Real estate technology company The Real Brokerage (NASDAQ:REAX) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 86.1% year on year to $200.7 million. It made a GAAP loss of $0.09 per share, down from its loss of $0.04 per share in the same quarter last year.

The Real Brokerage (REAX) Q1 CY2024 Highlights:

- Revenue: $200.7 million vs analyst estimates of $170.7 million (17.6% beat)

- EPS: -$0.09 vs analyst estimates of -$0.04 (-$0.05 miss)

- Gross Margin (GAAP): 10.3%, up from 10% in the same quarter last year

- Free Cash Flow of $21.38 million is up from -$6.04 million in the previous quarter

- Total Value of Completed Real Estate Transactions: $7.5 billion, up 88% year on year

- Market Capitalization: $782.6 million

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ:REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

Unlike traditional brokerages that often rely on physical office spaces, The Real Brokerage operates an online platform. This approach significantly reduces overhead costs and enables the company to offer more competitive commission splits to its agents with equity incentives, fostering a more collaborative and rewarding environment.

The company's platform provides agents with tools and resources to streamline their workflows, from marketing and lead generation to transaction management. These tools facilitate efficient communication and transaction processing, allowing agents to focus more on client service and less on administrative tasks.

The Real Brokerage's growth strategy has been marked by expansion across the United States and Canada. The company places a strong emphasis on providing continuous training, professional development opportunities, and supportive leadership to help agents grow their businesses.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The Real Brokerage’s primary competitors include eXp World (NASDAQ:EXPI), Redfin (NASDAQ:RDFN), Zillow (NASDAQ:ZG), and Compass (NYSE:COMP).Sales Growth

