Real estate technology company Redfin (NASDAQ:RDFN) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 5.3% year on year to $225.5 million. Guidance for next quarter's revenue was also optimistic at $291.5 million at the midpoint, 2.7% above analysts' estimates. It made a GAAP loss of $0.57 per share, down from its loss of $0.52 per share in the same quarter last year.

Redfin (RDFN) Q1 CY2024 Highlights:

- Revenue: $225.5 million vs analyst estimates of $217.6 million (3.6% beat)

- EPS: -$0.57 vs analyst estimates of -$0.58 (1.8% beat)

- Revenue Guidance for Q2 CY2024 is $291.5 million at the midpoint, above analyst estimates of $283.8 million

- Gross Margin (GAAP): 31.4%, up from 27.2% in the same quarter last year

- Free Cash Flow was -$49.54 million compared to -$37.49 million in the previous quarter

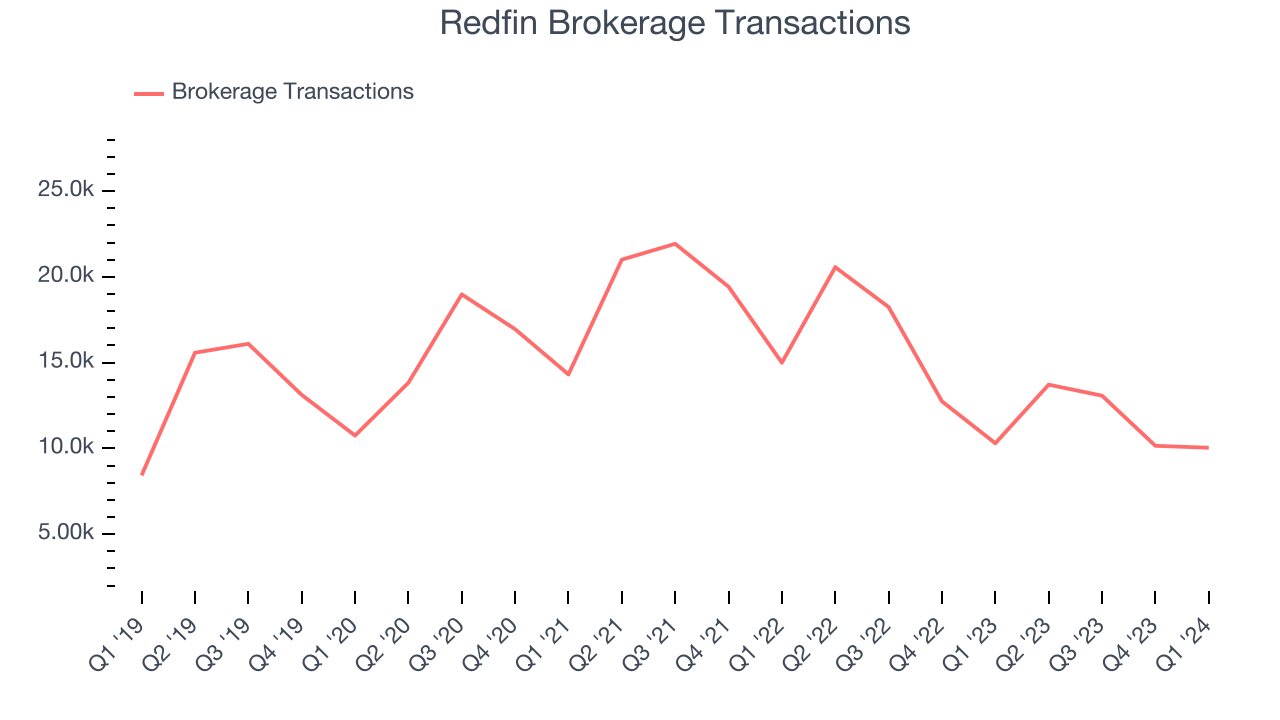

- Brokerage Transactions: 10,039

- Market Capitalization: $771.8 million

Founded by a former medical school student, electrical engineer, and Amazon data engineer, Redfin (NASDAQ:RDFN) is a real estate company offering brokerage services through an online platform.

