Off-price retail company Ross Stores (NASDAQ:ROST) fell short of the market’s revenue expectations in Q3 CY2024 as sales rose 3% year on year to $5.07 billion. Its GAAP profit of $1.48 per share was 6% above analysts’ consensus estimates.

Is now the time to buy Ross Stores? Find out by accessing our full research report, it’s free.

Ross Stores (ROST) Q3 CY2024 Highlights:

- Revenue: $5.07 billion vs analyst estimates of $5.15 billion (3% year-on-year growth, 1.5% miss)

- Adjusted EPS: $1.48 vs analyst estimates of $1.40 (6% beat)

- Adjusted EBITDA: $833.2 million vs analyst estimates of $686.3 million (16.4% margin, 21.4% beat)

- EPS (GAAP) guidance for the full year is $6.14 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 11.9%, in line with the same quarter last year

- Free Cash Flow Margin: 6.6%, up from 5.5% in the same quarter last year

- Locations: 2,192 at quarter end, up from 2,112 in the same quarter last year

- Same-Store Sales rose 1% year on year (5% in the same quarter last year)

- Market Capitalization: $46.22 billion

Barbara Rentler, Chief Executive Officer, commented, “We are disappointed with our third quarter sales results as business slowed from the solid gains we reported in the first half of 2024. Although our low-to-moderate income customers continue to face persistently high costs on necessities pressuring their discretionary spending, we believe we should have better executed some of our merchandising initiatives. In addition, a combination of severe weather during the quarter from Hurricanes Helene and Milton, along with unseasonably warm temperatures, also negatively impacted our results.”

Company Overview

Selling excess inventory or overstocked items from other retailers, Ross Stores (NASDAQ:ROST) is an off-price concept that sells apparel and other goods at prices much lower than department stores.

