Bedding and comfort retailer Purple (NASDAQ:PRPL) fell short of analysts' expectations in Q1 CY2024, with revenue up 12.5% year on year to $120 million. On the other hand, the company's outlook for the full year was close to analysts' estimates with revenue guided to $550 million at the midpoint. It made a non-GAAP loss of $0.19 per share, improving from its loss of $0.26 per share in the same quarter last year.

Purple (PRPL) Q1 CY2024 Highlights:

- Revenue: $120 million vs analyst estimates of $122.1 million (1.7% miss)

- EPS (non-GAAP): -$0.19 vs analyst estimates of -$0.16

- The company reconfirmed its revenue guidance for the full year of $550 million at the midpoint

- Gross Margin (GAAP): 34.8%, down from 38% in the same quarter last year

- Free Cash Flow was -$19.85 million compared to -$4.48 million in the previous quarter

- Market Capitalization: $182.7 million

Founded by two brothers, Purple (NASDAQ:PRPL) creates sleep and home comfort products such as mattresses, pillows, and bedding accessories.

Purple's origins trace back to the founders' earlier ventures in cushioning technology, including collaborations with globally recognized brands like Nike. Their breakthrough came with the development of a hyper-elastic polymer material designed to provide better support and comfort. This invention laid the foundation for Purple's products, addressing the need for better sleep solutions.

The company offers a range of products, including the Purple Mattress, known for its 'No Pressure' support and cooling features. It also manufactures and sells pillows, seat cushions, and bedding accessories designed with the same technology.

Purple employs a hybrid sales strategy, combining direct-to-consumer (DTC) sales through its online platform and physical retail stores with wholesale distribution through third-party retailers. This approach allows Purple to maintain close customer relationships and brand control while expanding its market reach.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Competitors in the mattress and sleep products sector include Tempur Sealy (NYSE:TPX), Sleep Number (NASDAQ:SNBR), Haverty Furniture (NYSE:HVT) and private company Casper.Sales Growth

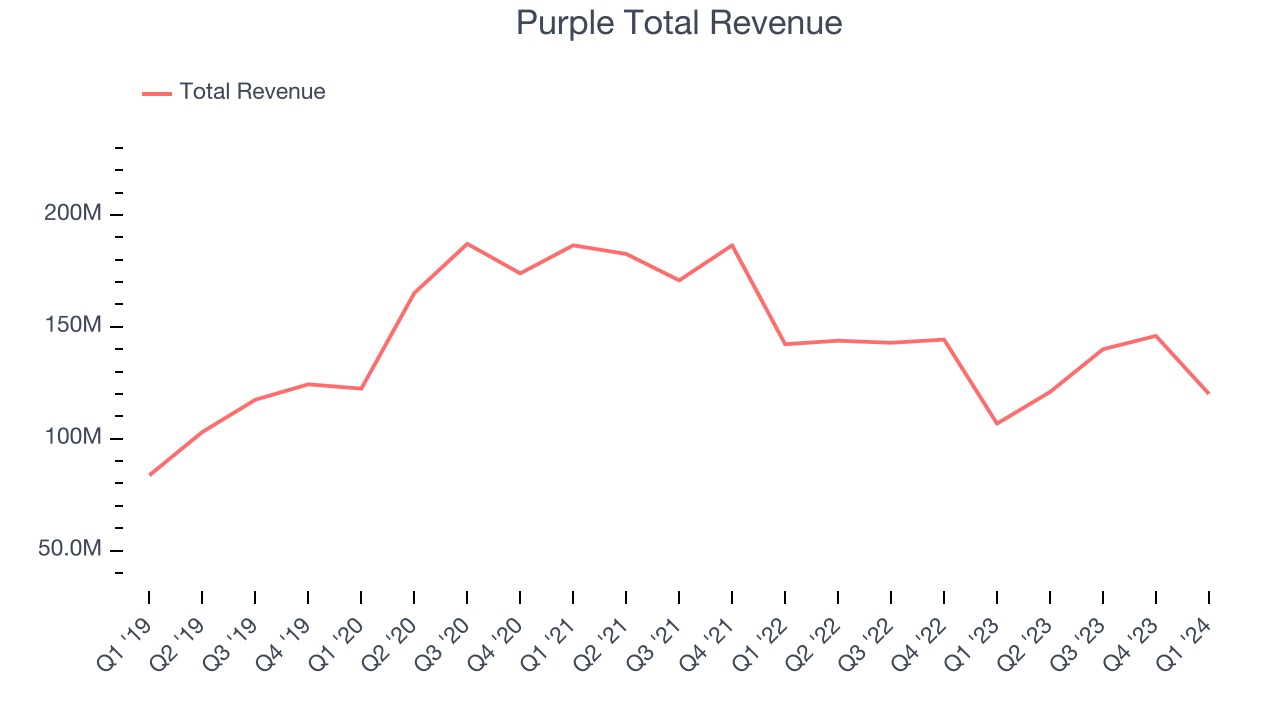

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Purple's annualized revenue growth rate of 11.3% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Purple's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 12.1% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Purple's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 12.1% over the last two years.