At the heart of Redfin's business model is its integrated platform, which leverages big data analytics and a user-friendly interface to provide consumers with a comprehensive real estate search tool. This platform offers extensive listings, detailed home information, and valuable market insights. Redfin’s website and mobile apps attract millions of visitors, making it one of the preeminent real estate websites in the United States.

Redfin utilizes a unique pricing model; unlike traditional brokerages that charge a standard commission, Redfin employs a low-fee model, charging sellers a lower commission and offering a rebate to buyers. This cost-effective approach enabled it to win market share in the past.

The company's agents benefit from the platform's technology, receiving a steady stream of leads and data-driven insights, which allows them to serve clients more efficiently. Redfin agents are paid a salary and bonuses based on customer satisfaction, aligning their interests with those of their clients and fostering a culture of high-quality customer service.

In addition to home buying and selling services, Redfin provides mortgage, title, and settlement services, offering an end-to-end solution for real estate transactions.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Redfin’s primary competitors include Zillow (NASDAQ:ZG), Realogy Holdings (NYSE:RLGY), eXp World (NASDAQ:EXPI), and Opendoor Technologies (NASDAQ:OPEN).Sales Growth

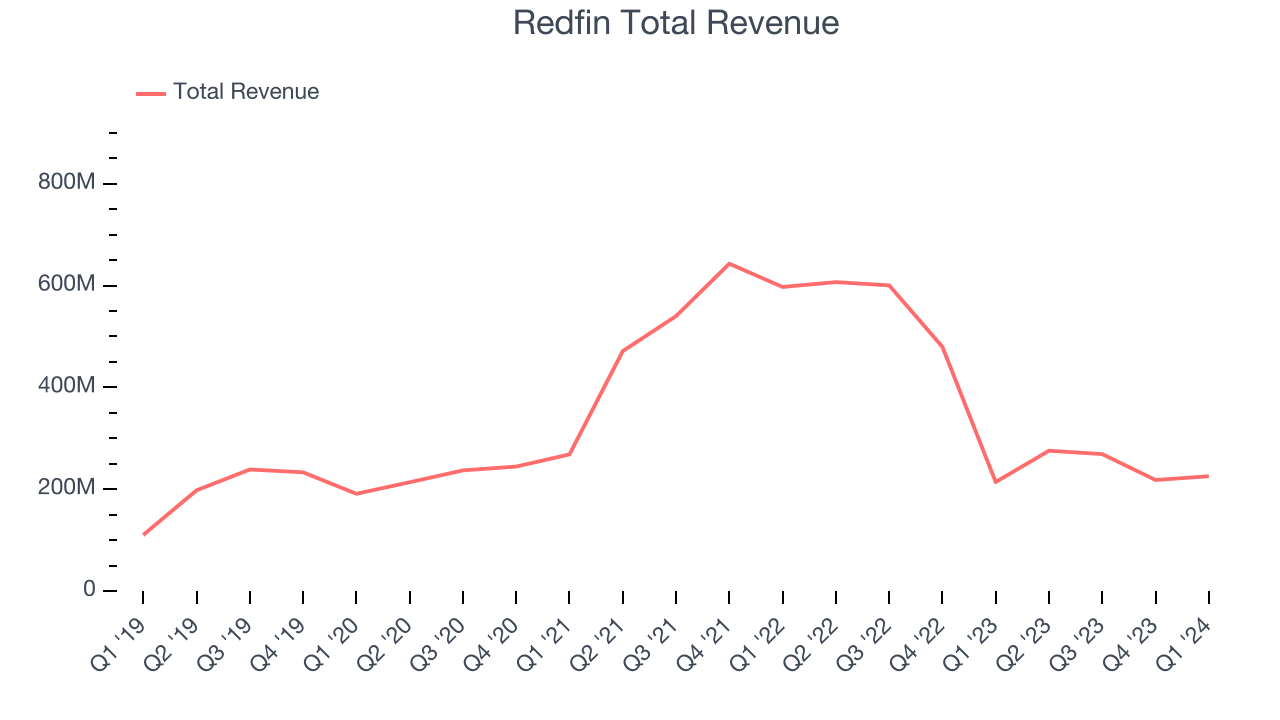

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Redfin's annualized revenue growth rate of 13.8% over the last five years was mediocre for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Redfin's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 33.8% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Redfin's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 33.8% over the last two years.

We can better understand the company's revenue dynamics by analyzing its number of brokerage transactions and partner transactions, which clocked in at 10,039 and 2,691 in the latest quarter. Over the last two years, Redfin's brokerage transactions averaged 21.1% year-on-year declines while its partner transactions averaged 7.9% year-on-year declines.

This quarter, Redfin reported solid year-on-year revenue growth of 5.3%, and its $225.5 million of revenue outperformed Wall Street's estimates by 3.6%. The company is guiding for revenue to rise 5.8% year on year to $291.5 million next quarter, improving from the 54.6% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 7.6% over the next 12 months, an acceleration from this quarter.

Operating Margin

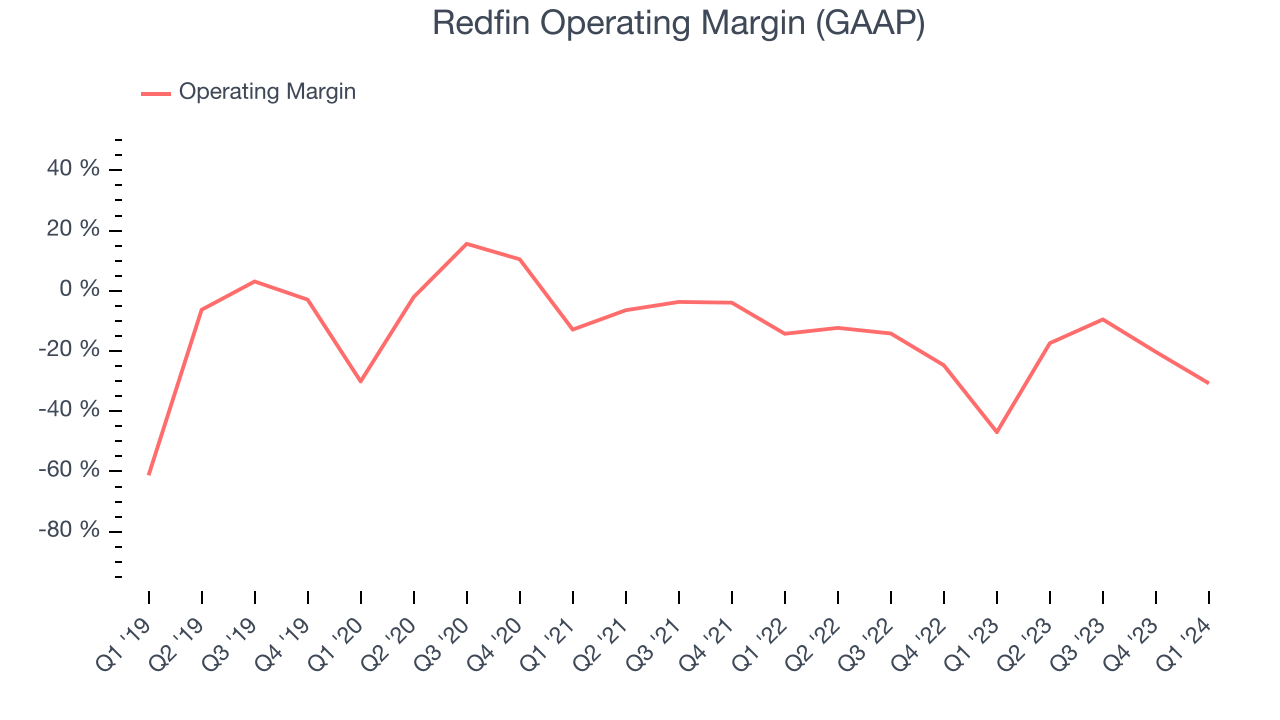

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Redfin's high expenses have contributed to an average operating margin of negative 19.6%.

