Cybersecurity software maker Rapid7 (NASDAQ:RPD) announced better-than-expected results in the Q4 FY2021 quarter, with revenue up 34% year on year to $151.6 million. On top of that, guidance for next quarter's revenue was surprisingly good, being $154 million at the midpoint, 3.45% above what analysts were expecting. Rapid7 made a GAAP loss of $44.6 million, down on its loss of $28.9 million, in the same quarter last year.

Is now the time to buy Rapid7? Access our full analysis of the earnings results here, it's free.

Rapid7 (RPD) Q4 FY2021 Highlights:

- Revenue: $151.6 million vs analyst estimates of $145.8 million (3.94% beat)

- EPS (non-GAAP): -$0.16 vs analyst estimates of -$0.17

- Revenue guidance for Q1 2022 is $154 million at the midpoint, above analyst estimates of $148.8 million

- Management's revenue guidance for upcoming financial year 2022 is $686 million at the midpoint, beating analyst estimates by 5.28% and predicting 28.1% growth (vs 27.9% in FY2021)

- Free cash flow was negative $2.17 million, down from positive free cash flow of $14.3 million in previous quarter

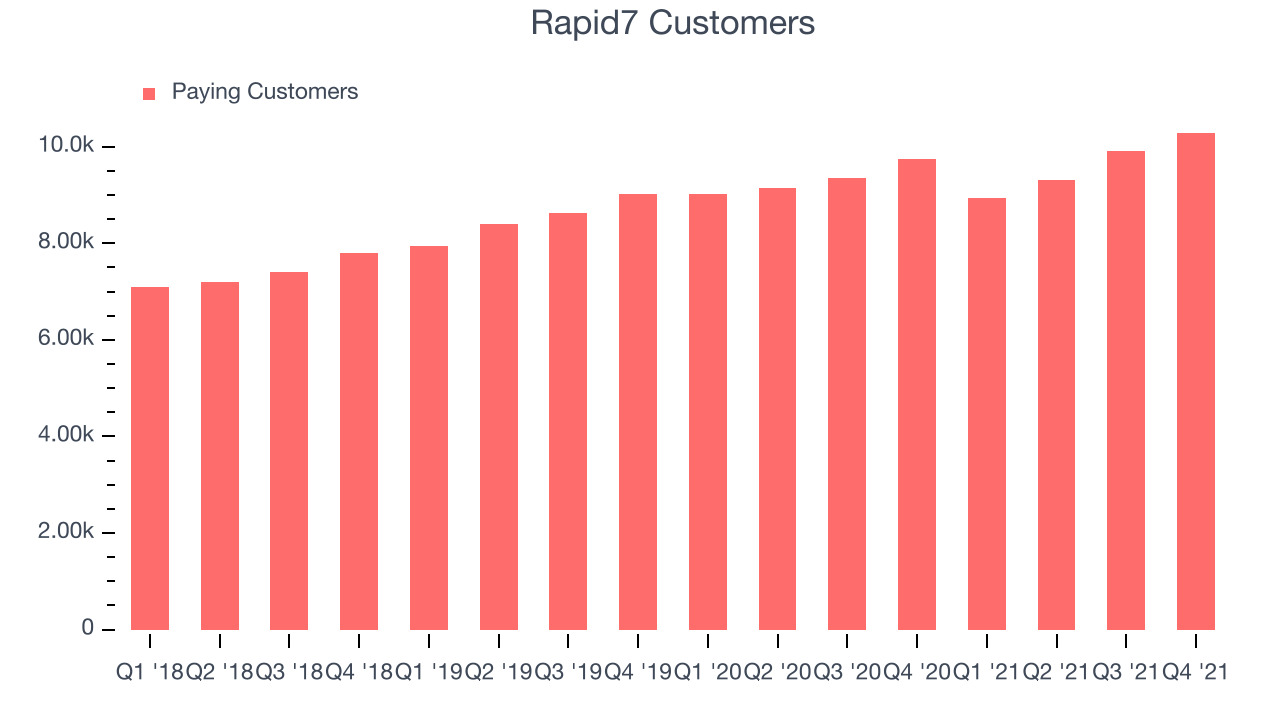

- Customers: 10,283, up from 9,909 in previous quarter

- Gross Margin (GAAP): 67.1%, down from 70.2% same quarter last year

"We ended 2021 on a high note, delivering strong fourth quarter results across our security transformation and vulnerability management solutions. We grew ARR by 38% during the year while eclipsing 10,000 customers globally, highlighting our team's strong execution and the growing need for customers to manage increasingly complex security environments," said Corey Thomas, Chairman and CEO of Rapid7.

