Cybersecurity software maker Rapid7 (NASDAQ:RPD) reported strong growth in the Q1 FY2021 earnings announcement, with revenue up 24.4% year on year to $117.4 million. Rapid7 made a GAAP loss of $29.8 million, down on it's loss of $22.9 million, in the same quarter last year.

Get access to the fastest analysis of earnings results on the market. Get investing superpowers with StockStory. Signup here for early access.

Rapid7 (NASDAQ:RPD) Q1 FY2021 Highlights:

- Revenue: $117.4 million vs analyst estimates of $114.3 million (2.67% beat)

- EPS (non-GAAP): -$0.03 vs analyst estimates of -$0.06

- Revenue guidance for Q2 2021 is $122.5 million at the midpoint, above analyst estimates of $119.2 million

- The company lifted revenue guidance for the full year, from $492 million to $503 million at the midpoint, a 2.23% increase

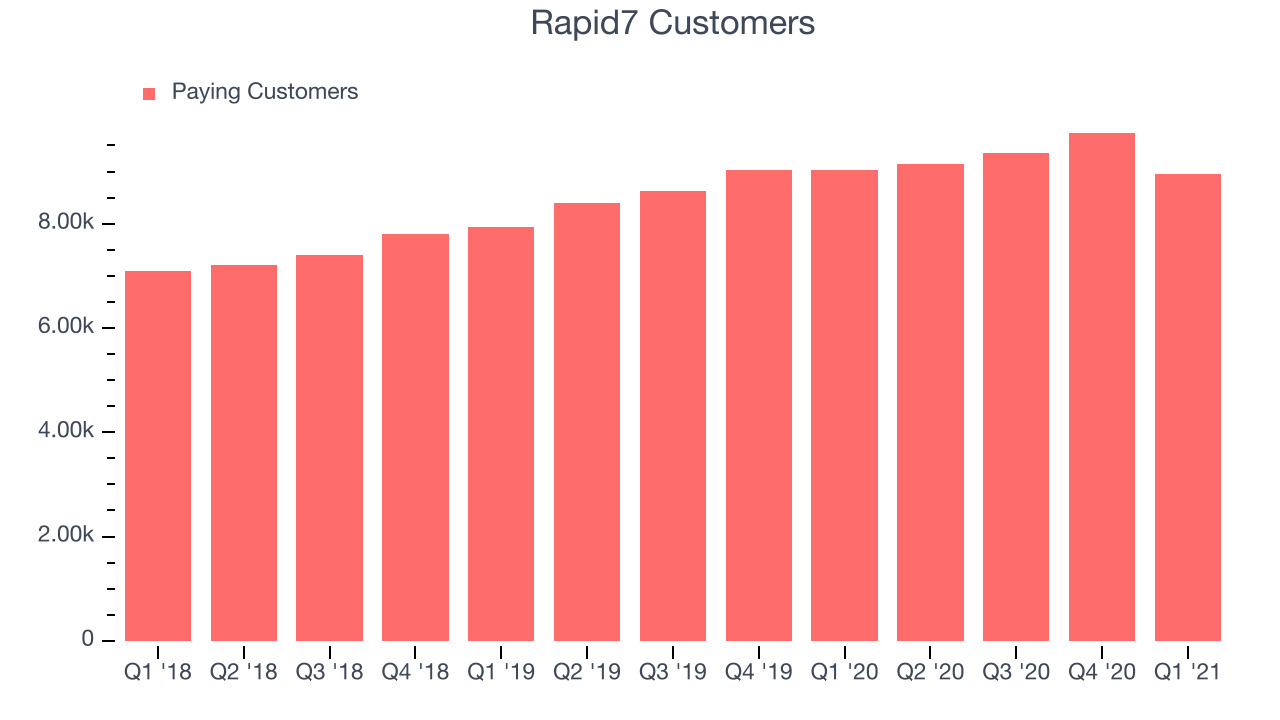

- Customers: 8,945

- Gross Margin (GAAP): 69.1%, in line with previous quarter

"Rapid7 delivered a strong start to 2021 as we accelerated year-over-year ARR growth to 30% while demonstrating strong free cash flow dynamics in our business. These results are a great validation of the vision we laid out at our recent Investor Day as we work to deliver industry-leading capabilities coupled with our unique focus on world-class accessibility," said Corey Thomas, Chairman and CEO of Rapid7.

Cloud Cybersecurity Platform

Founded in 2000, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them. Rapid7's software scans all computers, servers and other devices on their customer’s network and finds vulnerabilities that can be exploited by malware or hackers, like computers that haven’t had patches installed. It then automatically alerts responsible personnel and provides them with guidance on how to patch them, reducing average time to fix a vulnerability from days to hours.

