Programmatic advertising platform Pubmatic (NASDAQ: PUBM) announced better-than-expected results in Q4 FY2023, with revenue up 13.9% year on year to $84.6 million. On top of that, next quarter's revenue guidance ($62 million at the midpoint) was surprisingly good and 6.3% above what analysts were expecting. It made a non-GAAP profit of $0.45 per share, improving from its loss of $0.08 per share in the same quarter last year.

PubMatic (PUBM) Q4 FY2023 Highlights:

- Revenue: $84.6 million vs analyst estimates of $78.19 million (8.2% beat)

- EPS (non-GAAP): $0.45 vs analyst estimates of $0.30 (48.4% beat)

- Revenue Guidance for Q1 2024 is $62 million at the midpoint, above analyst estimates of $58.31 million

- Free Cash Flow of $19.54 million, up 13.8% from the previous quarter

- Net Revenue Retention Rate: 101%, up from 97% in the previous quarter

- Gross Margin (GAAP): 71.4%, up from 61.1% in the same quarter last year

- Market Capitalization: $830.5 million

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

The advertising industry continues to shift from traditional mediums to an expanding array of digital channels and platforms, which has created a convoluted ecosystem of ad buyers and sellers that includes header bidding, which involves putting software code on a website which allows different advertisers to bid in real time for each ad impression. Ever increasing ad impressions from ever rising digital adoption by consumers has resulted in an explosion of data around online advertising (e.g. who bid what when and who won each bid) that requires data mining to allow advertisers to more efficiently place bids.

Pubmatic’s platform plays the role of an intermediary between ad sellers and ad buyers. Publishers and app developers are the “ad-slot sellers'' that plug into Pubmatic’s platform, which in turn interfaces with “ad-slots buyers” and ad-slots buying platforms such as Google and The Trade Desk, along with individual advertisers and ad agencies. As an independent intermediary, Pubmatic’s platform provides transparency for advertisers to know who they are buying and selling from, along with data analytics to help improve buyers and sellers’ purchasing decisions.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

Pubmatic’s competitors include the big three ad platforms: Google (NASDAQ:GOOG), Facebook (NASDAQ: FB) and Amazon (NASDAQ: AMZN) along with specialized programmatic players like The Trade Desk (NASDAQ: TTD) and Integral Ad Science (NASDAQ: IAS).

