Online payroll and human resource software provider Paycor (NASDAQ:PYCR) beat analysts' expectations in Q2 FY2024, with revenue up 20.1% year on year to $159.5 million. On the other hand, next quarter's revenue guidance of $186 million was less impressive, coming in 1% below analysts' estimates. It made a non-GAAP profit of $0.11 per share, improving from its profit of $0.08 per share in the same quarter last year.

Is now the time to buy Paycor? Find out by accessing our full research report, it's free.

Paycor (PYCR) Q2 FY2024 Highlights:

- Revenue: $159.5 million vs analyst estimates of $155.8 million (2.4% beat)

- EPS (non-GAAP): $0.11 vs analyst estimates of $0.09 (26.8% beat)

- Revenue Guidance for Q3 2024 is $186 million at the midpoint, below analyst estimates of $187.9 million

- The company reconfirmed its revenue guidance for the full year of $653 million at the midpoint

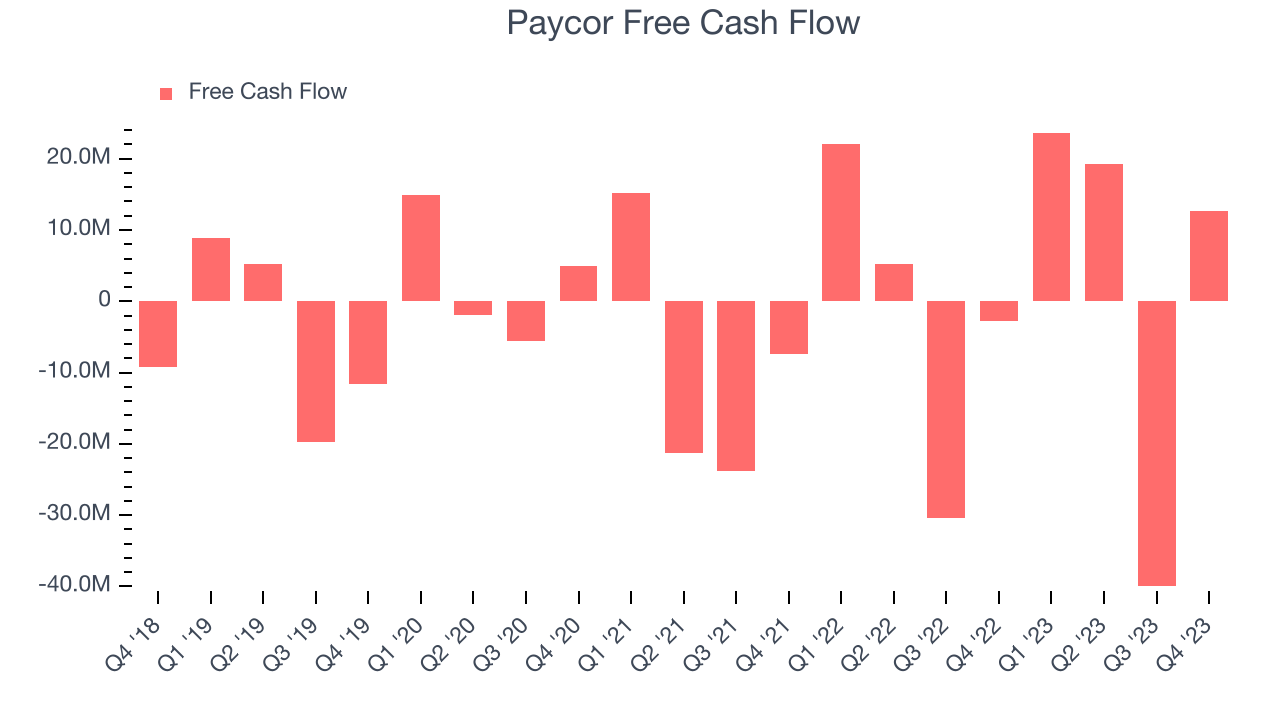

- Free Cash Flow of $12.67 million is up from -$40.01 million in the previous quarter

- Gross Margin (GAAP): 65.4%, in line with the same quarter last year

- Market Capitalization: $3.55 billion

“Paycor’s strong 20% year-over-year revenue growth is the latest demonstration of our success expanding employees and PEPM on our platform,” said Raul Villar, Jr., Chief Executive Officer of Paycor.

