Secondhand luxury marketplace The RealReal (NASDAQ: REAL) announced better-than-expected results in Q2 CY2024, with revenue up 10.8% year on year to $144.9 million. On the other hand, next quarter's revenue guidance of $138.5 million was less impressive, coming in 3.6% below analysts' estimates. It made a non-GAAP loss of $0.13 per share, improving from its loss of $0.41 per share in the same quarter last year.

Is now the time to buy The RealReal? Find out by accessing our full research report, it's free.

The RealReal (REAL) Q2 CY2024 Highlights:

- Revenue: $144.9 million vs analyst estimates of $139.9 million (3.6% beat)

- EPS (non-GAAP): -$0.13 vs analyst estimates of -$0.14

- Revenue Guidance for Q3 CY2024 is $138.5 million at the midpoint, below analyst estimates of $143.7 million

- The company dropped its revenue guidance for the full year from $592.5 million to $587.5 million at the midpoint, a 0.8% decrease

- Gross Margin (GAAP): 74.1%, up from 65.9% in the same quarter last year

- Adjusted EBITDA Margin: -1.2%, up from -17.1% in the same quarter last year

- Free Cash Flow was -$11.71 million compared to -$5.61 million in the previous quarter

- Market Capitalization: $328.5 million

“We continue to build on our progress and momentum,” said John Koryl, Chief Executive Officer of The RealReal.

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Sales Growth

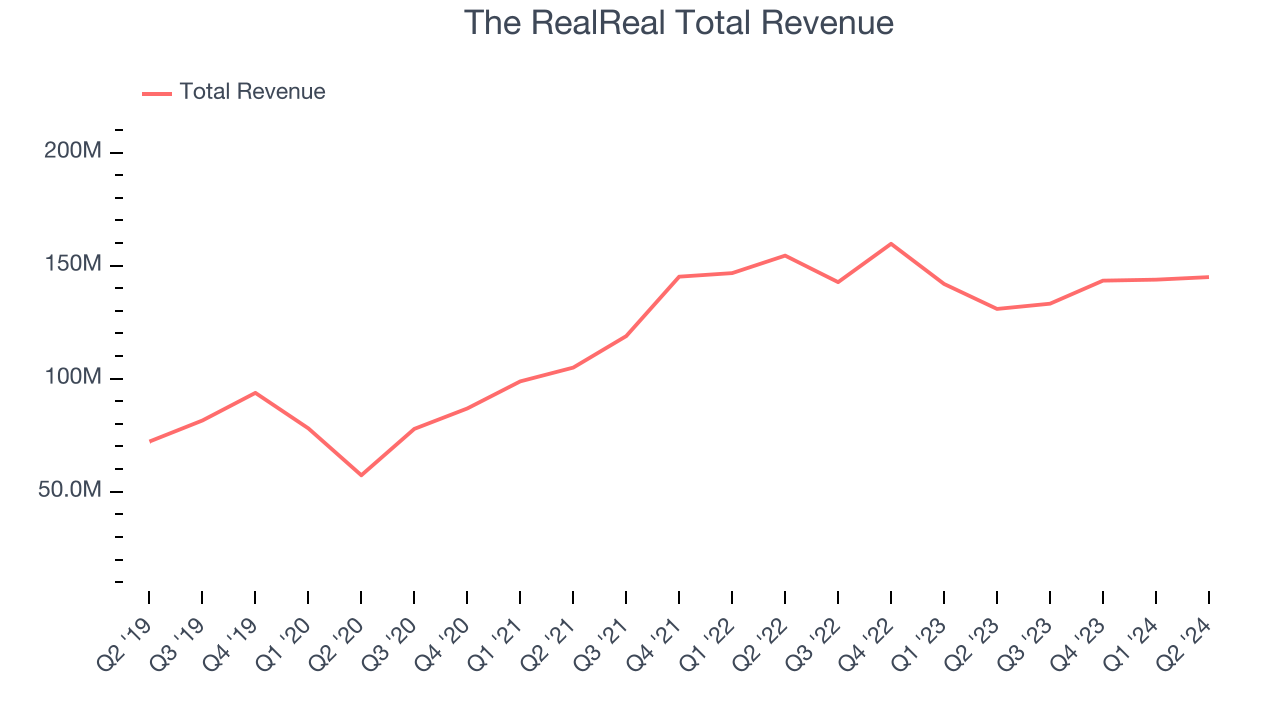

The RealReal's revenue growth over the last three years has been solid, averaging 18.5% annually. This quarter, The RealReal beat analysts' estimates but reported mediocre 10.8% year-on-year revenue growth.

Guidance for the next quarter indicates The RealReal is expecting revenue to grow 4% year on year to $138.5 million, improving from the 6.7% year-on-year decline it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 7.7% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Key Takeaways from The RealReal's Q2 Results

It was great to see The RealReal beat analysts' revenue expectations this quarter. Overall, this was a mediocre quarter for The RealReal. The stock traded down 9.4% to $2.80 immediately after reporting.

The RealReal may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.