Rapid7 also provides companies with a real-time monitoring dashboard with an overview of the activity on their network and alerts them about any suspicious activity, for example a user that has logged in from two different countries. When Rapid7 detects a successful attack it alerts the IT security personnel, scans the network to identify the size of the breach and then provides suggestions on which users should have their access revoked and which parts of the network should be quarantined.

As technology penetrates our lives, almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in unsecured environments are also contributing to increasing demand for cybersecurity software. The market is highly competitive, and Rapid7 is competing with companies like Tenable (NASDAQ:TENB), Qualys (NASDAQ:QLYS) and Crowdstrike (NASDAQ:CRWD).

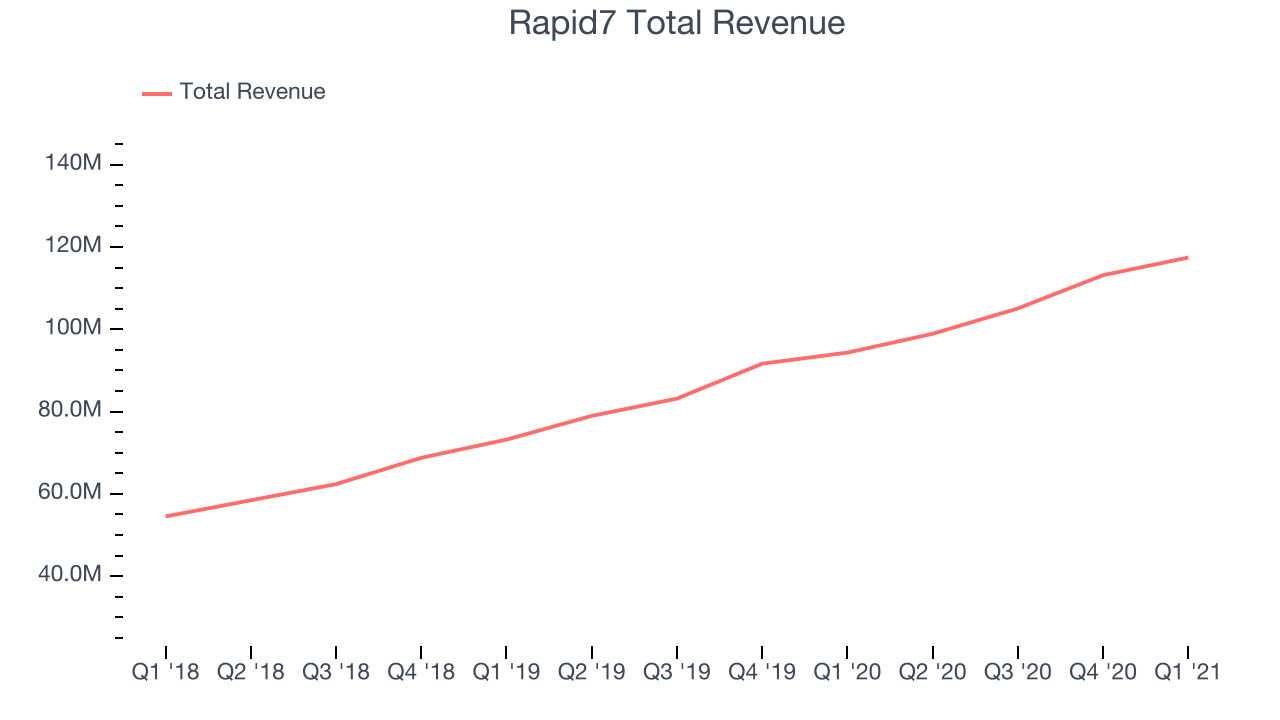

As you can see below, Rapid7's revenue growth has been strong over the last twelve months, growing from $94.3 million to $117.4 million.

This quarter, Rapid7's quarterly revenue was once again up a very solid 24.4% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $4.29 million in Q1, compared to $8.08 million in Q4 2020. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

Go To Market

Rapid7 has a diversified customer base that spans a wide variety of industries, and is equally split between large enterprises and small-medium sized businesses. The company is employing traditional enterprise sales to acquire new customers and is using the outputs of their security research team to promote its brand.

You can see below that Rapid7 reported 8,945 customers at the end of the quarter, less than in Q4 2020 due to the change in the methodology of what the company defines a paying customer.

Key Takeaways from Rapid7's Q1 Results

With market capitalisation of $4.16 billion and more than $605.8 million in cash, the company has the capacity to continue to prioritise growth.

We enjoyed the positive outlook Rapid7 provided for the next quarter’s revenue. And we were also excited to see it that it outperformed analysts' revenue expectations. Zooming out, we think this was a decent quarter. Rapid7 is a company worth watching and nothing we've seen today has changed that.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.