Streaming TV platform Roku (NASDAQ: ROKU) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 19% year on year to $881.5 million. The company expects next quarter's revenue to be around $935 million, in line with analysts' estimates. It made a GAAP loss of $0.35 per share, improving from its loss of $1.38 per share in the same quarter last year.

Roku (ROKU) Q1 CY2024 Highlights:

- Revenue: $881.5 million vs analyst estimates of $850.3 million (3.7% beat)

- Adjusted EBITDA: $40.9 million vs analyst estimates of $2.8 million (big beat)

- EPS: -$0.35 vs analyst estimates of -$0.62 (43.4% beat)

- Revenue Guidance for Q2 CY2024 is $935 million at the midpoint, roughly in line with what analysts were expecting (adjusted EBITDA guidance for the same period solidly ahead)

- Gross Margin (GAAP): 44.1%, down from 45.6% in the same quarter last year

- Free Cash Flow of $46.01 million, up from $12.81 million in the previous quarter

- Active Accounts: 81.6 million, up 10 million year on year

- Market Capitalization: $8.87 billion

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku was originally founded by Anthony Wood in 2002 – the name Roku means six in Japanese – it was Wood’s sixth company he founded. He would eventually go to work at Netflix tasked with developing a Netflix branded streaming player. Days before launch, Netflix decided it couldn’t release its own hardware player that would put it into competition with other hardware distribution partners like Sony or Samsung, so instead it spun Roku out.

Roku’s streaming content operating system runs on either Roku TV models or as the OS on a range of smart TV models. The company owns and operates the Roku channel, a collection of content offered for free. Its business is built on scaling the number of active accounts to grow the number of hours of viewing throughout its ecosystem, and then monetize through a combination of advertising and commissions from sales of subscription services.

The Roku ecosystem offers benefits to each of its stakeholders, ranging from consumers, content publishers, advertisers, Roku TV brand partners, and other partners. Consumers can discover and access a wide variety of streaming content, content publishers have access to a large base of over 50 million customers, while advertisers can leverage Roku’s data to serve targeted and measurable ads to TV viewers who increasingly don’t watch TV through traditional channels.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Roku (NASDAQ: ROKU) competes for streaming TV subscribers with Apple (NASDAQ: AAPL), Alphabet (NASDAQ:GOOG.L), Amazon (NASDAQ:AMZN), and competes with Disney (NYSE:DIS), Netflix (NASDAQ: NFLX), AT&T’s Warner (NYSE:T) and ViacomCBS (NASDAQ: VIAC) for streaming audiences, and a range of streaming advertisers notably YouTube and Amazon.