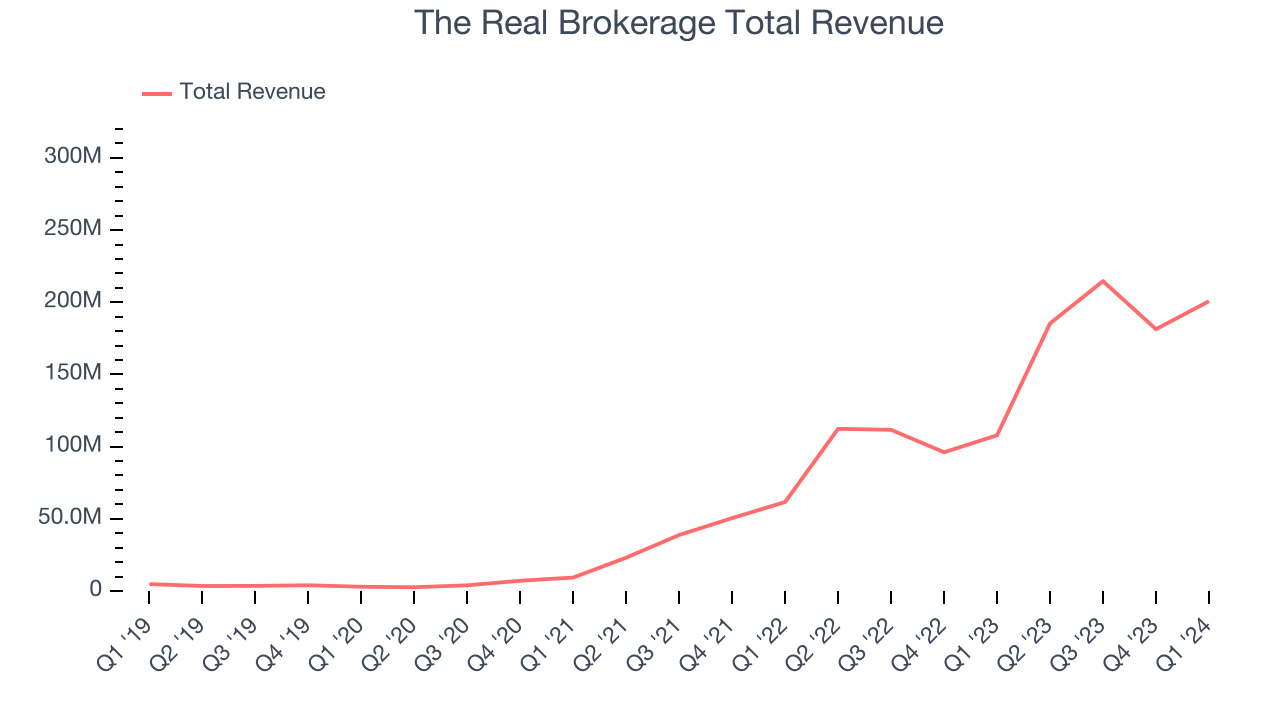

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. The Real Brokerage's annualized revenue growth rate of 174% over the last four years was incredible for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. The Real Brokerage's recent history shows its momentum has slowed as its annualized revenue growth of 112% over the last two years is below its four-year trend.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. The Real Brokerage's recent history shows its momentum has slowed as its annualized revenue growth of 112% over the last two years is below its four-year trend.

This quarter, The Real Brokerage reported magnificent year-on-year revenue growth of 86.1%, and its $200.7 million of revenue beat Wall Street's estimates by 17.6%. Looking ahead, Wall Street expects sales to grow 20.5% over the next 12 months, a deceleration from this quarter.

Operating Margin

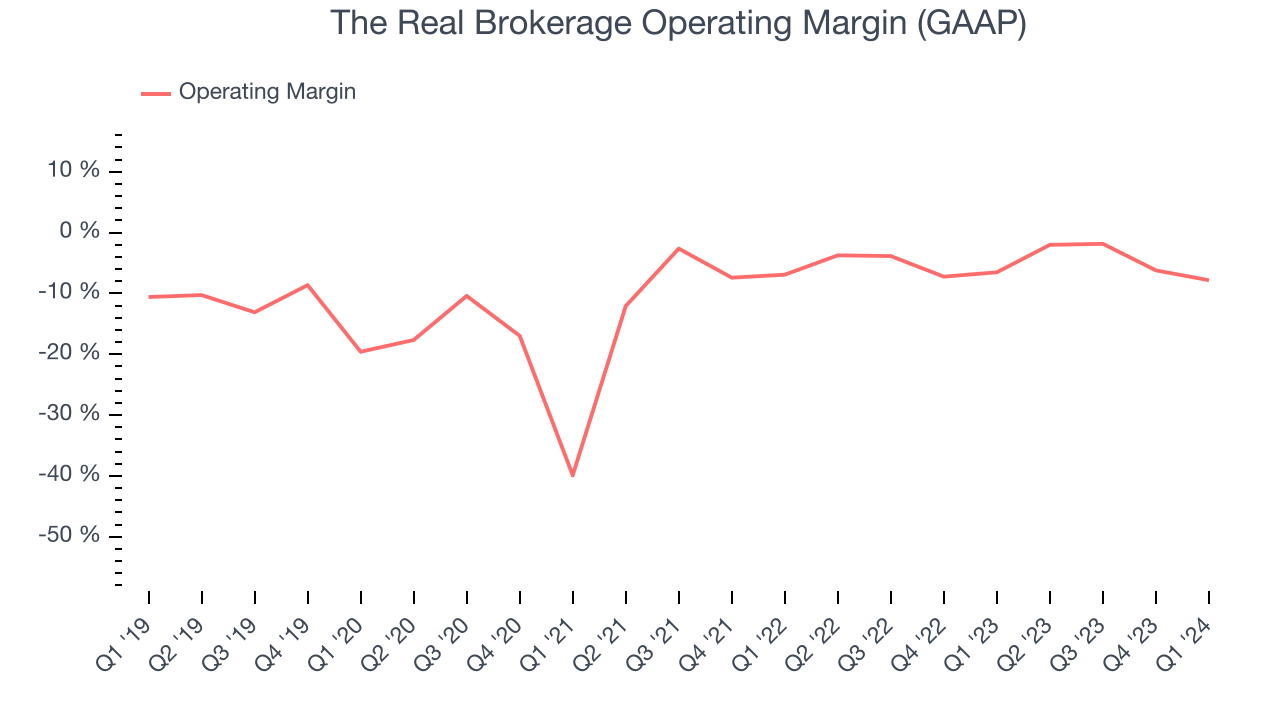

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, The Real Brokerage's high expenses have contributed to an average operating margin of negative 4.7%.

