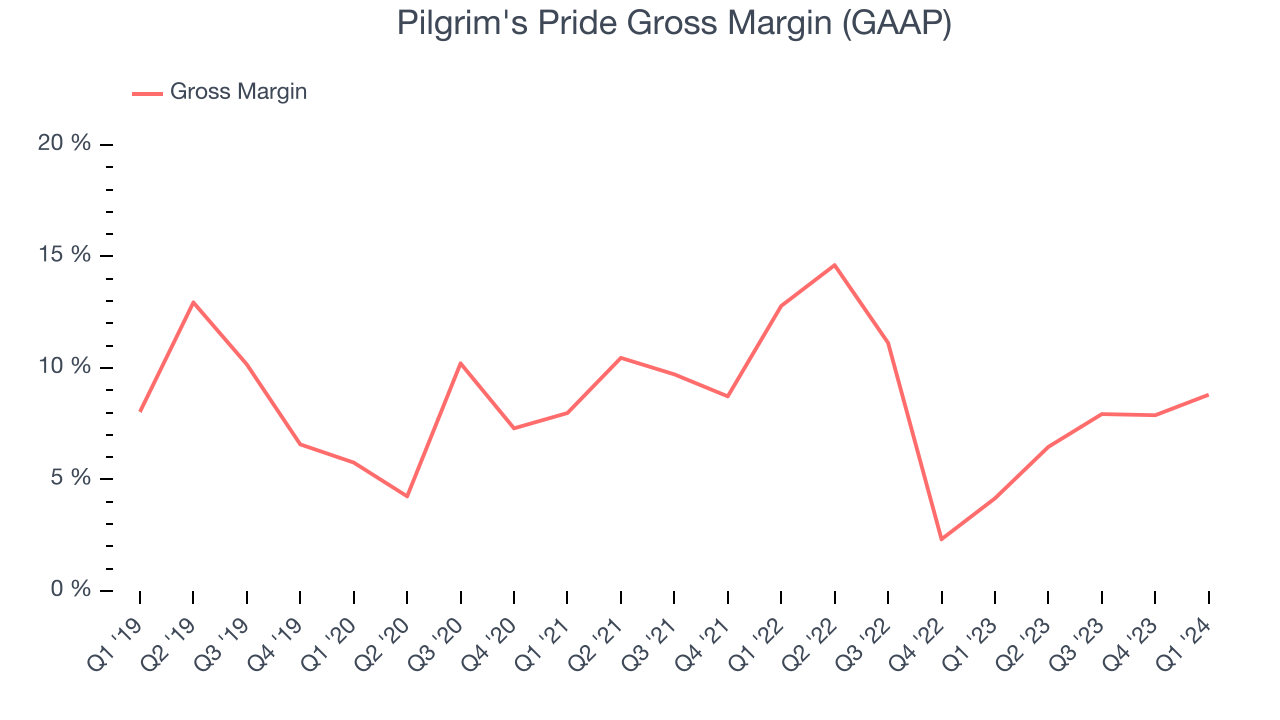

This quarter, Pilgrim's Pride's gross profit margin was 8.8%, up 4.6 percentage points year on year. That means for every $1 in revenue, a chunky $0.91 went towards paying for raw materials, production of goods, and distribution expenses.

Pilgrim's Pride has poor unit economics for a consumer staples company, leaving it with little room for error if things go awry. As you can see above, it's averaged a paltry 8% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 66.8% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

