Exercise equipment company Peloton (NASDAQ:PTON) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 4.2% year on year to $717.7 million. On the other hand, the company's full-year revenue guidance of $2.69 billion at the midpoint came in slightly below analysts' estimates. It made a GAAP loss of $0.45 per share, improving from its loss of $0.79 per share in the same quarter last year.

Peloton (PTON) Q1 CY2024 Highlights:

- CEO Barry McCarthy to step down, company initiates restructuring program that will include layoffs of 15% of workforce

- Revenue: $717.7 million vs analyst estimates of $718.6 million (small miss)

- EPS: -$0.45 vs analyst expectations of -$0.36 (24% miss)

- The company dropped its revenue guidance for the full year from $2.71 billion to $2.69 billion at the midpoint, a 0.9% decrease

- Gross Margin (GAAP): 43.2%, up from 36.1% in the same quarter last year

- Free Cash Flow of $8.6 million is up from -$37.1 million in the previous quarter

- Connected Fitness Subscribers: 3.06 million

- Market Capitalization: $1.18 billion

Started as a Kickstarter campaign, Peloton (NASDAQ: PTON) is a fitness technology company known for its at-home exercise equipment and interactive online workout classes.

Launched in 2012, Peloton brings immersive fitness experiences into the home. Its products aim to meet the growing need for a convenient and effective workout regimen.

The company offers a suite of interactive fitness equipment, including stationary bicycles and treadmills, complemented by video streams of live and on-demand workout classes. These solutions seek to bring the community and energy of live studio classes into the user's home.

Peloton's revenue streams are multifaceted, including the initial sale of exercise equipment, ongoing subscriptions for class content, and a range of branded apparel.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors offering at-home fitness products and online workout classes include Nautilus (NYSE:NLS), Lululemon (NASDAQ:LULU), and Planet Fitness (NYSE:PLNT).Sales Growth