Discount Retailer

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

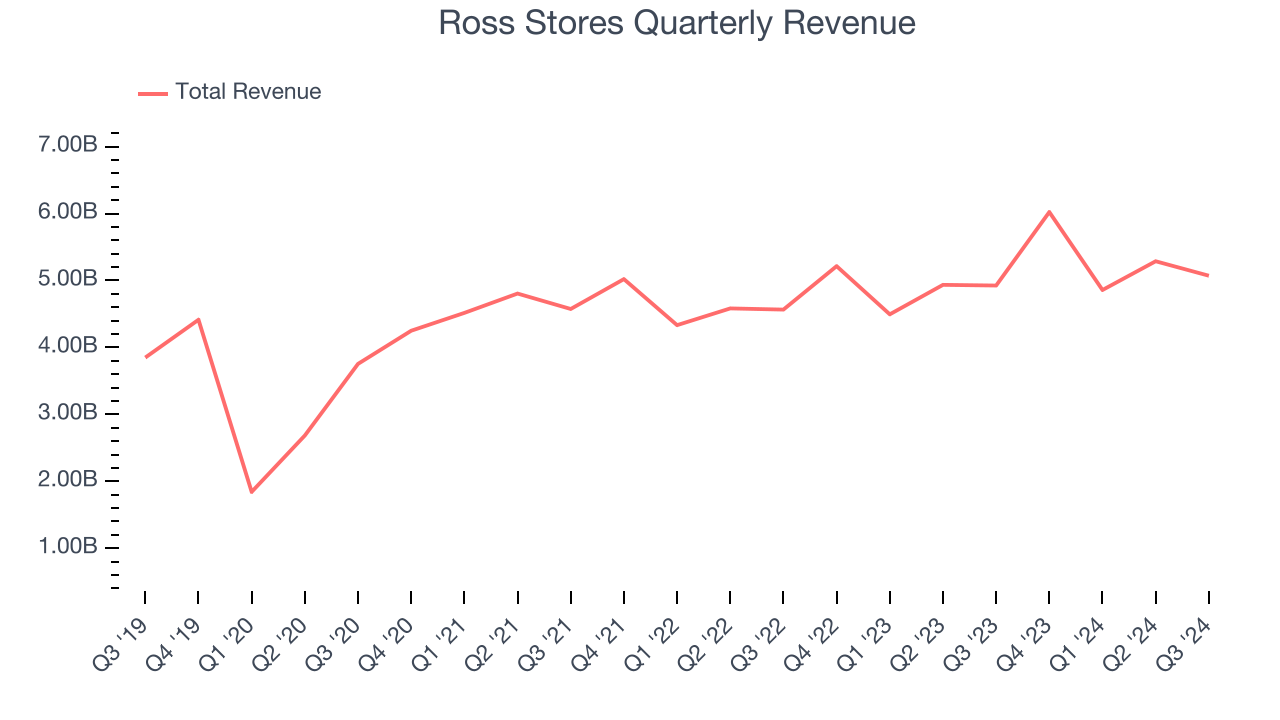

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Ross Stores is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because there is only so much real estate to build new stores, placing a ceiling on its growth.

As you can see below, Ross Stores’s 6.2% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was tepid, but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Ross Stores’s revenue grew by 3% year on year to $5.07 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a slight deceleration versus the last five years. We still think its growth trajectory is attractive and indicates the market sees success for its products. Some tapering/deceleration is natural given the magnitude of its revenue base.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

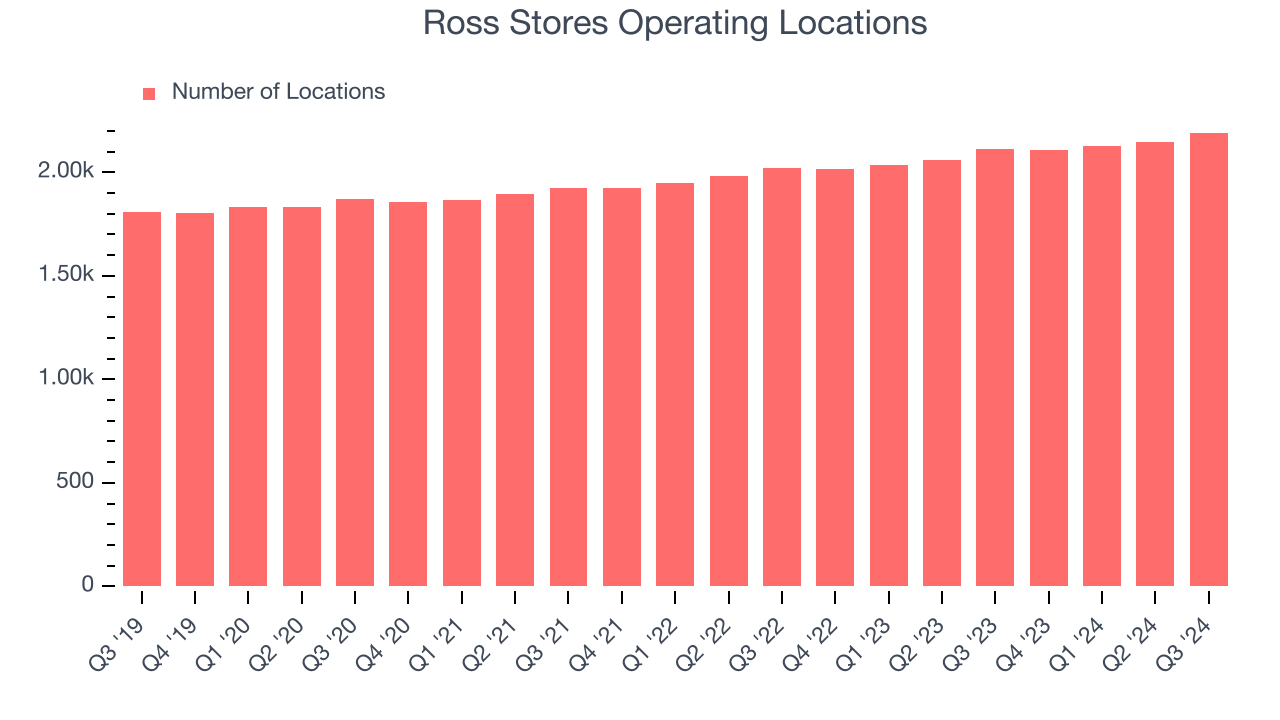

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Ross Stores sported 2,192 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip and averaged 4.4% annual growth, among the fastest in the consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

