Looking back on consumer internet stocks' Q1 earnings, we examine this quarters’ best and worst performers, including Roku (NASDAQ:ROKU) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 18 consumer internet stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1.71%, while on average next quarter revenue guidance was 2.69% under consensus. The whole tech sector has been facing a sell-off since late last year and consumer internet stocks have not been spared, with share price down 22.8% since earnings, on average.

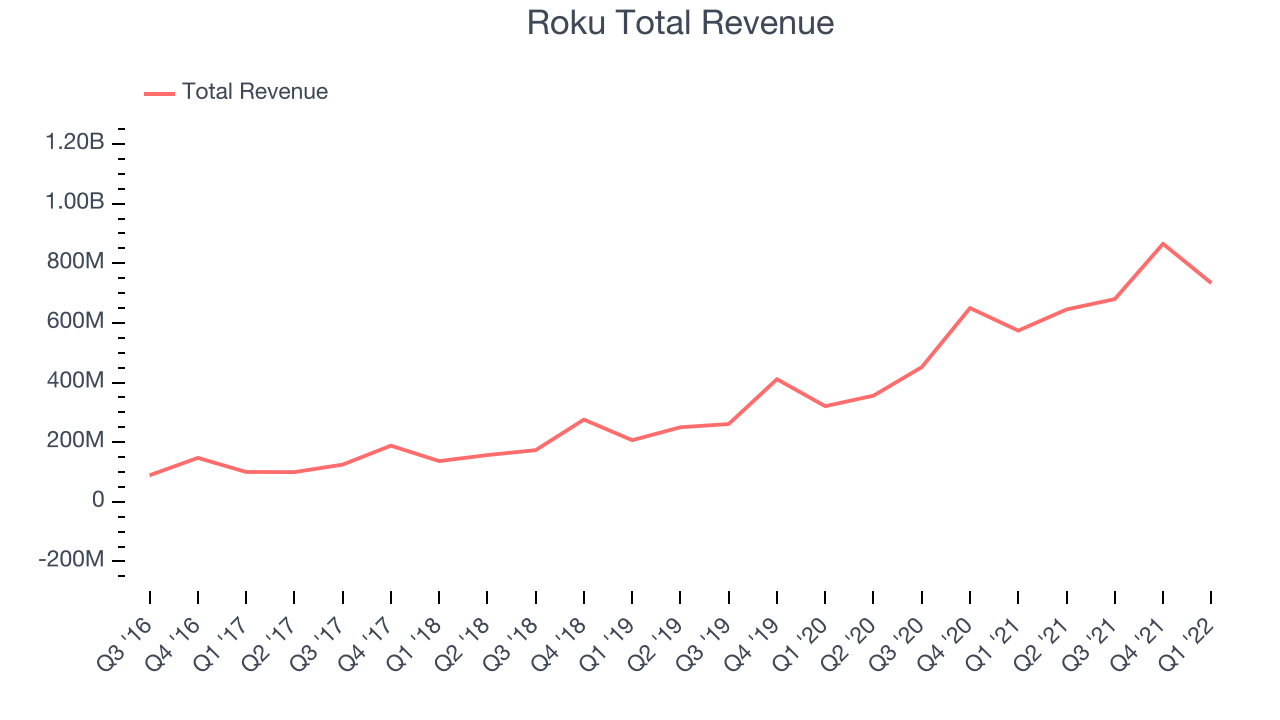

Roku (NASDAQ:ROKU)

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $733.6 million, up 27.7% year on year, beating analyst expectations by 2.1%. It was a mixed quarter for the company, with growing number of users but an underwhelming revenue guidance for the next quarter.

The stock is down 18.3% since the results and currently trades at $74.78.

Is now the time to buy Roku? Access our full analysis of the earnings results here, it's free.

