Cloud security and compliance software provider Qualys (NASDAQ:QLYS) reported results in line with analysts' expectations in Q2 CY2024, with revenue up 8.4% year on year to $148.7 million. On the other hand, next quarter's revenue guidance of $148.7 million was less impressive, coming in 3.3% below analysts' estimates. It made a non-GAAP profit of $1.52 per share, improving from its profit of $1.27 per share in the same quarter last year.

Is now the time to buy Qualys? Find out by accessing our full research report, it's free.

Qualys (QLYS) Q2 CY2024 Highlights:

- Revenue: $148.7 million vs analyst estimates of $148.8 million (small miss)

- Adjusted Operating Income: $65.93 million vs analyst estimates of $58.41 million (12.9% beat)

- EPS (non-GAAP): $1.52 vs analyst estimates of $1.32 (15.3% beat)

- Revenue Guidance for Q3 CY2024 is $148.7 million at the midpoint, below analyst estimates of $153.7 million

- Gross Margin (GAAP): 82.2%, up from 80.6% in the same quarter last year

- Free Cash Flow of $48.8 million, down 41.5% from the previous quarter

- Billings: $140.9 million at quarter end, down 9.7% year on year

- Market Capitalization: $4.91 billion

"We delivered a strong quarter of rapid innovation on the Qualys Enterprise TruRisk Platform, reflecting our ongoing commitment to extend our technology leadership and customer success," said Sumedh Thakar, president and CEO of Qualys.

Founded in 1999 as one of the first subscription security companies, Qualys (NASDAQ:QLYS) provides organizations with software to assess their exposure to cyber-attacks.

Vulnerability Management

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

Sales Growth

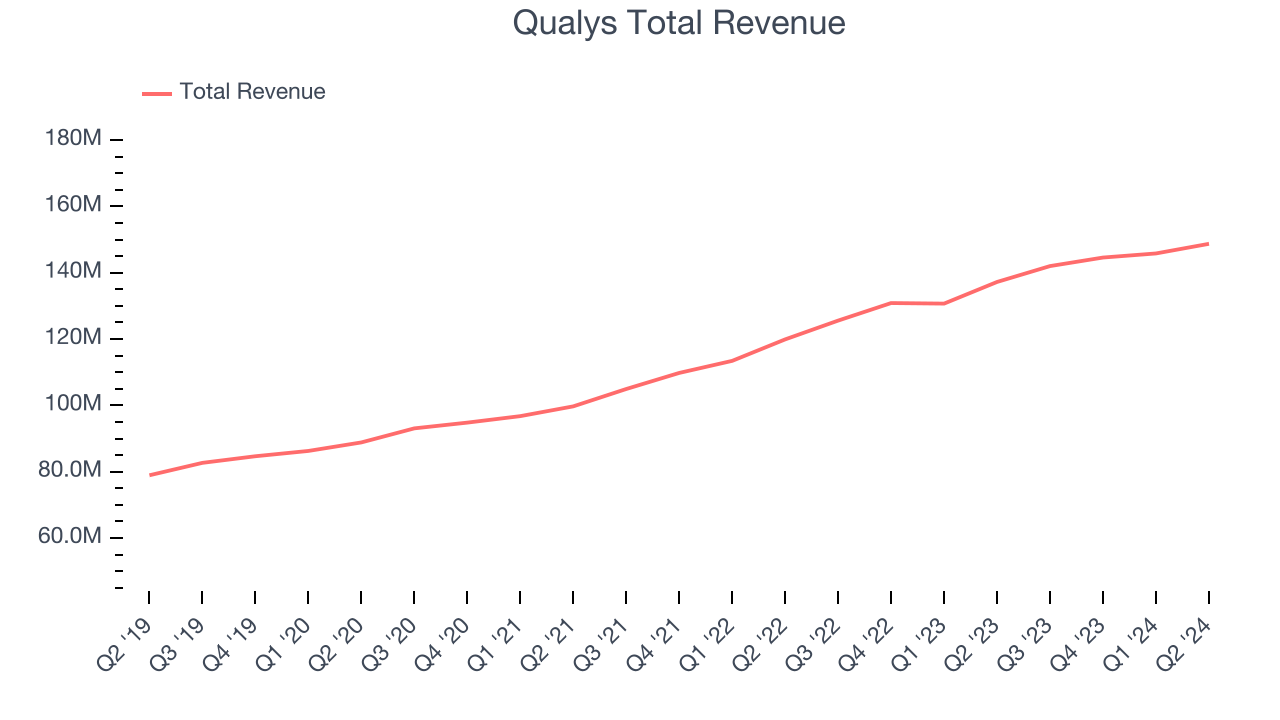

As you can see below, Qualys's revenue growth has been sluggish over the last three years, growing from $99.7 million in Q2 2021 to $148.7 million this quarter.