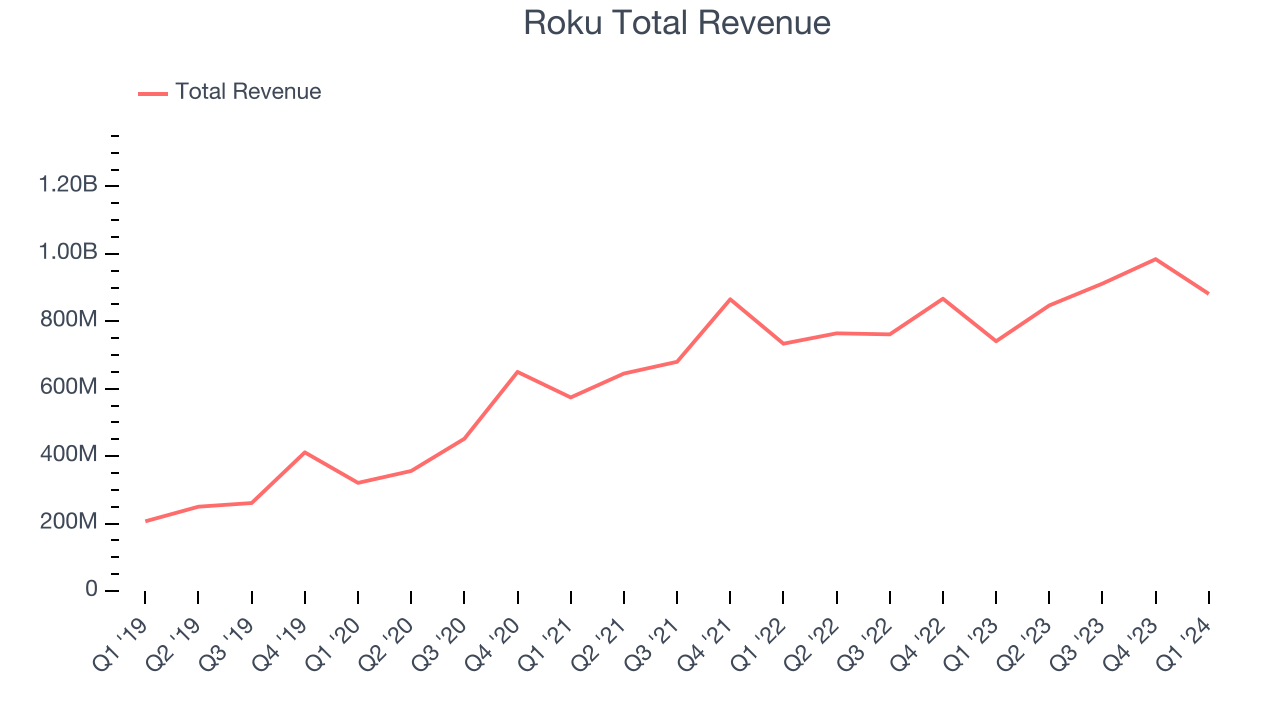

Sales Growth

Roku's revenue growth over the last three years has been strong, averaging 24% annually. This quarter, Roku beat analysts' estimates and reported 19% year-on-year revenue growth.

Guidance for the next quarter indicates Roku is expecting revenue to grow 10.4% year on year to $935 million, in line with the 10.8% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 10.2% over the next 12 months.

