Off-price retail company Ross Stores (NASDAQ:ROST) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 15.5% year on year to $6.02 billion. It made a GAAP profit of $1.82 per share, improving from its profit of $1.30 per share in the same quarter last year.

Ross Stores (ROST) Q4 FY2023 Highlights:

- Revenue: $6.02 billion vs analyst estimates of $5.81 billion (3.6% beat)

- EPS: $1.82 vs analyst estimates of $1.65 (10.2% beat)

- Free Cash Flow of $726.4 million, down 25.9% from the same quarter last year

- Gross Margin (GAAP): 27.3%, down from 42.5% in the same quarter last year

- Same-Store Sales were up 7% year on year

- Store Locations: 2,109 at quarter end, increasing by 94 over the last 12 months

- Market Capitalization: $50.49 billion

Selling excess inventory or overstocked items from other retailers, Ross Stores (NASDAQ:ROST) is an off-price concept that sells apparel and other goods at prices much lower than department stores.

For example, if department store Nordstrom is left with a glut of spring dresses because of unusually cold weather, Nordstrom may sell those in bulk to Ross at pennies on the dollar rather than discount the items and try to sell them individually. This is often done to clear floor space for a new season or to avoid promotions that could damage future pricing power.

Because of Ross’ unique buying approach, shopping there is often a treasure hunt–what the consumer loses in reliable selection or the latest trends is made up for with very low prices. Prices of Ross goods can be as much as 50% lower than those of department stores. Over time, the company’s size and buying power has led to a more consistent selection of items from brands such as Nike, Calvin Klein, and Columbia to name a few.

The core customer is the value-conscious shopper who enjoys the thrill of the hunt. This customer is typically a middle-aged, middle-income woman. This customer is willing to spend more time going through less organized racks and shopping exclusively in person–since Ross has a very limited online presence–in exchange for meaningful discounts.

Off-Price Apparel and Home Goods Retailer

Off-price retailers, which sell name-brand goods at major discounts because of their unique purchasing and procurement strategies, understand that everyone loves a good deal. Specifically, these companies buy excess inventory and overstocks from manufacturers and other retailers so they can turn around and offer these products at super competitive prices. Despite the unique draw lure of discounts, these off-price retailers must also contend with the secular headwinds of online penetration and stalling retail foot traffic in places like suburban shopping centers.

Off-price and discount retail competitors include TJX (NYSE:TJX), Burlington Stores (NYSE:BURL), and Ollie’s Bargain Outlet (NASDAQ:OLLI).Sales Growth

