The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how Qualys (NASDAQ:QLYS) and the rest of the cybersecurity stocks fared in Q4.

Cybersecurity continues to be one of the fastest growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 2.22%, while on average next quarter revenue guidance was 0.07% under consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable, but cybersecurity stocks held their ground better than others, with the share prices up 3.54% since the previous earnings results, on average.

Qualys (NASDAQ:QLYS)

Founded in 1999 as one of the first subscription security companies, Qualys (NASDAQ:QLYS) provides organizations with software to assess their exposure to cyber-attacks.

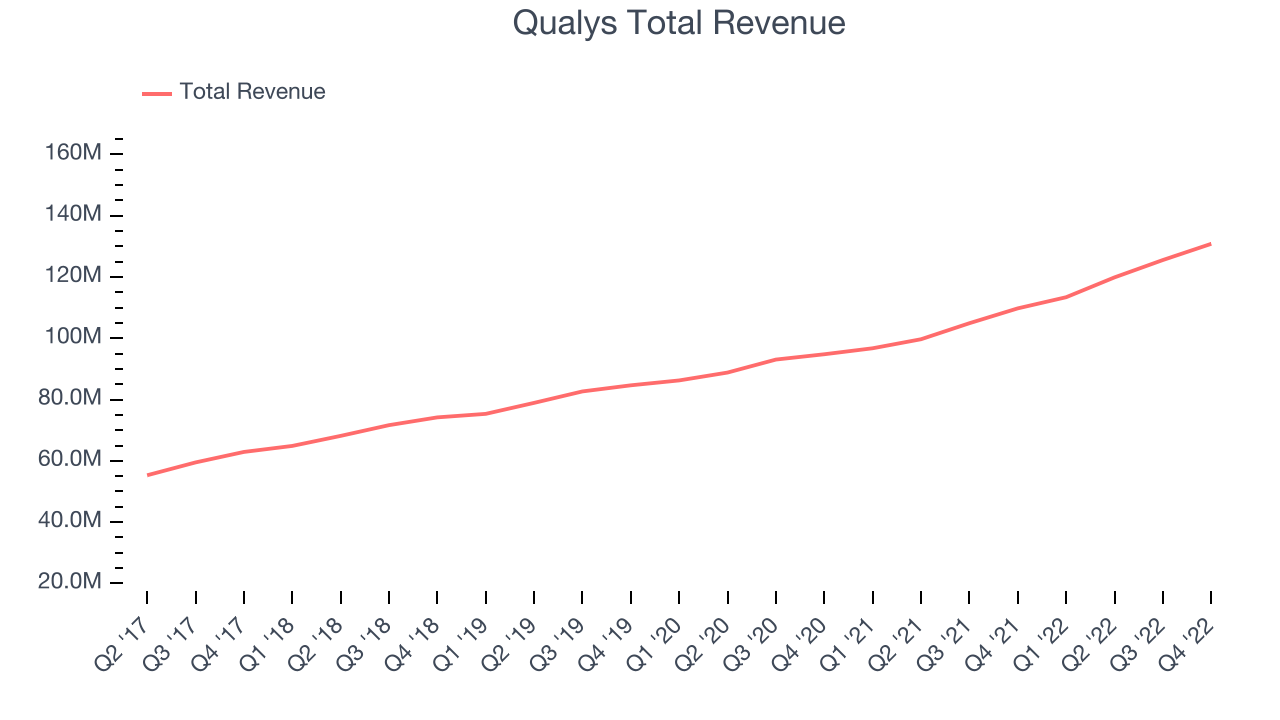

Qualys reported revenues of $130.8 million, up 19.2% year on year, in line with analyst expectations. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

"We are pleased to report another quarter of strong revenue growth, profitability, and cash flow generation," said Sumedh Thakar, president and CEO.

The stock is up 3.88% since the results and currently trades at $127.01.

Is now the time to buy Qualys? Access our full analysis of the earnings results here, it's free.

Best Q4: Zscaler (NASDAQ:ZS)

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ:ZS) offers software as a service that helps companies securely connect to applications and networks in the cloud.

