Exercise equipment company Peloton (NASDAQ:PTON) reported Q3 CY2024 results topping the market’s revenue expectations, but sales fell 1.6% year on year to $586 million. On the other hand, next quarter’s revenue guidance of $650 million was less impressive, coming in 2.3% below analysts’ estimates. Its GAAP loss of $0.90 per share was 491% below analysts’ consensus estimates.

Is now the time to buy Peloton? Find out by accessing our full research report, it’s free.

Peloton (PTON) Q3 CY2024 Highlights:

- Revenue: $586 million vs analyst estimates of $571.7 million (2.5% beat)

- EPS: -$0.90 vs analyst estimates of -$0.15 (-$0.75 miss)

- EBITDA: $115.8 million vs analyst estimates of $56.32 million (106% beat)

- The company reconfirmed its revenue guidance for the full year of $2.45 billion at the midpoint

- EBITDA guidance for the full year is $265 million at the midpoint, above analyst estimates of $233.2 million

- Gross Margin (GAAP): 51.8%, up from 48% in the same quarter last year

- Operating Margin: 2.1%, up from -22.2% in the same quarter last year

- EBITDA Margin: 19.8%, up from 1.5% in the same quarter last year

- Free Cash Flow was $10.7 million, up from -$83.3 million in the same quarter last year

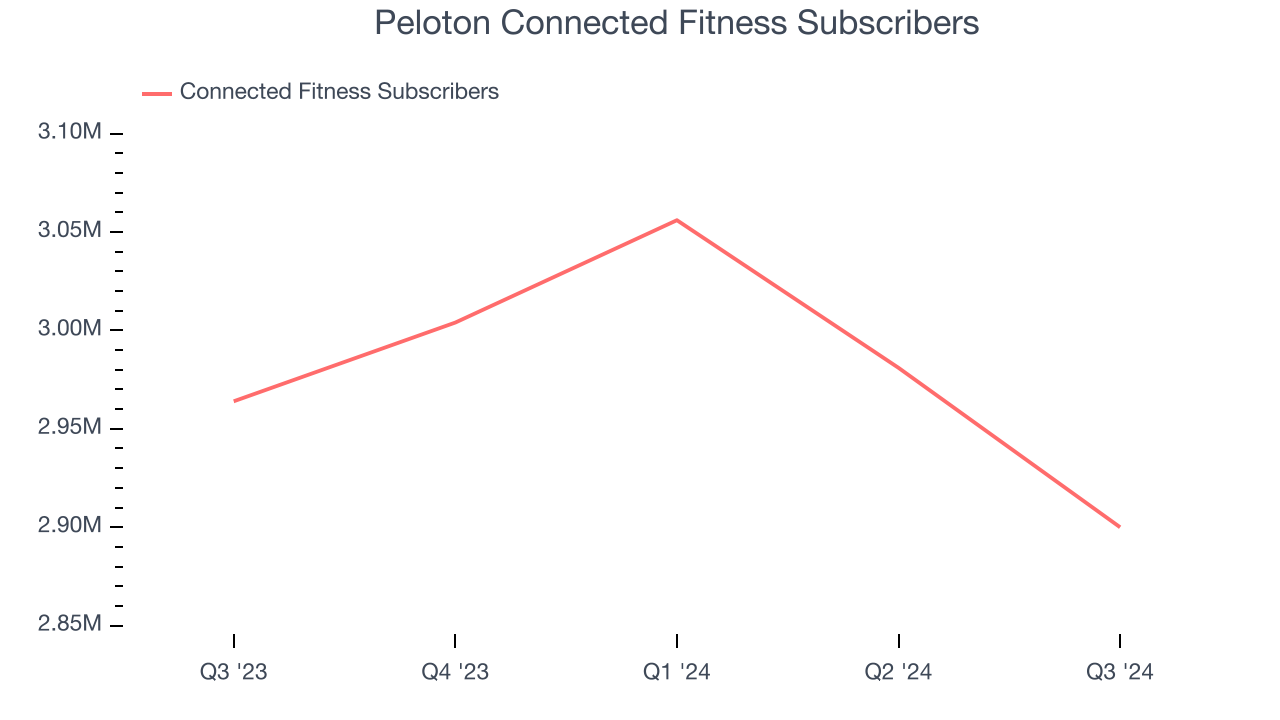

- Connected Fitness Subscribers: 2.9 million, down 64,000 year on year

- Market Capitalization: $2.54 billion

Company Overview

Started as a Kickstarter campaign, Peloton (NASDAQ: PTON) is a fitness technology company known for its at-home exercise equipment and interactive online workout classes.

Consumer Electronics

Consumer electronics companies aim to address the evolving leisure and entertainment needs of consumers, who are increasingly familiar with technology in everyday life. Whether it’s speakers for the home or specialized cameras to document everything from a surfing session to a wedding reception, these businesses are trying to provide innovative, high-quality products that are both useful and cool to own. Adding to the degree of difficulty for these companies is technological change, where the latest smartphone could disintermediate a whole category of consumer electronics. Companies that successfully serve customers and innovate can enjoy high customer loyalty and pricing power, while those that struggle with these may go the way of the VHS tape.

