Looking back on waste management stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Quest Resource (NASDAQ:QRHC) and its peers.

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 8 waste management stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 1.9%.

Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. This year has been a different story as mixed inflation signals have led to market volatility. However, waste management stocks have held steady amidst all this with share prices up 2.1% on average since the latest earnings results.

Quest Resource (NASDAQ:QRHC)

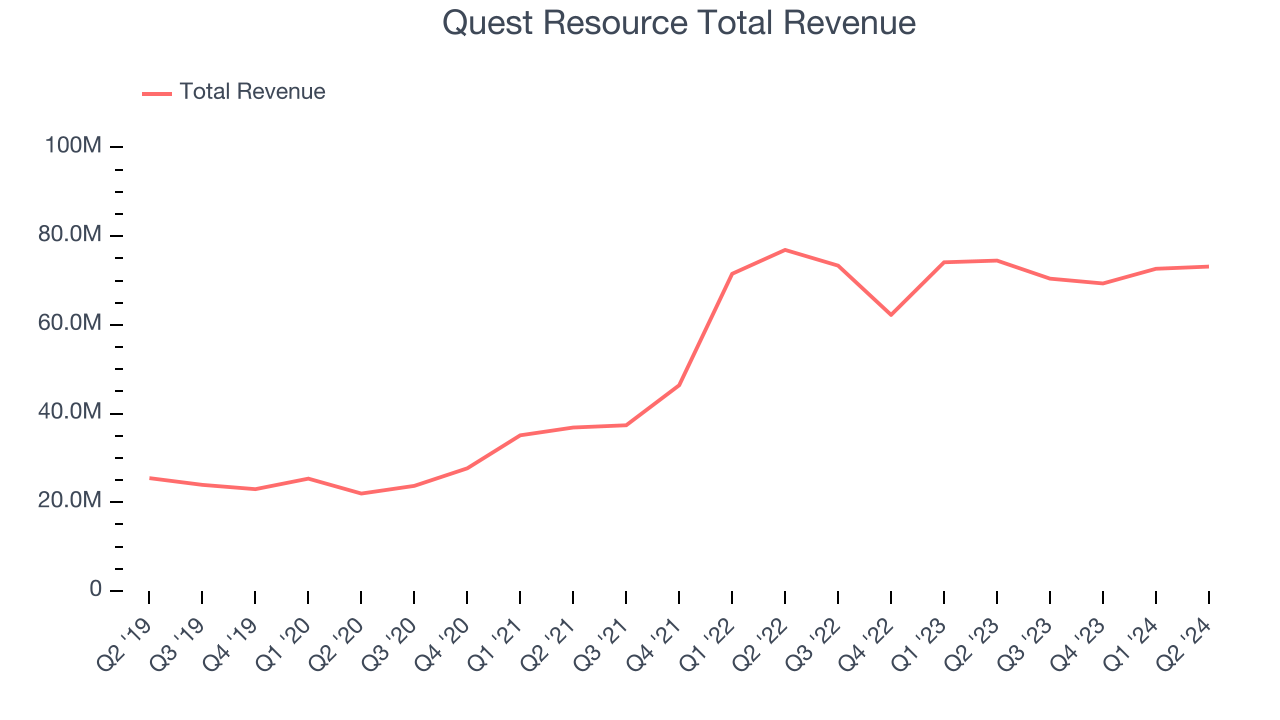

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ:QRHC) is a provider of waste and recycling services.

Quest Resource reported revenues of $73.15 million, down 1.8% year on year. This print fell short of analysts’ expectations by 4.6%. Overall, it was a disappointing quarter for the company with a miss of analysts’ earnings estimates.

“I am incredibly proud of the positive reaction and feedback we have received from clients we are onboarding, one of which has already committed to expanding our engagement with additional services.” said S. Ray Hatch, President and Chief Executive Officer of Quest.

Interestingly, the stock is up 6% since reporting and currently trades at $8.84.

Read our full report on Quest Resource here, it’s free.