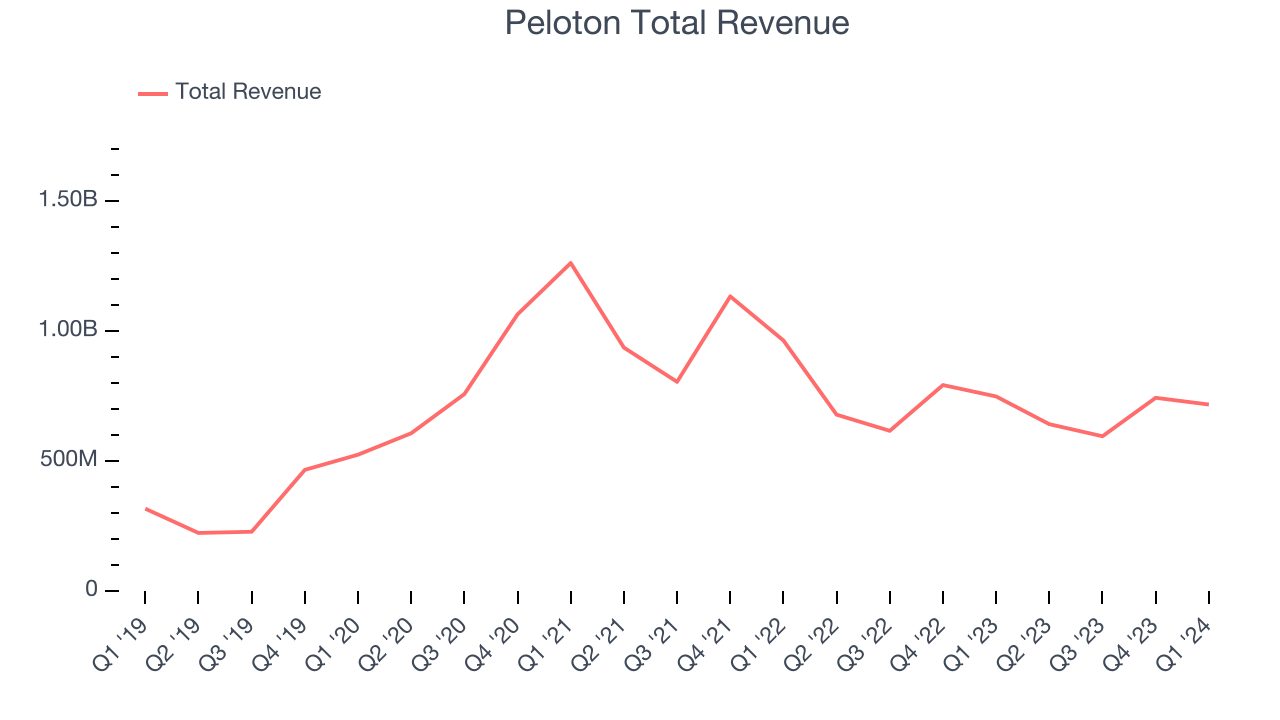

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Peloton's annualized revenue growth rate of 27.6% over the last five years was exceptional for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Peloton's recent history shows a reversal from its five-year trend, as its revenue has shown annualized declines of 16.2% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Peloton's recent history shows a reversal from its five-year trend, as its revenue has shown annualized declines of 16.2% over the last two years.

This quarter, Peloton reported a rather uninspiring 4.2% year-on-year revenue decline to $717.7 million of revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 2.5% over the next 12 months, an acceleration from this quarter.

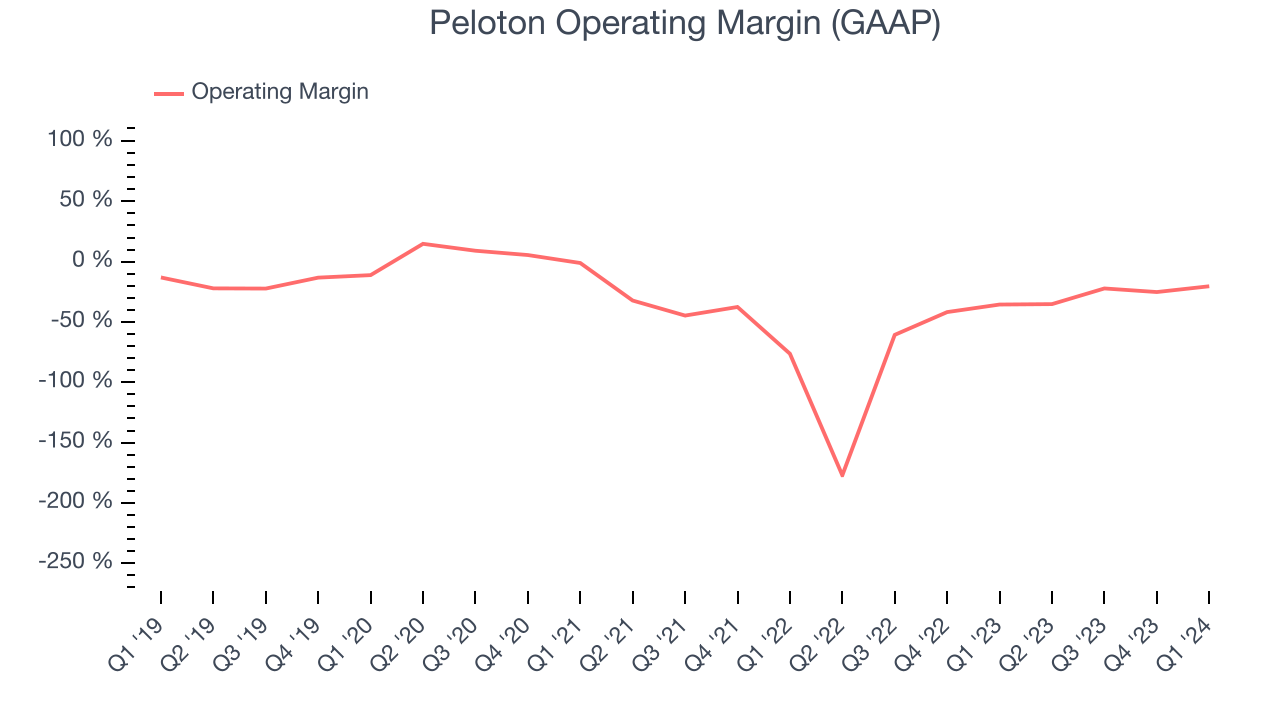

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Peloton's high expenses have contributed to an average operating margin of negative 51.7%.