Ross Stores is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

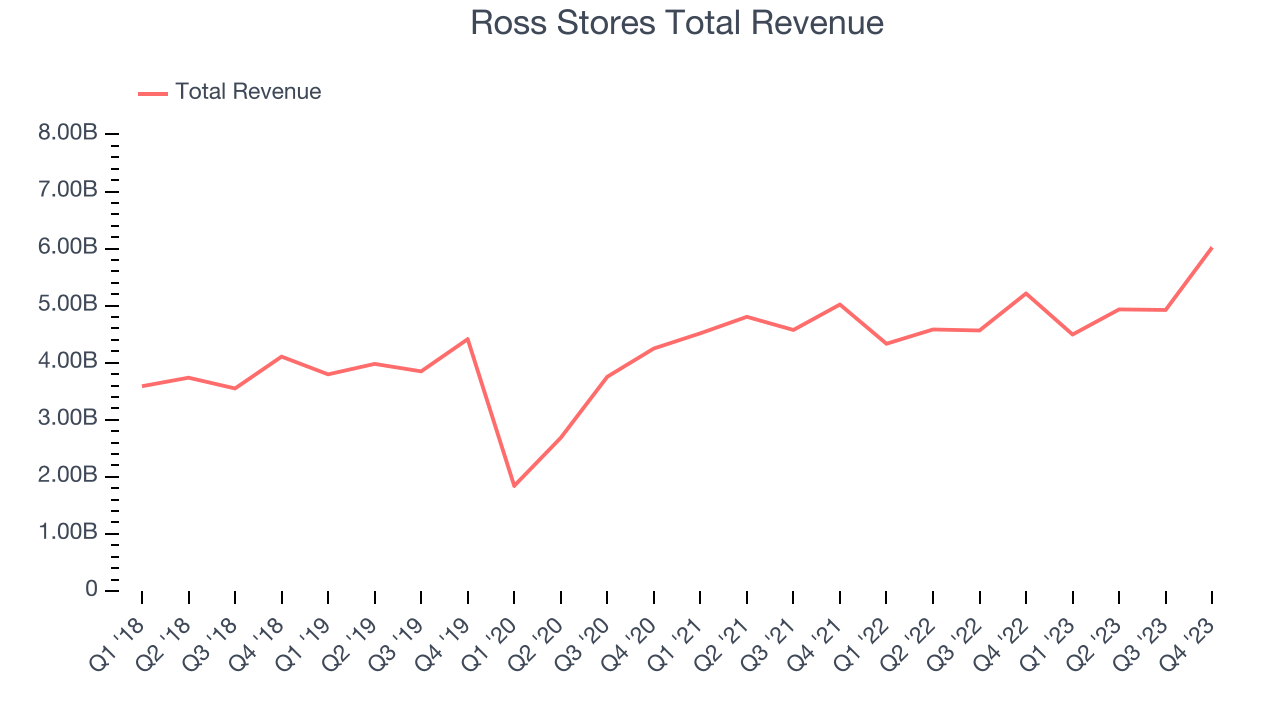

As you can see below, the company's annualized revenue growth rate of 6.2% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new stores and grew sales at existing, established stores.

This quarter, Ross Stores reported robust year-on-year revenue growth of 15.5%, and its $6.02 billion in revenue exceeded Wall Street's estimates by 3.6%. Looking ahead, Wall Street expects sales to grow 3.8% over the next 12 months, a deceleration from this quarter.

