Higher education company Perdoceo Education (NASDAQ:PRDO) reported results ahead of analysts' expectations in Q1 CY2024, with revenue down 14% year on year to $168.3 million. It made a GAAP profit of $0.59 per share, improving from its profit of $0.50 per share in the same quarter last year.

Perdoceo Education (PRDO) Q1 CY2024 Highlights:

- Revenue: $168.3 million vs analyst estimates of $163.3 million (3% beat)

- EPS: $0.59 vs analyst estimates of $0.52 (13.5% beat)

- EPS (non-GAAP) Guidance for Q2 CY2024 is $0.58 at the midpoint, above analyst estimates of $0.53

- EPS (non-GAAP) Guidance for full year 2024 is $2.19 at the midpoint, above analyst estimates of $2.12

- Gross Margin (GAAP): 82.3%, down from 84.1% in the same quarter last year

- Free Cash Flow of $53.29 million, up from $11.58 million in the previous quarter

- Market Capitalization: $1.2 billion

Formerly known as Career Education Corporation, Perdoceo Education (NASDAQ:PRDO) is an educational services company that specializes in postsecondary education.

Perdoceo Education primarily operates through online platforms and campuses across the United States, focusing on career-oriented education. The company caters to a diverse student population, including working adults, through its university and college brands such as Colorado Technical University (CTU) and American InterContinental University (AIU). These institutions offer associate, bachelor's, master's, and doctoral degrees covering business administration, information technology, criminal justice, and healthcare management.

Perdoceo Education's curriculum aims to be industry-relevant, teaching skills and knowledge aligned with current professional standards and market demands. This focus on career readiness is further supported by comprehensive career services offered to students and alumni, including career planning, resume building, and job placement assistance.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Perdoceo Education's primary competitors include Strayer Education (NASDAQ:STRA), Grand Canyon Education (NASDAQ:LOPE), Adtalem Global Education (NYSE:ATGE), and American Public Education (NASDAQ:APEI).Sales Growth

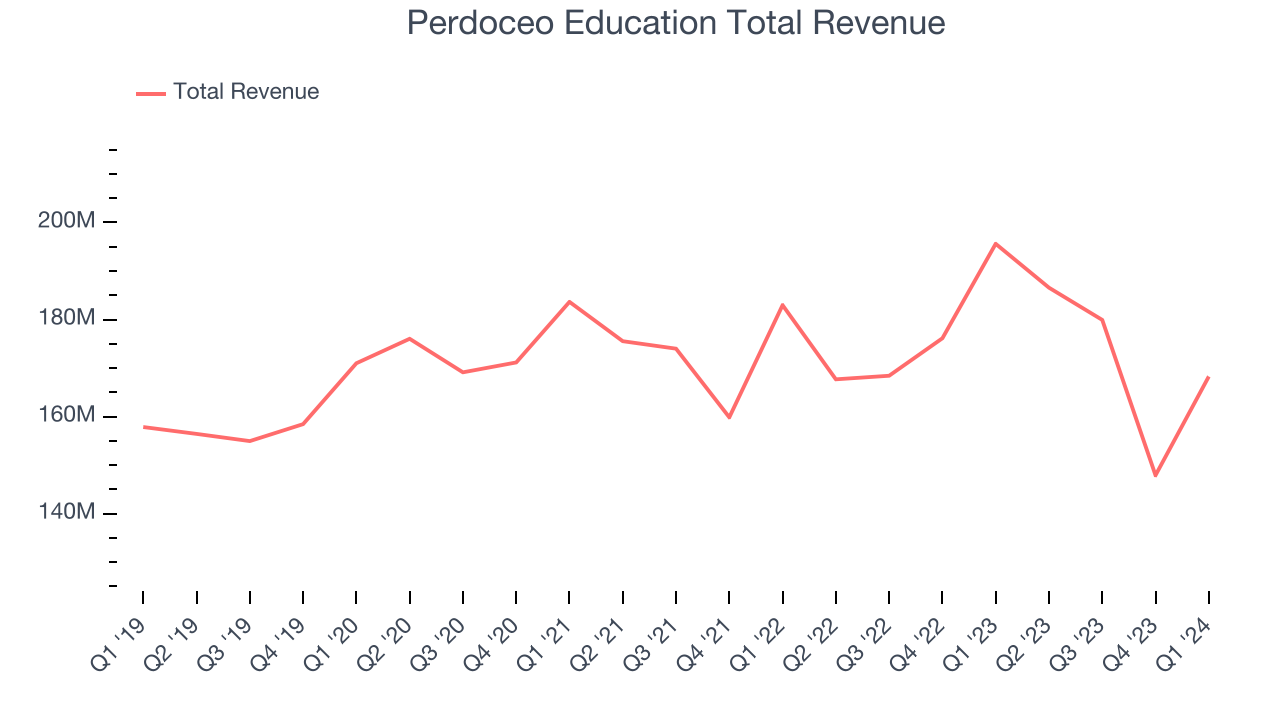

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Perdoceo Education's annualized revenue growth rate of 2% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Perdoceo Education's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Perdoceo Education's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

This quarter, Perdoceo Education's revenue fell 14% year on year to $168.3 million but beat Wall Street's estimates by 3%.