This quarter, Peloton generated an operating profit margin of negative 20.4%, up 15.2 percentage points year on year.

Over the next 12 months, Wall Street expects Peloton to shrink its losses but remain unprofitable. Analysts are expecting the company’s LTM operating margin of negative 25.6% to rise to negative 12.4%.EPS

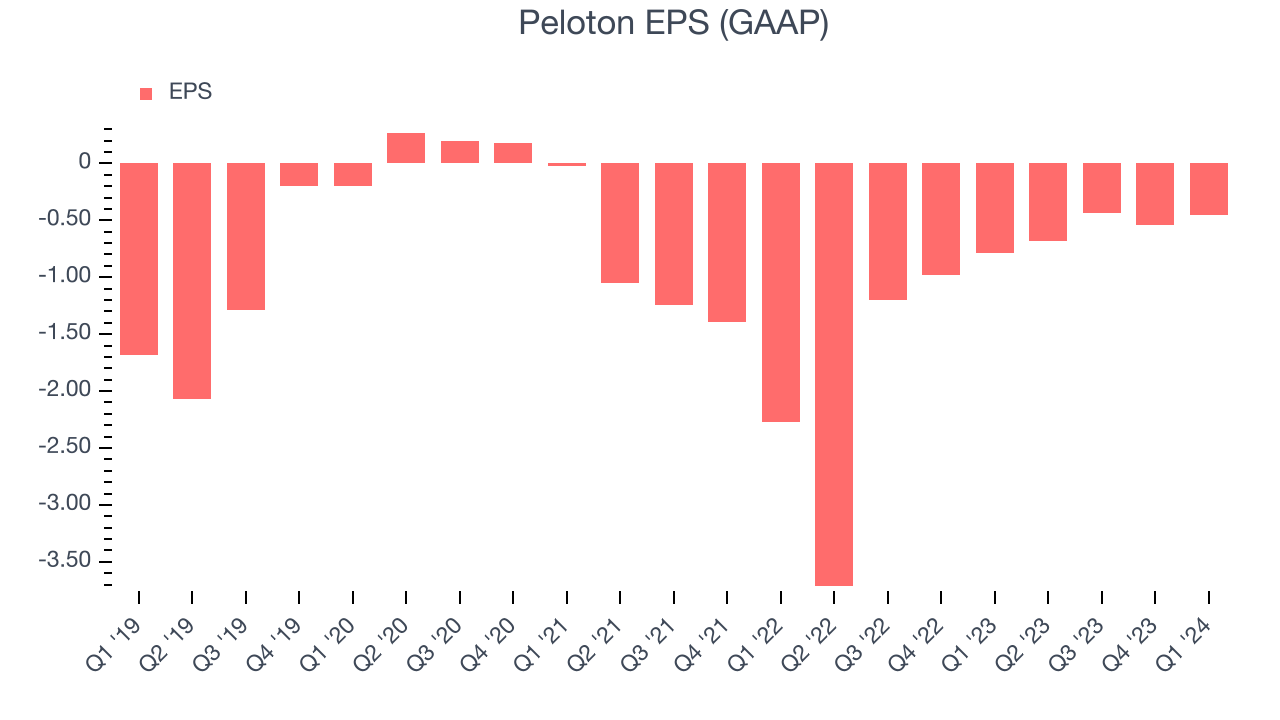

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Peloton cut its earnings losses and improved its EPS by 21.1% each year. This performance, however, is worse than its 27.6% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

While we mentioned earlier that Peloton's operating margin improved this quarter, a five-year view shows its margin has declined 7.3 percentage points, leading to lower profitability and earnings. Taxes and interest expenses can also affect EPS, but they don't tell us as much about a company's fundamentals.In Q1, Peloton reported EPS at negative $0.45, up from negative $0.79 in the same quarter last year. Despite growing year on year, this print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Peloton to improve its earnings losses. Analysts are projecting its LTM EPS of negative $2.11 to advance to negative $1.12.