Best Q2: Clean Harbors (NYSE:CLH)

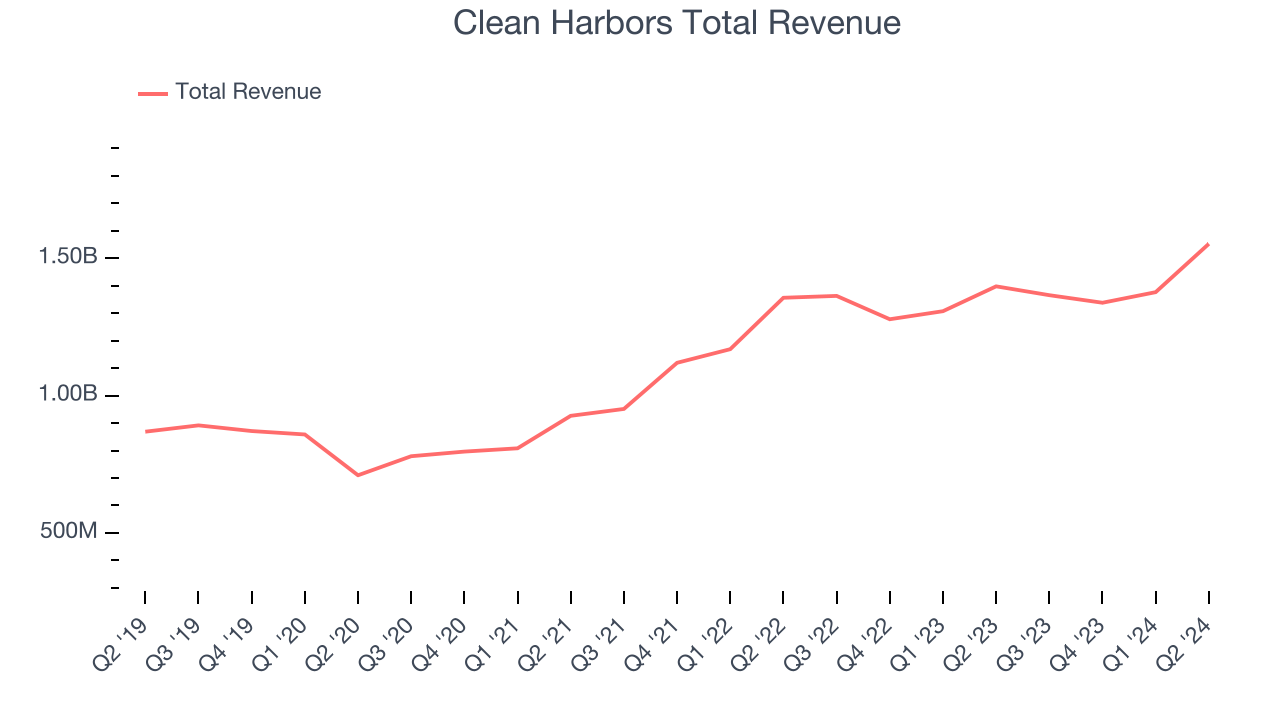

Established in 1980, Clean Harbors (NYSE:CLH) provides environmental and industrial services like hazardous and non-hazardous waste disposal and emergency spill cleanups.

Clean Harbors reported revenues of $1.55 billion, up 11.1% year on year, outperforming analysts’ expectations by 1.5%. The business had a very strong quarter with an impressive beat of analysts’ operating margin estimates and a decent beat of analysts’ earnings estimates.

Clean Harbors achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 9% since reporting. It currently trades at $244.67.

Is now the time to buy Clean Harbors? Access our full analysis of the earnings results here, it’s free.

Perma-Fix (NASDAQ:PESI)

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ:PESI) provides environmental waste treatment services.

Perma-Fix reported revenues of $13.99 million, down 44.1% year on year, falling short of analysts’ expectations by 12%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

Perma-Fix delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 10.2% since the results and currently trades at $11.25.

Read our full analysis of Perma-Fix’s results here.

Casella Waste Systems (NASDAQ:CWST)

Starting with the founder picking up garbage with a pickup truck he purchased using savings from high school, Casella (NASDAQ:CWST) offers waste management services for businesses, residents, and the government.

Casella Waste Systems reported revenues of $377.2 million, up 30.2% year on year. This number topped analysts’ expectations by 1.2%. Taking a step back, it was a decent quarter with full-year revenue guidance exceeding analysts’ expectations.

Casella Waste Systems pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The stock is up 5.6% since reporting and currently trades at $108.06.

Read our full, actionable report on Casella Waste Systems here, it’s free.

Montrose (NYSE:MEG)

Founded to protect a tree-lined two-lane road, Montrose (NYSE:MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

Montrose reported revenues of $173.3 million, up 8.9% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also recorded an impressive beat of analysts’ operating margin estimates but a miss of analysts’ earnings estimates.

The stock is flat since reporting and currently trades at $29.16.

Read our full, actionable report on Montrose here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.