Number of Stores

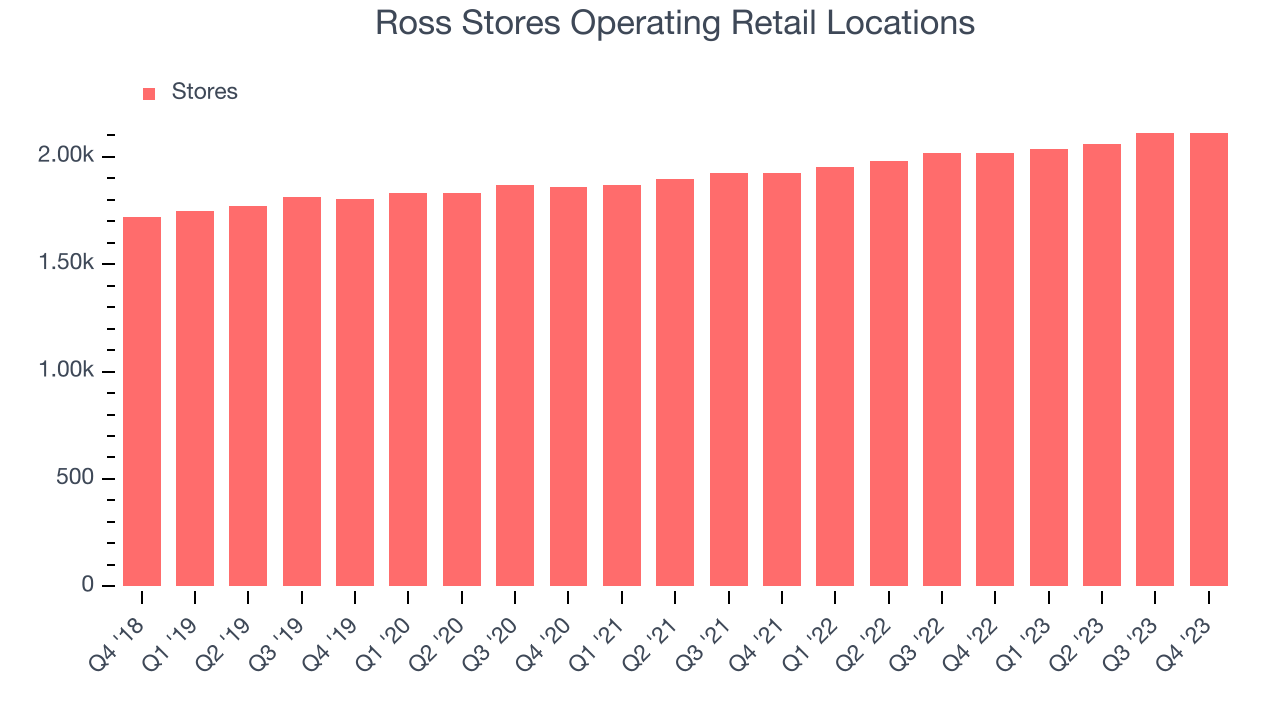

The number of stores a retailer operates is a major determinant of how much it can sell, and its growth is a critical driver of how quickly company-level sales can grow.

When a retailer like Ross Stores is opening new stores, it usually means it's investing for growth because demand is greater than supply. Ross Stores's store count increased by 94 locations, or 4.7%, over the last 12 months to 2,109 total retail locations in the most recently reported quarter.

Over the last two years, the company has generally opened new stores and averaged 4.5% annual growth in its physical footprint, which is decent and on par with the broader sector. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

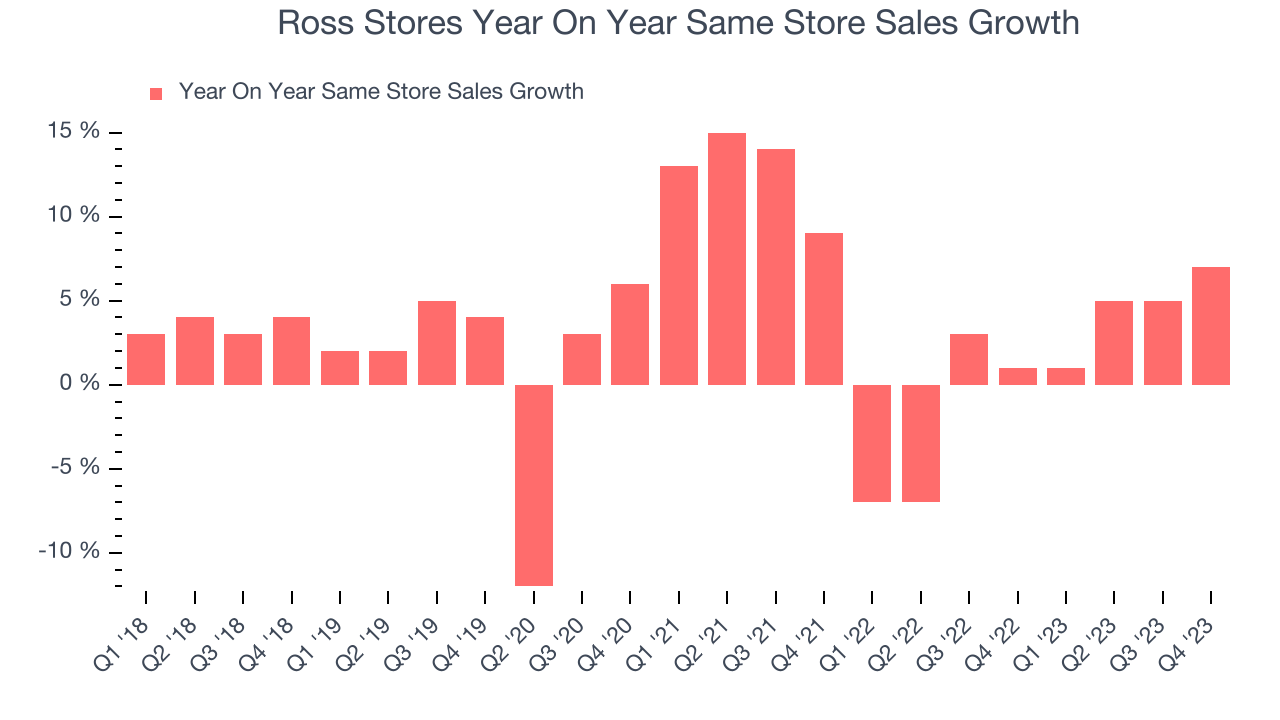

Ross Stores's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, Ross Stores's same-store sales rose 7% year on year. This growth was an acceleration from the 1% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Gross Margin & Pricing Power

