Online payroll and human resource software provider Paycor (NASDAQ:PYCR) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 15.8% year on year to $187 million. On the other hand, next quarter's revenue guidance of $161 million was less impressive, coming in 1.8% below analysts' estimates. It made a non-GAAP profit of $0.21 per share, improving from its profit of $0.18 per share in the same quarter last year.

Paycor (PYCR) Q1 CY2024 Highlights:

- Revenue: $187 million vs analyst estimates of $186.4 million (small beat)

- EPS (non-GAAP): $0.21 vs analyst estimates of $0.20 (5.7% beat)

- Revenue Guidance for Q2 CY2024 is $161 million at the midpoint, below analyst estimates of $163.9 million

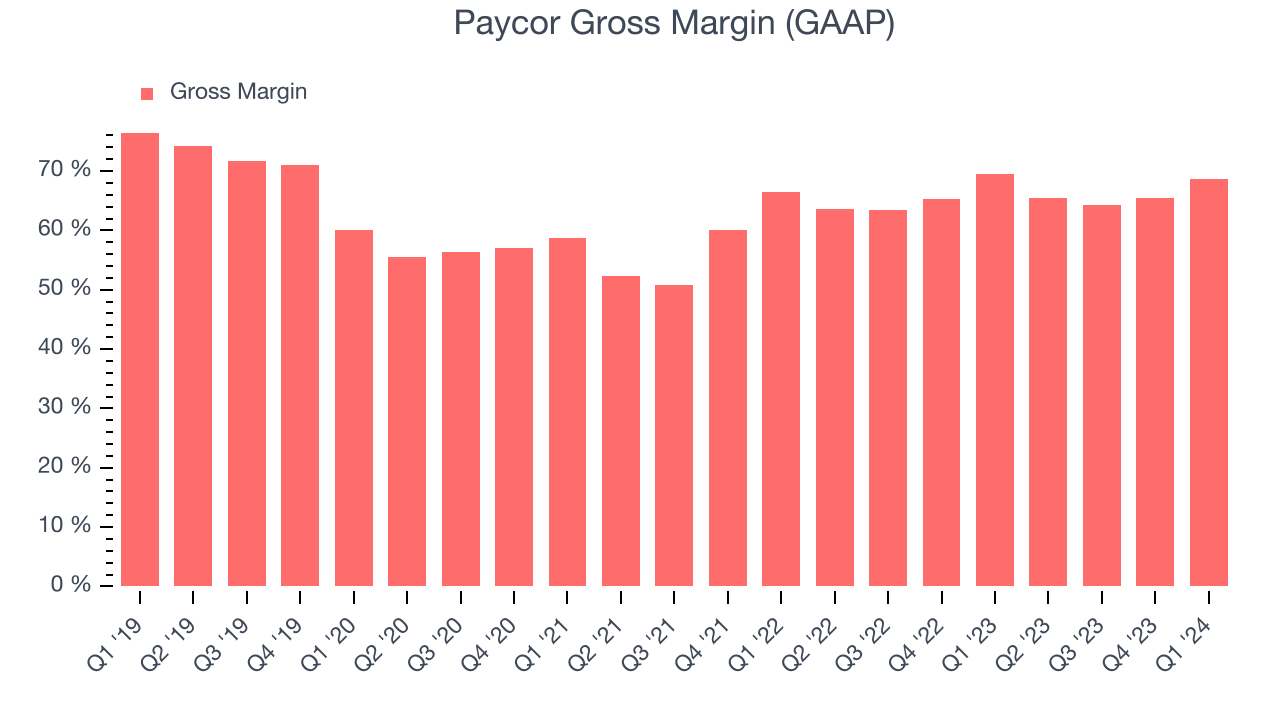

- Gross Margin (GAAP): 68.6%, down from 69.5% in the same quarter last year

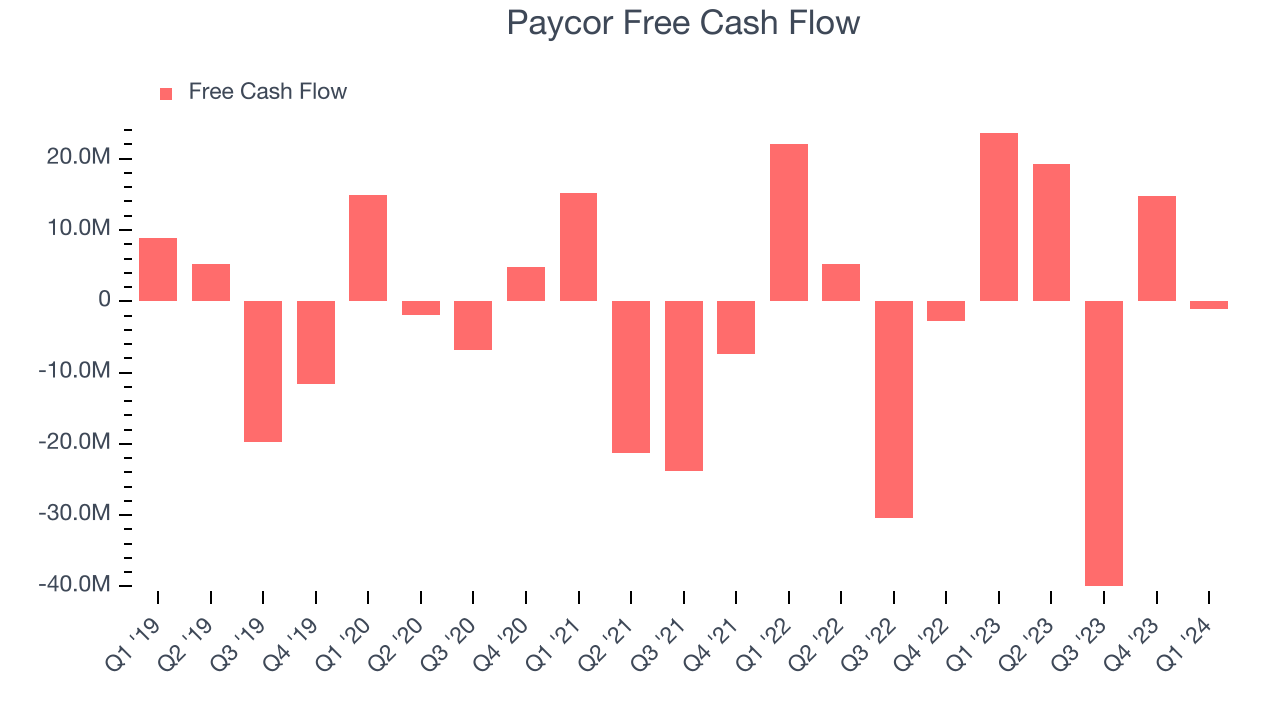

- Free Cash Flow was -$1.02 million, down from $14.82 million in the previous quarter

- Market Capitalization: $3.19 billion

Found in 1990 in Cincinnati, Ohio, Paycor (NASDAQ: PYCR) provides software for small businesses to manage their payroll and HR needs in one place.

Human Capital Management (HCM) software is meant to streamline mundane, but vital, business functions like keeping attendance, running payroll, and keeping compliant with shifting Federal and local government taxes and labor laws. For many small and medium sized businesses, these are often handled by their accountant which is an unnecessarily expensive use of resources, or QuickBooks style spreadsheets which don’t have sufficient functionality.

Using a single database or system of records, Paycor is a cost effective solution that allows small and medium businesses to simplify the management of all their HR operations throughout an employee’s lifecycle, from when they first apply for a job, to onboarding and managing performance reviews, all the way through collecting retirement benefits.

What sets Paycor apart from other cloud-based HCM software providers is its go-to-market model of partnering with local benefits brokers who work with small businesses. It has also traditionally avoided large cities in the US, instead focusing on the Midwest and Southeast.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Other providers of HR solutions for small businesses include Paycom (NYSE:PAYC), Paychex (NASDAQ:PAYX), ADP (NASDAQ:ADP), Asure (NYSE:ASUR) and Paylocity (NASDAQ:PCTY).