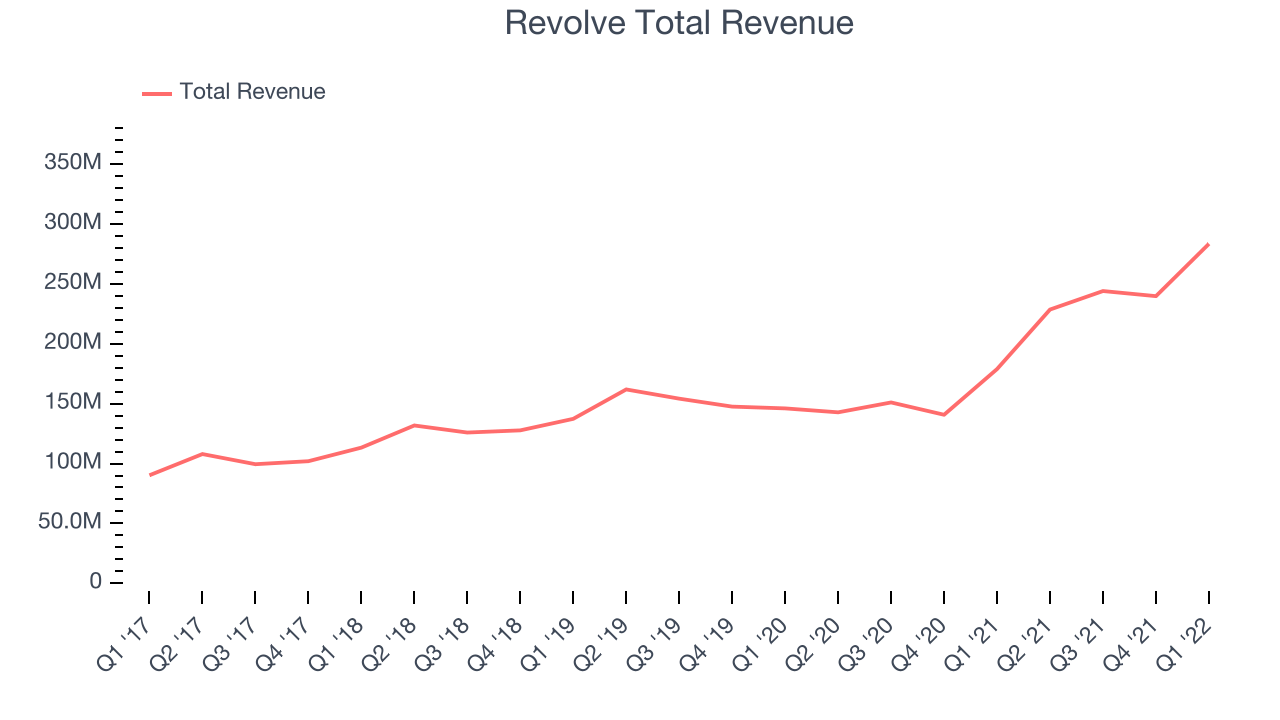

Best Q1: Revolve (NYSE:RVLV)

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve Group (NASDAQ: RVLV) is a next generation fashion retailer that leverages social media and a community of fashion influencers to drive its merchandising strategy.

Revolve reported revenues of $283.4 million, up 58.4% year on year, beating analyst expectations by 10.4%. Despite the stock dropping on the results, it was an incredible quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

The company reported 2.04 million active customers, up 38.1% year on year. The stock is down 33.5% since the results and currently trades at $28.96.

Is now the time to buy Revolve? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $536 million, down 18.8% year on year, missing analyst expectations by 6.49%. It was a weak quarter for the company, with a declining number of users and a slow revenue growth.

Overstock had the slowest revenue growth in the group. The company reported 7.4 million active buyers, down 25.3% year on year. The stock is down 6.33% since the results and currently trades at $29.40.

Read our full analysis of Overstock's results here.

Booking (NASDAQ:BKNG)

Formerly known as The Priceline Group, Booking Holdings (NASDAQ: BKNG) is the world’s largest online travel agency.

Booking reported revenues of $2.69 billion, up 136% year on year, beating analyst expectations by 6.61%. It was a stunning quarter for the company, with an exceptional revenue growth.

Booking scored the fastest revenue growth among the peers. The company reported 198 million nights booked, up 100% year on year. The stock is down 5.32% since the results and currently trades at $1,979.

Read our full, actionable report on Booking here, it's free.

Fiverr (NYSE:FVRR)

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $86.6 million, up 26.8% year on year, missing analyst expectations by 0.01%. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year below analysts' estimates.

Fiverr had the weakest full year guidance update among the peers. The company reported 4.2 million active buyers, up 10.5% year on year. The stock is down 16.2% since the results and currently trades at $34.21.

Read our full, actionable report on Fiverr here, it's free.

The author has no position in any of the stocks mentioned