In Q1, Redfin generated an operating profit margin of negative 30.7%, up 16.2 percentage points year on year.

Over the next 12 months, Wall Street expects Redfin to shrink its losses but remain unprofitable. Analysts are expecting the company’s LTM operating margin of negative 18.9% to rise to negative 11.3%.EPS

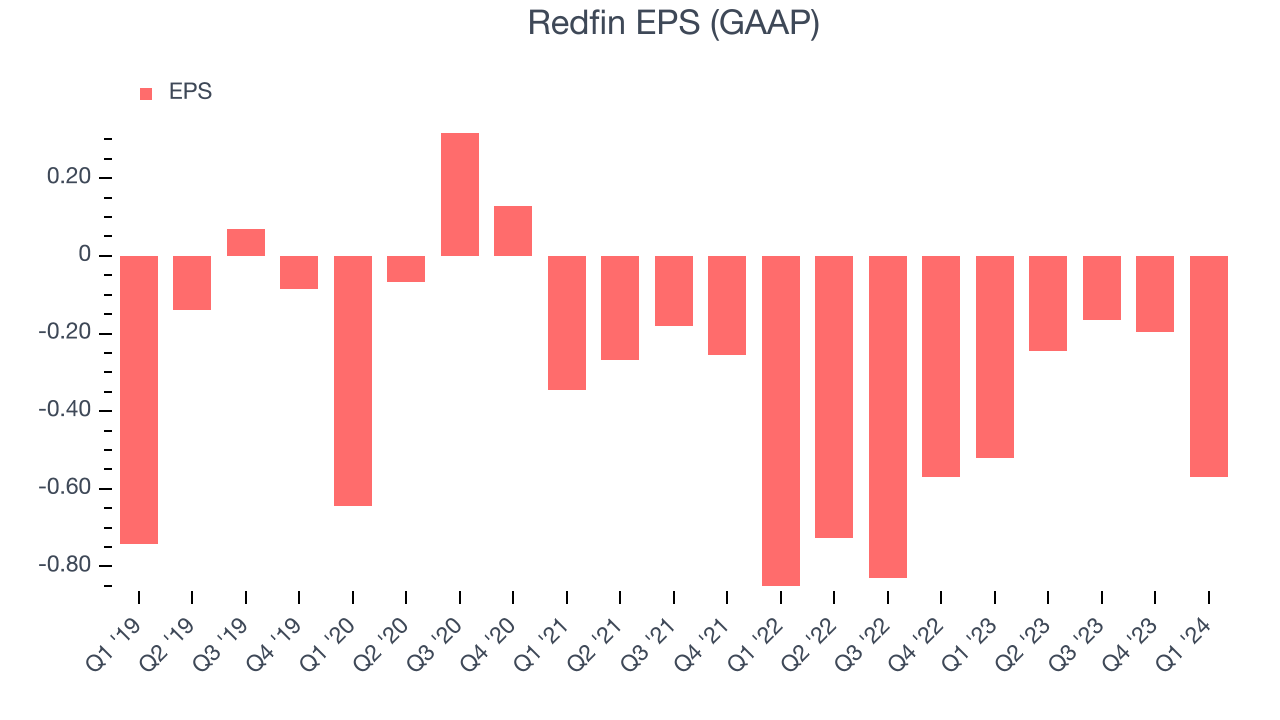

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Redfin's EPS dropped 46.2%, translating into 7.9% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, Redfin reported EPS at negative $0.57, down from negative $0.52 in the same quarter last year. Despite falling year on year, this print beat analysts' estimates by 1.8%. Over the next 12 months, Wall Street expects Redfin to perform poorly. Analysts are projecting its LTM EPS of negative $1.18 to tumble to negative $1.28.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

