Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Qorvo (NASDAQ:QRVO) and its peers.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

The 9 processors and graphics chips stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was 12.9% below.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate cut and future ones (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Qorvo (NASDAQ:QRVO)

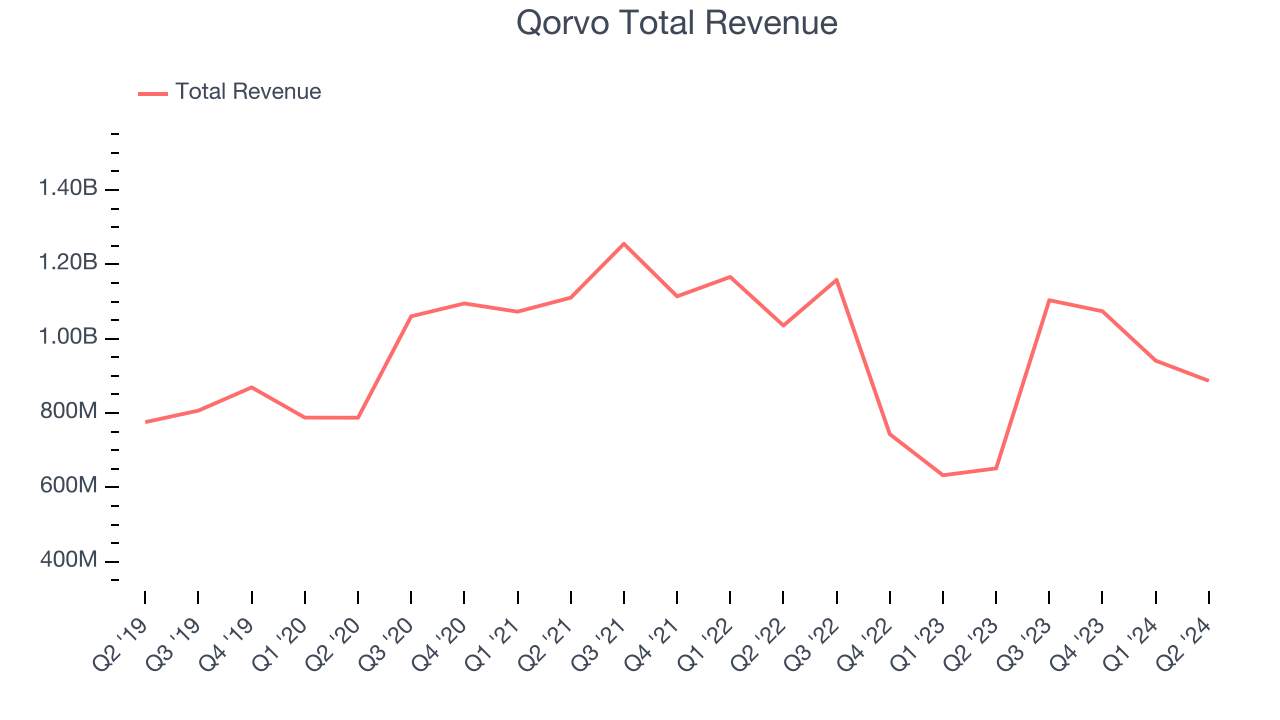

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

Qorvo reported revenues of $886.7 million, up 36.2% year on year. This print exceeded analysts’ expectations by 4.1%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates and a significant improvement in its operating margin.

Bob Bruggeworth, president and chief executive officer of Qorvo, said, “During the June quarter, we fully integrated Anokiwave into Qorvo, adding silicon beam-forming ICs and IF-RF conversion products. We are investing in technology leadership to broaden our market exposure and drive growth, and we are executing on cost and productivity initiatives to structurally enhance our gross margin.”

Unsurprisingly, the stock is down 16.3% since reporting and currently trades at $100.

Is now the time to buy Qorvo? Access our full analysis of the earnings results here, it’s free.