In Q1, The Real Brokerage generated an operating profit margin of negative 7.8%, down 1.3 percentage points year on year.

EPS

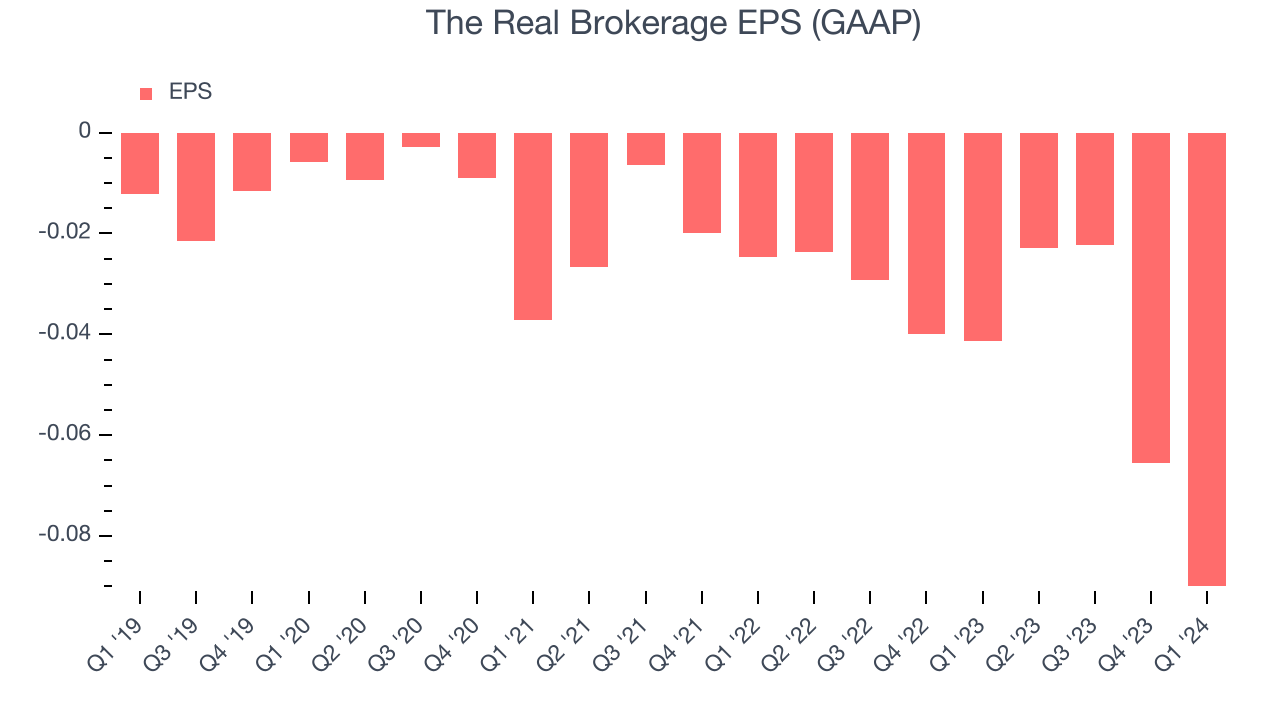

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last four years, The Real Brokerage's EPS dropped 357%, translating into 46.2% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, The Real Brokerage reported EPS at negative $0.09, down from negative $0.04 in the same quarter last year. This print unfortunately missed analysts' estimates. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but unfortunately, there is insufficient data.