Sales Growth

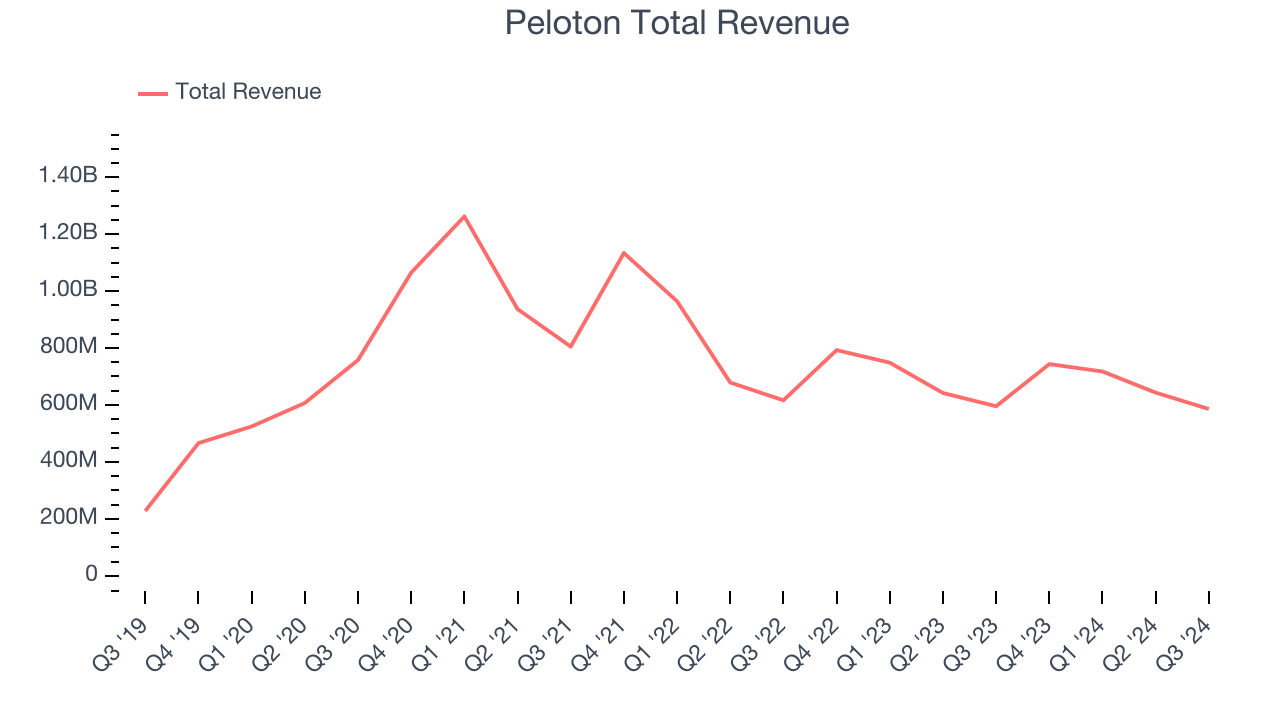

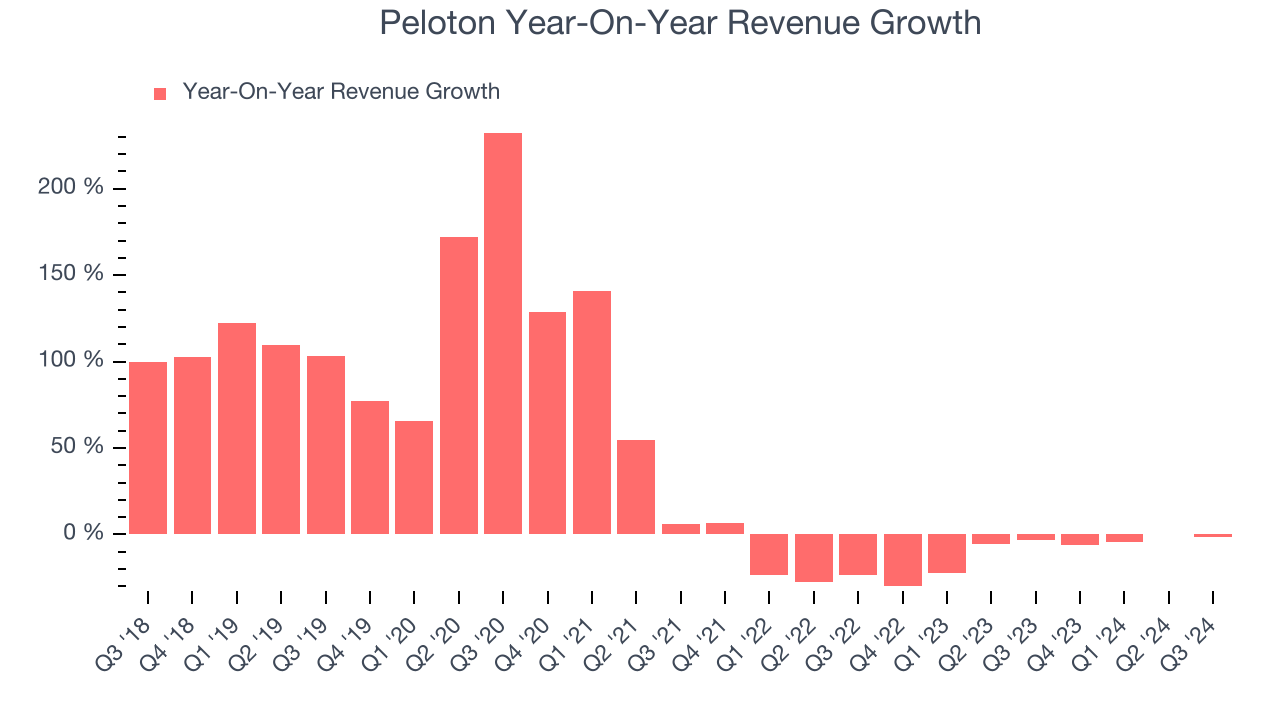

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Peloton’s sales grew at an impressive 21.2% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Peloton’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 11% over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its number of connected fitness subscribers, which reached 2.9 million in the latest quarter. Over the last two years, Peloton’s connected fitness subscribers averaged 2.2% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Peloton’s revenue fell 1.6% year on year to $586 million but beat Wall Street’s estimates by 2.5%. Management is currently guiding for a 12.6% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to decline 9% over the next 12 months. While this projection is better than its two-year trend it's hard to get excited about a company that is struggling with demand.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