Best Q2: Nvidia (NASDAQ:NVDA)

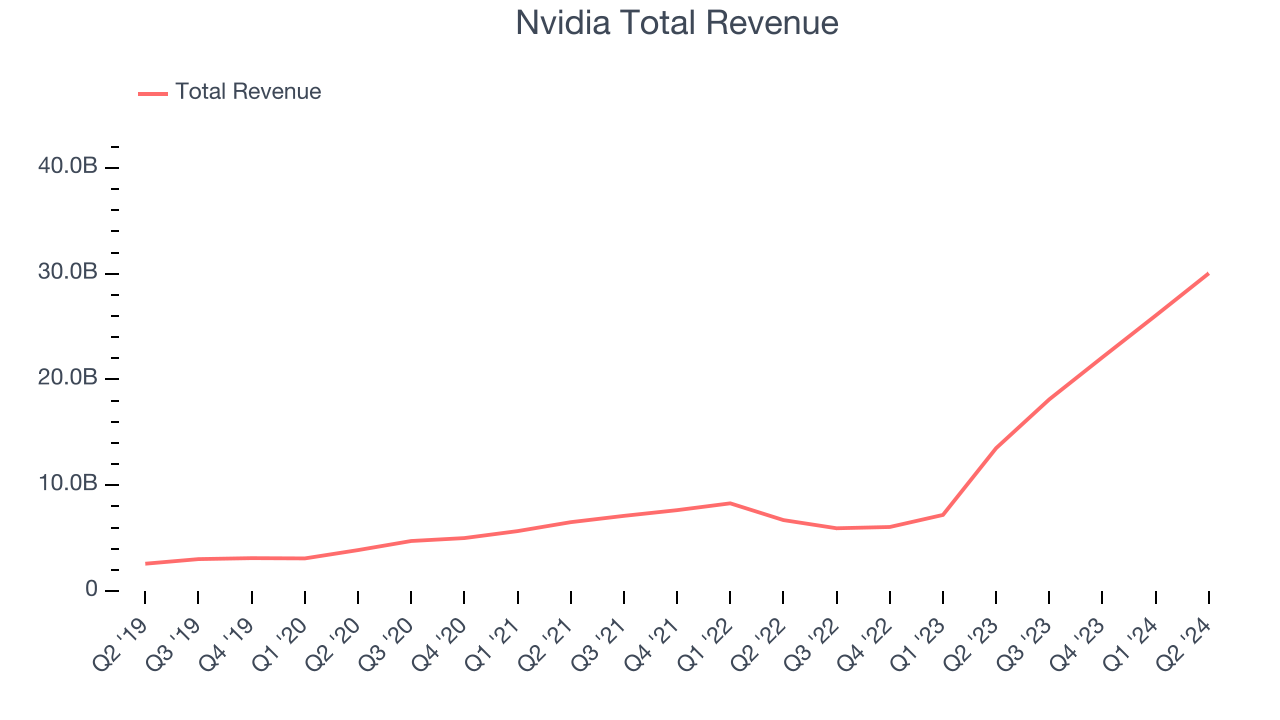

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $30.04 billion, up 122% year on year, outperforming analysts’ expectations by 4.5%. The business had an exceptional quarter with a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

Nvidia delivered the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.3% since reporting. It currently trades at $116.49.

Is now the time to buy Nvidia? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Lattice Semiconductor (NASDAQ:LSCC)

A global leader in its category, Lattice Semiconductor (NASDAQ:LSCC) is a semiconductor designer specializing in customer-programmable chips that enhance CPU performance for intensive tasks such as machine learning.

Lattice Semiconductor reported revenues of $124.1 million, down 34.7% year on year, falling short of analysts’ expectations by 4.7%. It was a disappointing quarter as it posted underwhelming revenue guidance for the next quarter and a decline in its operating margin.

Lattice Semiconductor delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 3.1% since the results and currently trades at $53.20.

Read our full analysis of Lattice Semiconductor’s results here.

Qualcomm (NASDAQ:QCOM)

Having been at the forefront of developing the standards for cellular connectivity for over four decades, Qualcomm (NASDAQ:QCOM) is a leading innovator and a fabless manufacturer of wireless technology chips used in smartphones, autos and internet of things appliances.

Qualcomm reported revenues of $9.39 billion, up 11.1% year on year. This result topped analysts’ expectations by 1.9%. Overall, it was a strong quarter as it also logged a decent beat of analysts’ EPS estimates and strong sales guidance for the next quarter.

The stock is down 4.6% since reporting and currently trades at $172.44.

Read our full, actionable report on Qualcomm here, it’s free.

AMD (NASDAQ:AMD)

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices or AMD (NASDAQ:AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

AMD reported revenues of $5.84 billion, up 8.9% year on year. This print surpassed analysts’ expectations by 2%. It was a strong quarter as it also recorded a significant improvement in its gross margin. Looking ahead, revenue guidance for next quarter was also above expectations.

The stock is up 10.1% since reporting and currently trades at $152.40.

Read our full, actionable report on AMD here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.