Sales Growth

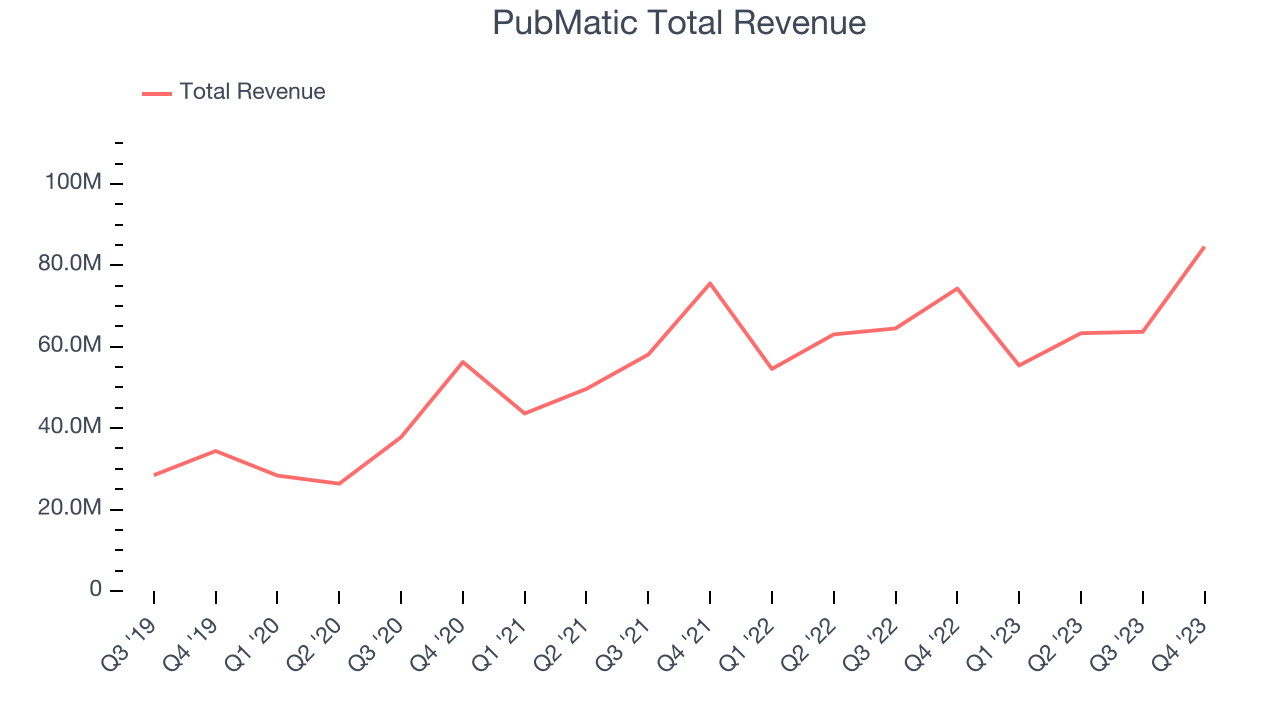

As you can see below, PubMatic's revenue growth has been unremarkable over the last two years, growing from $75.56 million in Q4 FY2021 to $84.6 million this quarter.

This quarter, PubMatic's quarterly revenue was up 13.9% year on year, above the company's historical trend. We can see that PubMatic's revenue increased by $20.92 million quarter on quarter, which is a solid improvement from the $347,000 increase in Q3 2023. Shareholders should applaud the acceleration of growth.

Next quarter's guidance suggests that PubMatic is expecting revenue to grow 11.9% year on year to $62 million, improving on the 1.6% year-on-year increase it recorded in the same quarter last year.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