Cash Is King

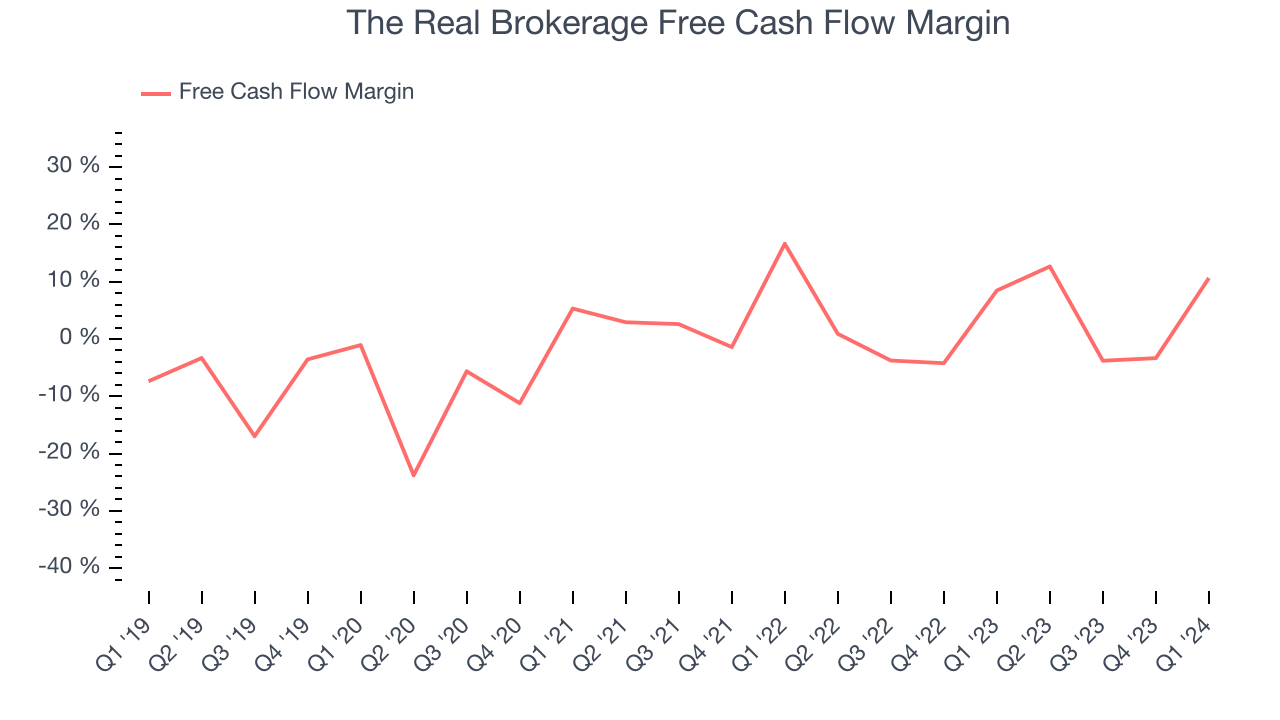

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, The Real Brokerage has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 2.7%, subpar for a consumer discretionary business.

The Real Brokerage's free cash flow came in at $21.38 million in Q1, equivalent to a 10.7% margin and up 134% year on year.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

The Real Brokerage is a well-capitalized company with $34.49 million of cash and no debt. This position gives The Real Brokerage the freedom to borrow money, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from The Real Brokerage's Q1 Results

We were impressed by how significantly The Real Brokerage blew past analysts' revenue expectations this quarter as its completed real estate transactions grew 88% year on year to $7.5 billion. On the other hand, its operating margin missed and its EPS fell short of Wall Street's estimates. Overall, this was a mediocre quarter for The Real Brokerage, but the market seems to be encouraged by its robust top-line growth, especially in a high-interest rate/tight housing market environment. The stock is up 5% after reporting and currently trades at $4.39 per share.

Is Now The Time?

The Real Brokerage may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of The Real Brokerage, we'll be cheering from the sidelines. Although its revenue growth has been exceptional over the last four years, its declining EPS over the last four years makes it hard to trust. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its operating margins reveal poor profitability compared to other consumer discretionary companies.

While we've no doubt one can find things to like about The Real Brokerage, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $4.25 per share right before these results (compared to the current share price of $4.39), implying they didn't see much short-term potential in The Real Brokerage.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.