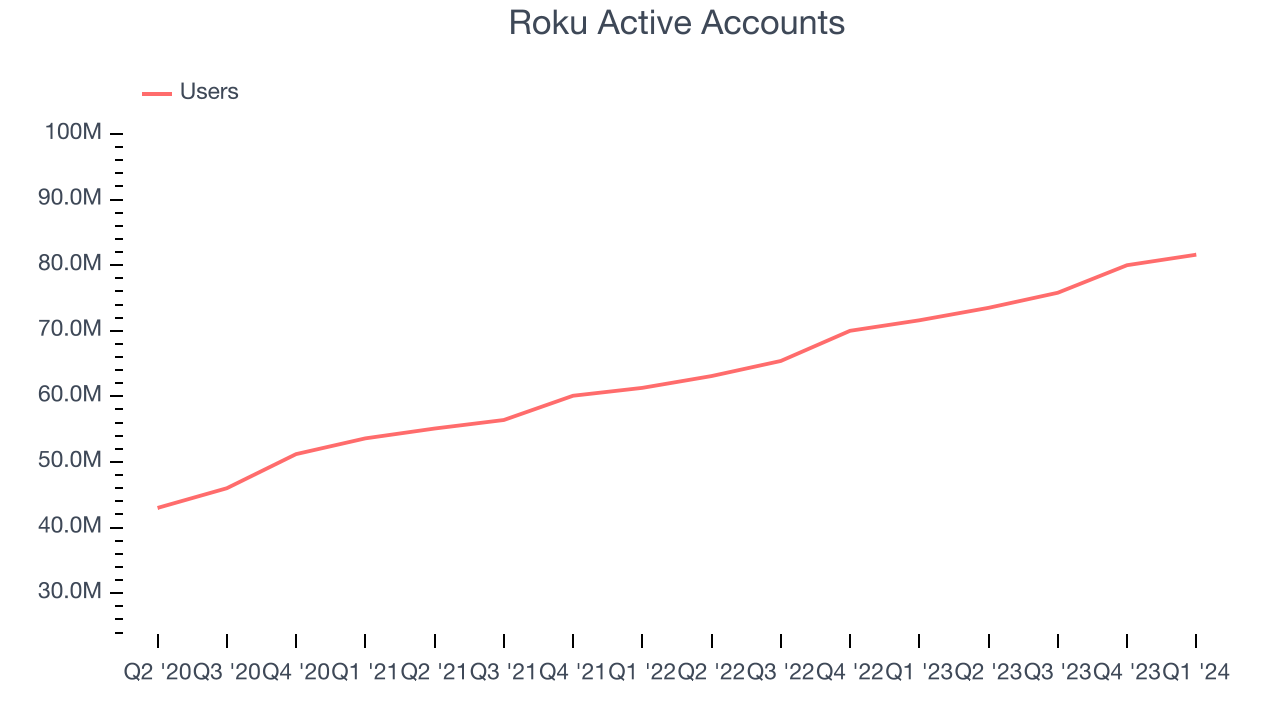

Usage Growth

As a subscription-based app, Roku generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Roku's monthly active users, a key performance metric for the company, grew 15.5% annually to 81.6 million. This is solid growth for a consumer internet company.

In Q1, Roku added 10 million monthly active users, translating into 14% year-on-year growth.

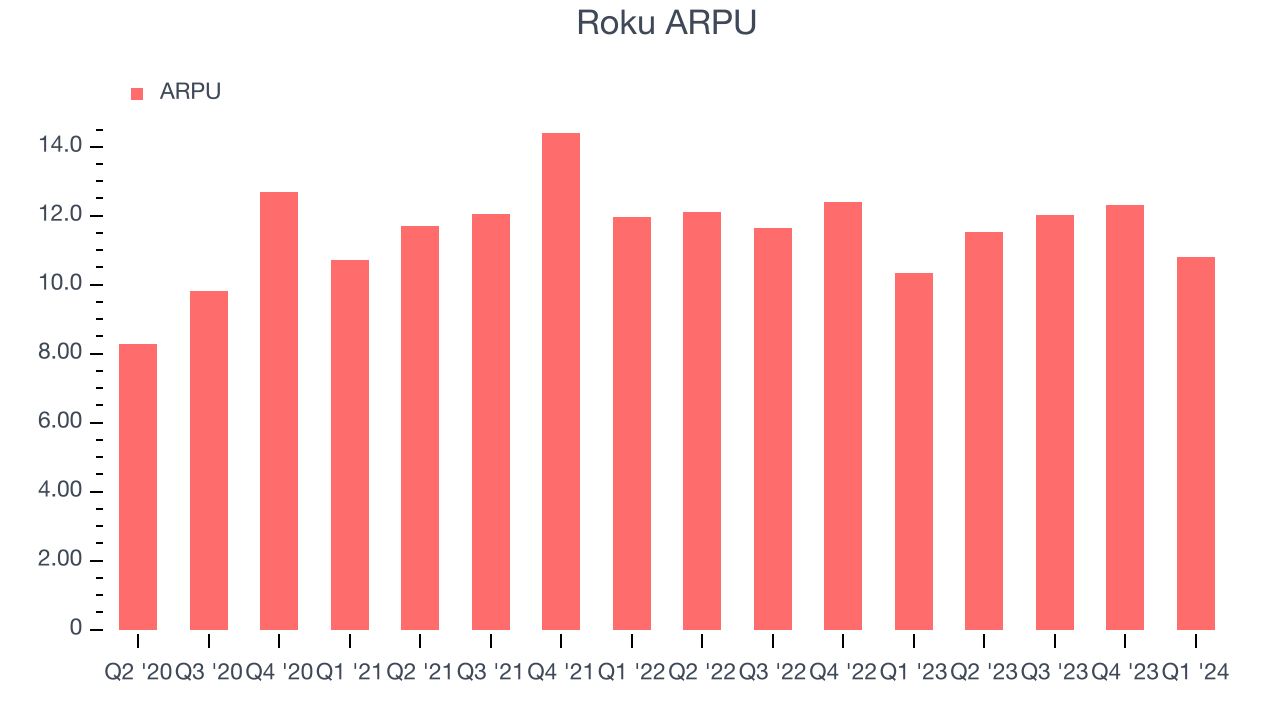

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Roku because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Roku's ARPU has declined over the last two years, averaging 3.2%. Although the company's users have continued to grow, it's lost its pricing power and will have to make improvements soon. This quarter, ARPU grew 4.4% year on year to $10.80 per user.

