Streaming TV platform Roku (NASDAQ: ROKU) missed analyst expectations in Q4 FY2021 quarter, with revenue up 33.1% year on year to $865.3 million. Guidance for the next quarter also missed analyst expectations with revenues guided to $720 million at the midpoint, or 4.76% below analyst estimates. Roku made a GAAP profit of $23.6 million, down on its profit of $67.3 million, in the same quarter last year.

Is now the time to buy Roku? Access our full analysis of the earnings results here, it's free.

Roku (ROKU) Q4 FY2021 Highlights:

- Revenue: $865.3 million vs analyst estimates of $894 million (3.21% miss)

- EPS (GAAP): $0.17

- Revenue guidance for Q1 2022 is $720 million at the midpoint, below analyst estimates of $756 million

- Free cash flow was negative $37.4 million, down from positive free cash flow of $94.6 million in previous quarter

- Gross Margin (GAAP): 43.8%, down from 47% same quarter last year

- Active Accounts: 60.1 million, up 8.9 million year on year

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to or what movie they watch, or finding a date, online consumer businesses today are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have increased usage and stickiness of many online consumer services.

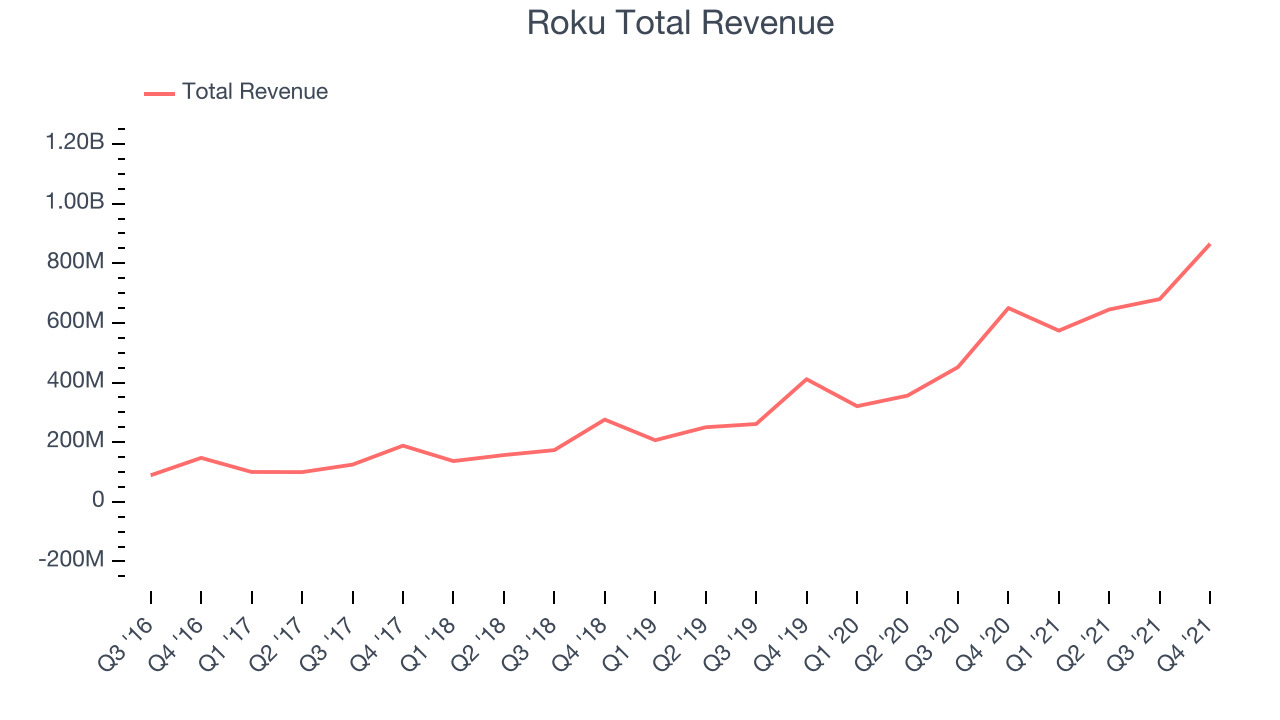

Sales Growth

Roku's revenue growth over the last three years has been exceptional, averaging 56.9% annually.