Found in 1990 in Cincinnati, Ohio, Paycor (NASDAQ: PYCR) provides software for small businesses to manage their payroll and HR needs in one place.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Sales Growth

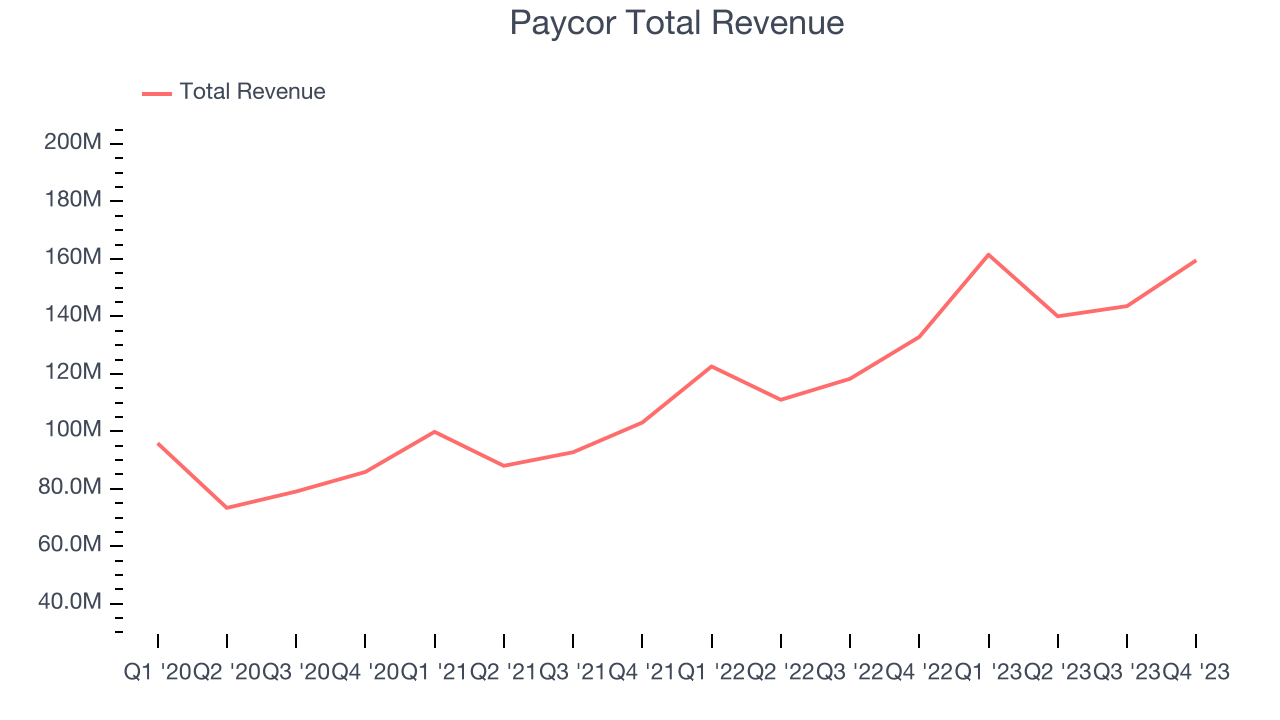

As you can see below, Paycor's revenue growth has been strong over the last two years, growing from $103.1 million in Q2 FY2022 to $159.5 million this quarter.

This quarter, Paycor's quarterly revenue was once again up a very solid 20.1% year on year. On top of that, its revenue increased $15.95 million quarter on quarter, a very strong improvement from the $3.55 million increase in Q1 2024. This is a sign of re-acceleration of growth and great to see.

Next quarter's guidance suggests that Paycor is expecting revenue to grow 15.2% year on year to $186 million, slowing down from the 31.7% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 15.7% over the next 12 months before the earnings results announcement.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Paycor's free cash flow came in at $12.67 million in Q2, turning positive over the last year.

Paycor has generated $15.62 million in free cash flow over the last 12 months, or 2.1% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Paycor's Q2 Results

It was great to see Paycor improve its free cash flow. We were also glad its revenue outperformed Wall Street's estimates. On the other hand, its revenue guidance for next quarter slightly missed analysts' expectations. Overall, this was a mixed quarter, but the company is staying on target. The stock is flat after reporting and currently trades at $19.59 per share.

Paycor may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.