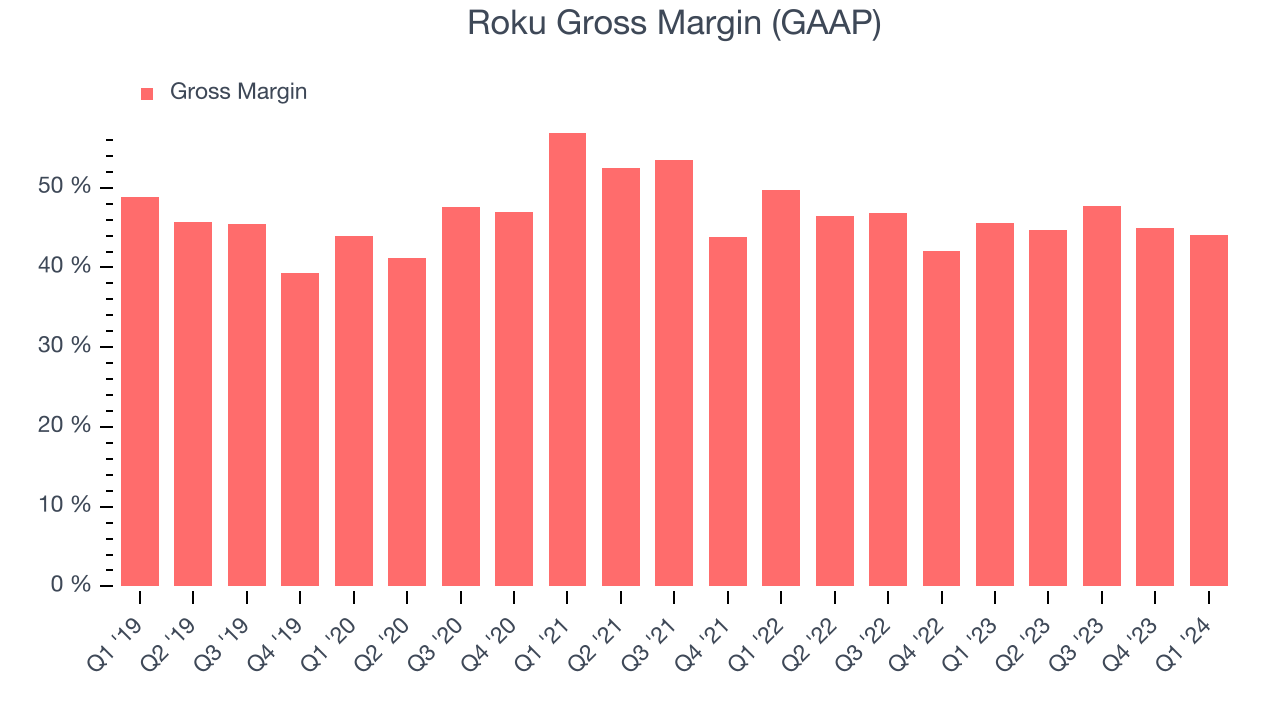

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Roku's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 44.1% this quarter, down 1.5 percentage points year on year.

For internet subscription businesses like Roku, these aforementioned costs typically include customer service, data center and infrastructure expenses, and royalties and other content-related costs if the company's offering includes features such as video or music services. After paying for these expenses, Roku had $0.44 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Roku's gross margins have been stable over the last 12 months, averaging 45.3%. Although its margins remain below the peer group average, the trend points to a stable pricing environment.