This quarter, Roku reported solid 33.1% year on year revenue growth, but this result fell short of what analysts were expecting.

Guidance for the next quarter indicates Roku is expecting revenue to grow 25.3% year on year to $720 million, slowing down from the 79% year-over-year increase in revenue the company had recorded in the same quarter last year.

There are others doing even better than Roku. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

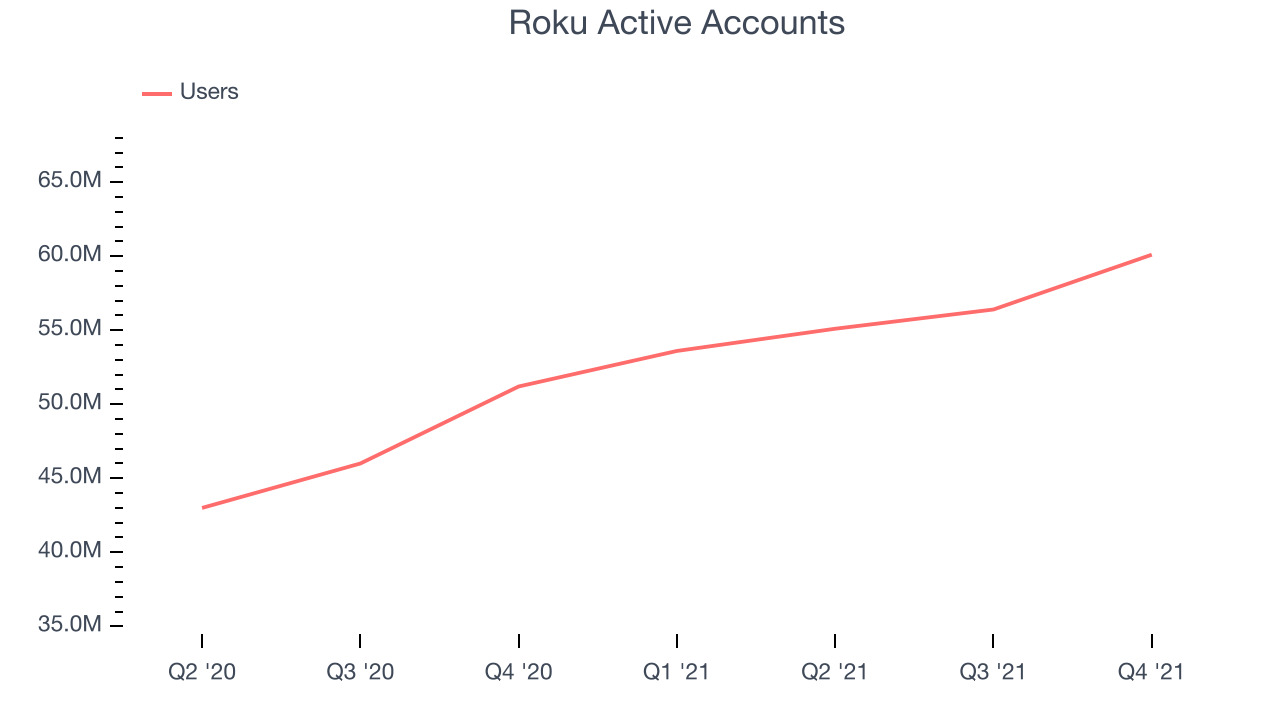

Usage Growth

As a subscription app, Roku generates revenue growth by growing both the subscriber numbers, and the total lifetime value of the average subscriber.

Over the last two years the number of Roku's monthly active users, a key usage metric for the company, grew 22.7% annually to 60.1 million users. This is a strong growth for a consumer internet company.

In Q4 the company added 8.9 million monthly active users, translating to a 17.3% growth year on year.

Key Takeaways from Roku's Q4 Results

Sporting a market capitalization of $21.6 billion, more than $2.14 billion in cash and with positive free cash flow over the last twelve months, we're confident that Roku has the resources it needs to pursue a high growth business strategy.

It was good to see Roku deliver strong user growth. On the other hand, it was unfortunate to see that it missed top of the line estimates and that the revenue guidance for the next quarter was also below analysts' expectations. Overall, it seems to us that this was a complicated quarter for Roku. The company is down 10.8% on the results and currently trades at $129.01 per share.

Roku may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.