This quarter, Purple's revenue grew 12.5% year on year to $120 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 6.3% over the next 12 months, a deceleration from this quarter.

Operating Margin

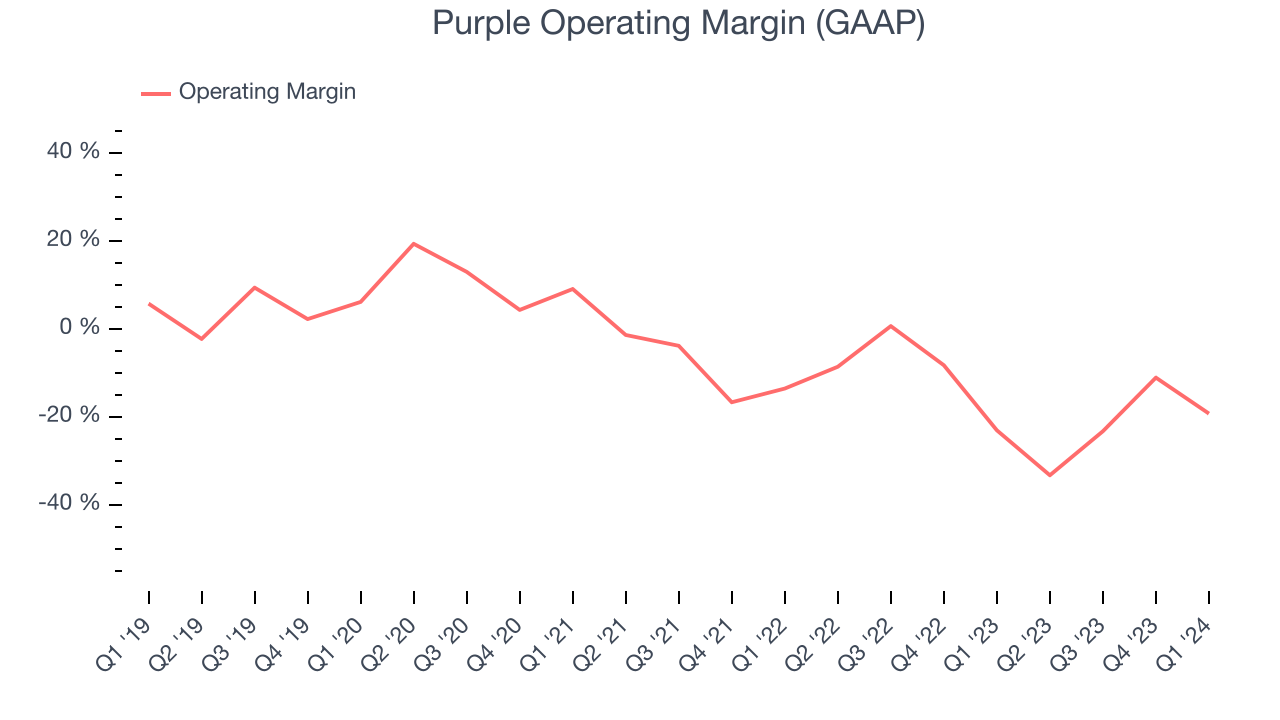

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Purple's high expenses have contributed to an average operating margin of negative 15.1%.

This quarter, Purple generated an operating profit margin of negative 19.3%, up 3.8 percentage points year on year.

Over the next 12 months, Wall Street expects Purple to shrink its losses but remain unprofitable. Analysts are expecting the company’s LTM operating margin of negative 21.3% to rise to negative 7.6%.EPS