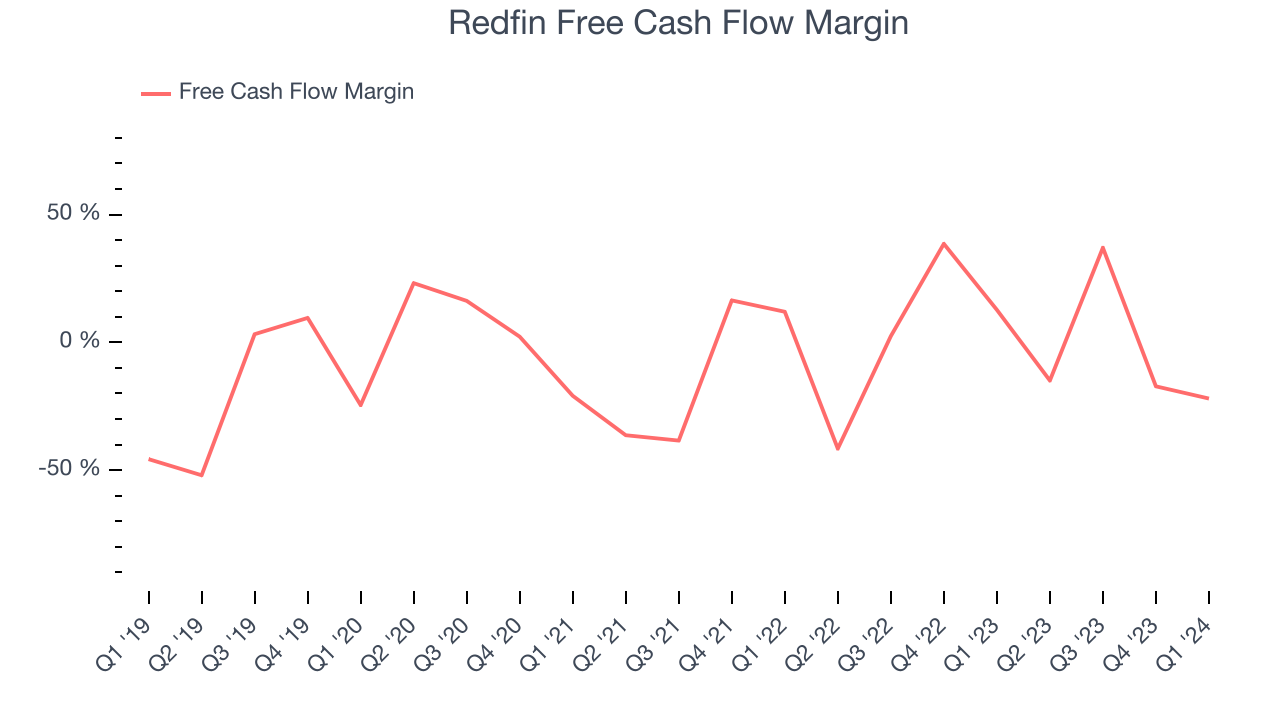

Over the last two years, Redfin's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 1.9%.