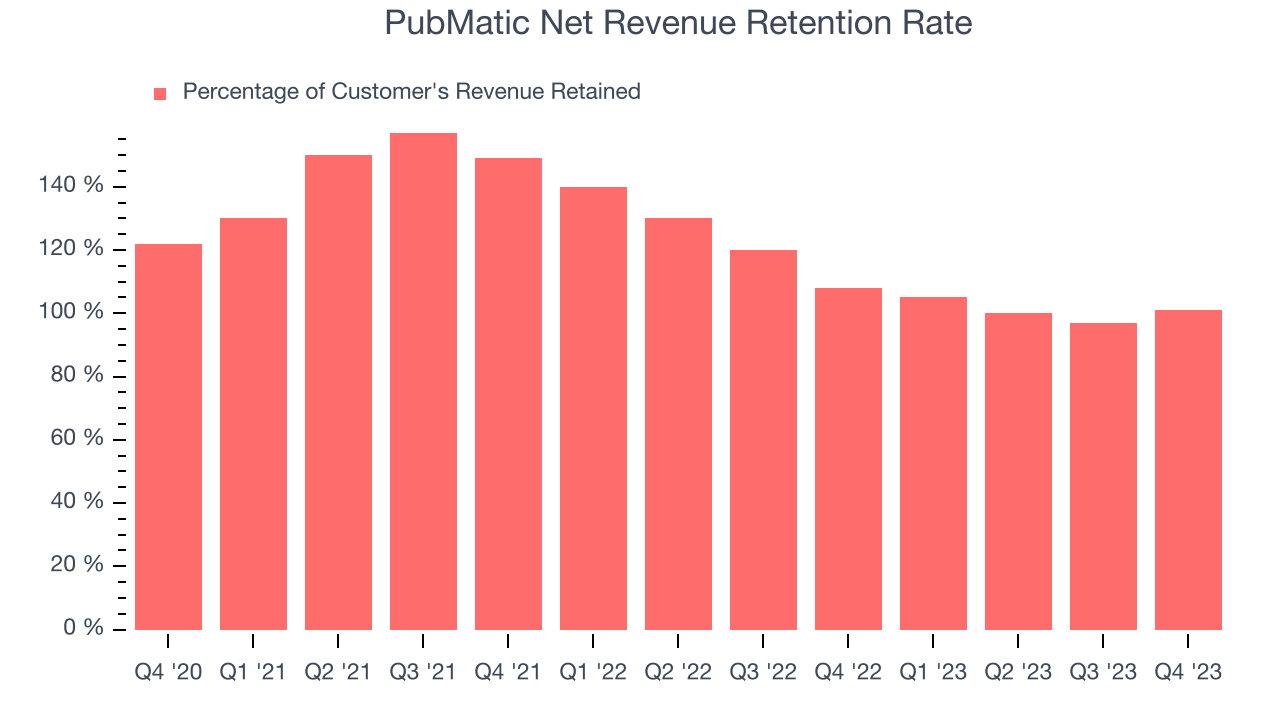

PubMatic's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 101% in Q4. This means that even if PubMatic didn't win any new customers over the last 12 months, it would've grown its revenue by 1%.

Significantly up from the last quarter, PubMatic has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Profitability

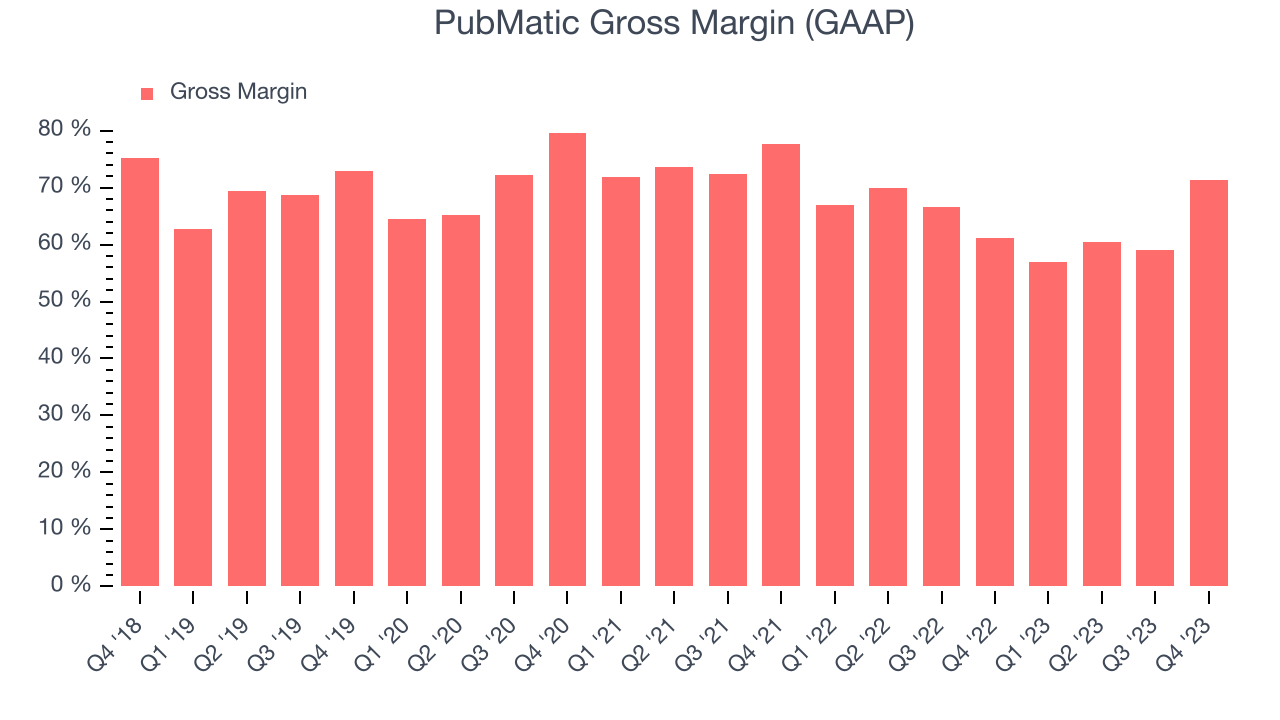

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. PubMatic's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 71.4% in Q4.