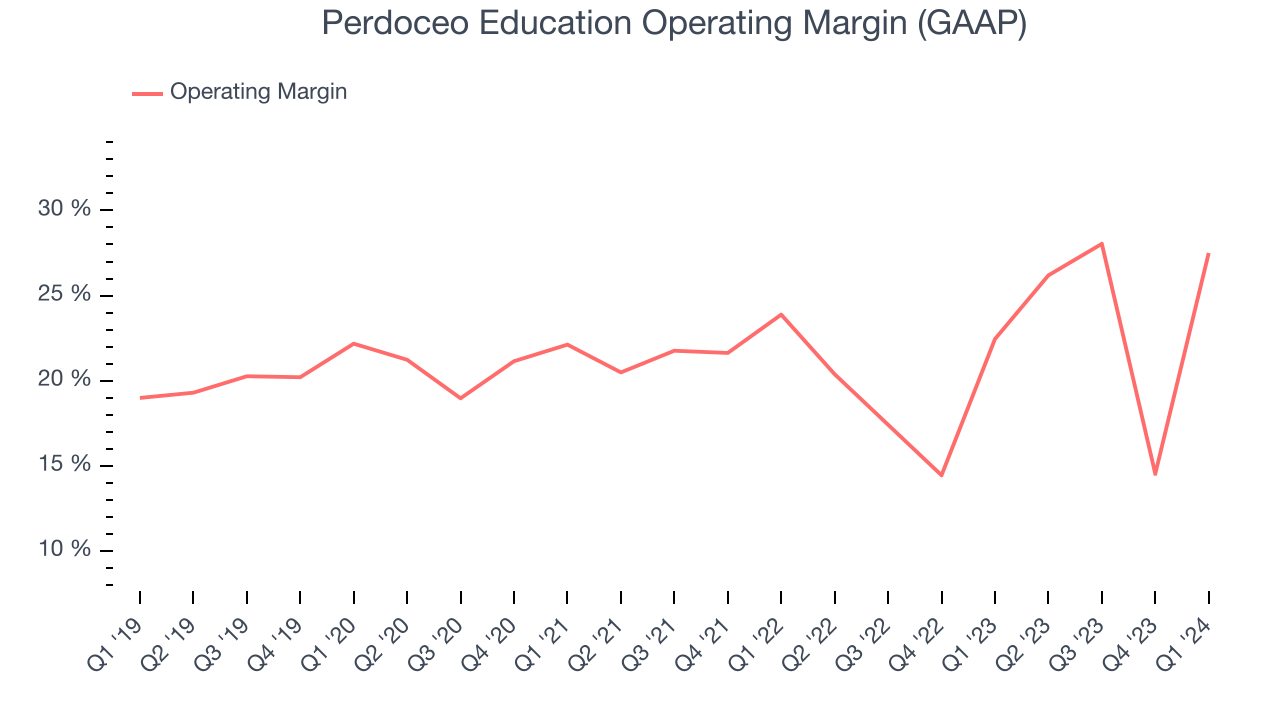

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Perdoceo Education has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 21.6%.

This quarter, Perdoceo Education generated an operating profit margin of 27.5%, up 5.1 percentage points year on year.