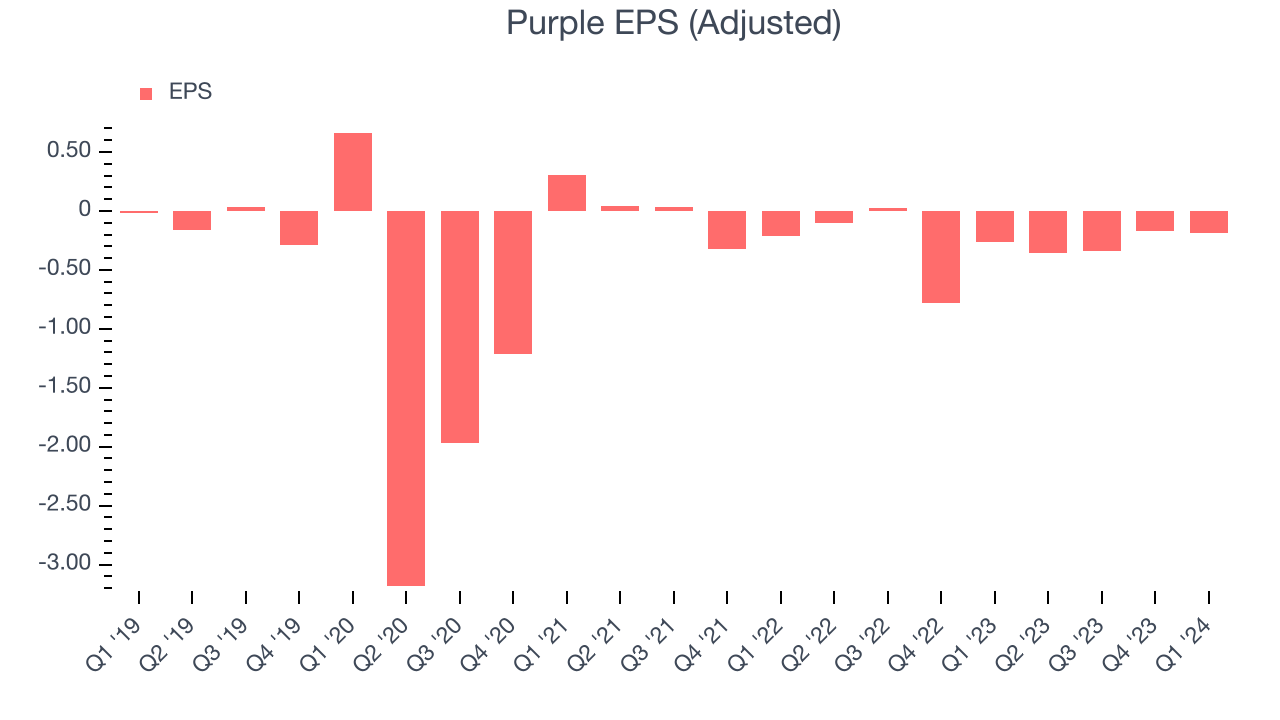

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Purple's EPS dropped 214%, translating into 25.7% annualized declines. Thankfully, Purple has bucked its trend as of late, growing its EPS over the last three years. We'll see if the company's growth is sustainable.

In Q1, Purple reported EPS at negative $0.19, up from negative $0.26 in the same quarter last year. Despite growing year on year, this print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Purple's LTM EPS of negative $1.06 to reach break even.

Cash Is King

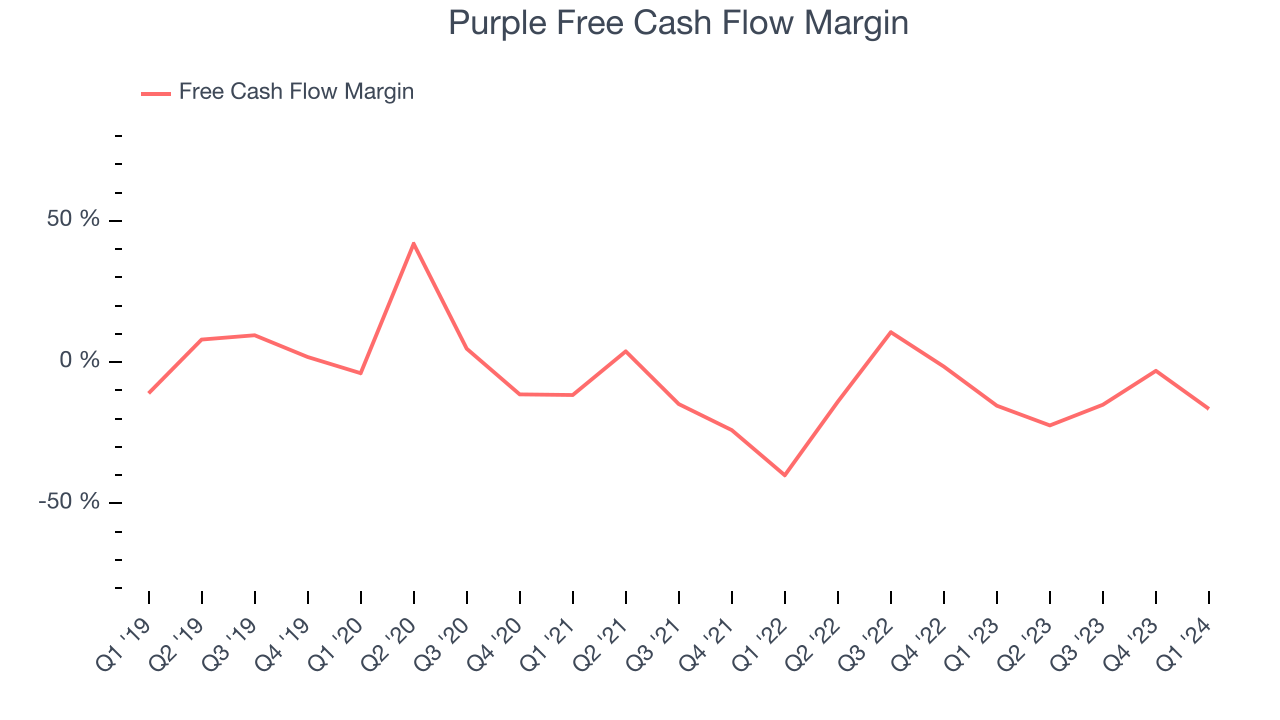

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Purple's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 9%.