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

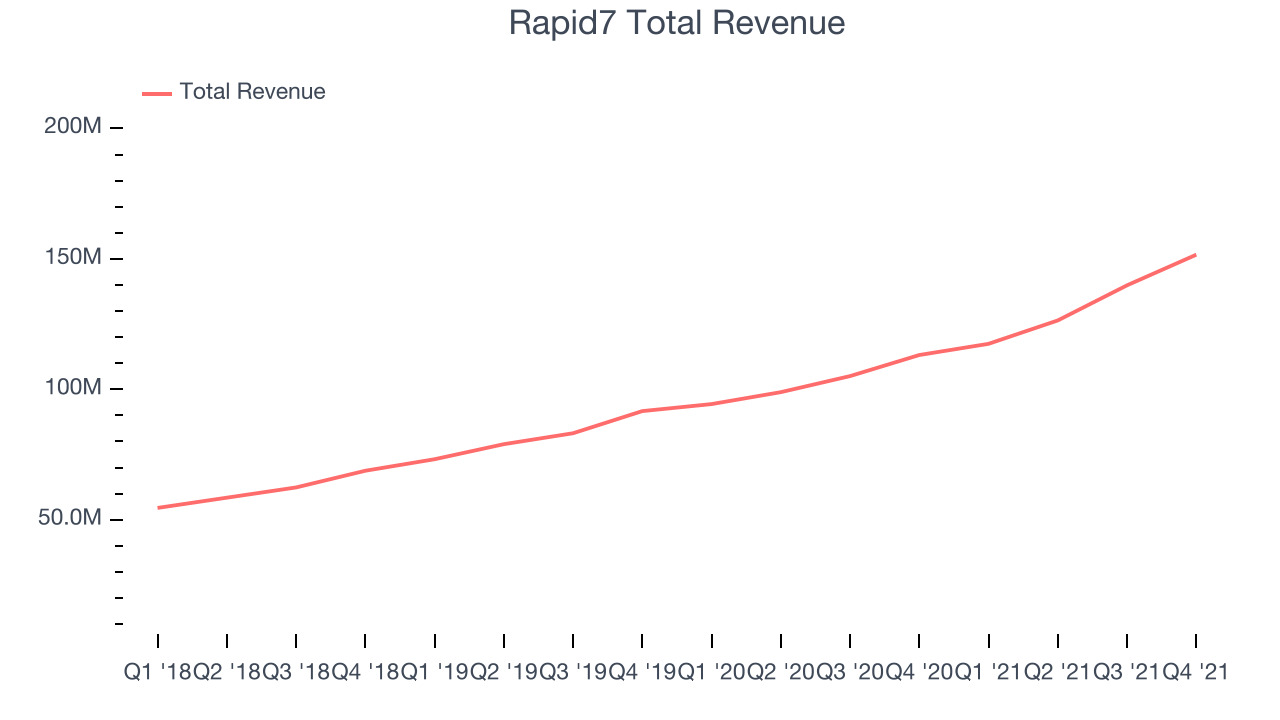

Sales Growth

As you can see below, Rapid7's revenue growth has been strong over the last year, growing from quarterly revenue of $113.1 million, to $151.6 million.

This was a standout quarter for Rapid7, with the quarterly revenue up 34% year on year, which is above average for the company. But the growth did slow down a little compared to last quarter, as Rapid7 increased revenue by $11.7 million in Q4, compared to $13.4 million revenue add in Q3 2021. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Guidance for the next quarter indicates Rapid7 is expecting revenue to grow 31.1% year on year to $154 million, improving on the 24.4% year-over-year increase in revenue the company had recorded in the same quarter last year. For the upcoming financial year management expects revenue to be $686 million at the midpoint, growing 28.1% compared to 27.9% increase in FY2021.

There are others doing even better than Rapid7. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

Customer Growth

You can see below that Rapid7 reported 10,283 customers at the end of the quarter, an increase of 374 on last quarter. That is a little slower customer growth than last quarter but quite a bit still above what we have typically seen over the last year, suggesting sales momentum is coming off slightly after a stronger quarter. Rapid7 updated its customer count methodology in Q1 2021, which is the reason for the related drop in the number of customers.

Key Takeaways from Rapid7's Q4 Results

With a market capitalization of $5.61 billion Rapid7 is among smaller companies, but its more than $223.4 million in cash and positive free cash flow over the last twelve months give us confidence that Rapid7 has the resources it needs to pursue a high growth business strategy.

We were impressed by the very optimistic revenue outlook Rapid7 provided for the next year. On the other hand, it was unfortunate to see the slowdown in customer growth and gross margin deteriorated a little. Overall, this quarter's results still seemed pretty positive and shareholders can feel optimistic. The company is flat on the results and currently trades at $100.35 per share.

Should you invest in Rapid7 right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.