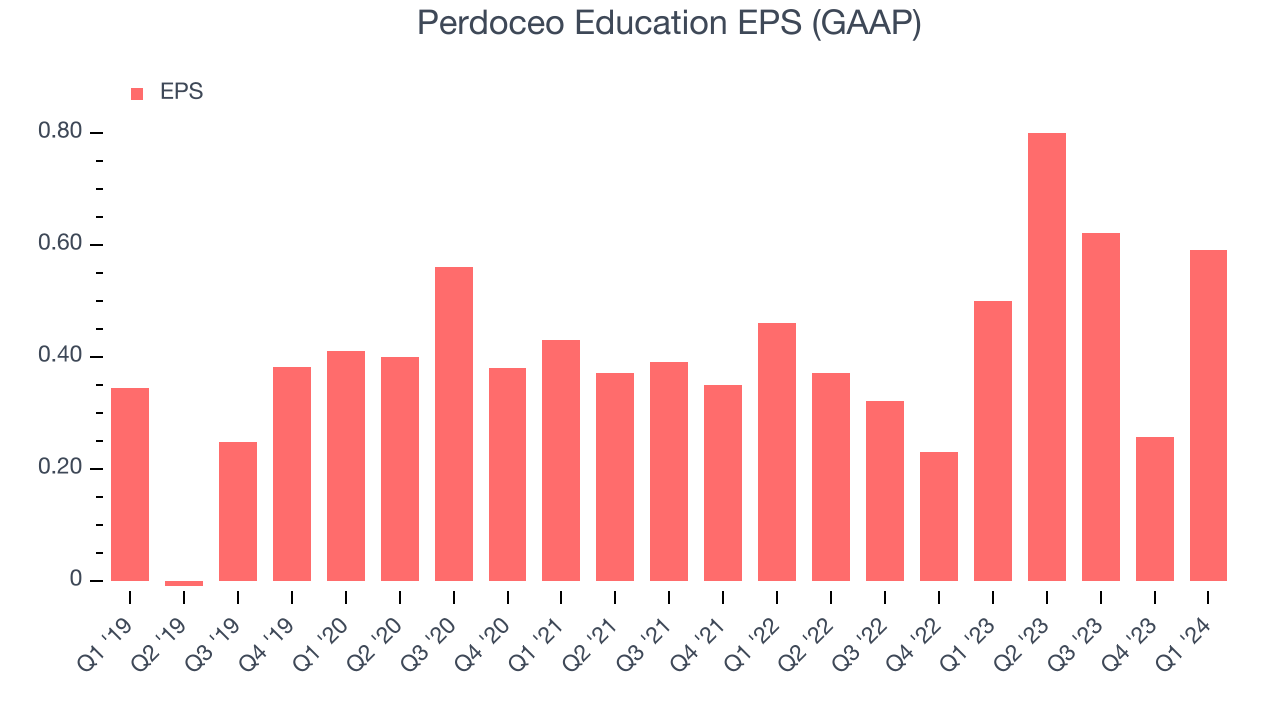

EPS

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Perdoceo Education's EPS grew 97.2%, translating into a solid 14.5% compounded annual growth rate. This performance is materially higher than its 2% annualized revenue growth over the same period. Let's dig into why.

Perdoceo Education's operating margin has expanded 8.5 percentage points over the last five years while its share count has shrunk 6.5%. Improving profitability and share buybacks are positive signs as they juice EPS growth relative to revenue growth.In Q1, Perdoceo Education reported EPS at $0.59, up from $0.50 in the same quarter last year. This print beat analysts' estimates by 13.5%. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but unfortunately, there is insufficient data.

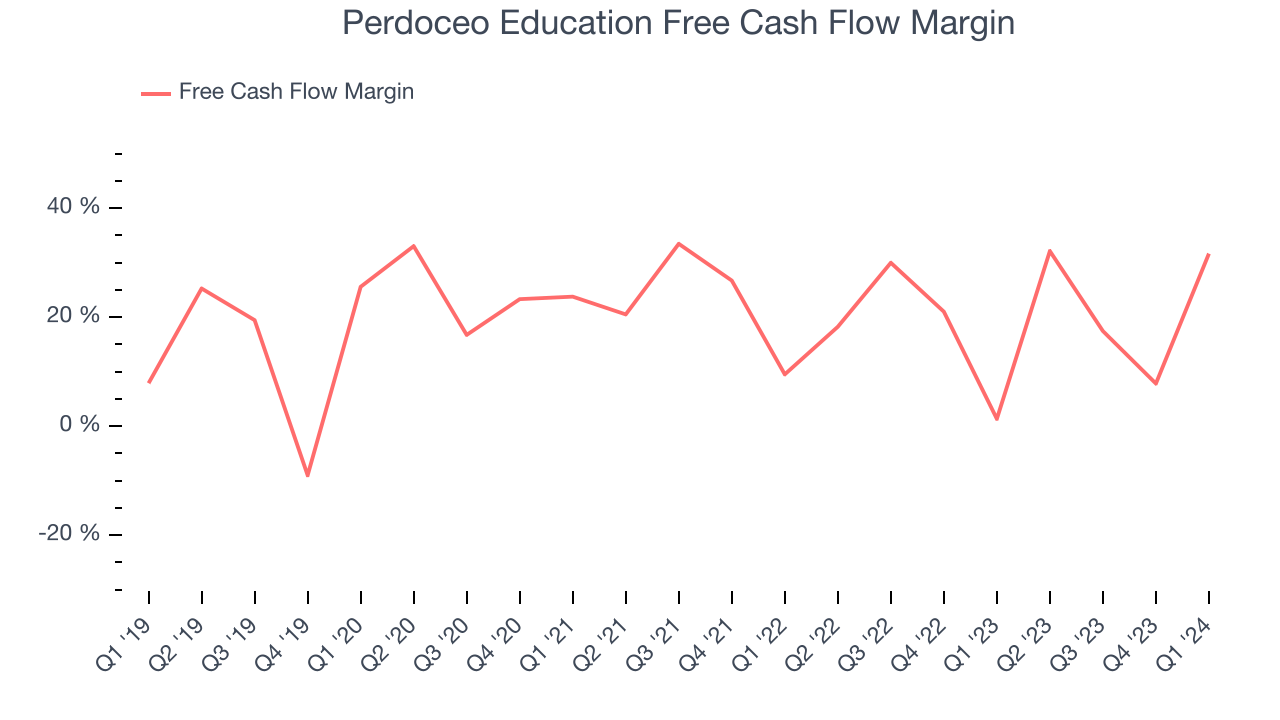

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Perdoceo Education has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 19.9%, quite impressive for a consumer discretionary business.