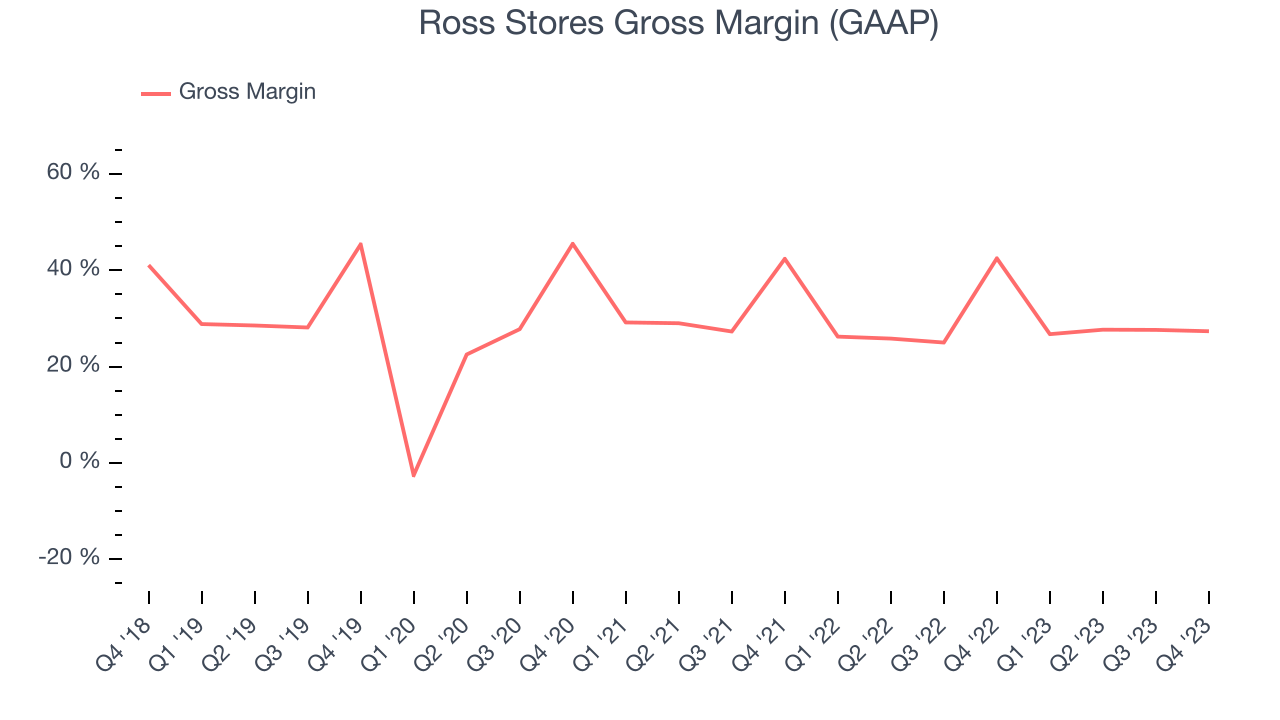

Ross Stores has poor unit economics for a retailer, leaving it with little room for error if things go awry. As you can see below, it's averaged a 28.8% gross margin over the last two years. This means the company makes $0.29 for every $1 in revenue before accounting for its operating expenses.

Ross Stores produced a 27.3% gross profit margin in Q4, marking a 15.1 percentage point decrease from 42.5% in the same quarter last year. Although the company could've performed better, we care more about its long-term trends rather than just one quarter. Additionally, a retailer's gross margin can often change due to factors outside its control, such as product discounting and dynamic input costs (think distribution and freight expenses to move goods). We'll keep a close eye on this.