Cash Is King

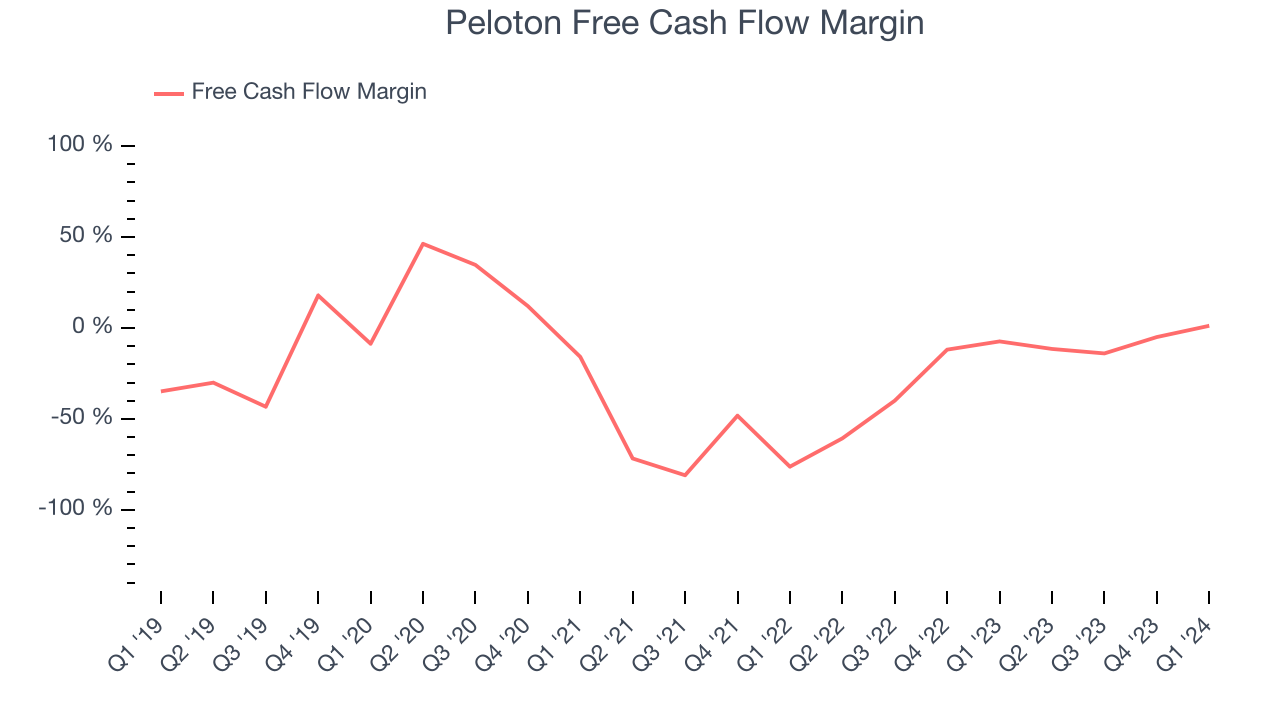

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

While Peloton posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Peloton's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 18%.

Peloton's free cash flow came in at $8.6 million in Q1, equivalent to a 1.2% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to cash flow positive this quarter.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Peloton is a well-capitalized company with $794.5 million of cash and $629.1 million of debt, meaning it could pay back all its debt tomorrow and still have $165.4 million of cash on its balance sheet. This net cash position gives Peloton the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Peloton's Q1 Results

The big news here isn't related to the quarter's financials. Peloton that CEO Barry McCarthy (formerly of Netflix and Spotify) will be stepping down just over two years after he took over from founder John Foley. The company also announced a restructuring program to cut costs, and this will include laying off 15% of its workforce or roughly 400 employees. With regards to the numbers, they weren't good. EPS missed and its operating margin fell short of Wall Street's estimates. The company lowered full year revenue guidance. Overall, the results could have been better. The stock is up 13.8% after reporting and currently trades at $3.68 per share.

Is Now The Time?

Peloton may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Peloton, we'll be cheering from the sidelines. Although its revenue growth has been exceptional over the last five years, its cash burn raises the question of whether it can sustainably maintain growth. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its operating margins reveal poor profitability compared to other consumer discretionary companies.

While we've no doubt one can find things to like about Peloton, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $5.82 per share right before these results (compared to the current share price of $3.68).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.