Perdoceo Education's free cash flow came in at $53.29 million in Q1, equivalent to a 31.7% margin and up 1,913% year on year.

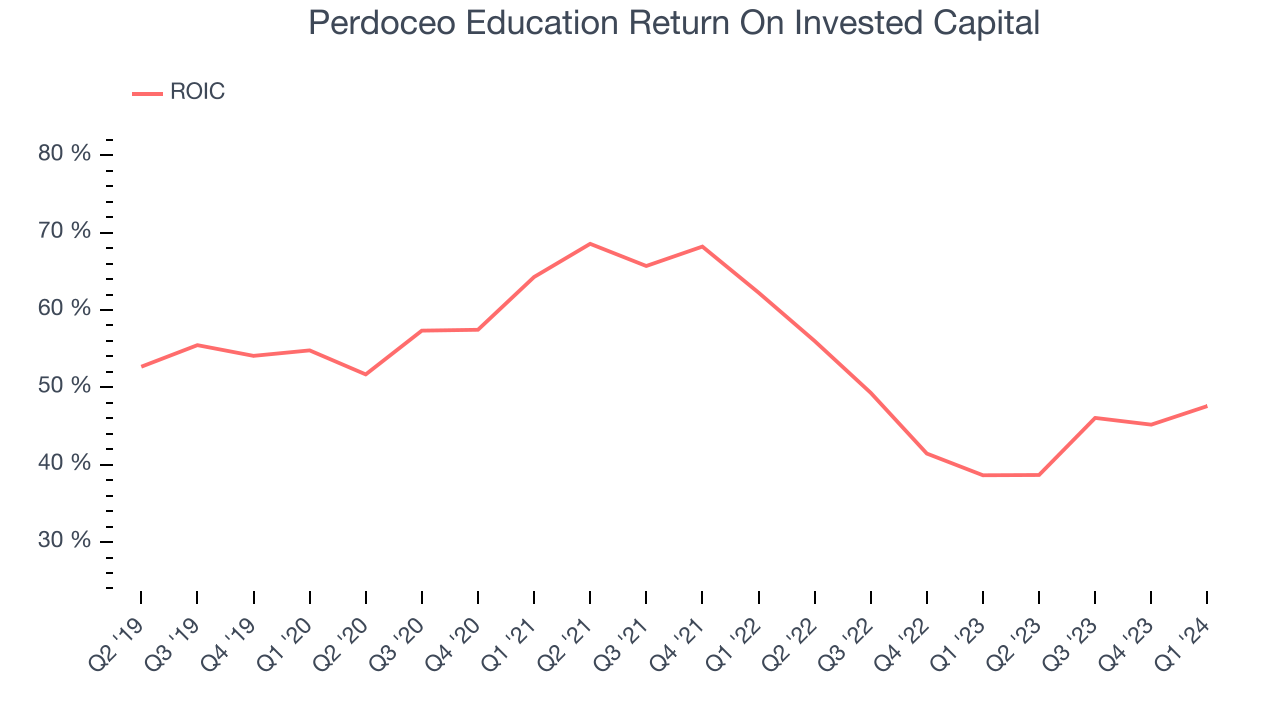

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Perdoceo Education hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 53.5%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Perdoceo Education's ROIC significantly decreased over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Perdoceo Education is a profitable, well-capitalized company with $641.4 million of cash and $16.7 million of debt, meaning it could pay back all its debt tomorrow and still have $624.7 million of cash on its balance sheet. This net cash position gives Perdoceo Education the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Perdoceo Education's Q1 Results

We liked that Perdoceo Education's revenue and EPS outperformed Wall Street's estimates. Next quarter's EPS was ahead of expectations, as was full year EPS guidance. Overall, we think this was a really good quarter that should please shareholders. The stock is flat after reporting and currently trades at $18.2 per share.

Is Now The Time?

Perdoceo Education may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Perdoceo Education isn't a bad business, but it probably wouldn't be one of our picks. First off, its revenue growth has been weak over the last five years. And while its stellar ROIC suggests it has been a well-run company historically, unfortunately, its projected EPS for the next year is lacking.

We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Perdoceo Education, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $23 per share right before these results (compared to the current share price of $18.20).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.