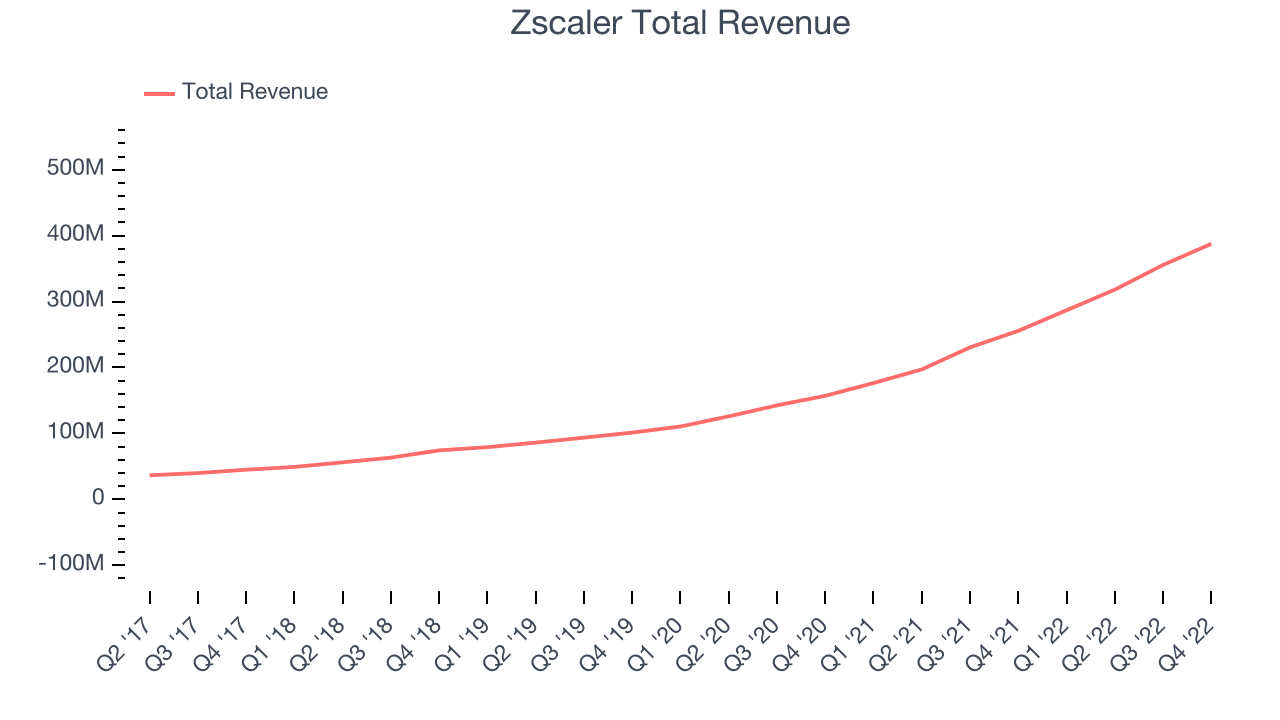

Zscaler reported revenues of $387.6 million, up 51.7% year on year, beating analyst expectations by 6.26%. Despite the stock falling on the results, it was a very strong quarter for the company, with exceptional revenue growth and a solid beat of analyst estimates.

Zscaler achieved the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is down 23.3% since the results and currently trades at $102.92.

Is now the time to buy Zscaler? Access our full analysis of the earnings results here, it's free.

Tenable (NASDAQ:TENB)

Founded in 2002 by three cybersecurity veterans, Tenable (NASDAQ:TENB) provides software as a service that helps companies understand where they are exposed to cyber security risk and how to reduce it.

Tenable reported revenues of $184.6 million, up 23.9% year on year, beating analyst expectations by 1.79%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

The stock is up 5.02% since the results and currently trades at $45.6.

Read our full analysis of Tenable's results here.

CrowdStrike (NASDAQ:CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $637.4 million, up 47.9% year on year, beating analyst expectations by 1.68%. It was a decent quarter for the company, with exceptional revenue growth but underwhelming guidance for the next year.

The company added 1,873 customers to a total of 23,019. The stock is up 8.09% since the results and currently trades at $135.02.

Read our full, actionable report on CrowdStrike here, it's free.

Rapid7 (NASDAQ:RPD)

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Rapid7 reported revenues of $184.5 million, up 21.7% year on year, beating analyst expectations by 2.72%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

The company added 138 customers to a total of 10,929. The stock is down 7.95% since the results and currently trades at $47.38.

Read our full, actionable report on Rapid7 here, it's free.

The author has no position in any of the stocks mentioned