Qualys's quarterly revenue was only up 8.4% year on year, which might disappoint some shareholders. However, we can see that the company's revenue grew by $2.90 million quarter on quarter, accelerating from $1.24 million in Q1 CY2024.

Next quarter's guidance suggests that Qualys is expecting revenue to grow 4.7% year on year to $148.7 million, slowing down from the 13.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 9.2% over the next 12 months before the earnings results announcement.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

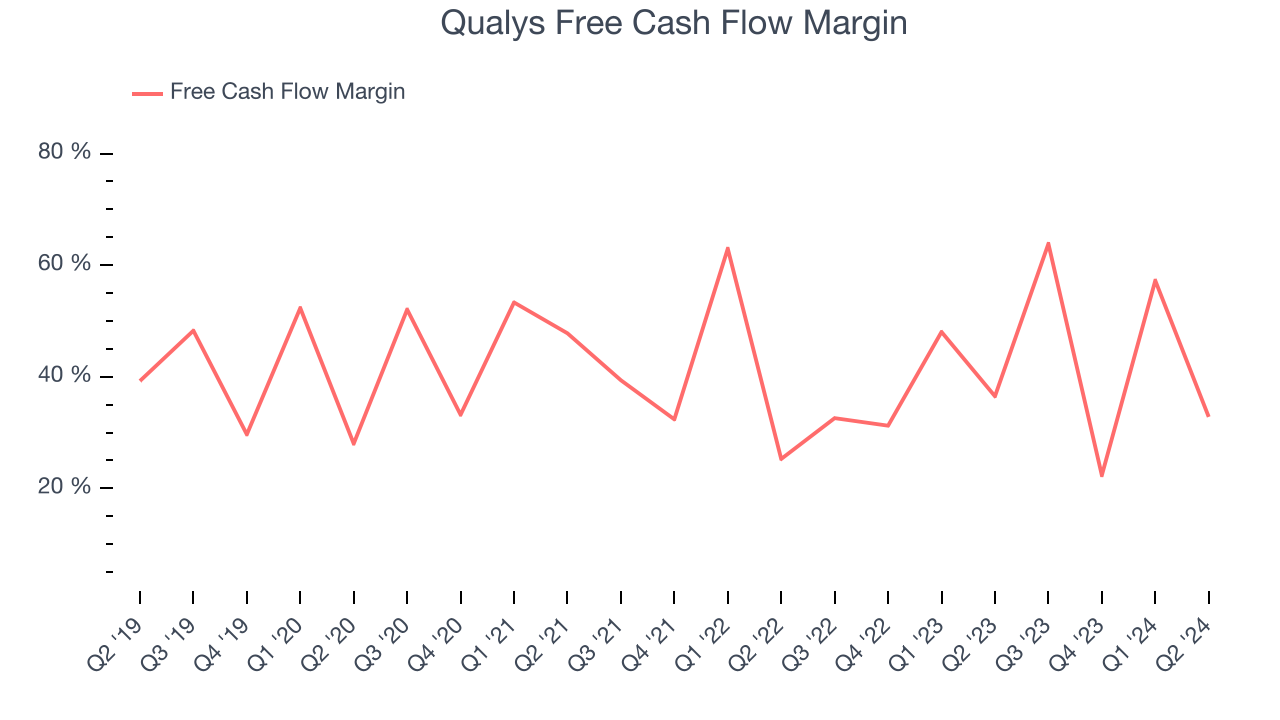

Qualys has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cash cushion. The company's free cash flow margin was among the best in the software sector, averaging an eye-popping 43.9% over the last year.

Qualys's free cash flow clocked in at $48.8 million in Q2, equivalent to a 32.8% margin. The company's cash profitability regressed as it was 3.7 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren't a big deal because investment needs can be seasonal, but we'll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Qualys's cash conversion will fall. Their consensus estimates imply its free cash flow margin of 43.9% for the last 12 months will decrease to 35.6%.

Key Takeaways from Qualys's Q2 Results

It was good to see Qualys slightly improve its gross margin this quarter. On the other hand, its revenue guidance for next quarter missed analysts' expectations and its billings missed Wall Street's estimates. Overall, this was a bad quarter for Qualys. The stock remained flat at $137.10 immediately following the results.

Qualys may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.