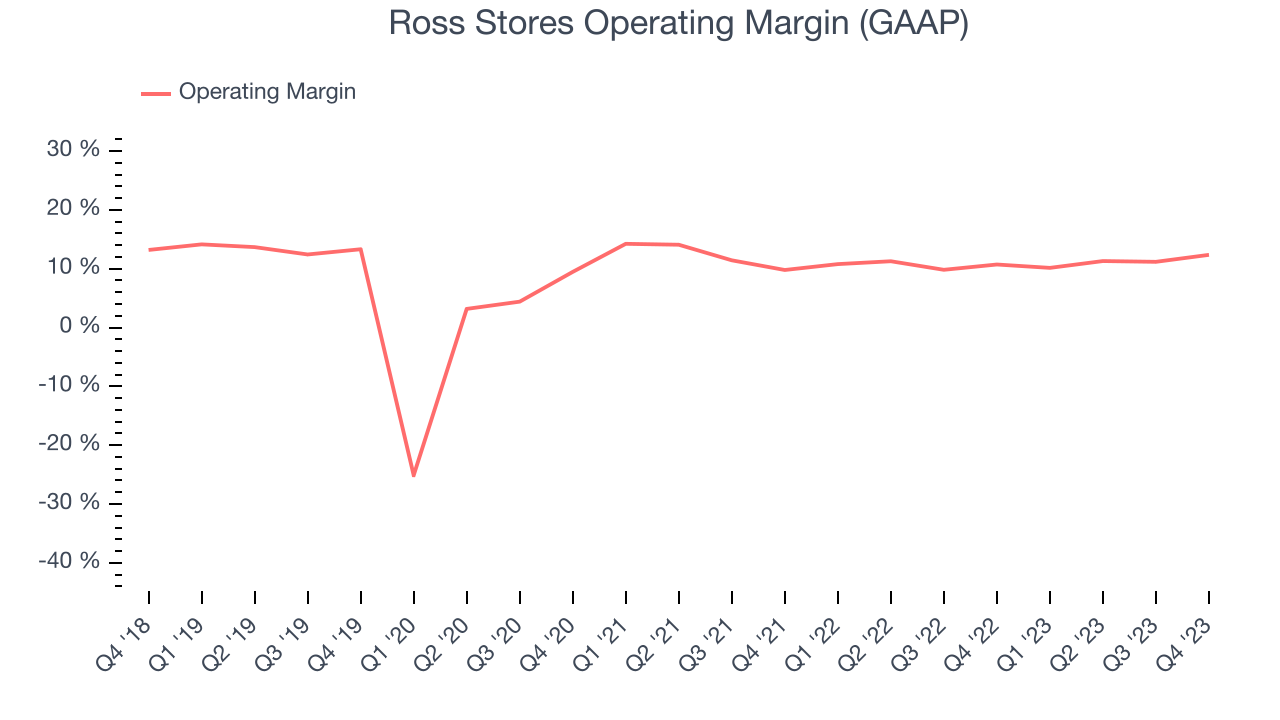

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Ross Stores generated an operating profit margin of 12.4%, up 1.6 percentage points year on year. This increase was encouraging, and since the company's gross margin actually decreased, we can assume the rise was driven by a magnificent improvement in cost controls or operating leverage on fixed costs.

Zooming out, Ross Stores has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer retail business, producing an average operating margin of 11%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. The company's operating profitability was particularly impressive because of its low gross margin. This margin is mostly a factor of what Ross Stores sells and takes fundamental shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Ross Stores).