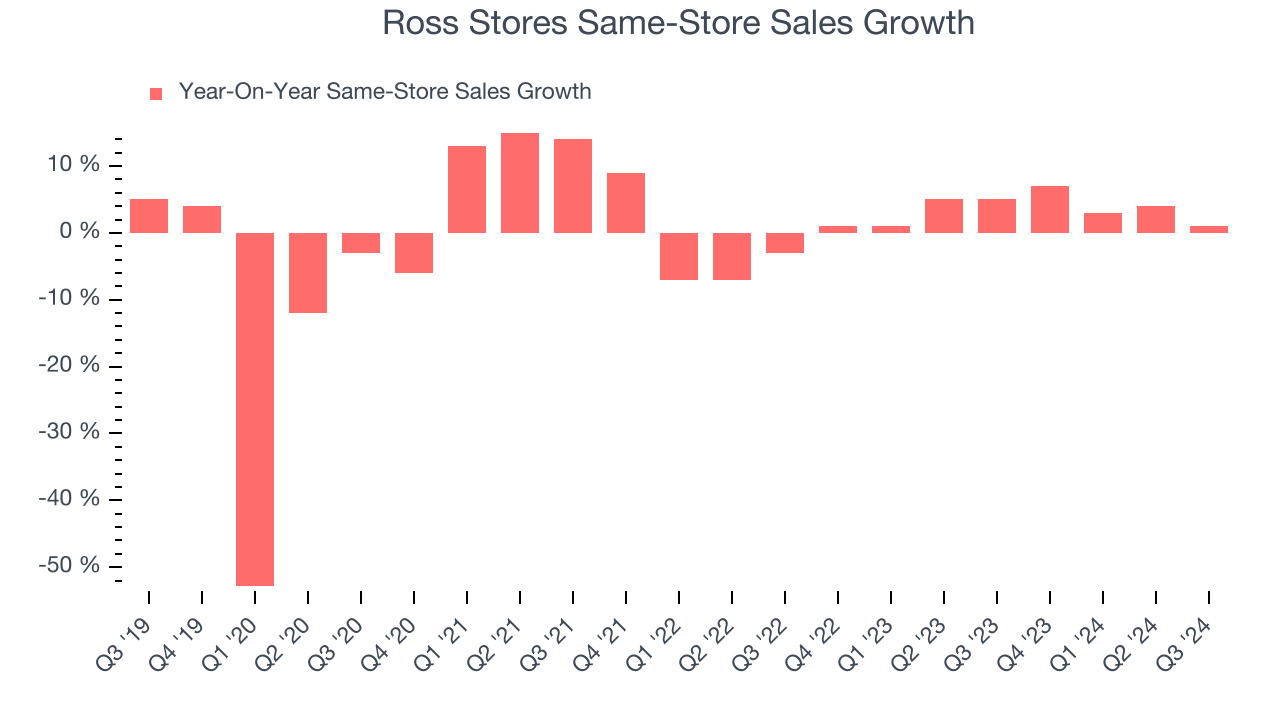

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Ross Stores’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.4% per year. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Ross Stores multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Ross Stores’s same-store sales rose 1% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Ross Stores can reaccelerate growth.

Key Takeaways from Ross Stores’s Q3 Results

We were impressed by how significantly Ross Stores blew past analysts’ EBITDA expectations this quarter. We were also glad its gross margin outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Overall, the results were mixed but still had some key positives. The stock traded up 5.2% to $150.39 immediately after reporting.

Big picture, is Ross Stores a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.