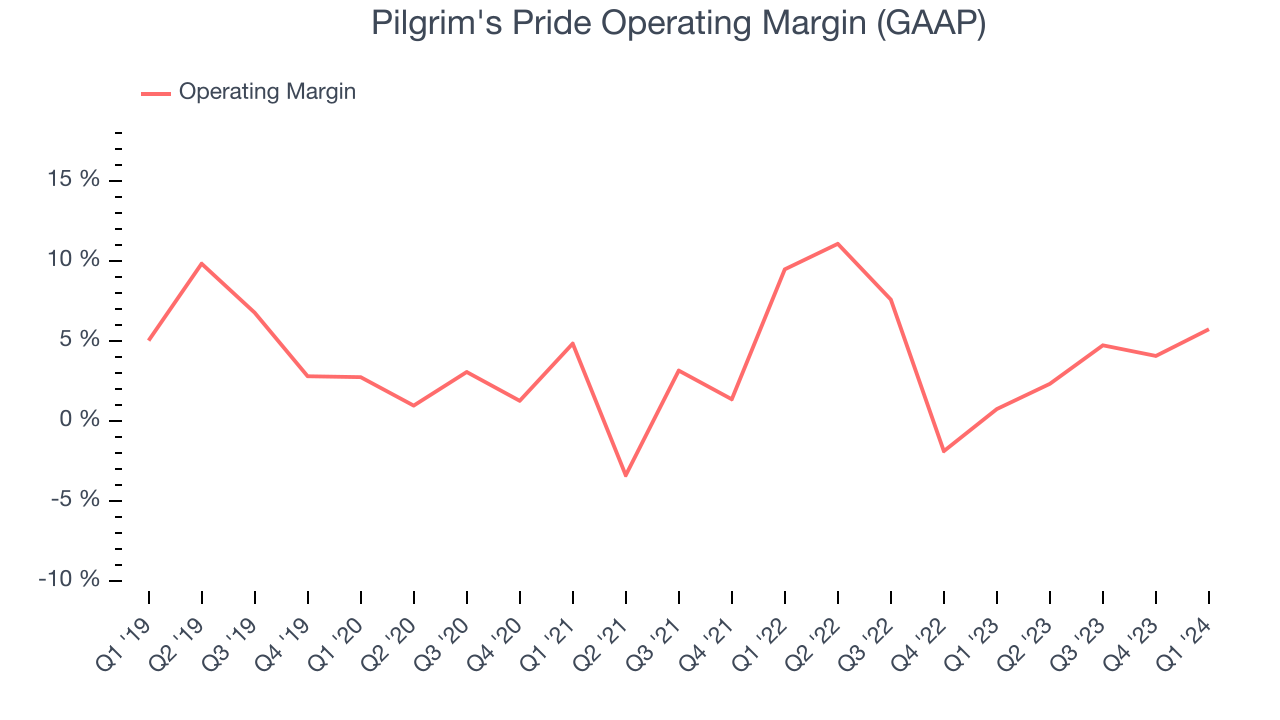

In Q1, Pilgrim's Pride generated an operating profit margin of 5.7%, up 5 percentage points year on year. This increase was encouraging, and we can infer Pilgrim's Pride was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, Pilgrim's Pride was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer staples business, producing an average operating margin of 4.4%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.

Zooming out, Pilgrim's Pride was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer staples business, producing an average operating margin of 4.4%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.EPS