Sales Growth

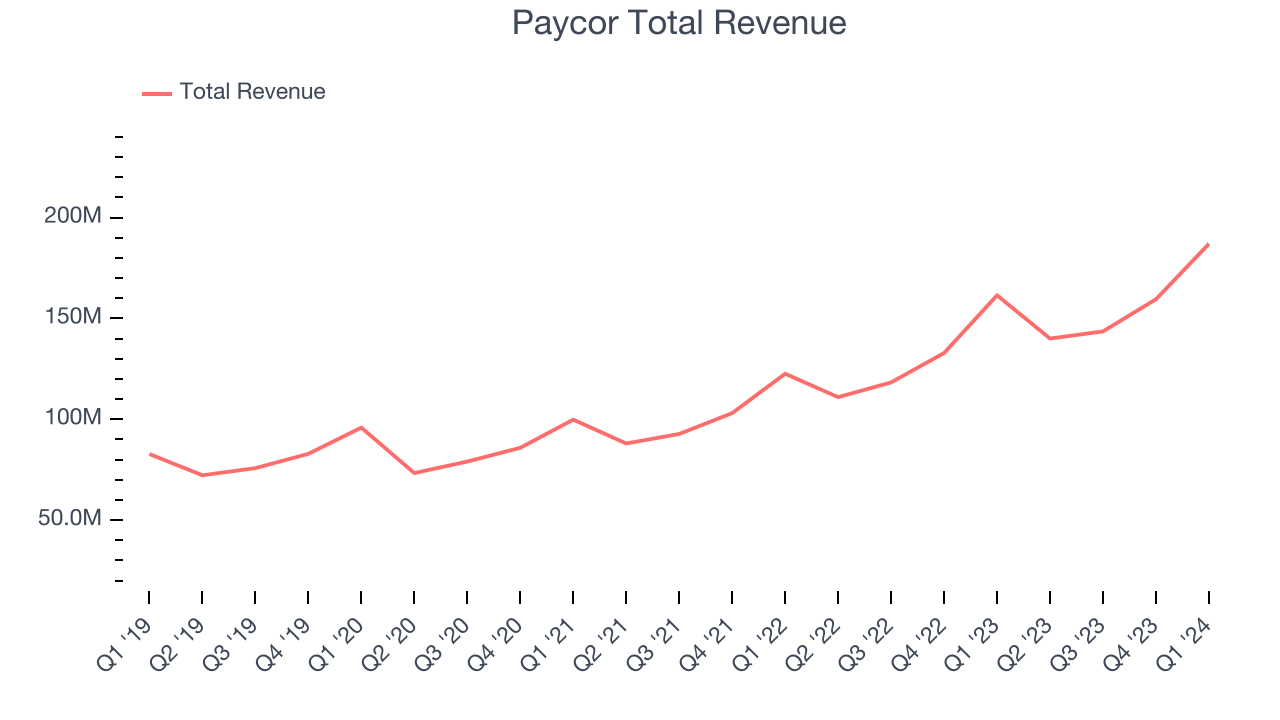

As you can see below, Paycor's revenue growth has been strong over the last three years, growing from $99.84 million in Q3 2021 to $187 million this quarter.

This quarter, Paycor's quarterly revenue was once again up 15.8% year on year. We can see that Paycor's revenue increased by $27.48 million quarter on quarter, which is a solid improvement from the $15.95 million increase in Q4 CY2023. Shareholders might applaud the re-acceleration of growth.

Next quarter's guidance suggests that Paycor is expecting revenue to grow 15% year on year to $161 million, slowing down from the 26.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 15.8% over the next 12 months before the earnings results announcement.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Paycor's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 68.6% in Q1.

That means that for every $1 in revenue the company had $0.69 left to spend on developing new products, sales and marketing, and general administrative overhead. While its gross margin has improved significantly since the previous quarter, Paycor's gross margin is still low for a SaaS business.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Paycor burned through $1.02 million of cash in Q1 despite being cash flow positive last year.

Paycor has burned through $6.91 million of cash over the last 12 months, resulting in a negative 1.1% free cash flow margin. This low FCF margin stems from Paycor's constant need to reinvest in its business to stay competitive.

Key Takeaways from Paycor's Q1 Results

We were impressed by Paycor's strong gross margin improvement this quarter. On the other hand, its revenue guidance missed analysts' expectations and cash flow turned negative year on year. Overall, the results could have been better. The stock is flat after reporting and currently trades at $17.5 per share.

Is Now The Time?

Paycor may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although we have other favorites, we understand the arguments that Paycor isn't a bad business. We'd expect growth rates to moderate from here, but its revenue growth has been solid over the last three years. And while its existing customers have been reducing their spending, which is a bit concerning, the good news is its efficient customer acquisition hints at the potential for strong profitability.

Paycor's price-to-sales ratio based on the next 12 months is 4.3x, suggesting the market is expecting more moderate growth relative to the hottest software stocks. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Paycor, it seems to be trading at a reasonable price right now.

Wall Street analysts covering the company had a one-year price target of $25.82 right before these results (compared to the current share price of $17.50).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.