That means that for every $1 in revenue the company had $0.71 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite improving significantly since the last quarter, PubMatic's gross margin is still lower than that of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

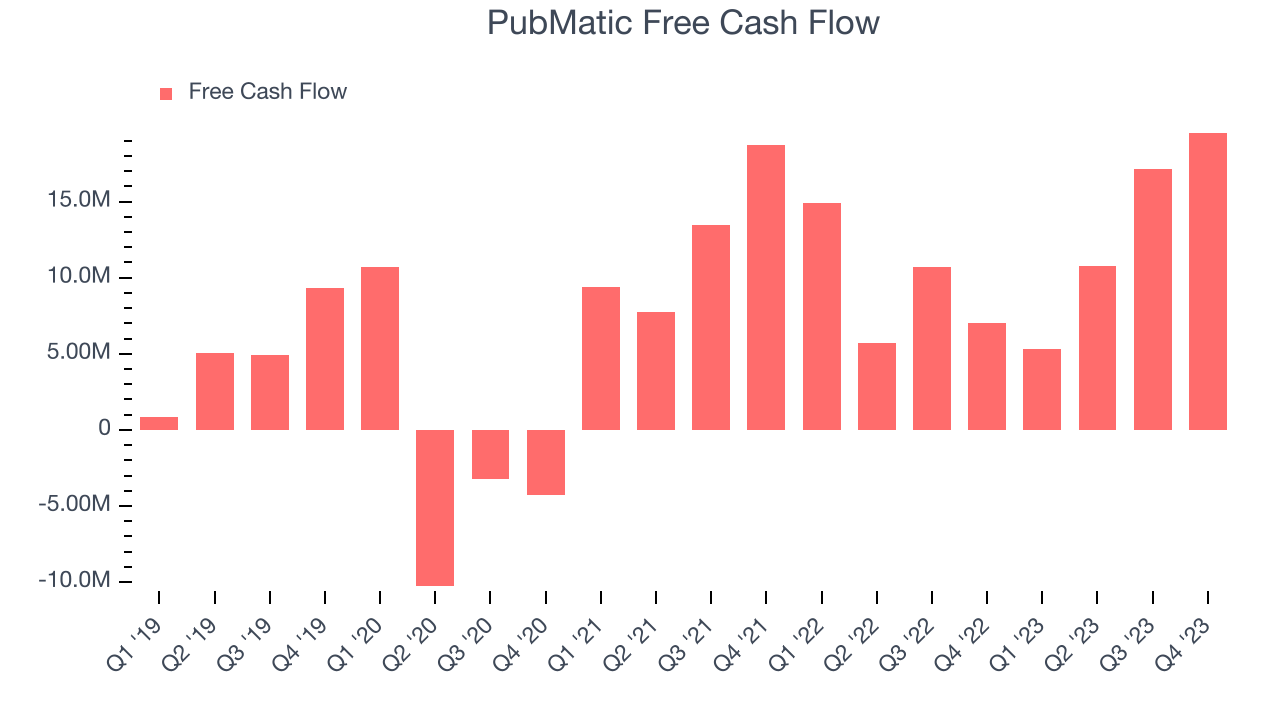

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. PubMatic's free cash flow came in at $19.54 million in Q4, up 178% year on year.

PubMatic has generated $52.83 million in free cash flow over the last 12 months, a solid 19.8% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from PubMatic's Q4 Results

We were impressed by PubMatic's strong free cash flow margin improvement this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. Zooming out, we think this was a fantastic beat and raise quarter that should have shareholders cheering. The stock is up 25.8% after reporting and currently trades at $20.85 per share.

Is Now The Time?

PubMatic may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although PubMatic isn't a bad business, it probably wouldn't be one of our picks. Although its growth has been measured, Wall Street expects it to deteriorate from here. And while its strong free cash flow generation gives it re-investment options, the downside is its gross margins show its business model is much less lucrative than the best software businesses. On top of that, its customer are spending less on average over the last year, which gives us pause.

PubMatic's price-to-sales ratio based on the next 12 months is 3.2x, suggesting that the market has lower expectations of the business, relative to the high growth tech stocks. We can find things to like about PubMatic and there's no doubt it's a bit of a market darling, at least for some. But we are wondering whether there might be better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $17.88 per share right before these results (compared to the current share price of $20.85), implying they didn't see much short-term potential in the PubMatic.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.