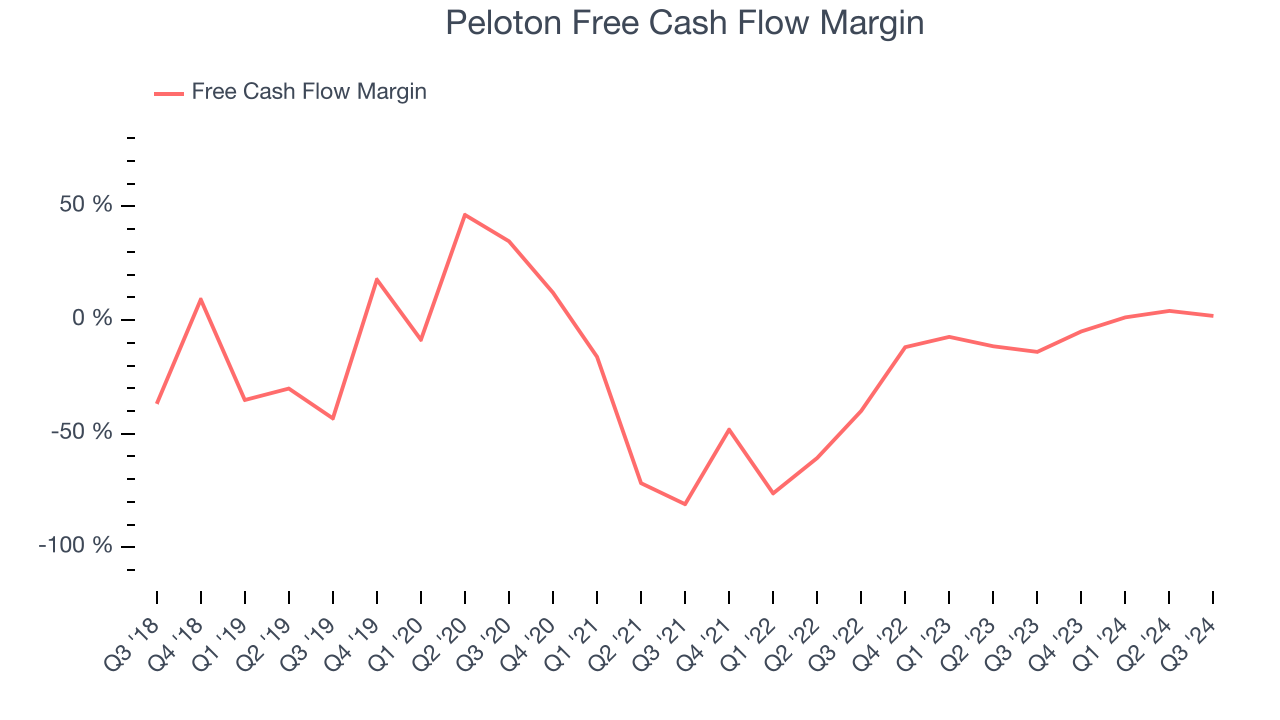

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Peloton posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Peloton’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 5.5%, meaning it lit $5.46 of cash on fire for every $100 in revenue.

Peloton’s free cash flow clocked in at $10.7 million in Q3, equivalent to a 1.8% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

Key Takeaways from Peloton’s Q3 Results

We were impressed that EBITDA handily beat Wall Street's estimates. We also liked that Peloton’s optimistic EBITDA forecast for next quarter blew past analysts’ expectations. On the other hand, its revenue guidance for next quarter came in slightly below Wall Street’s estimates. Zooming out, we think the market is willing to overlook a few negatives due to the EBITDA beat and guide. The stock traded up 15% to $7.64 immediately after reporting.

Is Peloton an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.