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

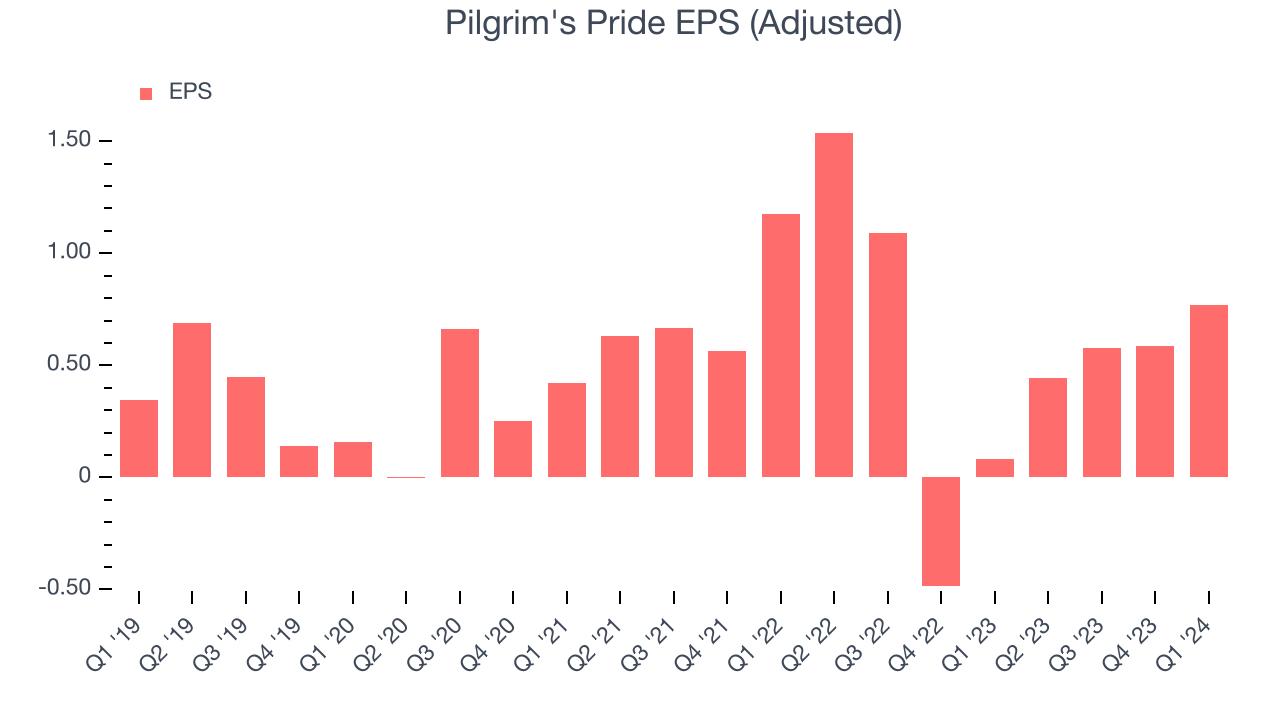

In Q1, Pilgrim's Pride reported EPS at $0.77, up from $0.08 in the same quarter a year ago. This print beat Wall Street's estimates by 22.1%.

Between FY2021 and FY2024, Pilgrim's Pride's EPS grew 78.5%, translating into an astounding 21.3% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 30.9% year-on-year increase in EPS.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

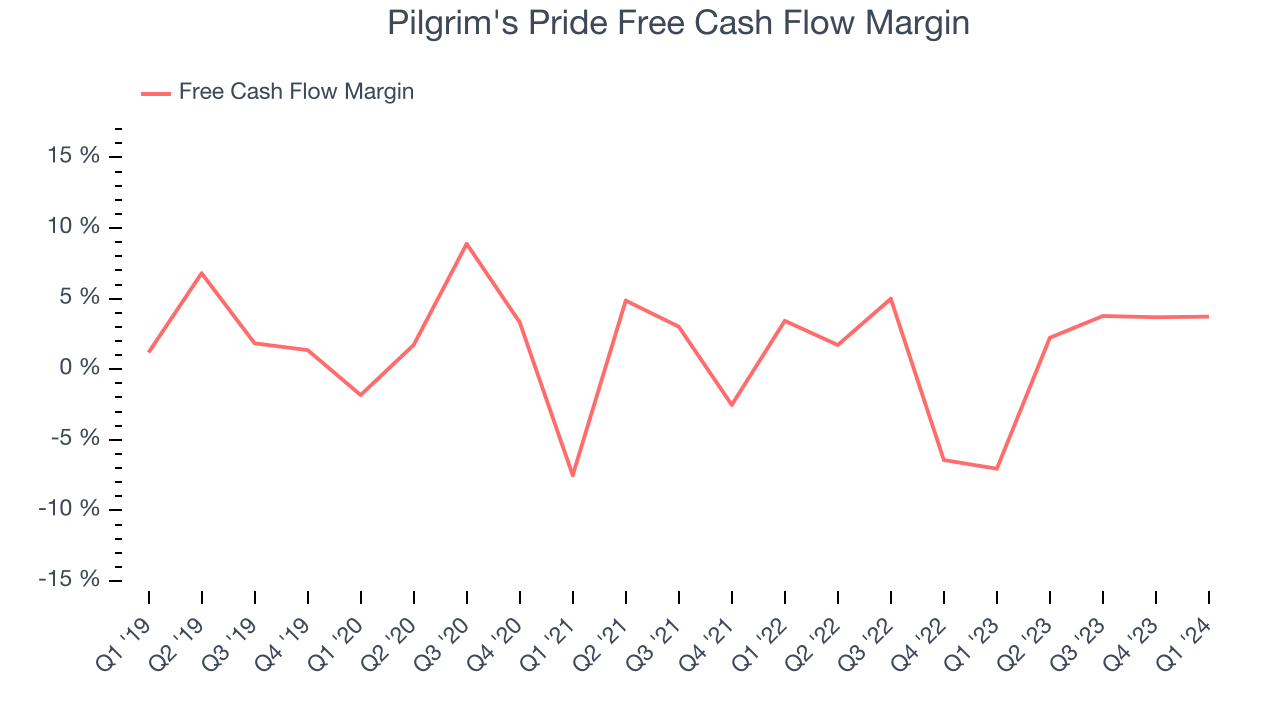

Pilgrim's Pride's free cash flow came in at $162.6 million in Q1, representing a 3.7% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to positive this quarter.