Zooming out, Ross Stores has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer retail business, producing an average operating margin of 11%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. The company's operating profitability was particularly impressive because of its low gross margin. This margin is mostly a factor of what Ross Stores sells and takes fundamental shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Ross Stores).EPS

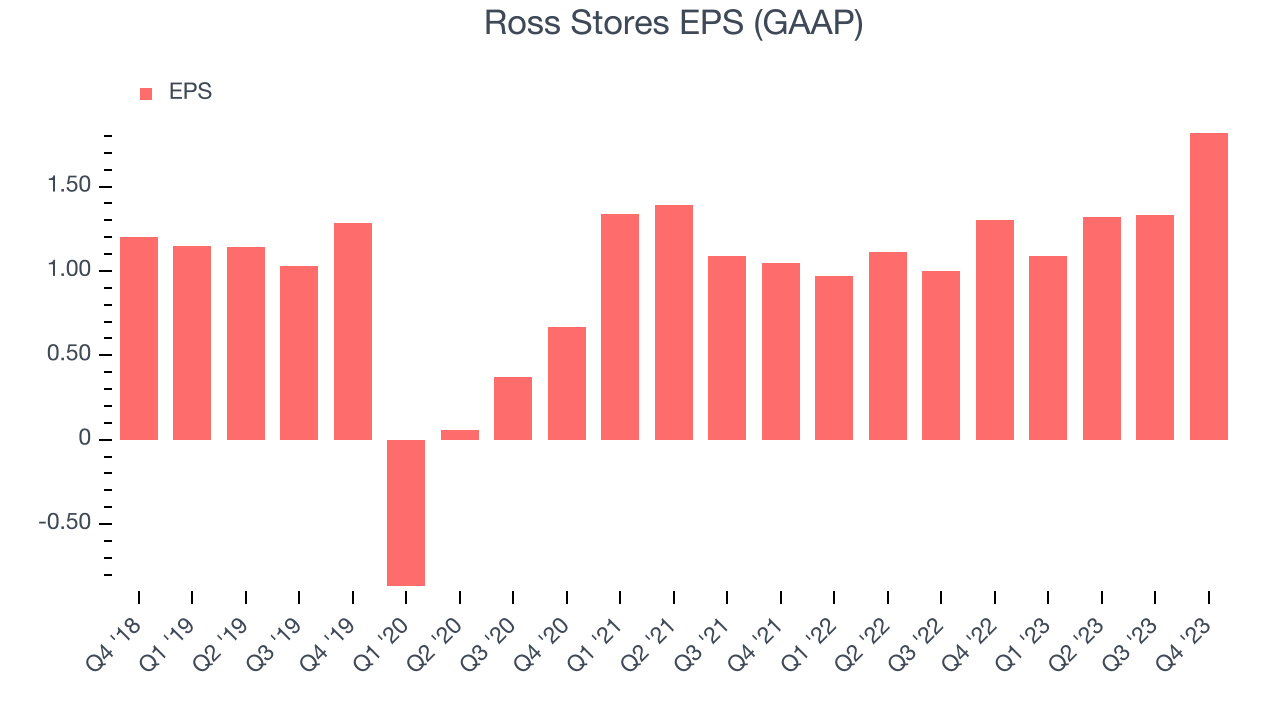

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, Ross Stores reported EPS at $1.82, up from $1.30 in the same quarter a year ago. This print beat Wall Street's estimates by 10.2%.

Between FY2019 and FY2023, Ross Stores's adjusted diluted EPS grew 20.8%, translating into an unimpressive 4.8% compounded annual growth rate.

On the bright side, Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 6.2% year-on-year increase in EPS.