Redfin burned through $49.54 million of cash in Q1, equivalent to a negative 22% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

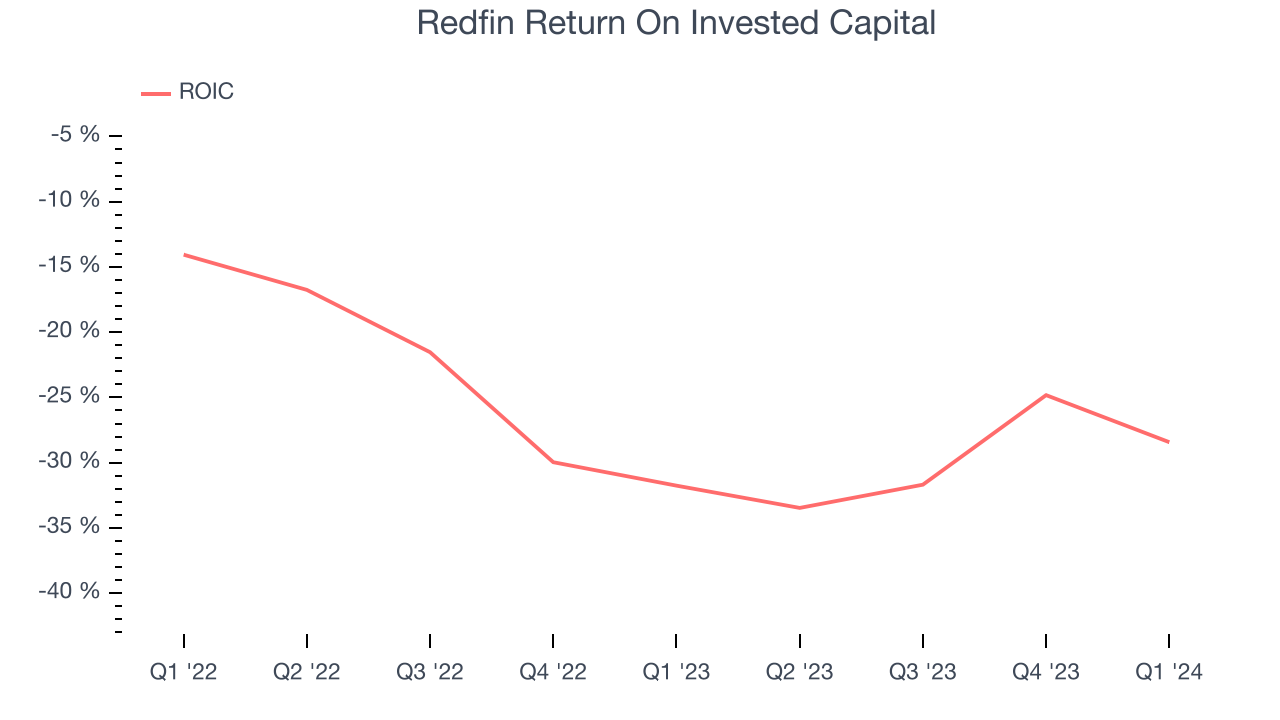

Redfin's five-year average return on invested capital was negative 24.7%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Redfin, which has $107.1 million of cash and $165.6 million of debt on its balance sheet, was unprofitable over the last 12 months. It posted negative $40.33 million of EBITDA, and as investors in high-quality companies, we seek to avoid indebted loss-making companies.

We implore our readers to do the same because credit agencies could downgrade Redfin if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Redfin can improve its profitability and remain cautious until then.

Key Takeaways from Redfin's Q1 Results

It was great to see Redfin's optimistic revenue guidance for next quarter, which exceeded analysts' expectations. We were also excited its revenue outperformed Wall Street's estimates. On the other hand, its operating margin missed and its number of brokerage transactions fell short of Wall Street's estimates. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 3.9% after reporting and currently trades at $6.62 per share.

Is Now The Time?

Redfin may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Redfin, we'll be cheering from the sidelines. Its revenue growth has been mediocre over the last five years, and analysts expect growth to deteriorate from here. On top of that, its number of partner transactions has been disappointing, and its declining EPS over the last five years makes it hard to trust.

While we've no doubt one can find things to like about Redfin, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $6.60 per share right before these results (compared to the current share price of $6.62).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.