User Acquisition Efficiency

Consumer internet businesses like Roku grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It's expensive for Roku to acquire new users as the company has spent 54.5% of its gross profit on sales and marketing expenses over the last year. This relative inefficiency indicates that Roku's product offering can be easily replicated and that it must continue investing to maintain its growth trajectory.

Profitability & Free Cash Flow

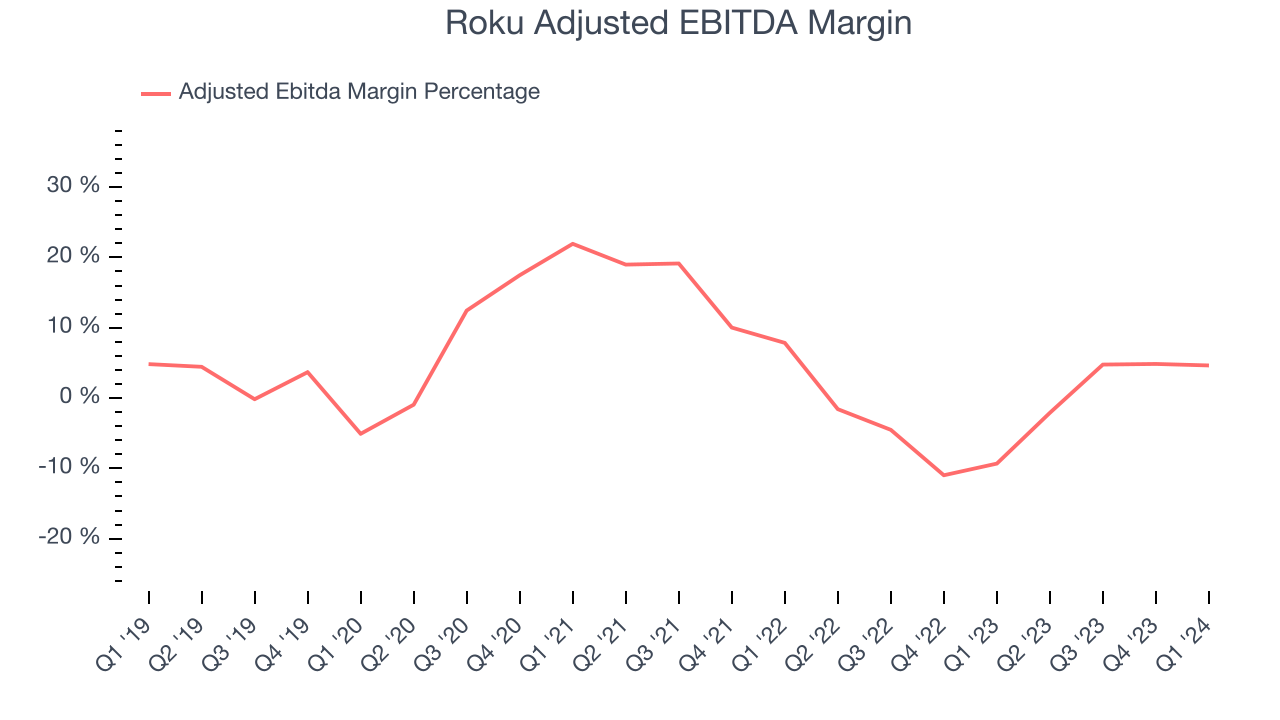

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Roku reported EBITDA of $40.87 million this quarter, resulting in a 4.6% margin. The company has also shown above-average profitability for a consumer internet business over the last four quarters, with average EBITDA margins of 3.2%.