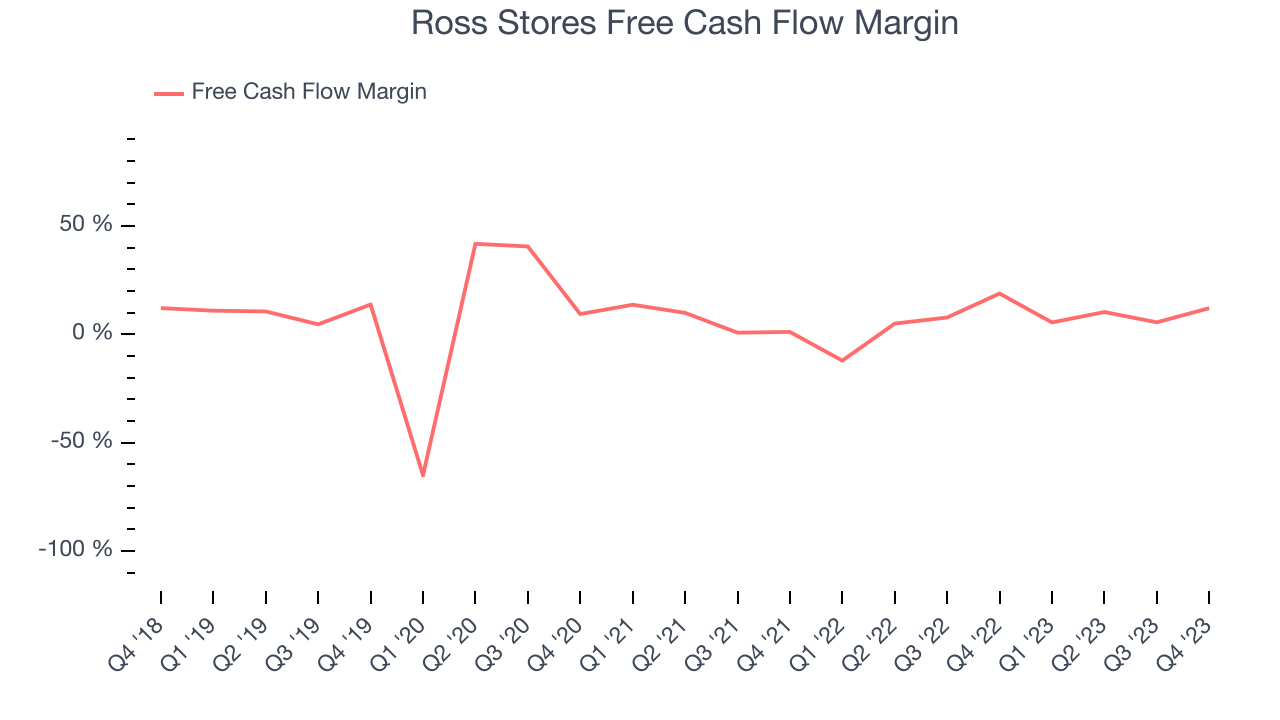

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

Ross Stores's free cash flow came in at $726.4 million in Q4, down 25.9% year on year. This result represents a 12.1% margin.

Over the last two years, Ross Stores has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 7.1%, quite impressive for a consumer retail business. Furthermore, its margin has averaged year-on-year increases of 3.1 percentage points. This likely pleases the company's investors.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Ross Stores hasn't been the highest-quality company lately, it historically did a wonderful job investing in profitable business initiatives. Its five-year average ROIC was 26.5%, splendid for a retail business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Ross Stores's ROIC averaged 11.4 percentage point increases each year. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Key Takeaways from Ross Stores's Q4 Results

We were impressed by how significantly Ross Stores blew past analysts' revenue and EPS expectations this quarter, driven by huge outperformance in its same-store sales (7% growth vs estimates of 3%). On the other hand, its full-year 2024 same-store sales and earnings guidance was underwhelming. Management noted it was being conservative because "while inflation has moderated, housing, food, and gasoline costs remain elevated and continue to pressure our low-to-moderate income customers’ discretionary spend".

During the quarter, Ross Stores approved a new two-year $2.1 billion stock repurchase program for fiscal 2024 and 2025 and authorized a 10% increase in its quarterly cash dividend to $0.3675 per share.

Despite the soft guidance, we think this was a strong quarter that should satisfy shareholders. The stock is flat after reporting and currently trades at $149.42 per share.

Is Now The Time?

Ross Stores may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Ross Stores isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been a little slower over the last four years, and analysts expect growth to deteriorate from here. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its poor same-store sales performance has been a headwind. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses.

Ross Stores's price-to-earnings ratio based on the next 12 months is 25.3x. We can find things to like about Ross Stores and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $147.61 per share right before these results (compared to the current share price of $149.42).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.