Over the last eight quarters, Pilgrim's Pride has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1%, subpar for a consumer staples business. However, its margin has averaged year-on-year increases of 4.8 percentage points over the last 12 months. Continued momentum should improve its cash flow prospects.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

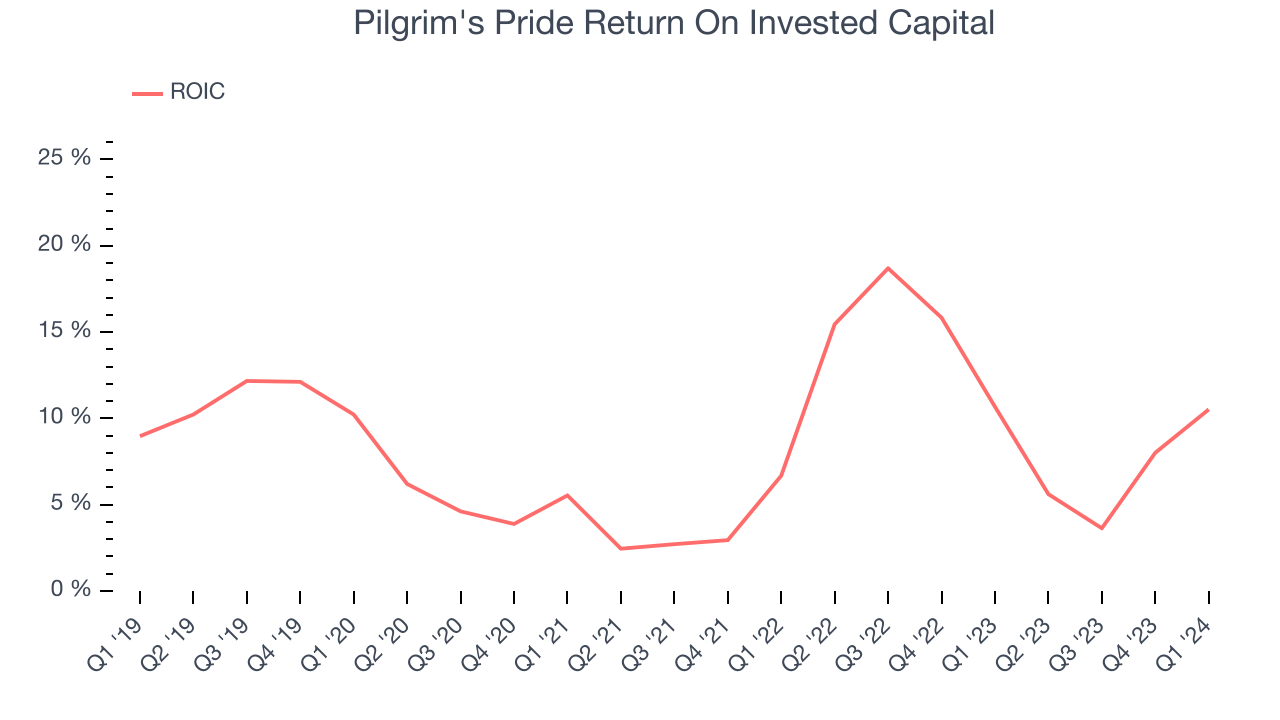

Pilgrim's Pride's five-year average ROIC was 8.7%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Pilgrim's Pride's ROIC averaged 2.7 percentage point increases. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Pilgrim's Pride reported $870.8 million of cash and $3.56 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $1.25 billion of EBITDA over the last 12 months, we view Pilgrim's Pride's 2.1x net-debt-to-EBITDA ratio as safe. We also see its $158.5 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Pilgrim's Pride's Q1 Results

We enjoyed seeing Pilgrim's Pride beat Wall Street’s expectations on adjusted EBITDA and EPS this quarter. On the other hand, its revenue missed, with the company CEO citing “depressed market conditions” and “persistent consumer inflation.” Overall, investors were likely expecting more, and with this quarter’s results being mixed, the stock is down 4.2% after reporting, trading at $33.89 per share.

Is Now The Time?

Pilgrim's Pride may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Pilgrim's Pride isn't a bad business. First off, its revenue growth has been solid over the last three years. And while its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses, its well-known brand makes it a household name consumers consistently turn to.

Pilgrim's Pride's price-to-earnings ratio based on the next 12 months is 11.4x. In the end, beauty is in the eye of the beholder. While Pilgrim's Pride wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $35.63 per share right before these results (compared to the current share price of $33.89).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.