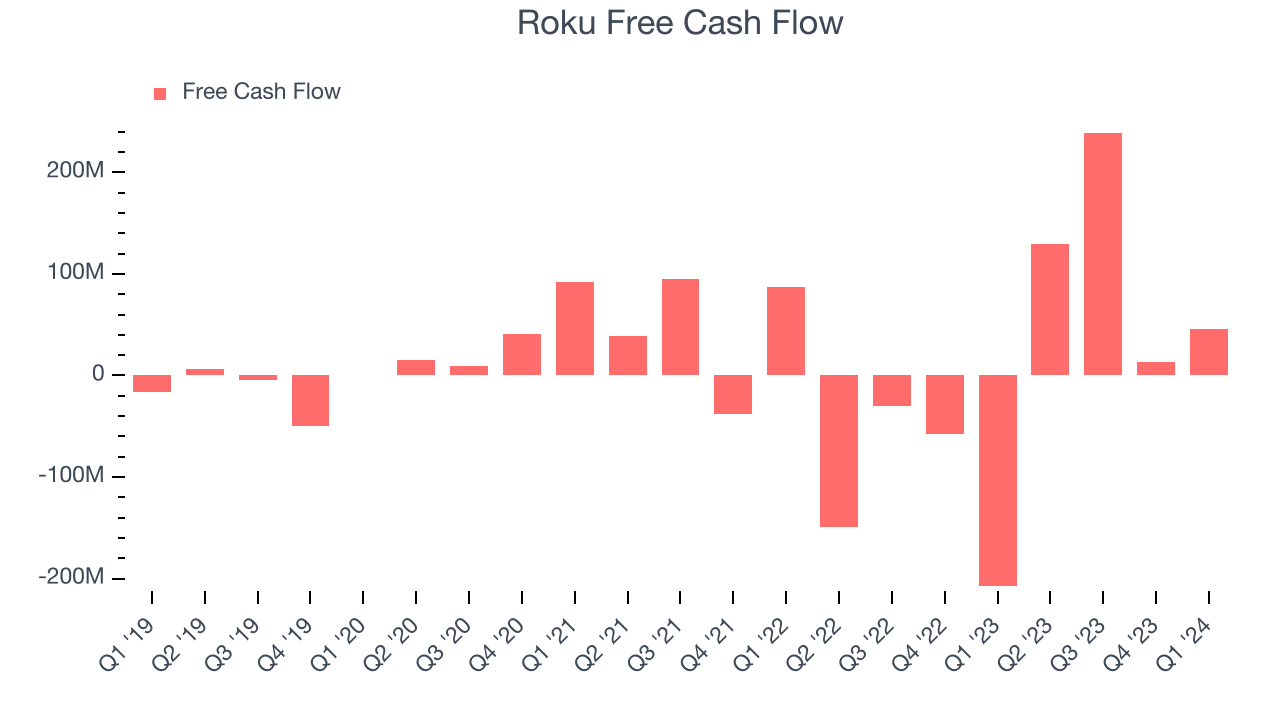

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Roku's free cash flow came in at $46.01 million in Q1, turning positive year on year.

Roku has generated $426.9 million in free cash flow over the last 12 months, a solid 11.8% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Roku is a well-capitalized company with $2.06 billion of cash and $568.6 million of debt, meaning it could pay back all its debt tomorrow and still have $1.49 billion of cash on its balance sheet. This net cash position gives Roku the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Roku's Q1 Results

It was great to see Roku beat analysts' revenue expectations and crush adjusted EBITDA expectations this quarter. We were also glad it expanded its number of users. Guidance was similar to the results themselves, with Q2 revenue guidance roughly in line while adjusted EBITDA guidance was well ahead. This signals that growth is roughly as expected but the profitability of that growth is outperforming. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 7.1% after reporting and currently trades at $67.26 per share.

Is Now The Time?

When considering an investment in Roku, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although Roku isn't a bad business, it probably wouldn't be one of our picks. Although its revenue growth has been good over the last three years, Wall Street expects growth to deteriorate from here. And while its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cash cushion, the downside is its ARPU has declined over the last two years. On top of that, its gross margins make it more difficult to reach positive operating profits compared to other consumer internet businesses.

Roku's price/gross profit ratio based on the next 12 months is 5.0x. We can find things to like about Roku and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder whether there might be better opportunities elsewhere.

Wall Street analysts covering the company had a one-year price target of $81.40 per share right before these results (compared to the current share price of $67.26).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.