Purple burned through $19.85 million of cash in Q1, equivalent to a negative 16.5% margin, reducing its cash burn by 20.7% year on year.

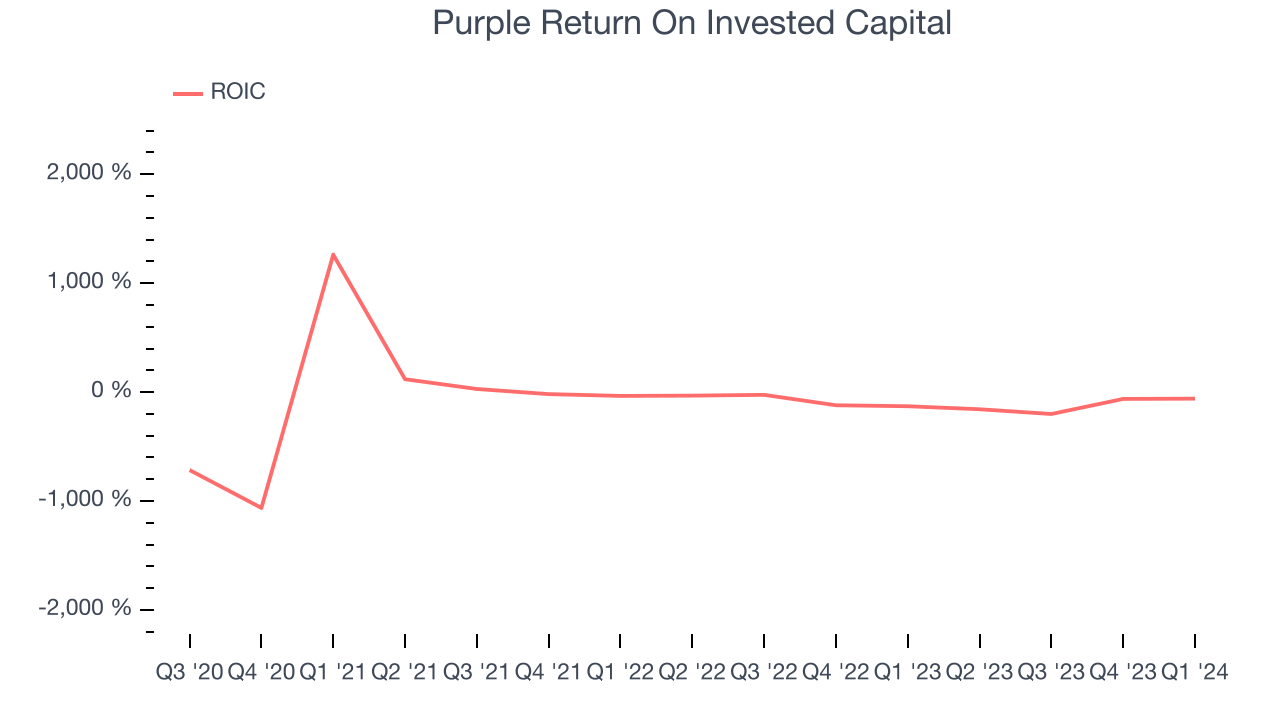

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Purple's five-year average return on invested capital was negative 47.7%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Purple, which has $34.48 million of cash and $162.5 million of debt on its balance sheet, was unprofitable over the last 12 months. It posted negative $60.76 million of EBITDA, and as investors in high-quality companies, we seek to avoid indebted loss-making companies.

We implore our readers to do the same because credit agencies could downgrade Purple if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Purple can improve its profitability and remain cautious until then.

Key Takeaways from Purple's Q1 Results

We struggled to find many strong positives in these results. Its revenue and EPS fell short of Wall Street's estimates. On the bright side, its full-year revenue guidance was in line while its EBITDA forecast beat. Overall, the results were mixed. The stock is flat after reporting and currently trades at $1.7 per share.

Is Now The Time?

When considering an investment in Purple, investors should consider its valuation and business qualities.

We cheer for all companies serving consumers, but in the case of Purple, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

While we've no doubt one can find things to like about Purple, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $2.75 per share right before these results (compared to the current share price of $1.70).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.